Fillable Printable Budget Template for Licensed Family Day Homes and Independent Foster Homes

Fillable Printable Budget Template for Licensed Family Day Homes and Independent Foster Homes

Budget Template for Licensed Family Day Homes and Independent Foster Homes

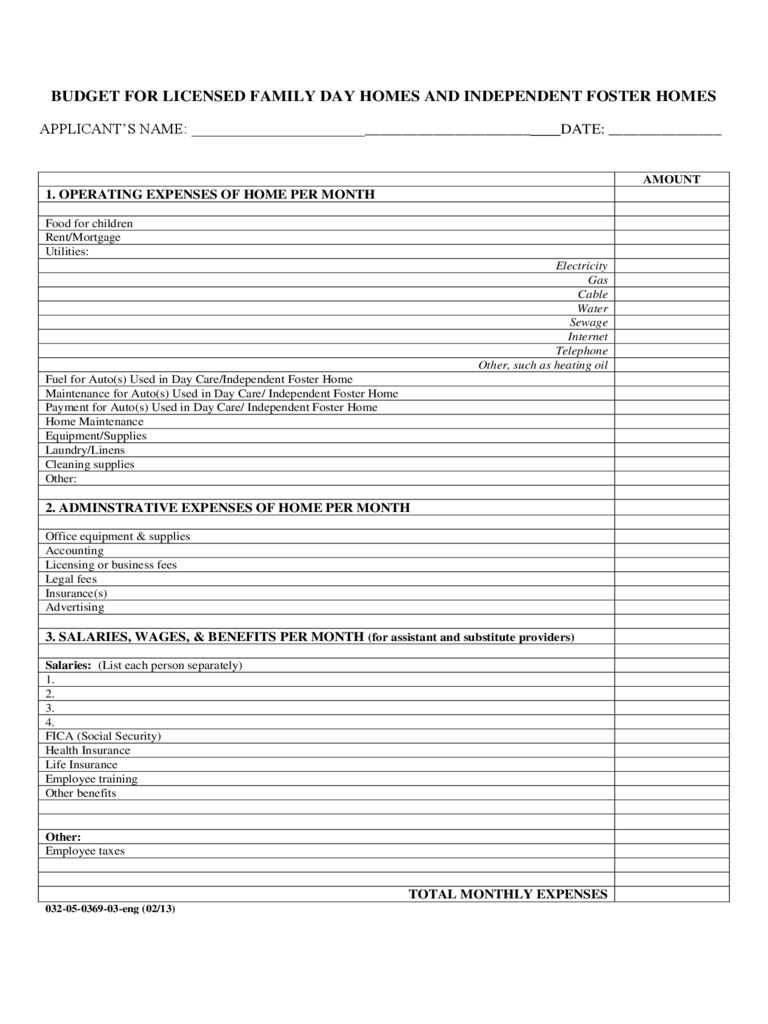

BUDGET FOR LICENSED FAMILY DAY HOMES AND INDEPENDENT FOSTER HOMES

APPLICANT’S NAME: _____________________________________________ DATE: _______________

032-05-0369-03-eng (02/13)

AMOUNT

1. OPERATING EXPENSES OF HOME PER MONTH

Food for children

Rent/Mortgage

Utilities:

Electricity

Gas

Cable

Water

Sewage

Internet

Telephone

Other, such as heating oil

Fuel for Auto(s) Used in Day Care/Independent Foster Home

Maintenance for Auto(s) Used in Day Care/ Independent Foster Home

Payment for Auto(s) Used in Day Care/ Independent Foster Home

Home Maintenance

Equipment/Supplies

Laundry/Linens

Cleaning supplies

Other:

2. ADMINSTRATIVE EXPENSES OF HOME PER MONTH

Office equipment & supplies

Accounting

Licensing or business fees

Legal fees

Insurance(s)

Advertising

3. SALARIES, WAGES, & BENEFITS PER MONTH (for assistant and substitute providers)

Salaries: (List each person separately)

1.

2.

3.

4.

FICA (Social Security)

Health Insurance

Life Insurance

Employee training

Other benefits

Other:

Employee taxes

TOTAL MONTHLY EXPENSES

The budget includes the monthly expenses of the family day home operation. It is the total of all expense items shown

below. Three major categories of expenses are shown. The explanations of the sub-headings are intended to assist the

applicant in understanding the number and types of financial considerations which may be involved in a family day home

operation, and to assist the Department in evaluating the home’s application. Base the monthly expenses on the

anticipated number of children to actually be in care during the first three months of operation.

