Fillable Printable Child Tax Benefit Application Form - Canada

Fillable Printable Child Tax Benefit Application Form - Canada

Child Tax Benefit Application Form - Canada

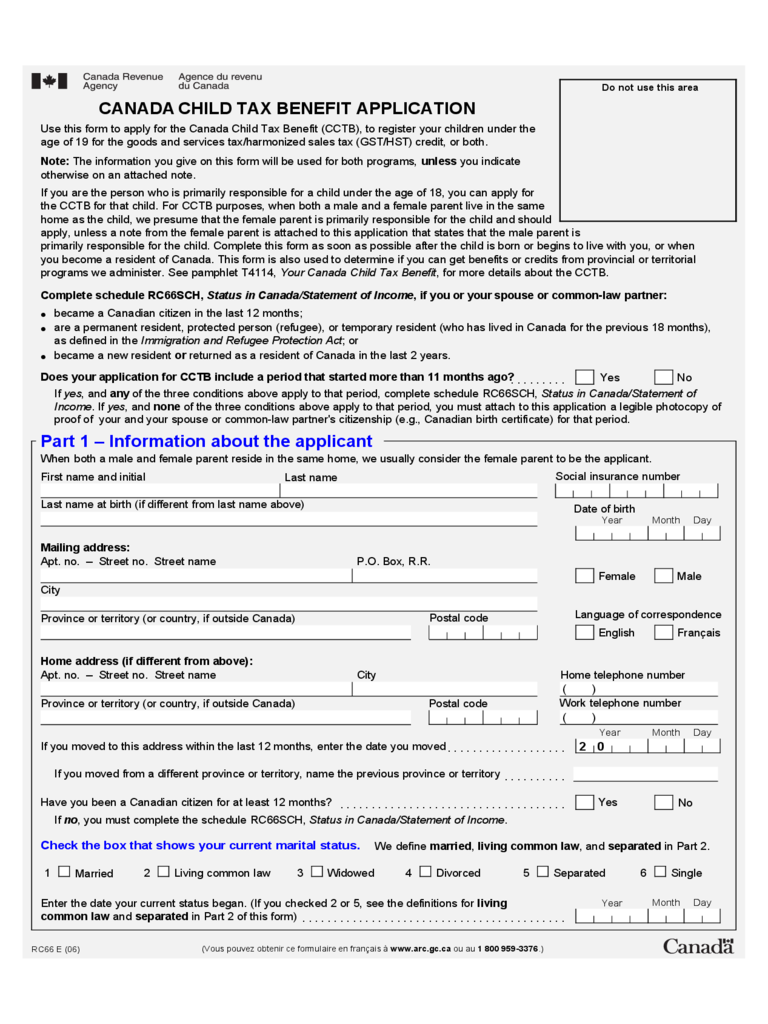

Part 1 – Information about the applicant

CANADA CHILD TAX BENEFIT APPLICATION

Use this form to apply for the Canada Child Tax Benefit (CCTB), to register your children under the

age of 19 for the goods and services tax/harmonized sales tax (GST/HST) credit, or both.

RC66 E (06)

Do not use this area

If you moved from a different province or territory, name the previous province or territory

If you moved to this address within the last 12 months, enter the date you moved

MonthYear Day

. . . . . . . . . . . . . . . . . . .

. . . . . . . . . .

Social insurance number

First name and initial

()

Last name

Enter the date your current status began. (If you checked 2 or 5, see the definitions for living

common law and separated in Part 2 of this form)

Month

Year

Day

We define married, living common law, and separated in Part 2.

Check the box that shows your current marital status.

20

Married

1

2

Living common law

5

Separated Divorced Single

3

Widowed

4 6

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Complete schedule RC66SCH, Status in Canada/Statement of Income, if you or your spouse or common-law partner:

Yes

No

()

Last name at birth (if different from last name above)

Female Male

Province or territory (or country, if outside Canada)

Date of birth

Month

Year Day

Apt. no. – Street no. Street name P.O. Box, R.R.

City

Postal code

Language of correspondence

English

Français

Work telephone number

Home telephone number

Postal code

Home address (if different from above):

Province or territory (or country, if outside Canada)

Apt. no. – Street no. Street name

Have you been a Canadian citizen for at least 12 months?

