Fillable Printable Budgeting Loans from the Social Fund

Fillable Printable Budgeting Loans from the Social Fund

Budgeting Loans from the Social Fund

Budgeting Loans

from the Social Fund

Notes sheet

Please turn over for more information

t

Please read these notes carefully. They explain the circumstances when a budgeting loan can be paid.

Budgeting Loans

l You may be able to get a Budgeting Loan if:

you have been getting Income Support, income-based Jobseeker’s Allowance, income-related Employment and Support

Allowance, Pension Credit or payment on account of one of these benefits or entitlements for at least 26 weeks

and

l You need help

– to buy furniture or household equipment

– to buy clothing and footwear

– to pay rent in advance and/or removal expenses to secure fresh accommodation

– to pay for home improvements, maintenance or security

– with travelling, maternity and funeral expenses

– to pay for things to help you look for or start work

– to repay HP or other debts that have been taken out.

We cannot help with any other types of items or services.

Budgeting Loans have to be paid back but they are interest free.

You can have one of three rates of Budgeting Loan. The amount depends on whether you are single, a couple without children

or qualifying young persons, or a one or two parent family with children or qualifying young persons. For a single person the

maximum rate is £348, for a couple without children or qualifying young persons the maximum rate is £464, and for one or

two parent families with children the maximum rate is £812. We cannot pay you more than these amounts.

The amount of Budgeting Loan you can have also depends on whether you still have any other Budgeting Loans or Crisis

Loans you haven’t paid back to the Social Fund. We cannot make a payment for a loan if you already owe £1,500 or more to

the Social Fund for any previous Crisis Loans or Budgeting Loans combined.

SF500 11/14

Savings

l If you and your partner are aged under 62, savings of more than £1,000

may affect the amount of money you can get.

l If you or your partner are aged 62 or over, savings of more than £2,000

may affect the amount of money you can get.

We cannot make a payment for a loan if you already owe £1,500 or more

to the Social Fund.

We cannot pay a Budgeting Loan for expenses of less than £100.

How we decide what we can pay you

The decision maker will look at the relevant circumstances and decide the

maximum size of Budgeting Loan you can have, if you have no existing Social

Fund debt. Whether or not you can have a loan of up to that amount will

depend on if you already have a budgeting loan debt.

How you pay back a loan

l We will look at what you can afford before we decide on the arrangements

for repayments.

l If we can pay you a Budgeting Loan, we may make you up to three

different offers. It will be up to you which of these offers you can afford to

pay back. We may not be able to lower the repayment rate if you later feel

you cannot afford the rate you originally agree to.

l If we can pay you a Budgeting Loan, we will ask you to agree to repay it

and also to agree the way you will repay it before we make the payment.

l We will take the money back in weekly repayments from your benefit. If

you or your partner do not get any benefit, we will arrange for the loan to

be repaid in another way.

l If you have problems later on making the repayments as originally agreed,

we may be able to help, for example reducing your payments by extending

the repayment period. Your Jobcentre Plus office can give you advice.

These notes give general guidance only and should not be treated

as a complete and authoritative statement of the law.

We use partner to mean

l a person you live with who is your husband, wife or civil partner, or

l a person you live with as if you are a married couple.

We use child to mean a person aged under 16 who you are getting

Child Benefit for.

We use qualifying young person to mean a person aged 16, 17, 18 or

19 who you are getting Child Benefit for.

Tear off this page to keep for your information

s

Help and advice

If you want more information

l get in touch with Jobcentre Plus. Phone 0345 603 6967. You can also call

0845 603 6967. Check with your phone company which code is cheaper

for you.

You can also get more information from www.gov.uk

or

l get in touch with an advice centre like the Citizens Advice Bureau.

