Fillable Printable Capital Expenditure Budget Form

Fillable Printable Capital Expenditure Budget Form

Capital Expenditure Budget Form

WHEDA Form 700 Revised 10/14

th d

e

if WHEDA ld if th

Capital Expenditures Budget

General

The Capital Budget Form 700 is required to be submitted for all WHEDA & ARRA developments,

unless approval has been granted by the Portfolio Risk Officer (PRO) to waive the requirement. It is

due thirty days prior to the start of the fiscal year for the development. For projects operating on a

calendar year basis, it is due on December 1 of each year.

The Capital Budget form 700 is also available on WHEDA’s website at

http://www.wheda.com/root/BusinessPartners/PropertyManagers/Dynamic.aspx?id=1353.

Submission of the capital budget does not invoke acceptance of the expenditures by WHEDA

SM

or grant pre-approval for any amount to be disbursed from WHEDA-held reserve funds.

Requests for disbursements from these reserves must conform to the WHEDA Reserve

Disbursement Policy

(http://www.wheda.com/uploadedFiles/Website/Business_Partners/Property_Managers/reserves.pdf).

Purpose

This form is intended to identify projected capital expenditures for the development during the next

three years and to determine if cash transfers will be necessary from WHEDA held reserves or if the

ree years an

t

o

d t

erm

i

ne cas

h

t

rans

f

ers w

ill

b

e necessary

f

rom -

h

e reserves, or e

development can afford to pay from operations. This determination is made based on the assumption

that management has some estimate of revenues and expenses for the next few years.