Mailing address:

If you are the person who is primarily responsible for a child under the age of 18, you can apply for

the CCTB for that child. For CCTB purposes, when both a male and a female parent live in the same

home as the child, we presume that the female parent is primarily responsible for the child and should

apply, unless a note from the female parent is attached to this application that states that the male parent is

primarily responsible for the child. Complete this form as soon as possible after the child is born or begins to live with you, or when

you become a resident of Canada. This form is also used to determine if you can get benefits or credits from provincial or territorial

programs we administer. See pamphlet T4114, Your Canada Child Tax Benefit, for more details about the CCTB.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

City

If yes, and any of the three conditions above apply to that period, complete schedule RC66SCH, Status in Canada/Statement of

Income. If yes, and none of the three conditions above apply to that period, you must attach to this application a legible photocopy of

proof of your and your spouse or common-law partner's citizenship (e.g., Canadian birth certificate) for that period.

(Vous pouvez obtenir ce formulaire en français à www.arc.gc.ca ou au 1 800 959-3376.)

Yes No

. . . . . . . . .

Does your application for CCTB include a period that started more than 11 months ago?

If no, you must complete the schedule RC66SCH, Status in Canada/Statement of Income.

are a permanent resident, protected person (refugee), or temporary resident (who has lived in Canada for the previous 18 months),

as defined in the Immigration and Refugee Protection Act; or

became a Canadian citizen in the last 12 months;

became a new resident or returned as a resident of Canada in the last 2 years.

z

z

z

Note: The information you give on this form will be used for both programs, unless you indicate

otherwise on an attached note.