Notes

Surname or family name

All other names, in full

Date of birth

/ /

/ /

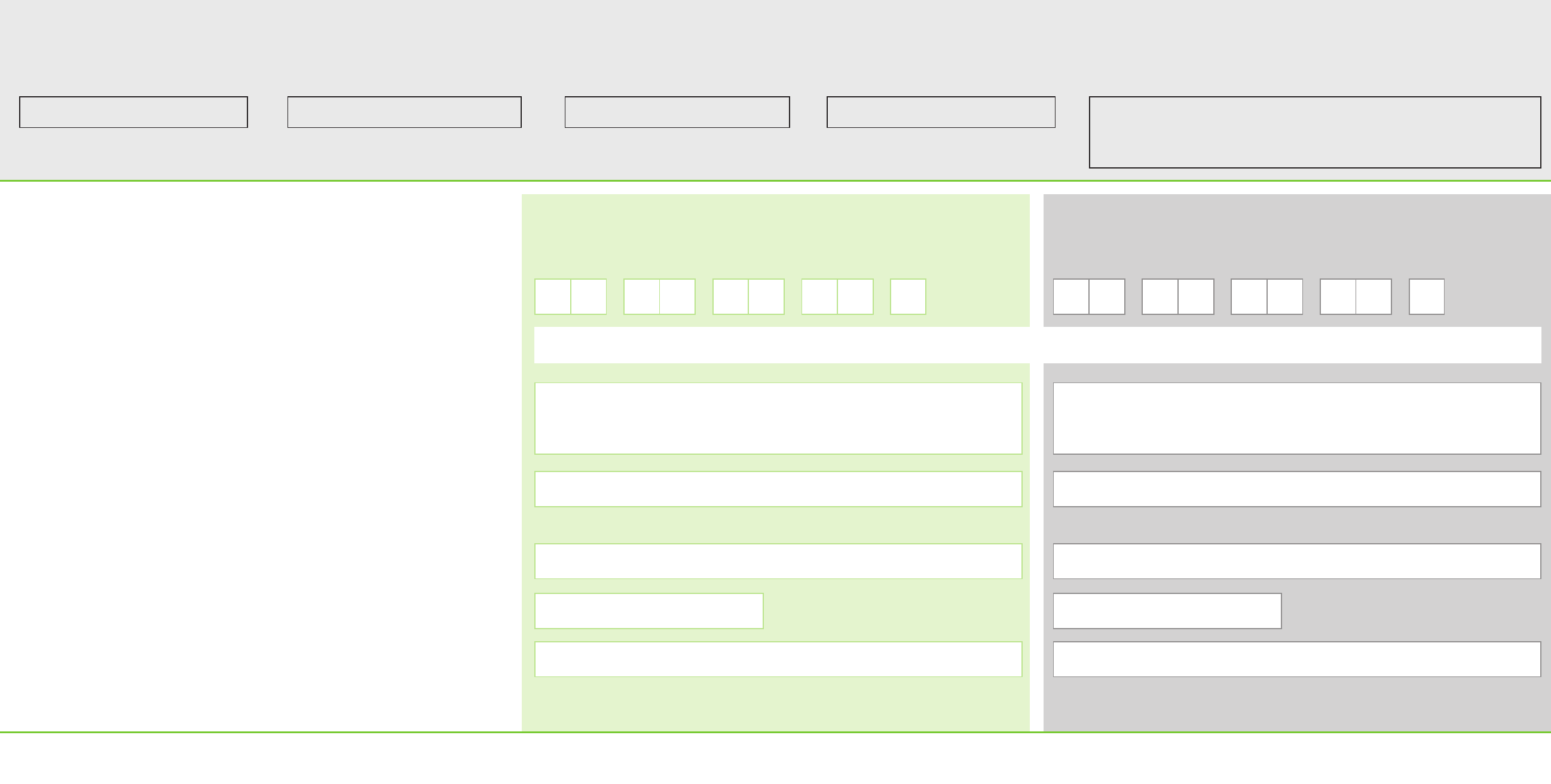

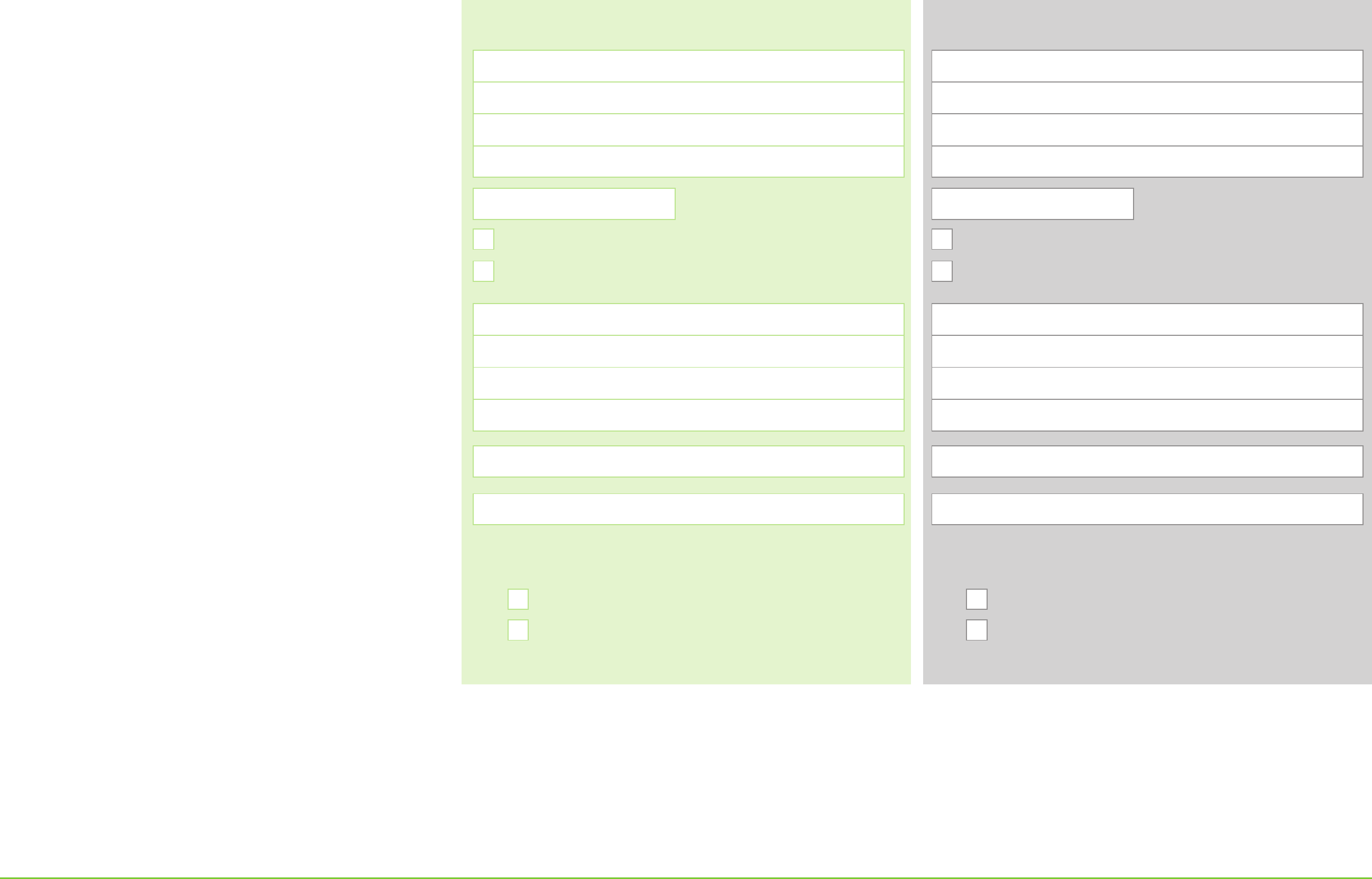

Part 1: About you and your partner

You Your partner

1

l Before you complete this form, please read the notes sheet which tells

you about all types of help you can get from the Social Fund.

l Use this form to apply for a Budgeting Loan. Sign and date any alterations

you make.

l If you are getting Income Support, income-based Jobseeker’s Allowance,

income-related Employment and Support Allowance or Pension Credit, the

person who both claims and gets paid that benefit or entitlement should fill

in this form.

l Tell us about yourself and your partner, if you have one. We use partner to

mean

– a person you are married to or a person you live with as if you are married

to them, or

– a civil partner or a person you live with as if you are civil partners.

l Fill in the form fully by answering all the questions and requests for

information. Your application may be delayed if we do not have all the

information we need. Please fill in this form with BLACK INK and in CAPITALS.

Any other surnames or family names you have

been known by

National Insurance (NI) number

Letters Numbers Letter Letters Numbers

Letter

You can find the number on a National Insurance (NI) numbercard, letters about benefit, or payslips.

