Fillable Printable Budgeting Loans from the Social Fund Form

Fillable Printable Budgeting Loans from the Social Fund Form

Budgeting Loans from the Social Fund Form

Budgeting Loans

from the Social Fund

Please read these notes carefully. They explain the circumstances when

a loan can be paid. Different circumstances apply to payments of

Community Care Grants and Crisis Loans. If you think you may be

eligible for either of these types of payments, read the section on the

other side of this page.

You will need to fill in the right application form for the type of payment

you need. These are:

l

form SF300 for a Community Care Grant

l

form SF500 for a Budgeting Loan

l

form SF401 for a Crisis Loan

l

form SF100 (Sure Start) for a Sure Start Maternity Grant

l

form SF200 for a Funeral Payment

You must fill in a separate form for each one.

SF500 04/05

We cannot help with any other types of items or services.

Budgeting Loans have to be paid back but they are

interest free.

The maximum size of Budgeting Loan you can have depends

on your circumstances and whether you have any other

loans from the Social Fund that still have to be paid back.

The amount of any Budgeting Loan we may pay together

with the amount you still owe the Social Fund cannot be

more than £1,000.

To make a decision, the decision maker will look at

l how long you have been on benefit

l how many people there are in your household

l how much you already owe the Social Fund.

Savings

l If you and your partner are aged under 60, savings of more

than £500 may affect the amount of money you can get.

l If you or your partner are aged 60 or over, savings of more

than £1,000 may affect the amount of money you can get.

We cannot make a payment for a loan if you already owe

£1,000 or more to the Social Fund.

We cannot pay a Budgeting Loan for expenses of less

than £30.

Budgeting Loans

l

You may be able to get a Budgeting Loan if:

you have been getting Income Support, income-based Jobseeker’s

Allowance, Pension Credit or payment on account of one of these

benefits or entitlements for at least 26 weeks

and

l

You need help

– to buy furniture or household equipment

– to buy clothing and footwear

– to pay rent in advance and/or removal expenses to secure fresh

accommodation

– to pay for home improvements, maintenance or security

– with travelling expenses

– to pay for things to help you look for or start work

– to repay HP or other debts that have been taken out.

How we decide what we can pay you

The decision maker will look at the relevant circumstances and

decide the maximum size of Budgeting Loan you can have, if you

have no existing Social Fund debt. Whether or not you can have a

loan of up to that amount will depend on if you already have a

budgeting loan debt.

Notes

How you pay back a loan

l We will look at what you can afford before we decide on the

arrangements for repayments.

l If we can pay you a Budgeting Loan, we may make you up to

three different offers. It will be up to you which of these offers

you can afford to pay back. We may not be able to lower the

repayment rate if you later feel you cannot afford the rate you

originally agree to.

l

If we can pay you a Budgeting Loan, we will ask you to agree

to repay it and also to agree the way you will repay it before

we make the payment.

l We will take the money back in weekly repayments from your

benefit. If you do not get any benefit, we will arrange for the

loan to be repaid in another way.

l If you have problems later on making the repayments as

originally agreed, we may be able to help, for example

reducing your payments by extending the repayment period.

Your local office can give you advice.

About your claim

l you are moving because you have had an unsettled way of life and an

organisation like a council or charity are resettling you, or

l you need help to travel for special reasons, or you need help because a prisoner

or young offender is going to be living with you while they are on release on a

temporary license.

Community Care grants do not have to be paid back.

Savings

l If you and your partner are aged under 60, savings of more than £500 may affect

the amount of money you can get.

l

If you or your partner are aged 60 or over, savings of more than £1,000 may

affect the amount of money you can get.

These notes give general guidance only and should not be

treated as a complete and authoritative statement of the law.