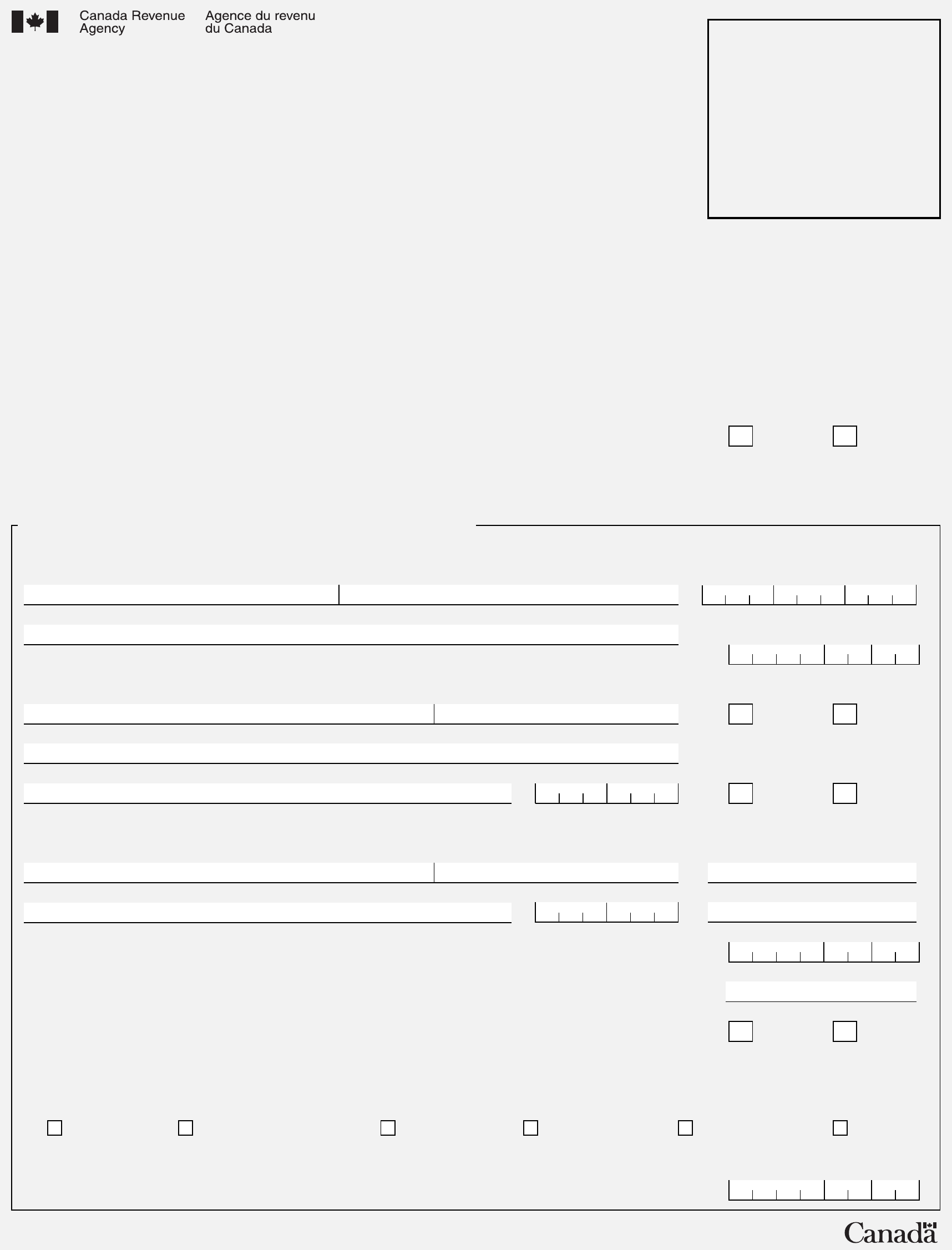

When both a male and female parent reside in the same home, we usually consider the female parent to be the applicant.

1)

You have a common-law partner and are

living common law if you are living in a

conjugal relationship with a person who is

is the parent of your child by birth or adoption; or

Living common law

You are married and have a spouse when

you are legally married.

Married

Part 2 – Information about your spouse or common-law partner

Social insurance number

Month

Year Day

If your spouse or common-law partner's address is different from your address, please explain:

First name and initial

Last name

You are separated when you start living

separate and apart from your spouse or

common-law partner because of a breakdown in

the relationship for a period of at least 90 days

and you have not reconciled.

Separated

Date of birth

Last name at birth (if different from last name above)

Female Male

has been living with you in a conjugal relationship for at least 12 continuous

months;

2)

Attach legible photocopies of all sides of all pages of one of the following documents for proof of birth:

Proof of birth

a baptismal or cradle roll certificate or other church record;

a birth certificate or birth registration;

the hospital record of birth or the record of the physician,

nurse, or midwife who attended the birth;

z

What is this child's relationship to you?

If no, when did you become primarily responsible for the child?

Place of birth:

City

. . . . . . . . . . . . . . . . . . . . . . . . . . . .

MonthYear Day

Female Male

MonthYear Day

Have you been primarily responsible for this child since birth?

Yes No

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Province or territory (or country, if outside Canada)

First name and initial

Last name

First child

Part 3 – Information about your child(ren)

Yes No

Has your spouse or common-law partner been a Canadian citizen for at least 12 months?

. . . . . . . . . . .

Complete this part to provide information about your child(ren).

Do not provide information about a child for whom you have already applied, or for whom you receive, the CCTB.

Date of birth

Note: Separated status begins on the first

day of the period (at least 90 days) in which

you lived apart.

In addition, an individual immediately becomes your common-law partner if you

previously lived together in a conjugal relationship for at least 12 continuous

months and you have resumed living together in such a relationship. Under

proposed changes, this condition will no longer exist. The effect of this

proposed change is that a person (other than a person described in 2) or 3)

above) will be your common-law partner only after your current relationship with

that person has lasted at least 12 continuous months. This proposed change will

apply to 2001 and later years.

a passport;

z

z

a Notice of Decision or a Temporary Resident's Permit

issued under the Immigration and Refugee Protection Act.

a Record of Landing or Confirmation of Permanent Residence

issued by Citizenship and Immigration Canada;

3)

has custody and control of your child (or had custody and control

immediately before your child turned 19 years of age) and your child is wholly

dependent on that person for support.

z

a citizenship certificate; or

z

z

z

Attach proof of birth to this completed form if the Canada Revenue Agency has not previously paid CCTB benefits or

the GST/HST credit for the child, and either of the following applies:

z

z

the child was born outside Canada; or

the child was born in Canada and is one year of age or older.

Reference to "12 continuous months" in this definition includes any period that

you were separated for less than 90 days because of a breakdown in the

relationship.

(Do not include children for whom you have already applied.)

If no, you must complete schedule RC66SCH, Status in Canada/Statement of Income.

. . . . . .

not your spouse, and any of the following applies. He or she:

If you are applying for more than three children, use a separate sheet of paper to give the information requested above for the

additional children. Sign the sheet and attach it to your completed form.

What is this child's relationship to you?

