Budget Templates

- DOCUMENTS

- GUIDANCE

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

What is a Budget?

A budget is a basic financial strategy outlining potential expenditure and income over a specific period of time. It is an essential aspect of financial planning for both business and domestic purposes. It is a crucial counter measure against excessive spending, miscalculations and risk.Defining in detail

A Budget is defined as a quantifiable rendition of a financial plan for a specifically demarcated period of time.- Domestic Budget:

- Business Budget:

What is a Budget Planner?

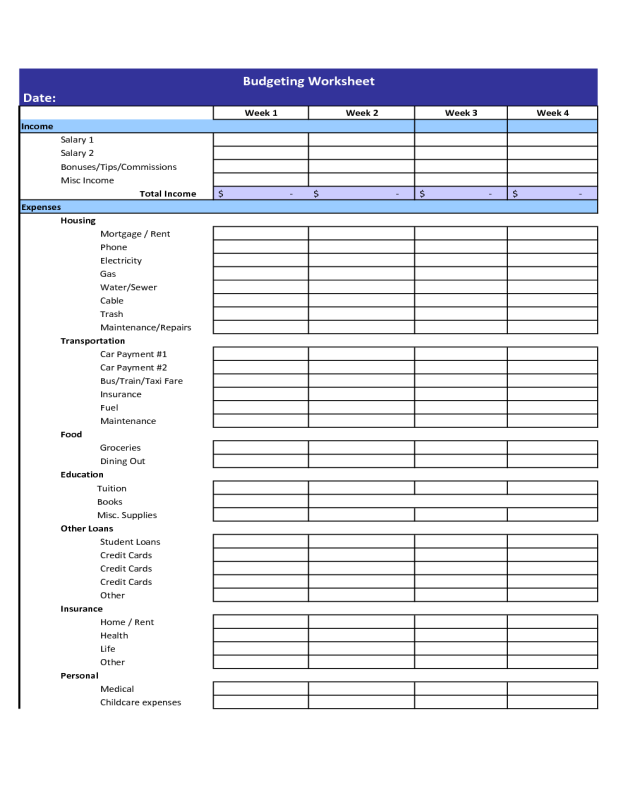

A Budget planner is an inclusive calculation tool that keeps tabs on your budget and helps to optimize your available resources. It allows you create your own worksheets with subcategories to organize different sources of income and expenditure.Budget Planners are versatile tools which can help calculate various kinds of budgets according to your needs like:- Home budget