Community Care Grants

You may be able to get a Community Care Grant if

l you are already getting Income Support, income-based

Jobseeker’s Allowance or Pension Credit.

or

l

you are likely to be getting Income Support, income-based

Jobseeker’s Allowance, Pension Credit or payment on

account of one of these benefits or entitlements, in the next

six weeks because you are leaving institutional care or

residential care.

and

l you are moving out of institutional care or residential care, or

l you need help to stay in your own home, or

l

your family is having very difficult problems, or

Crisis Loans

You may be able to get a Crisis Loan if

l you are aged 16 or over

and

l in an emergency or because of a disaster, you do not have enough money to

meet the immediate needs of yourself and your family, if you have one

and

l there is no other way to prevent serious damage or serious risk to the health,

or safety, of yourself or a member of your family.

You also may be able to get a Crisis Loan if you need help with paying rent in

advance

l

either in an emergency or as a consequence of a disaster, or

l

to a non-local authority landlord because you are moving out of a care home

or institutional care and a Community Care Grant is being paid to establish

you in the community.

Crisis Loans have to be paid back but they are interest free.

Help and advice

If you want more information

l Get in touch with your local office. You can find the phone number and address

on the advert in the business numbers section of the phone book. Look under

Jobcentre Plus or Social Security. See also

– leaflets GL18 Help from the Social Fund available from any of our offices, and

– SB16 A guide to the Social Fund. which can be found on our webside. The

address is www.dwp.gov.uk

l Get in touch with an advice centre like the Citizens Advice Bureau.