Instructions

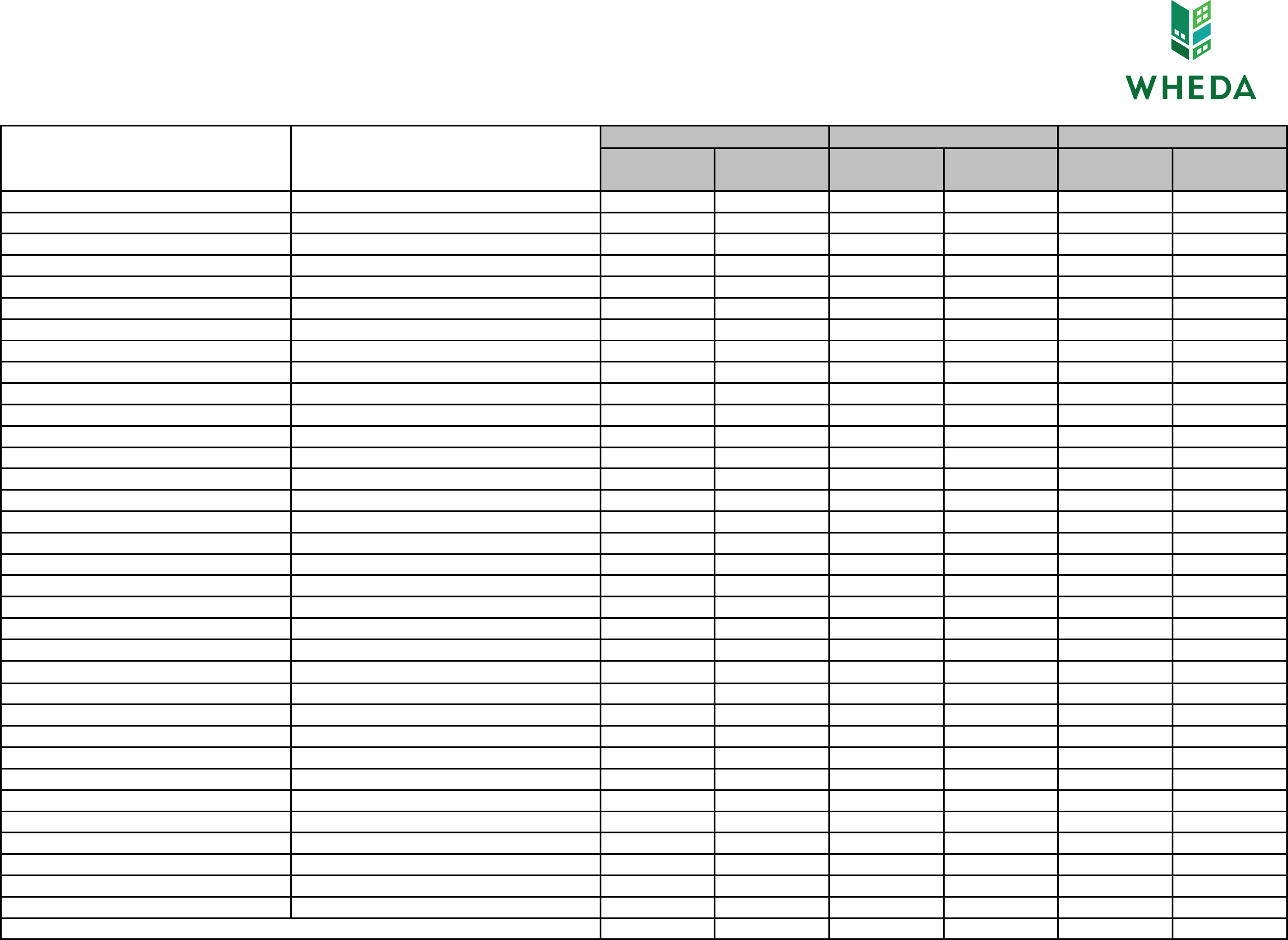

• Enter the WHEDA development number, name, management company, phone number, email

address, if applicable, and the name of the individual completing the spreadsheet.

• The fiscal years have been entered in the top column of spreadsheet for which the capital budget

applies. A three-year plan is required.

• Enter a brief description of the expenditure, such as quantity, location of repair or replacement, or

specific information related to the type of work needing to be performed.

y

next three years. Do not include operating expenses that are incurred from normal business

operations, unless it is estimated that cash flows will not cover the expense . Examples of capital

expenditures are listed on the form, but are not limited to these items.

• Enter totals in each column for each year.

•

Management Agent and Owner must sign the signature page.

• Submit to WHEDA at least 30 days prior to the start of the development’s fiscal year. This will be

December 1 for developments that report on a calendar year.

WHEDA Form 700 Revised 12/14

WHEDA DEVELOPMENT #: ________________________ Prepared By: ____________________________________

Development Name:____________________________________________ Phone #: ________________________________________

Management Name:____________________________________________ E-mail Address: __________________________________

Year 20 Year 20 Year 20

Type of Expenditure Description

Operating

Account

Reserve

Escrow

Operating

Account

Reserve

Escrow

Operating

Account

Reserve

Escrow

Air Systems

Appliances (Specify):

Appliances (Specify):

Appliances (Specify):

Cabinets

Carpeting

Closets

Computer Equipment & Software

Cooling Systems

Countertops

Doors

Driveway/Parking Lot

Electrical Systems

Equipment & Machinery (Specify)

Exterior Walls, Siding, Foundation

Flooring (vinyl, wood, etc.)

Heating Systems

Interior Walls, Ceiling

Landscaping

Lighting Systems

Painting

Play areas, equipment, benches

Roofing, flashing, chimneys & vents

Section 504 Compliance (Specify):

Security Systems

Storage

Trash Collection Area

Walks, steps, ramps and handrails

Windows

Other (Specify):

Other (Specify):

Other (Specify):