For office use only

Application numberDate of SFCS input

/ /

Date decision made

/ /

Initials Signature

Mr / Mrs / Miss / Ms Mr / Mrs / Miss / Ms

Mobile phone number

SF500 11/14

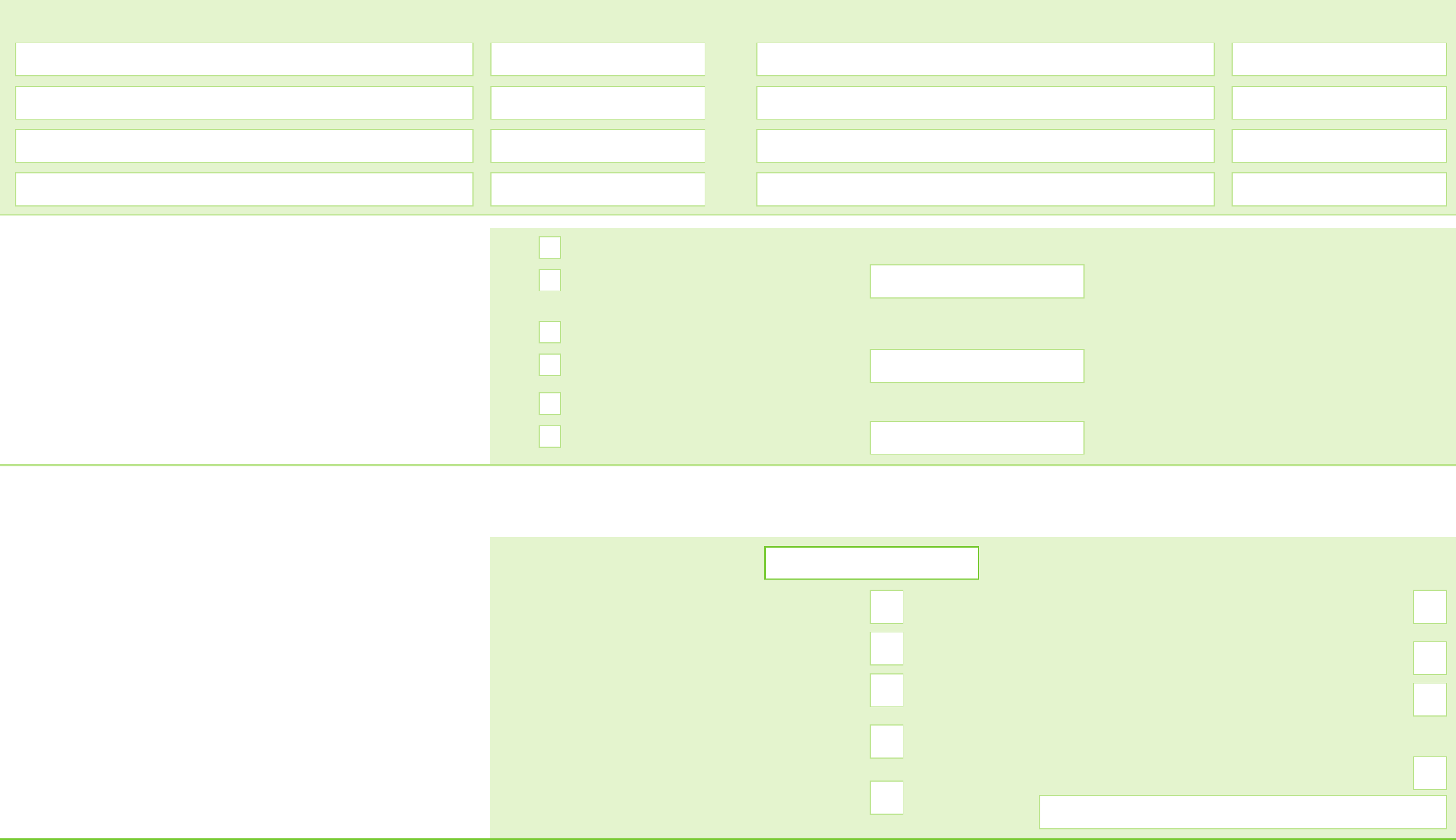

Part 1: About you and your partner continued

You Your partner

2

Your email address, if you have one

Address where you live now

Please tell us your current address, and tell us your

partner’s current address, if it is different.

Postcode Postcode

Date you or your partner moved into this address

/ /

/ /

Tell us if this address is

temporary.

permanent.

temporary.

permanent.

Previous address

Please tell us your previous address, and tell us your

partner’s previous address, if it is different.

Postcode Postcode

Code Number

Daytime phone number, if you have one

Code Number

Are you or your partner involved in a trade dispute?

We use trade dispute to mean a strike, walk-out,

lock-out or any other dispute about work.

Yes

No

Yes

No

Part 2: About your children or qualifying young persons

3

Are you getting Income Support or

income-based Jobseeker’s Allowance for

your children or qualifying young persons?

Yes

No

How much do you get a week?

Furniture and household equipment

Please tell us about any children or qualifying

young persons you are getting a benefit or

entitlement for.

l We use child to mean a person aged under 16 who you are getting Child Benefit for.

l We use qualifying young person to mean a person aged 16, 17, 18 or 19 who you are

getting Child Benefit for.

/ / / /

/ / / /

/ / / /

/ / / /

Name NameDate of birth Date of birth

£

Are you getting Child Tax Credit for your

children or qualifying young persons?

Yes

No

How much do you get a week?