Please keep this page for your information

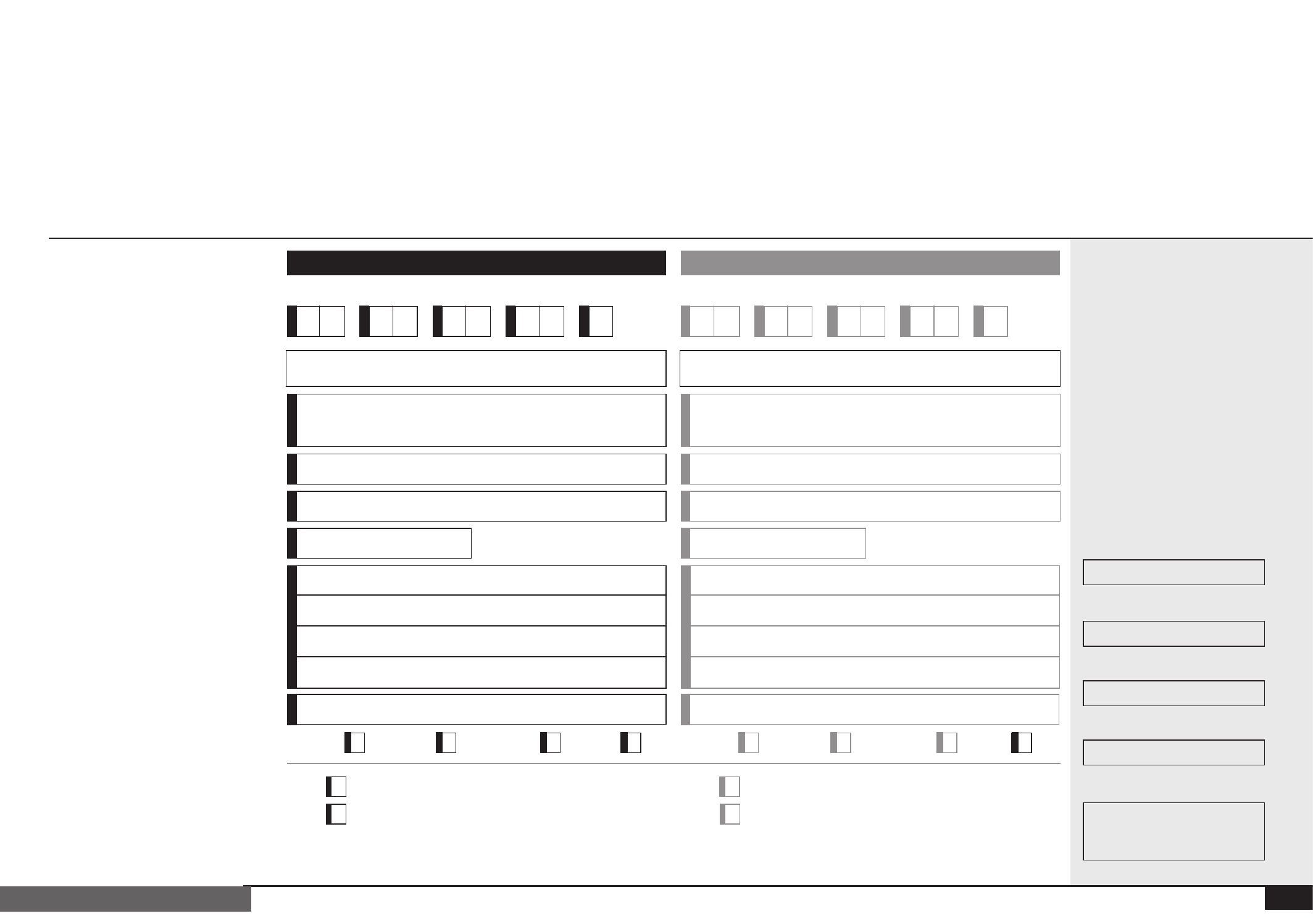

About you and your partner

Part 1

For office use only

Application number

Date of SFCS input

/ /

Date decision made

/ /

Initials

Signature

1

SF500 04/05

l

Before you complete this form, please read the notes sheet which

tells you about all types of help you can get from the Social Fund.

l

Use this form to apply for a

Budgeting Loan

. Complete this form in

ink, sign and date any alterations you make.

l If you are getting Income Support, income-based Jobseeker’s Allowance

or Pension Credit, the person who both claims and gets paid that benefit

or entitlement should fill in this form.

You Your partner

Surname or family

name

Other surnames you

have been known by

National Insurance (NI)

number

Letters Numbers Letter Letters Numbers Letter

Mr / Mrs / Miss / Ms

All other names in full

Mr / Mrs / Miss / Ms

You can find the number on your National Insurance

(NI) numbercard, letters about your benefit or payslips

You can find the number on their National Insurance

(NI) numbercard, letters about their benefit or payslips

Address where you

live now

Tell us your partner’s

address, if different

Postcode Postcode

/ / / /

What is this number?

Please tick

Code Number Code Number

workHome mobile fax faxworkHome mobile

Are you or your partner

involved in a trade dispute?

We use trade dispute to mean

a strike, walk-out, lock-out or

any other dispute about work.

No

Yes

No

Yes

l

Tell us about yourself and your partner, if you have one.

We use partner to mean a person you are married to or a person

you live with as if you are married to them.

l

Fill in the form fully by answering all the questions and requests for

information. Your application may be delayed if we do not have

all the information we need.

