Fillable Printable Canada Child Tax Benefit - Statement of Income

Fillable Printable Canada Child Tax Benefit - Statement of Income

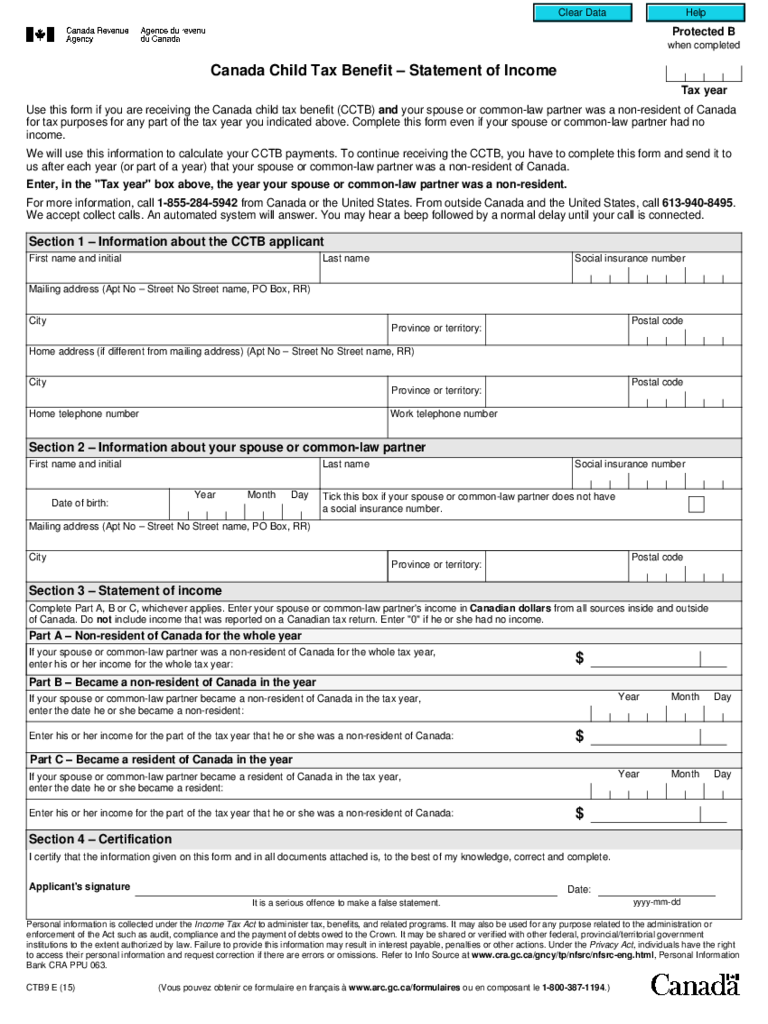

Canada Child Tax Benefit - Statement of Income

Protected B

when completed

Canada Child Tax Benefit – Statement of Income

Tax year

Use this form if you are receiving the Canada child tax benefit (CCTB) and your spouse or common-law partner was a non-resident of Canada

for tax purposes for any part of the tax year you indicated above. Complete this form even if your spouse or common-law partner had no

income.

We will use this information to calculate your CCTB payments. To continue receiving the CCTB, you have to complete this form and send it to

us after each year (or part of a year) that your spouse or common-law partner was a non-resident of Canada.

Enter, in the "Tax year" box above, the year your spouse or common-law partner was a non-resident.

For more information, call 1-855-284-5942 from Canada or the United States. From outside Canada and the United States, call 613-940-8495.

We accept collect calls. An automated system will answer. You may hear a beep followed by a normal delay until your call is connected.

Section 1 – Information about the CCTB applicant

First name and initial Last name Social insurance number

Mailing address (Apt No – Street No Street name, PO Box, RR)

City

Province or territory:

Postal code

Home address (if different from mailing address) (Apt No – Street No Street name, RR)

City

Province or territory:

Postal code

Home telephone number Work telephone number

Section 2 – Information about your spouse or common-law partner

First name and initial Last name Social insurance number

Date of birth:

Year Month Day

Tick this box if your spouse or common-law partner does not have

a social insurance number.

Mailing address (Apt No – Street No Street name, PO Box, RR)

City

Province or territory:

Postal code

Section 3 – Statement of income

Complete Part A, B or C, whichever applies. Enter your spouse or common-law partner's income in Canadian dollars from all sources inside and outside

of Canada. Do not include income that was reported on a Canadian tax return. Enter "0" if he or she had no income.

Part A – Non-resident of Canada for the whole year

If your spouse or common-law partner was a non-resident of Canada for the whole tax year,

enter his or her income for the whole tax year:

$

Part B – Became a non-resident of Canada in the year

If your spouse or common-law partner became a non-resident of Canada in the tax year,

enter the date he or she became a non-resident:

Year Month Day

Enter his or her income for the part of the tax year that he or she was a non-resident of Canada:

$

Part C – Became a resident of Canada in the year

If your spouse or common-law partner became a resident of Canada in the tax year,

enter the date he or she became a resident:

Year Month Day

Enter his or her income for the part of the tax year that he or she was a non-resident of Canada:

$

Section 4 – Certification

I certify that the information given on this form and in all documents attached is, to the best of my knowledge, correct and complete.

Applicant's signature

It is a serious offence to make a false statement.

Date:

yyyy-mm-dd

Personal information is collected under the Income Tax Act to administer tax, benefits, and related programs. It may also be used for any purpose related to the administration or

enforcement of the Act such as audit, compliance and the payment of debts owed to the Crown. It may be shared or verified with other federal, provincial/territorial government

institutions to the extent authorized by law. Failure to provide this information may result in interest payable, penalties or other actions. Under the Privacy Act, individuals have the right

to access their personal information and request correction if there are errors or omissions. Refer to Info Source at www.cra.gc.ca/gncy/tp/nfsrc/nfsrc-eng.html, Personal Information

Bank CRA PPU 063.

CTB9 E (15)

(Vous pouvez obtenir ce formulaire en français à www.arc.gc.ca/formulaires ou en composant le 1-800-387-1194.)

Clear Data

Help