£

Are you getting Child Benefit for your

children or qualifying young persons?

Yes

No

How much do you get a week?

£

Part 3: About what you need

Budgeting loans can only be given for the types of

items or services listed in this part.

Please enter the total amount you need in the Total

amount applied for box for what you need. Also tick

the other category boxes that apply to you.

We do not need any more information for this part.

Please refer to the notes sheets for the maximum

rates of Budgeting Loans depending on your

circumstances.

Total amount applied for

£

Travelling expenses within the UK

Clothing and footwear

Expenses associated with seeking or

re-entering work

Rent in advance or removal expenses

to secure fresh accommodation

Maternity or funeral expenses

Improvement, maintenance and

security of the home

Repaying HP and other debts – for any

items or expenses which are associated

with the categories above

Other items or expenses – please specify

4

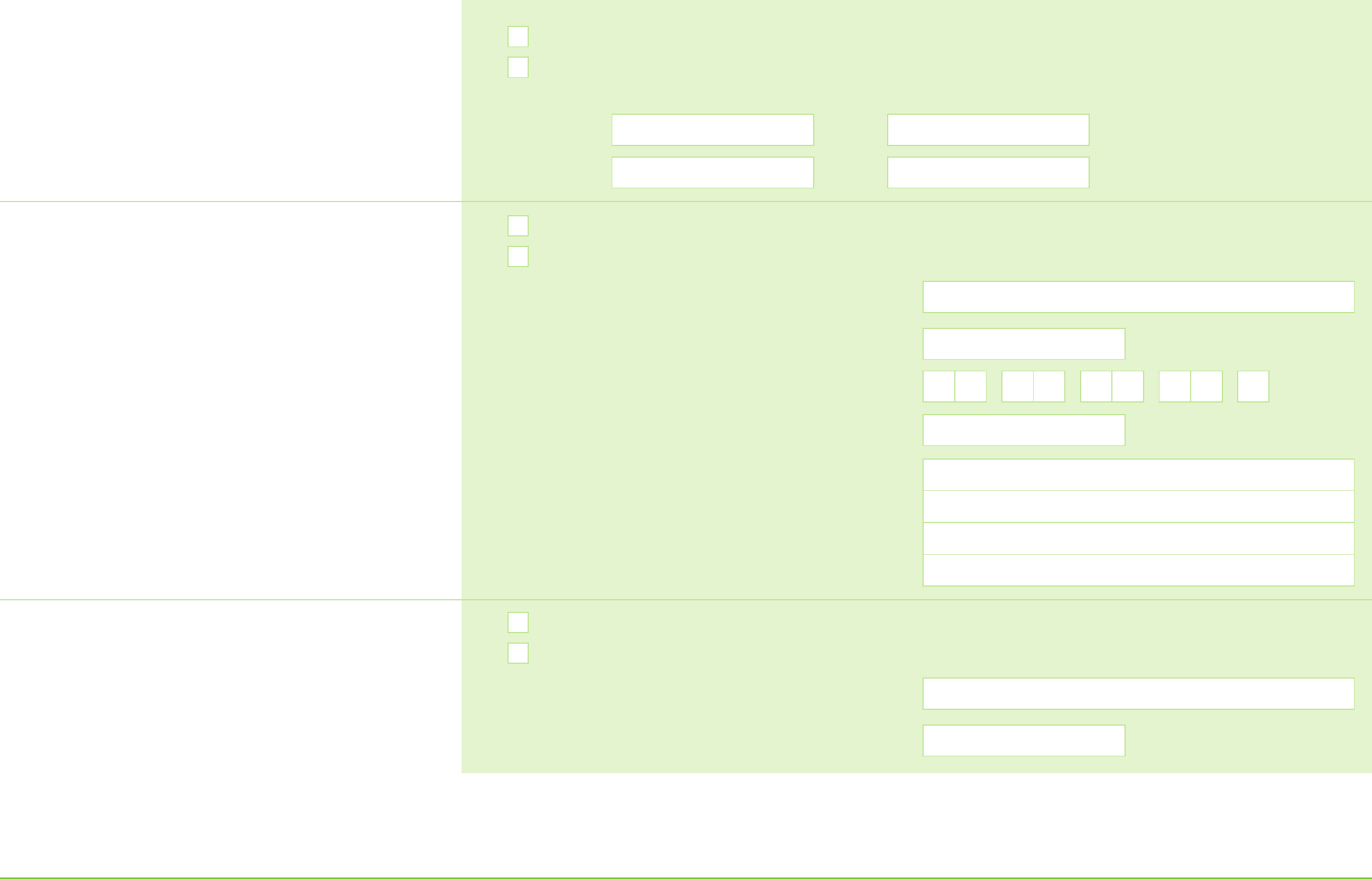

Part 4: About benefits and entitlements

Are you or your partner currently getting Income

Support, income-based Jobseeker’s Allowance,

income-related Employment and Support

Allowance, Pension Credit or payment on account

of one of these benefits or entitlements?