If no, when did you become primarily responsible for the child?

Date of birth

Place of birth:

City

. . . . . . . . . . . . . . . . . . . . . . . . . . . . .

MonthYear Day

Female Male

MonthYear Day

Have you been primarily responsible for this child since birth?

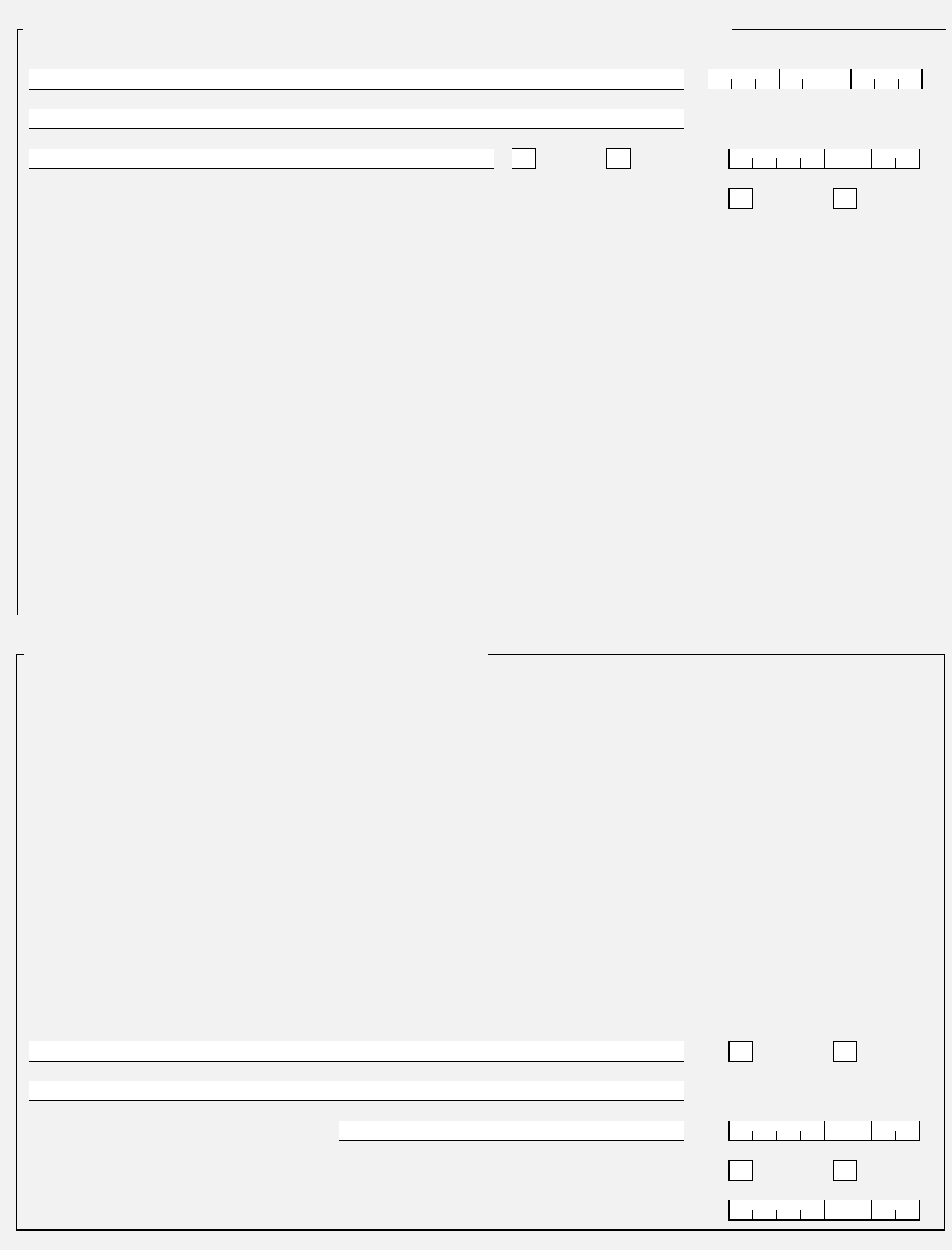

Province or territory (or country, if outside Canada)

First name and initial

Last name

Second child

What is this child's relationship to you?

If no, when did you become primarily responsible for the child?

Date of birth

Place of birth:

City

. . . . . . . . . . . . . . . . . . . . . . . . . . . . .