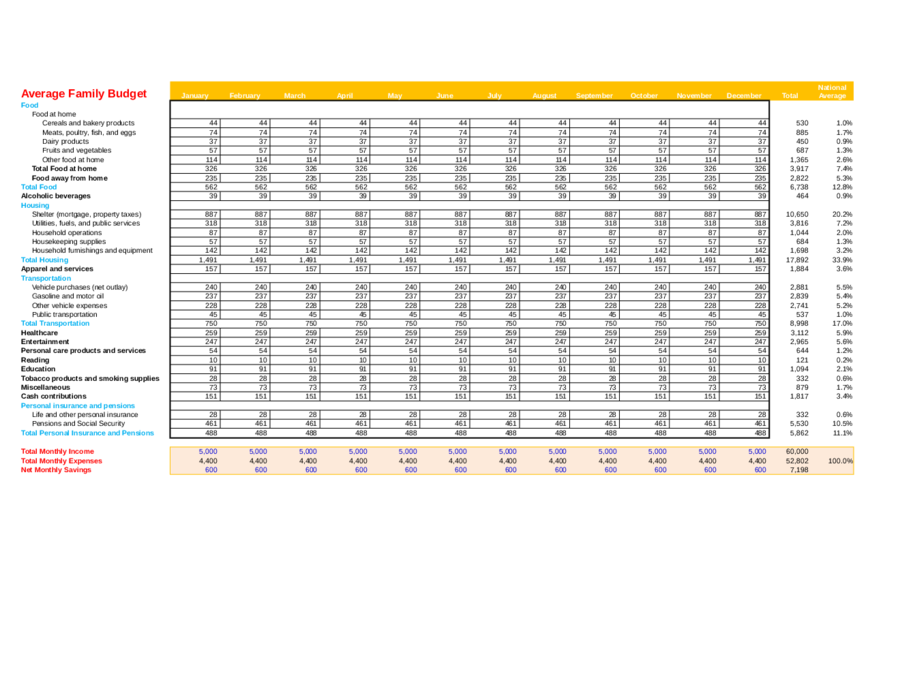

- Family budget

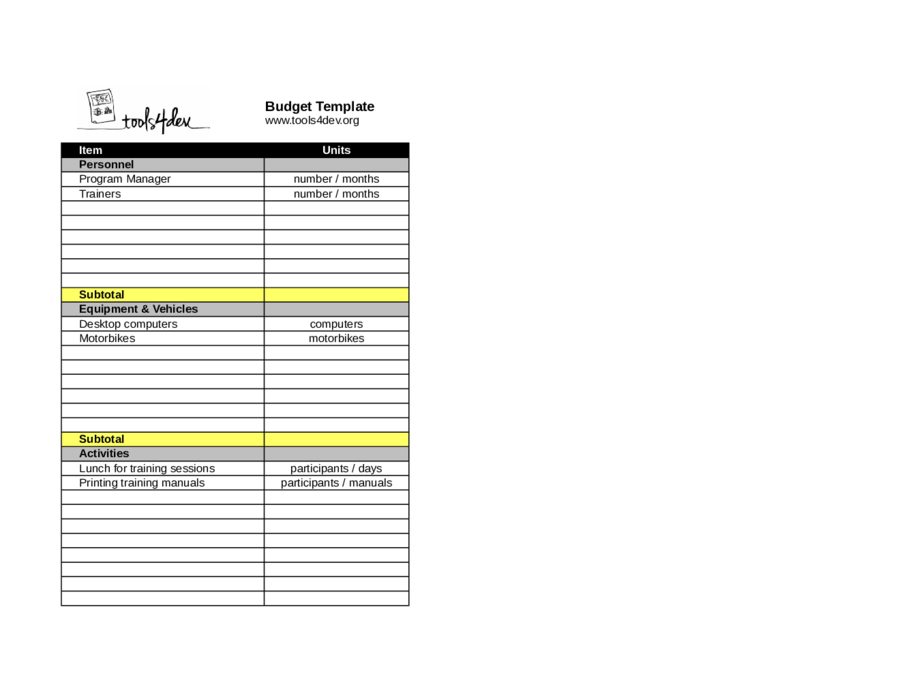

- Business budget

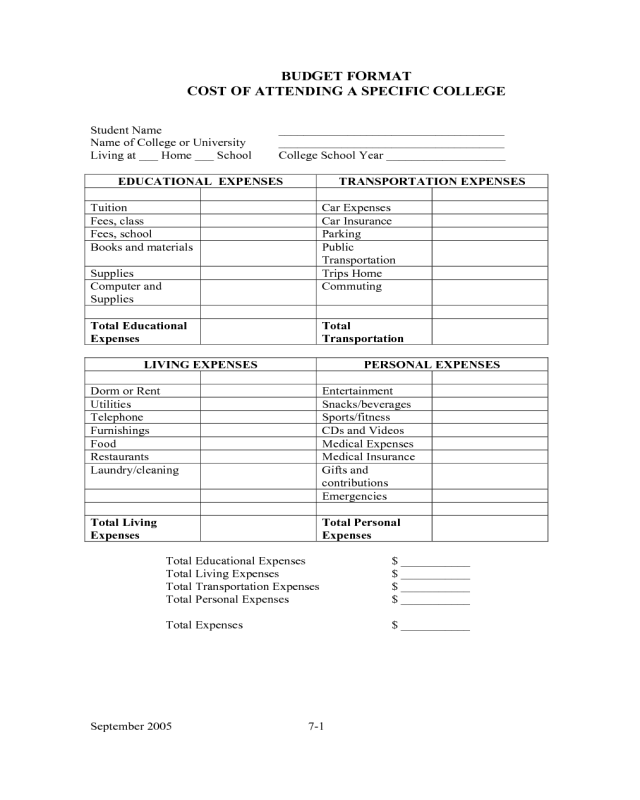

- Education budget

How to make a Budget

Budgeting is a crucial part of financial planning. Most people deal with steady sources of monthly or weekly income in the form of salaries, commissions, stipends or even allowances. However at the end of the month a lot of them end up broke or slightly in debt.A budget helps you control your resources and fulfill specific goals in the process. It is a great way to save for goals or ensure that you stick to a specific financial plan in order to pay back your debts and improve your credit.Here are some Tips to help you understand exactly How to make a budget:Calculate your exact income

- Find out how much you take home after you pay your taxes.

- Subtract all EMIs on loans and insurances to figure out your working budget.

- Include tips, bonuses and incentives.

- Include any and all supplementary income in the form of tuitions, baby sitting or dog walking.