Yes

No

Tell us the dates you have been getting any of these benefits

or entitlements in the last 26 weeks.

/ /From / /to

/ /From / /to

Go to Part 8.

Has a partner or an ex-partner received Income

Support, income-based Jobseeker’s Allowance,

income-related Employment and Support

Allowance, Pension Credit or payment on account

of one of these benefits or entitlements for you,

in the last 26 weeks?

Yes

No

Tell us about this person:

Their name

Their National Insurance (NI) number

Their address

Date of birth

Date of separation

/ /

/ /

Postcode

Have you made this claim because you have

separated from someone?

Yes

No

Tell us about the person you have separated from:

Their name

Date of birth

/ /

Part 5: About money you have to pay out

5

Who do you pay the money to?

How much are you paying and how often?

How much is owed?

Please tell us about any money that you or your partner have to pay out regularly, but do not include

normal living expenses like gas and electric charges or food bills.

Include things like catalogue money, hire purchase, loan payments and fines.

Please answer all the questions for each regular payment. If you do not give us all the information, we will

not be able to decide this claim.

Payment 1

£

every week

every fortnight every month

£

Who do you pay the money to?

How much are you paying and how often?

How much is owed?

Payment 2

£

every week every fortnight every month

£

Who do you pay the money to?

How much are you paying and how often?

How much is owed?

Payment 3

£

every week

every fortnight every month

£

Who do you pay the money to?

How much are you paying and how often?

How much is owed?