MonthYear Day

Female Male

MonthYear Day

Have you been primarily responsible for this child since birth?

Province or territory (or country, if outside Canada)

First name and initial

Last name

Third child

Yes No

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes No

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Complete this part if someone else has applied for, or is receiving, the CCTB for the child(ren).

If you cannot get the previous caregiver's signature, please explain:

Date the child(ren) left the

previous recipient's care

MonthYear Day

Previous caregiver's signature

Part 4 – Change of recipient

I certify that the information given on this form is, to the best of my knowledge, correct and complete.

If you cannot get your spouse or common-law partner's signature, please explain:

Spouse or common-law partner's signature

Part 5 – Certification

We cannot process this form unless it is signed. If you are married or living common law, your spouse or common-law partner

also needs to sign this form.

It is a serious offence to make a false statement.

Date

Applicant's signature

Date

Use the checklist on the back of this page to be sure you have filled out all the proper sections. You will also find

information on where to send your completed form and a section to apply for direct deposit for your CCTB payments.

Part 3 – continued

Name, address, and telephone number

of previous caregiver or agency

Name of child (or children)

20

It is a serious offence to make a false statement.

(Do not include children for whom you have already applied.)

(Do not include children for whom you have already applied.)

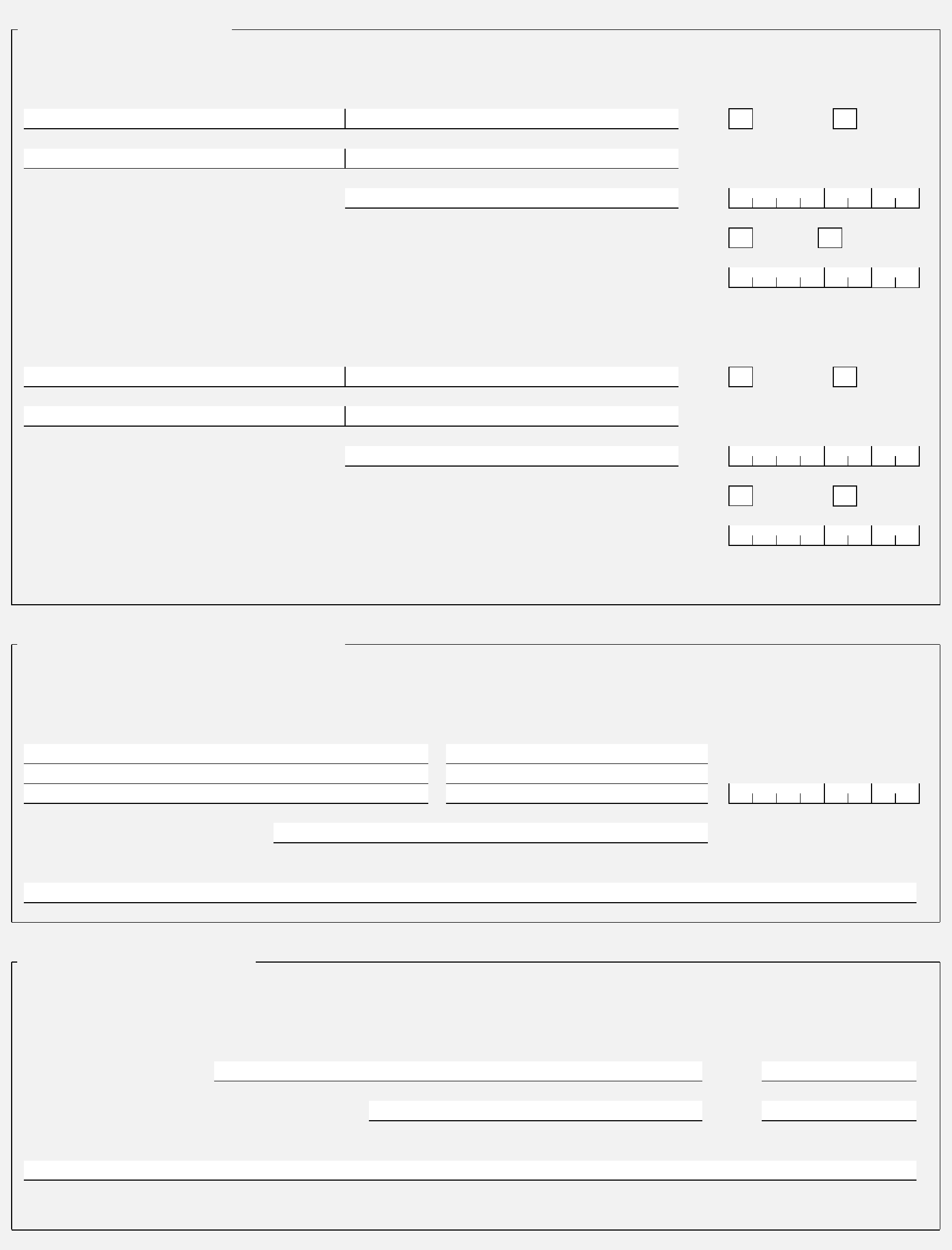

If you do not have direct deposit for your CCTB payments and you want to start, provide the banking information requested below.

If you do not have direct deposit for your income tax refund or GST/HST credit and you want to start, or you have it and want to

change the account information, complete Form T1-DD(1), Direct Deposit Request – Individuals.

Complete all parts of the form that apply to you and to your spouse or common-law partner.

Attach legible photocopies of all required documents (such as immigration documents and proof of birth).

We want to process your completed form as soon as we can. Be sure to do the following:

Checklist

For information about the CCTB or to get pamphlet T4114, Your

Canada Child Tax Benefit, visit our Web site at

www.cra.gc.ca/benefits. You can also get the pamphlet by calling

1-800-959-2221 or get information by calling 1-800-387-1193.

Additional information

We can only calculate your CCTB if you and your spouse or common-law partner have filed a return for the previous year (if you were a

resident of Canada in that year). To continue getting the CCTB, you both have to file a return every year that you are a resident in Canada,

even if you have no income to report. However, if your spouse or common-law partner is a non-resident, he or she must report his or

her income on Form CTB9, Canada Child Tax Benefit Statement of Income.