Date of birth

Daytime phone number

Budgeting

Loans

from the

Social Fund

2

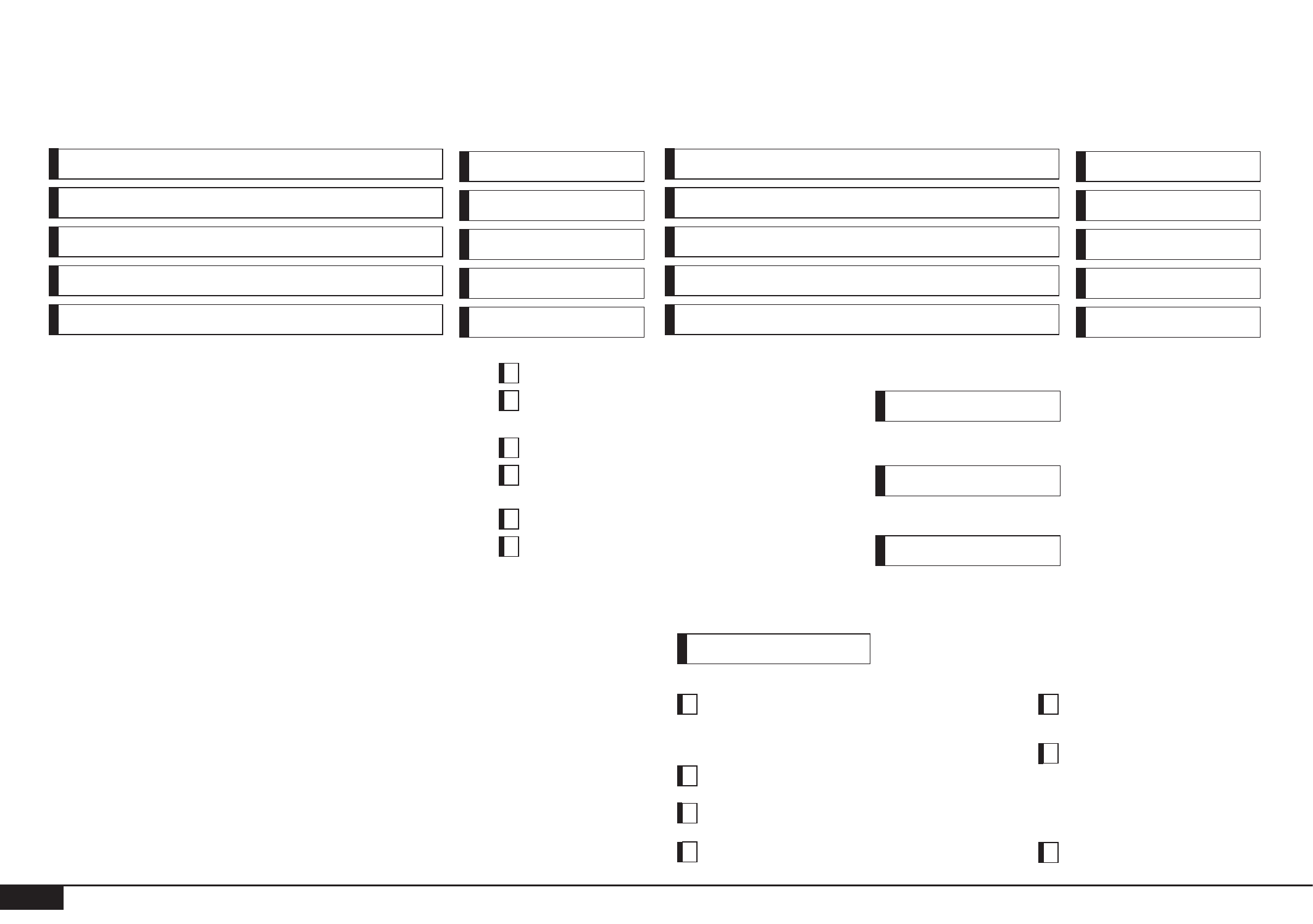

Part 2

About your children

Are you getting Income Support or

income-based Jobseeker’s Allowance for

your children?

No

Yes

How much do you receive weekly?

Are you getting Child Tax Credit for your

children?

No

Yes

How much do you receive weekly?

Are you getting Child Benefit for your children?

No

Yes

How much do you receive weekly?

About what you need

Part 3

/ /

Please tell us about any children you are

getting a benefit or entitlement for.

Date of birthName

/ /

/ / / /

/ / / /

/ / / /

/ / / /

Name Date of birth

£

£

£

Furniture and household

equipment

Rent in advance or removal

expenses to secure fresh

accommodation

Travelling expenses

Improvement, maintenance and

security of the home

Expenses associated with

seeking or re-entering work

Repaying HP and other debts –

for any items or expenses

which are associated with the

categories above

Clothing and footwear

Budgeting loans can only be given for the

types of items or services listed in this part.

Please enter the total amount you need in the

Total amount applied for box for what you

need. Also tick the other category boxes that

apply to you.

We do not need any more information for this

Part 3.