Payment 4

£

every week every fortnight every month

£

6

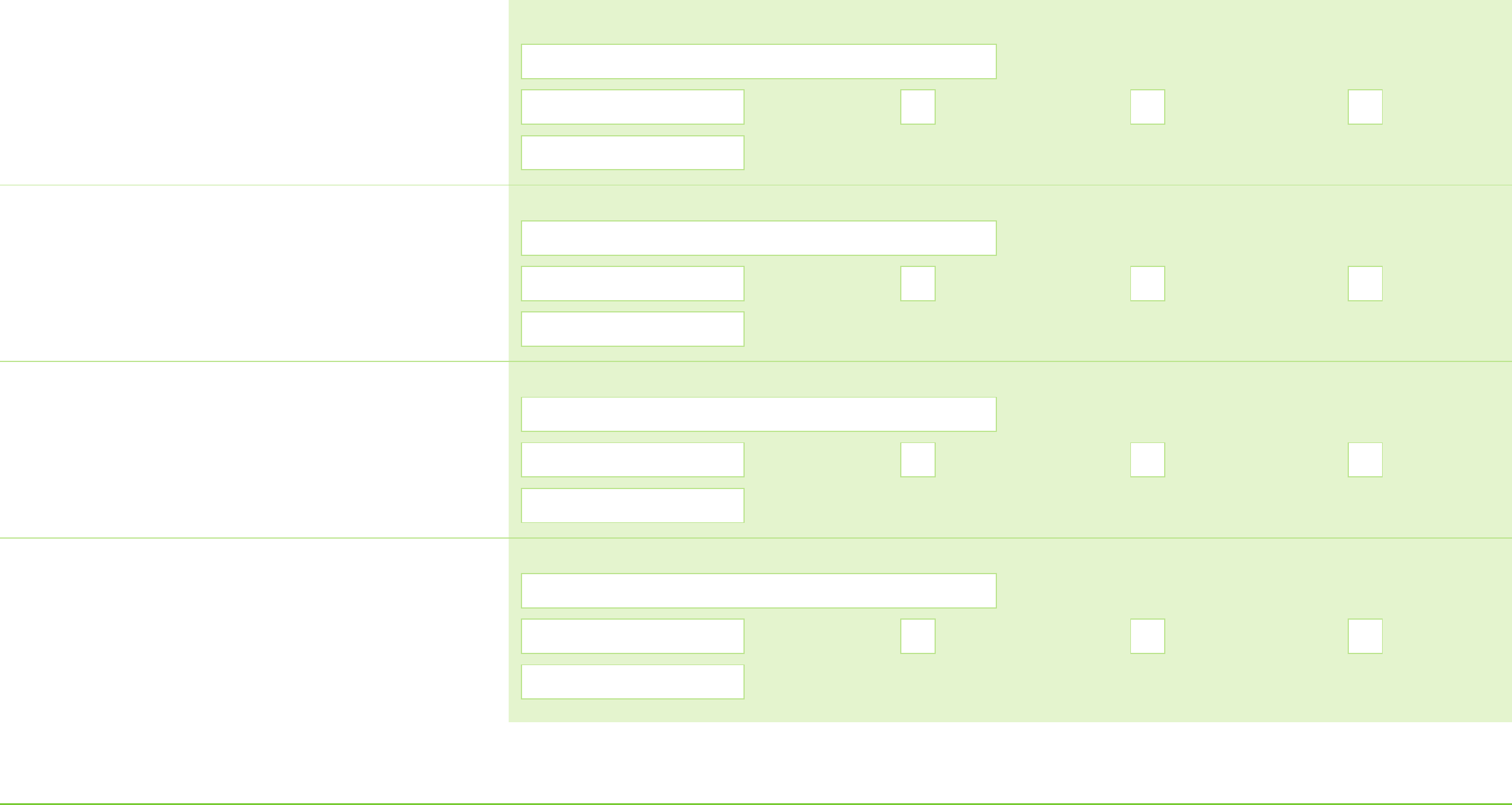

Part 6: About savings

Do you or your partner have any savings?

If you and your partner are both aged under 62,

we may be able to disregard the first £1,000 of

your savings. If either you or your partner are

over 62, we may be able to disregard the first

£2,000 of your savings.

Savings means any capital you and your partner

have, including

l any money you have at home, in the bank, in

the building society or in a credit union account

l premium bonds

l investments, such as shares or unit trusts.

l the value of any property you or your partner

own that you do not live in. For example, a

house you let out, a holiday home, or

somewhere another member of your

family lives.

Yes

No

How much do you have?

£

7

Part 7: How we pay you

We normally pay your money directly into the same account as we pay your benefit into.

Many banks and building societies will let you collect your money at the post office.

We will tell you when your Social Fund payment will be made and how much it will be for.

Finding out how much we have paid into the account

You can check your payments on account statements. The statements may show your National Insurance (NI) number next

to any payments we have made. If you think a payment is wrong, get in touch with the office that pays you straight away.

If we pay you too much money

If we pay you too much money we have the right to take back any money we pay that you are not entitled to. This may be

because of the way the system works for payments into an account.

For example, you may give us some information which means you are entitled to less money. Sometimes we may not be

able to change the amount we have already paid you. This means we will have paid you money that you are not entitled to.

We will contact you before we take back any money.

What to do now

l Go to Part 8, unless you want us to pay your Social Fund payment into a different account to the one we pay your

benefit into.

l If you want us to pay your Social Fund payment into a different account, tell us about this on the next page. By giving us

these account details you

– agree that we will pay you into this account, and

– understand what we have told you above in the section If we pay you too much money.

l If you are going to open an account, please tell us your account details as soon as you get them.

l If you do not have an account, and do not intend to open one, please tick this box and we will contact you.

Fill in the rest of this form. You do not have to wait until you have opened an account or contacted us.

8

Part 7: How we pay you continued

About the account you want to use for this payment

l You can use an account in your name, or a joint account.

l You can use someone else’s account if

– the terms and conditions of their account allow this, and

– they agree to let you use their account, and

– you are sure they will use your money in the way you tell them.

l You can use a credit union account. You must tell us the credit union’s

account details. Your credit union will be able to help you with this.

l If you are an appointee or a legal representative acting on behalf of the

claimant, the account should be in your name only.

Please tell us your account details below.

It is very important you fill in all the boxes correctly, including the

building society roll or reference number, if you have one. If you tell us

the wrong account details your payment may be delayed or you may

lose money.

You can find the account details on your chequebook or bank statements.

If you do not know the account details, ask the bank or building society.

Name of the account holder

Please write the name of the account holder exactly

as it is shown on the chequebook or statement.

Full name of bank or building society

Sort code

Please tell us all 6 numbers, for example: 12-34-56.

Account number

Most account numbers are 8 numbers long. If your

account number has fewer than 10 numbers,

please fill in the numbers from the left.

Building society roll or reference number

If you are using a building society account you

may need to tell us a roll or reference number.

This may be made up of letters and numbers,

and may be up to 18 characters long. If you are

not sure if the account has a roll or reference

number, ask the building society.

You may get other benefits and entitlements we do

not pay into an account. If you want us to pay them

into the above account, please tick this box.