1. OPERATING EXPENSES OF HOME PER MONTH:

a. Food for children: Anticipated monthly cost of food to be provided to children in care. It includes the cost of

all meals and snacks each day. (Do not include the cost of food provided to household members during the

home’s hours of operation. Do not include the cost of food provided at no cost to staff who are required to

eat with participants or residents. The cost of food provided to staff is reported under Item 3.m: Other.)

b. Rent or Mortgage Payments: Payments for the home; amount shown must be the total monthly expense.

c. Utilities: Total of monthly payments made or to be made by the home for electricity, water, fuel oil, gas (for

heating), sewage and refuse services, telephone and similar services.

d. Fuel for Autos: Monthly cost for fuel to operate of car, vans, trucks, etc. used in support of the operation of

the home.

e. Maintenance for Autos: All expenses related to the maintenance and operation of cars, vans, trucks, etc,

owned by the home and used in support of the operation of the home.

f. Home Maintenance: Monthly cost of all items used to maintain and carry out necessary repairs on the family

day home. This would include such items as mulch for play areas, paint, plumbing repairs, lumber, nails,

roofing materials, grass seed.

g. Equipment/Supplies: Total actual and projected annual cost of equipment and expendable supplies which

were and will be used to support the operation of the family day home. Equipment rental costs should be

included here.

h. Laundry/Linens: Cost of soap, detergents, etc., required for the laundry of table linens, bed linens, etc., used

by the family day home operation.

i. Cleaning Supplies: Cost of cleaning solutions and supplies used in the family day home operation.

2. ADMINSTRATIVE EXPENSES OF HOME PER MONTH:

a. Office Equipment & Supplies: Cost of items purchased monthly for administrative purposes. (for

example: file folders, pens, pencils, paper).

b. Accounting: Amount (if any) paid monthly to an accountant or someone (other than the family day home

operator) who handles the billing, etc. for the family day home operation.

c. Licensing/business fees: Total amount paid per year for family day home license, business license,

personal property taxes (for vehicles used in the family day home operation), real estate taxes (if not

included as part of the mortgage payment under Item 1. B above), special use permit, etc. Divide the total

by 12 to obtain the monthly (prorated) amount.

d. Legal fees: Total of fees paid to an attorney for assistance related to the family day home operation.

e. Insurance:

(1) Liability (Premises and Operations): Total monthly cost of liability insurance covering the premises

and operation.

(2) Liability (Vehicles): Total monthly cost of liability insurance covering all of the vehicles used in

support of the family day home operation.

(3) Other: Total monthly cost of other types of insurance (e.g. fire insurance). NOTE: Health Care,

Group Life, and other insurance benefiting employees should be shown under Item 3.a. Salaries, Wages

& Benefits and not in this item.

f. Advertising: Total monthly cost to advertise the family day home.

3. SALARIES, WAGES & BENEFITS PER MONTH:

a. Salaries & Wages: All salaries and wages paid per month by the family day home to its employees.

b. FICA (Social Security): Enter the total monthly FICA (Social Security) tax, (including both OASDI and

Medicare) to be paid by the facility for all employees and listed above.

c. Health Insurance: Total amount of monthly premiums paid by the family day home for health care

insurance for employees listed above when the cost of all or part of such insurance is provided by the

family day home. Do not include portions paid by employees.

d. Life Insurance: Total amount of monthly premiums paid by the family day home for employee life

insurance when the cost of all or part of such insurance is provided by the family day home.

e. Employee Training: Total monthly cost for formal training for employees that will be paid for or

reimbursed by the family day home.

f. Other Benefits (Specify): On an item-by-item basis, the cost(s) of any additional benefits provided by the

family day home to employees listed above.

Other:

Employee Taxes: Taxes which must be paid by the family day home. This would include VEC taxes and Federal

Unemployment Taxes which must be paid on employees' salaries. NOTE: The Employer's FICA (Social

Security) taxes must be shown under Item 3, b above and not in this item. Specify each tax on a separate line

under the entry “taxes.”

Other (Specify): Monthly cost of all other expenses not included in other items. Specify each item of expense

included here and the expense amount (e.g. the estimated cost of meals provided at no cost to employees would be

entered here.