Fillable Printable Sample Monthly Budget Template for Adults/Families

Fillable Printable Sample Monthly Budget Template for Adults/Families

Sample Monthly Budget Template for Adults/Families

1

Sample Monthly Budget for Adults & Families

Making a Budget

Making a budget is the most important step in controlling your money.

A budget allows you to track your Income (the money that you have) and your Expenses (the

money you spend). By writing down your monthly income and expenses, you can see how

much money you expect to have for the month and plan for how much you can spend.

The First Rule of Budgeting

The first rule of budgeting is simple: Spend less than you earn!

If you earn $2,000 a month from your job, $50 from Interest on your savings account, then

your income for the month is $2,050. Now you know that you have to spend less than $2,050

for the entire month.

Structuring Your Budget

1: Determine your Income.

Estimate all “incoming” money, including Salary/Bonus/Commissions, Interest, Child

Support, and other sources.

2. Estimate Required Expenses.

Required expenses include taxes and bills. Required bills include mortgage/rent, utilities,

insurance, car maintenance, gas, groceries, credit card/debt payments and medical

expenses. You should also include payment to your savings in the “Required Expenses”

category. You should strive to save enough to cover three months of expenses. You can

also save for vacations and Christmas gifts. It is critical that you get in the habit of paying

yourself first! Even a few dollars each month helps build your savings.

3. Estimate Discretionary Expenses

After you have paid your Required Expenses, you can use the money left over for some

discretionary expenses, like entertainment (movies and dining out), or new furniture.

Review the following Sample Budget on page 2, and then make your own monthly budget

using the worksheet on page 3. Stay within your budget, pay yourself first, and you will

always be in control of your Money and Stuff!

2

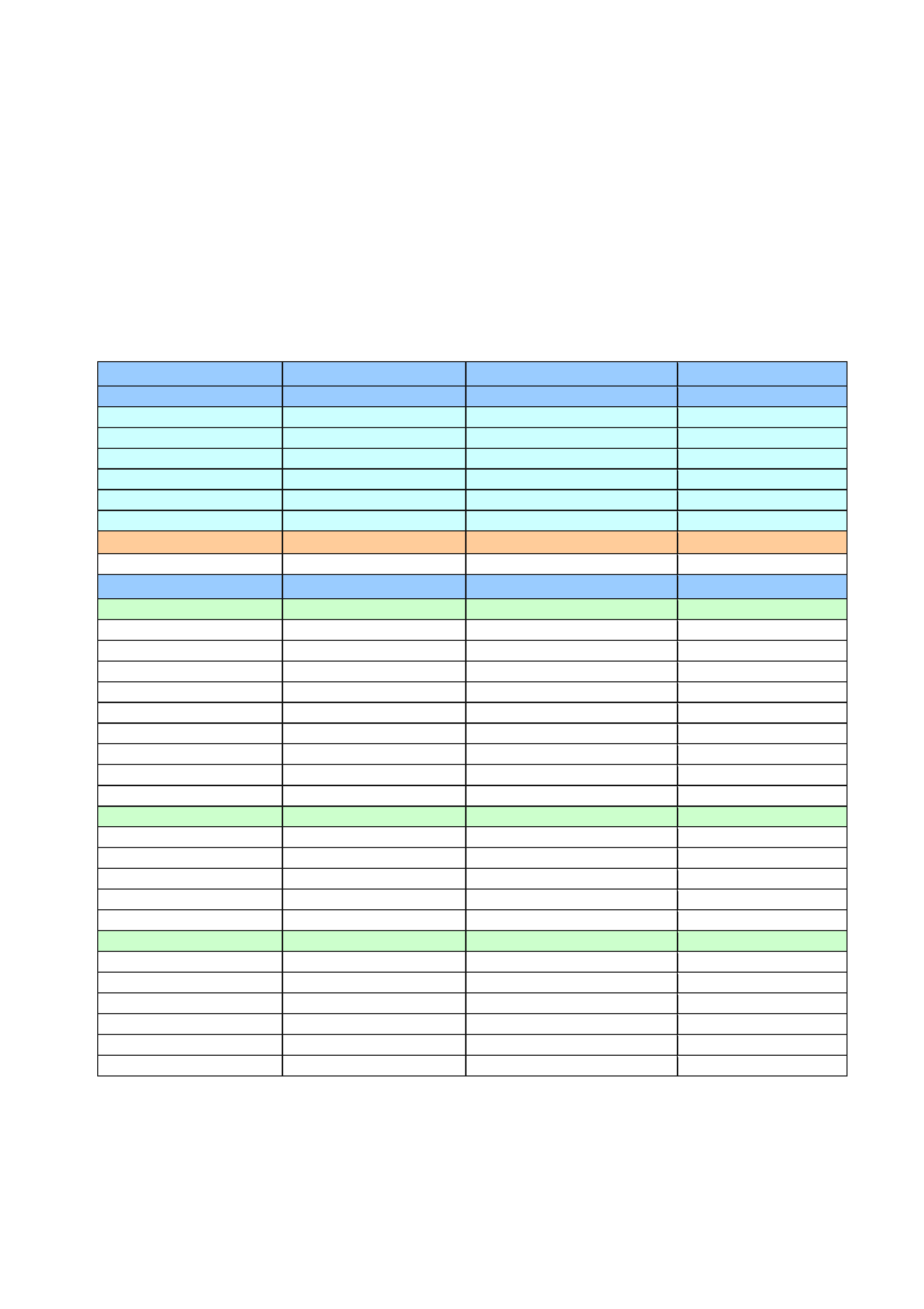

Sample Monthly Budget for Adults/Families

Month ______________ Year_____________

Category Monthly Budget Actual Amount Difference

INCOME:

Estimate Your Income Your Actual Income

Salary

Commission

Interest

Bonus

Child Support

Other Income

INCOME SUBTOTAL

EXPENSES:

Estimate Your Expenses Your Actual Expenses

Salary Withholdings

Federal Income Tax

State Income tax

City Income Tax

Social Security/Medicare

Medical Insurance

Life Insurance

Disability Insurance

401(k) Contribution

Other Withholdings

Required Expenses

Savings (Pay Yourself First!)