9

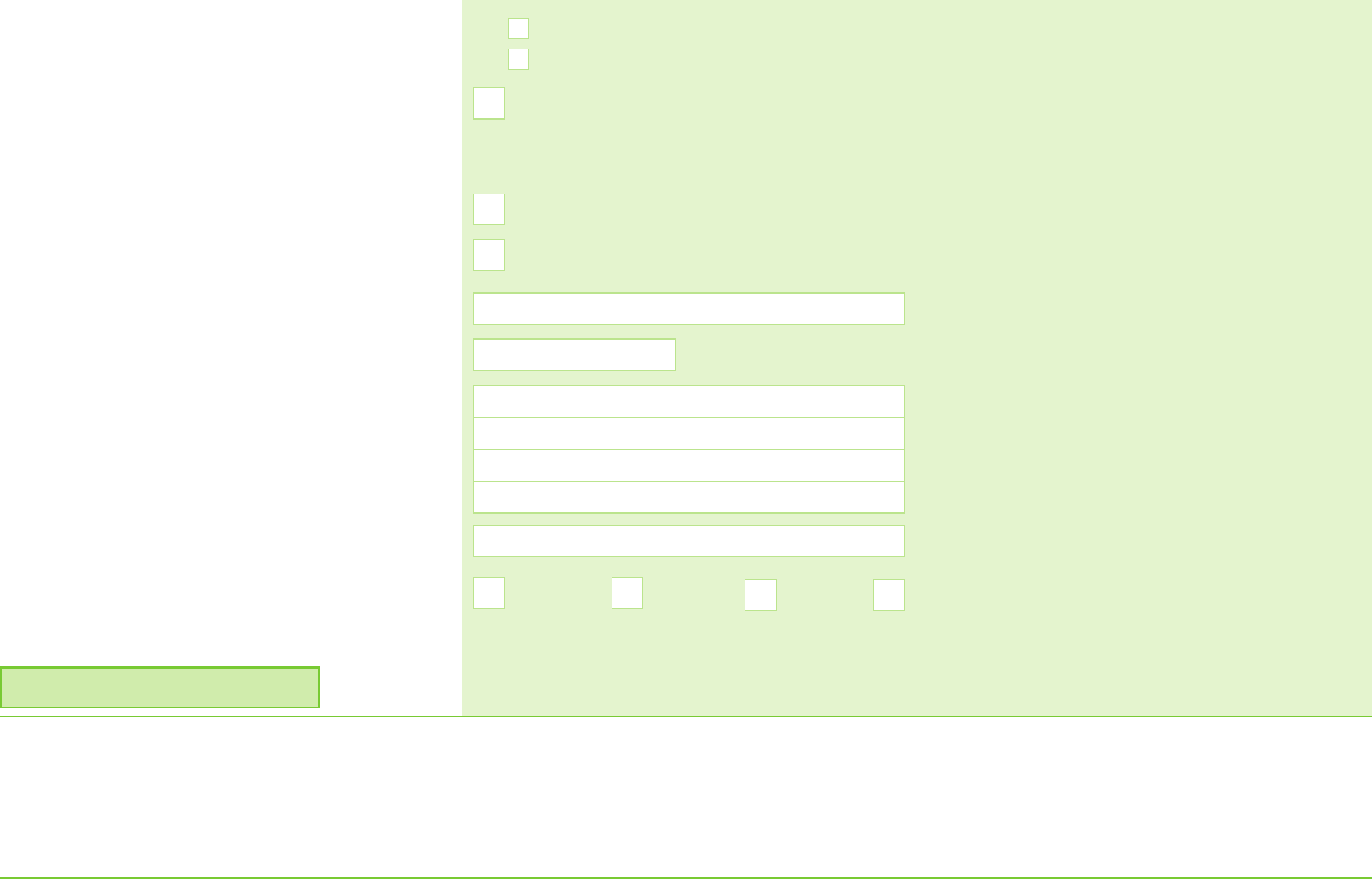

Part 8: For people filling and signing this form for someone else

Have you filled this form in for someone else?

Yes

No

Go to Part 9.

Please tell us about yourself.

Please tell us why you are filling in and signing

this form for someone else.

I am sending a letter signed by the claimant

with this form. The letter tells you that they

agree to me making the claim for them.

Now sign this form in Part 9.

I am their appointee.

I have power of attorney.

Your full name

Your address

Your date of birth

Your phone number

What is this number?

Please tick

/ /

Postcode

Code Number

Home

Work

Mobile Fax

Now sign this form in Part 9.