Total Budgeted Capital Expenditures

CAPITAL EXPENDITURES BUDGET

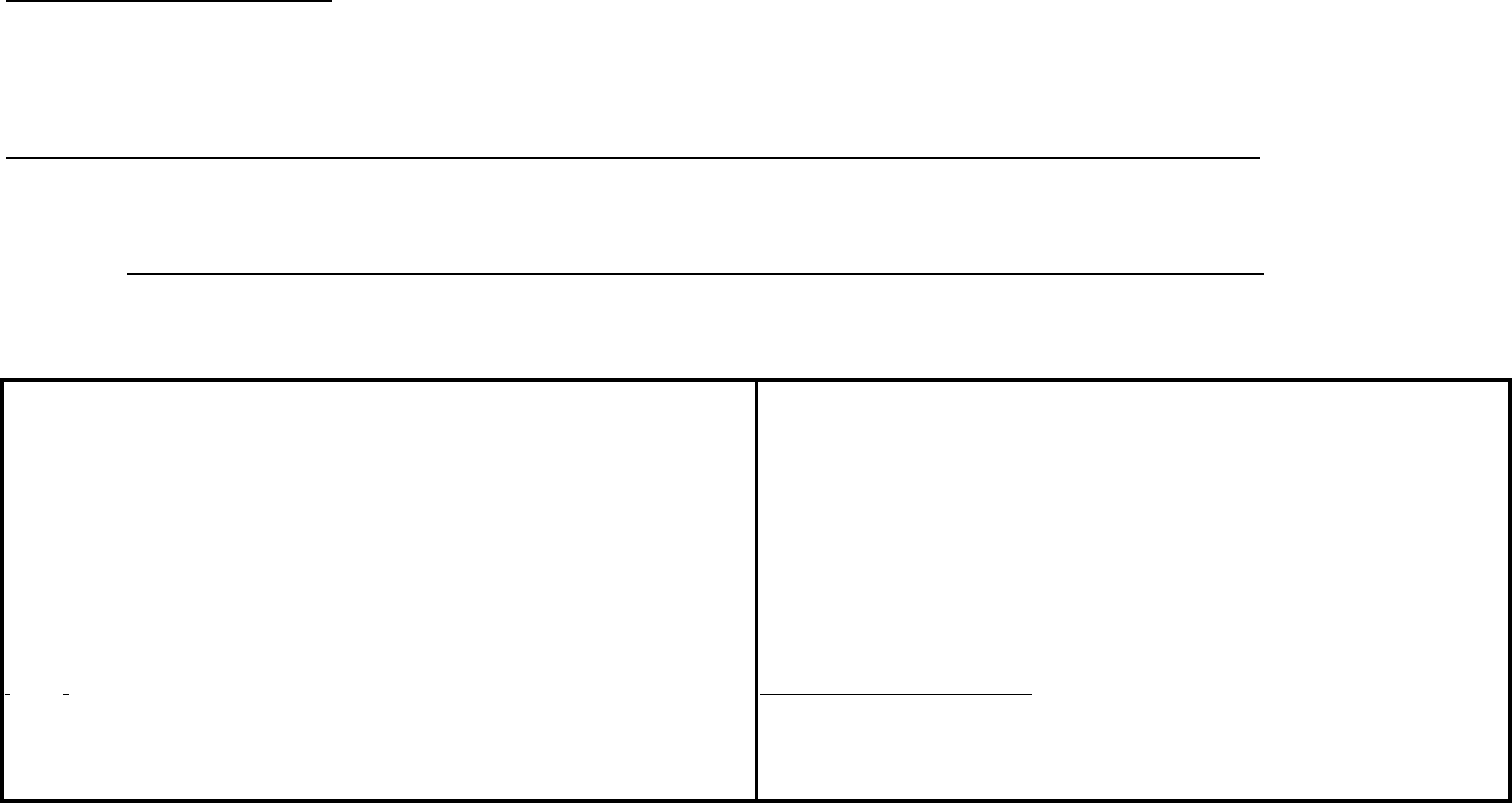

Disbursement of Reserve Funds

Management Entity’s Signature Owner’s Acceptance

Budget prepared by:

I have reviewed and I approve the Capital Expenditures Budget. I have read and accept WHEDA’s reserve

disbursement policy.

_______________________________________________ _________________________ ______________________________________________ __________________

Name and title Date Owner Date

2. The total disbursement requests for a project are less than $5,000 per month; and

3. If the property is a section 8 development that has extended its low-income use through WHEDA’s Preservation Program, the expenditure has

been identified in the Capital Needs Assessment; and

4. The expenditure does not require WHEDA specifications (i.e., roofing, concrete, asphalt); and

5. For carpeting and flooring, the expenditure meets HUD/FHA standards and requirements

.

Please remember escrowed funds may not be available to fund capital improvement initiatives unless these initiatives are reviewed and approved by WHEDA

prior to contracting for purchase of goods and services.

1. The development has minimum reserve balances in aggregate of $1,500 per unit after the amount of the request is deducted; and

Expenditures that are not

pre-authorized by WHEDA may be disbursed from reserve accounts if all of the following conditions apply:

_______________________________

Management Entity Name Ownership entity name

(

______)___________________________________ (__________)____________________

Telephone number Telephone number

________________________________

Email address Email address

WHEDA Form 700 Revised 10/14