Total amount applied for

£

About you and your partner

Part 3

3

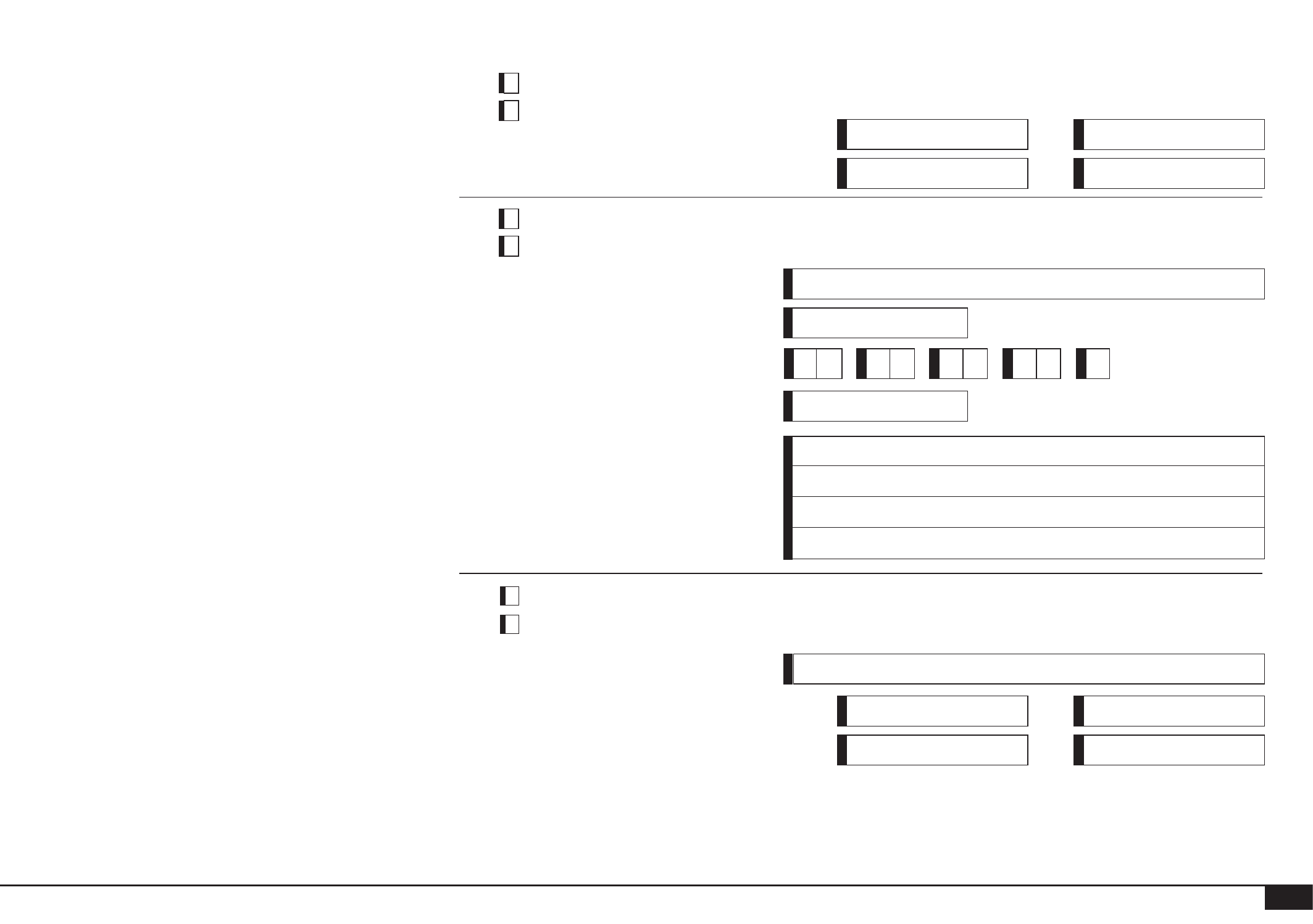

About benefits and entitlements

Are you or your partner currently getting

Income Support, income-based

Jobseeker’s Allowance, Pension Credit or

payment on account of one of these

benefits or entitlements?

No Go to Part 9.