Complete and attach the schedule Status in Canada/Statement of Income if it applies to you or to your spouse or common-law

partner.

For information about the GST/HST credit or to get

pamphlet RC4210, GST/HST Credit, visit our Web site at

www.cra.gc.ca/benefits. You can also get the pamphlet by

calling 1-800-959-2221 or get information by calling

1-800-959-1953.

Privacy Act Personal Information Bank number CRA/P-PU-140

CCTB

GST/HST credit

This form is used to register your child(ren) under 19 years

of age for the GST/HST credit. If you did not apply for the

GST/HST credit on your last return, you can apply now by

including a letter with this form.

Sign this form. If you are married or living common law, your spouse or common-law partner must also sign this form.

Send us your completed form and any required documents in the

envelope included with your package. If you do not have the

preprinted envelope, send them to one of our tax offices. You can

find the addresses on our Web site at www.cra.gc.ca/benefits or in

pamphlet T4114, Your Canada Child Tax Benefit.

Where to send your completed form

Printed in Canada

If you use direct deposit for your CCTB payments, we will automatically deposit (into the same account) any payments from related

provincial or territorial benefit and credit programs that we administer.

If you are changing any account into which we deposit a payment, do not close the old account before we deposit the payment into

the new account. If your financial institution tells us that you have a new account, we may deposit your payments into the new

account. If we cannot deposit a payment into your account, we will mail a cheque to you at the address we have on file.

Your direct deposit request will stay in effect until you change the information or cancel the service. However, your payments

may stop if you move and do not give us your new address.

Branch number

(5 digits)

Institution number

(3 digits)

Account number

(12 digits maximum)

Name of financial institution

If you have direct deposit for your CCTB payments for other children and your account information has not changed, you do not

need to complete this part. If your account information has changed, provide the banking information requested below.

Attach a blank cheque with the banking information encoded on it and write "VOID – CCTB" or complete the banking information

requested below. To find these numbers, see your passbook, bank statement, encoded deposit slip, or cheque, or contact your

financial institution.

z

Banking information

. . . . . . . . . . . . . . . . . . . . . . . . . . .

z

If you have direct deposit for your tax refund and GST/HST credit payments and you want your CCTB payments

deposited into the same account, check this box. If you want your CCTB payments deposited into a different

account, do not check the box. Provide the banking information requested below

z

Part 6 – Direct deposit

If you checked the box above, do not provide your banking information.