Fillable Printable California Payroll Taxes (De 201)

Fillable Printable California Payroll Taxes (De 201)

California Payroll Taxes (De 201)

DE 201 Rev. 3 (2-17) (INTERNET) Page 1 of 1 CU

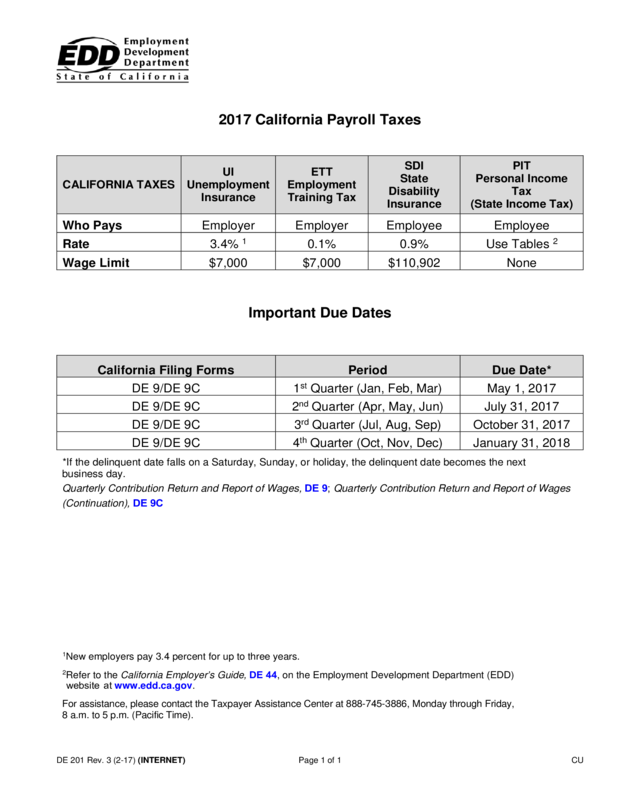

2017 Calif ornia Payroll Taxe s

CALIFORNIA TAXES

UI

Unemployment

Insurance

ETT

Employment

Training Tax

SDI

State

Disability

Insurance

PIT

Personal Income

Tax

(State Income Tax)

Who Pays

Employer

Employer

Employee

Employee

Rate

3.4%

1

0.1%

0.9%

Use Tables

2

Wage Limit

$7,000

$7,000

$110,902

None

Impor t a nt Due Da tes

California Fi ling Forms

Period

Due Date*

DE 9/DE 9C

1

st

Quarter (Jan, Feb, M ar )

May 1, 2017

DE 9/DE 9C

2

nd

Quarter (Apr, May, Jun)

July 31, 2017

DE 9/DE 9C

3

rd

Quarter (Jul, Aug, Sep)

October 31, 2017

DE 9/DE 9C

4

th

Quarter (Oct, Nov, Dec)

January 31, 2018

*If the delinquent date falls on a Saturday, Sunday, or holiday, the delinquent date becomes the next

business day.

Quarterly Contribution Return and Report of Wages, DE 9; Quarterly Contribution Return and Report of Wages

(Continuation), DE 9C

1

New employers pay 3.4 percent for up to three years.

2

Refer to the California Employer’s Guide, DE 44, on the Employment Development Department (EDD)

website at www.edd.ca.gov.

For assistance, please contact the Taxpayer Assistance Center at 888-745-3886, Monday through Friday,

8 a.m. to 5 p.m. (Pacific Time).