Yes

Tell us the date you have

been getting any of these

benefits or entitlements in

the last 3 years.

Has a partner or an ex-partner received

Income Support, income-based

Jobseeker’s Allowance, Pension Credit or

payment on account of one of these

benefits or entitlements for you, in the last

three years?

No

Yes

Tell us about this person.

Their name

Their National Insurance (NI)

number

Their address

Postcode

/ /

Date of birth

/ /

Date of separation

/ // /

From To

/ /

/ /

From To

Have you, or your partner if you have one,

received any of these benefits or entitlements,

in the last three years?

l

Working Families Tax Credit

l

Working Tax Credit which includes a disability

or severe disability element

l

Child Tax Credit at a rate higher than the

family element.

From April 2005 to April 2006 this means a Child

Tax Credit of £548 a year or more, or £1096 a

year or more if you have a baby under one.

l

Housing Benefit

l

Council Tax Benefit.

No

Yes

Tell us which one. If more than one, tell us about the one you have been getting the longest.

Type of benefit or

entitlement

/ /

/ /

From To

/ /

/ /

From To

4

Part 4

About benefits and entitlements – continued

Has an ex-partner received any of

these benefits or entitlements, in the

last three years?

l

Working Families Tax Credit

l

Working Tax Credit which includes a

disability or severe disability

element

l

Child Tax Credit at a rate higher

than the family element.

From April 2005 to April 2006 this

means a Child Tax Credit of £548 a

year or more, or £1096 a year or more

if you have a baby under one.

l

Housing Benefit

l

Council Tax Benefit.

No

Yes

Tell us about this person.

/ /

/ /

From To

Their name

Their National Insurance (NI)

number

Their address

Postcode

/ /

Date of birth

Type of benefit or entitlement

Have you made this claim because you

have separated from someone?

No

Yes

Tell us about the person you have separated from.

Are you or your partner expecting a baby?

No

Yes

Is there more than one child expected, if so how many?

Their name

Their date of birth

/ /

Part 5

About you and your partner

5

Tell us about any other people who live in your home

Are there any people who are getting Income

Support, income-based Jobseeker’s

Allowance or Pension Credit and their

dependent children in your household?

Do not tell us about your partner or any children

you are getting money for.

No Please go to Part 6.

Yes

Complete the details below.

Name

Date of birth if

dependent child

Date of birth if

dependent child

Name

We need this information to help the decision

maker make a decision on your application.

/ /

/ /

/ /

/ /

/ /

/ /

/ / / /

6

Part 6

About money you have to pay out

Do you or your partner have any savings?

If you or your partner are aged under 60, savings

of more than £500 may affect the amount of

money you can get.

If you or your partner are aged 60 or over, savings

of more than £1000 may affect the amount of

money that you can get.

This can be things like:

l

bank, building society or Post Office® accounts

l premium bonds

l National Savings Certificates.

No

Yes

How much do you have?

£

Who do you pay the money to? How much are you paying and how often ? How much is owed ?

About savings

Part 7

Please tell us about any money that you or

your partner have to pay out regularly, but do

not include normal living expenses like gas

and electric charges or food bills.

Include things like catalogue money, hire

purchase, loan payments and fines.

l

If you need more space, use the box in Part 9.

£

£ every

£

£ every

£

£ every

Part 7

About you and your partner

7

Making payments to you

Our policy is to pay Social Fund payments directly into an account. This is the safest

way to pay you and lets you choose how and when you get your money. You can use

a bank or building society. You may be able to use a cash machine, which will usually

mean you can get your money at any time of the day or night. There are arrangements

with banks and building societies so that you can collect cash from some of their

accounts at your Post Office® branch.

The Post Office® also provides a bank account that we can pay benefits, pensions,

allowances and credits into. With this account you can only collect your money in cash

from Post Office® branches, however a Post Office® card account cannot be opened

solely for the use of a Social Fund payment.

Other advantages of getting your money paid into an

account are:

l You can get your money from many different places.

l From some accounts you can have regular bills paid. This could

save you money but you will need to make sure that there is

enough money in your account to pay the bills. If not, you may be

charged a fee.