Mortgage/Rent

Auto Payment/Lease

Auto Insurance

Medical Insurance

Utilities

Water

Gas

Electric

Cable/Internet

Phone/Cell Phone

Other Utilities

Continued on Next Page

3

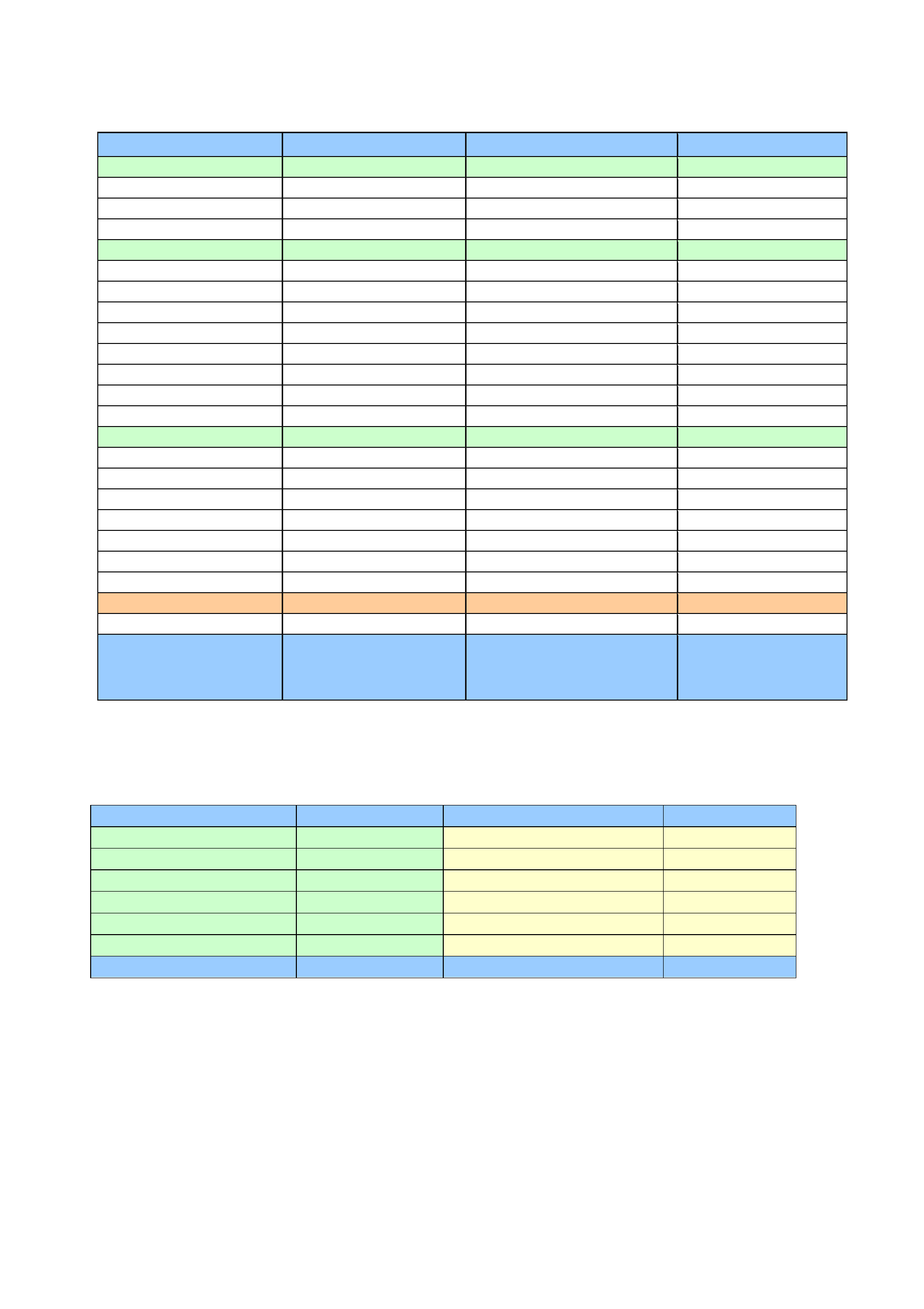

EXPENSES (Con’t):

Estimate Your Expenses Your Actual Expenses

Credit/Debit Payments

Credit Cards

Loans

Other Accounts

Typical Cash Expenses

Groceries/Household

Auto Maintenance/Gasoline

Personal Care/Hair

Prescriptions/Medical Co-Pay

Clothing

Dry Cleaning

School Expenses

Other Regular Expenses

Discretionary Expenses

Dining Out

Entertainment (Movies, etc.)

Gifts/Holidays

Home Furnishings

Vacation

Memberships

Other

EXPENSES SUBTOTAL

NET INCOME

(Income

Minus Expenses)

List of Assets and Liabilities

Assets Liabilities

Home $ Mortgage $

401(k) Account $ Credit Card Balances $

Fine Jewelry $ Loans $

Savings $ Outstanding Debts $

Other $ Other $

Total Assets $ Total Liabilities $