Finding out how much is paid into the account

We will tell you when the first payment will be made and how much it

is for.

You can check your Social Fund payments on your account

statements.Your statements will show your National Insurance (NI)

number next to payments that are from us. A Post Office® card

account statement shows your payment details but not your National

Insurance (NI) number. If you think your payment is wrong, get in

touch with the office that pays you.

Sometimes we may pay too much money into the account

If this is because of the way the system works for payments direct

into an account, we have the right to recover any money you are not

entitled to. For example, you may give us information which means

you are entitled to less money but we may not be able to change the

amount already sent out. We will contact you first if we propose to

recover money under this rule.

Getting someone to collect your Social Fund payment

If you want someone else to collect your Social Fund payment for

you, you may be able to make arrangements with your bank, building

society or, if you have a Post Office® card account, the Post Office®.

Please ask them for help with this.

A – Payment direct into an account

8

Part 8

Making payments to you – continued

B – About the account you want to use

Please give your account details below

You can find the account details on the cheque book, passbook or statements.

If you are not sure about the details, ask the bank or building society, or the

Post Office® if it is a Post Office® card account.

What name or names is the account in?

Please write the name or names as they appear on the

cheque book, passbook or statement.

Full name of bank or building society

Print the full name of your bank or building society.

For a Post Office® card account write Post Office.

Sort Code

Please tell us all six numbers, for example: 12-34-56.

Account number. This is seven to ten numbers long.

Building Society roll or reference number – some

building societies accounts use a roll or reference

number. The number is on the passbook.

The roll or reference can contain letters and numbers and can be up to 18 characters long.

If you are not sure if the account has a roll or reference number, ask the building society.

More information if it is a building society account

In your name

Whose name or names is the account in?

We use partner to mean the person you are married to or

the person you live with as if you were married to them.

By ticking the box for an account that includes the

name of the person acting on your behalf, you confirm

that you will authorise them to use the money in the

way you tell them.

In the name of your partner

In the names of you and your partner

In the name of the person acting on your behalf

In the names of you and the person acting on your behalf

You may be getting other benefits that are not paid direct

into an account at the moment. If you now agree to have

them paid into this account, please tell us the name of the

benefit or benefits.

Please tick one box.

Part 8

About you and your partner

9

Making payments to you – continued

C – If you did not complete section B

If you have a bank or building society account but you do not wish to use it, for example,

a joint account, any bank or building society will help you open an account that suits you

better. Remember to ask whether their accounts allow you to get your money from the

Post Office®, if this is important to you.

l

Basic bank account

If you have had problems opening a current account, or if you

are worried about being overdrawn, you could ask any bank or

building society about opening a basic bank account. These are

sometimes called introductory or starter accounts and are

available from all major banks. These accounts offer free

banking but overdrafts are not available. You can use these

accounts to pay money in, pay bills automatically and get cash

out. Many basic bank accounts also allow you to get cash from

Post Offices®.

I intend to open an account.

I have not given details of an account, or

do not intend to open an account.

We will contact you about your payment.

Complete the claim form and send it to us now.

Do not wait until you have opened an account.

Complete the claim form and send it to us now.

Do not wait until you have opened an account.

What to do now

Tick the box that applies to you.

Please read the notes below then tick Box 1 or Box 2.

l

Post Office® card account

This is a simple bank account that can only have benefit payments

paid into it. Housing Benefit cannot be paid into it. You can only

collect payment from the account in cash at a Post Office®

branch. You will not have a cheque book and cannot withdraw

money at a cash machine. You will not be able to run up an

overdraft, pay bills by Direct Debit or Standing Order, or have your

salary or any other money paid in. The account can only be in

your name. You may be able to arrange with the Post Office® for

someone else to collect your benefit regularly from this account.

Box 1

Box 2

Any bank or building society will help you open an account.

If you want to get your money at the Post Office®, check that

the account allows you to do this. When you have the

account details, tell us straight away.