Calculate your potential expenses

- Don’t just guess. Make a calculated guess.

- Consult old receipts so that you can make realistic estimates.

- Save old receipts in order to reconcile your budget at the end of the month.

- Keep track of your biggest sources of expenditure so that recurring expenses like gas, groceries and electricity never go above budget.

Set realistic goals

- This is the easiest way to motivate yourself to stick to a goal.

- The goal oriented approach is great way to measure you success or failure at sticking to your budget.

- Ensure that your goals are small and realistic. Those are easier to work towards and you’re less likely to get disheartened.

- Slowly build your goals upon one another. Use multiple short term goals to slowly build up to a bigger goal. So putting aside 5% of your weekly income over a period of a month is easier that trying to save 20% of your monthly salary.

- For example, you can use our Budget template excel worksheet to split up your Monthly budget into small achievable goals like a weekly target on savings that you add to until you reach your monthly savings target.

Prioritize your budget

- Allocate funds sensibly.

- Prioritize necessities over desires.

- Divide your budget into detailed categories like household maintenance, groceries, entertainment, clothing and medical expenses.

- Understand the difference between needs and wants. For instance, a pedicure is a luxury that you may or may not choose to spend on, but monthly groceries are a non-negotiable necessity.

- Always maintain an emergency fund to provide for unexpected circumstances.

Calculate your incidentals judiciously

- Do not underestimate incidental expenses.

- Try to record every expense with the help of a small notebook or simply pay in cash and check your wallet at the end of the day to see how much you’ve spent.

- These seemingly insignificant little expenses can add up to a substantial discrepancy at the end of the month if unchecked.

Save consistently

- Saving is a habit that must be inculcated slowly.

- Save a little across the board instead of cutting down on all fronts.

- Be sure to treat yourself once in a while as encouragement to stick to your budget plan.

- At the end of each month compare your total expenditure and total income. Slowly but consistently try to save a little extra every month until you reach your goal.

Find the right Budgeting tool

- This is one of the most important aspects of smart budgeting.

- Your choice of budgeting tools can make or break your budget.

- Not only do you need to know How to make a budget, you also need the proper tools to enable you to stick to it.

- A Budget planner is the first basic tool that you need to have.

- You may draw up your own or use a Budget worksheet.

- With a Budget template excel sheet is perfect for drawing up and customizing budgets for various purposes.

Understand your requirements

- Both your budget and your tools will depend on your individual needs.

- A college student, a stay at home mother, a teacher and a corporate CEO will not have the same needs so ensure that your budget and budgetary tools suit your purpose.

- A clear understanding of your needs will help you choose the right template for your budget.

Stick to a Budgetary method

- While you may use different budgets to control your financial resources in various aspects of my life, do not go overboard.

- It is best to stick to a maximum of three budgets otherwise you may lose track of them all.

- Too many budgets and too many budgetary tools are confusing. Once you find one that suits you, stick to it.

Set time bound goals

- Don’t stick to the same budget. Switch it up every few months. At most have a Five Year Plan.

- Some budgets help save for short term goals and others for long term goals, so design your budget for a time period.

- Try to work around your payment schedule so that your budget coincides with either your salary or your bills.

- Feel free to mix it up. You may calculate some expenses on a monthly basis like electricity, while you calculate others like daily commuting expenses on a weekly basis.

What is a Budget Template?

A Budget Template is a simple outline to help keep track of your finances over a certain period of time. A Budget template will help you tabulate your cash influx and outflow in a systematic manner. It may be used for both business and domestic purposes and is a great way to conserve time as it saves you the trouble of designing your own Budget worksheet. With the help of these templates you can customize you own Budget planner without all the trouble of having to start from scratch.What are Budget Templates used for?

A Budget template is a simple tool that gives you a skeletal framework upon which you may construct your budget. While you may choose to design your budget independently, a template is simple and easy to use alternative that will save you a lot of time and effort.Benefits of using a Budget Template

- Templates are neat and extremely user friendly.

- They are absolutely ready to use.

- Most of these templates are easy to download and saves manual labor to a great extent.

- They are neat and uncluttered.

- They help you tabulate your income and expenditure in such a way that you can see it all at a glance.

- Different Templates provide in a variety of formats ranging from MS Excel, MS Word and PDF options.

- The Templates are detailed; flexible and equipped to accommodate a variety of customizations without a hitch.

- It is given you an economical and completely hassle free solution to all your budgetary woes.

- These templates are designed by professionals who ensure that they meet optimum business standards.

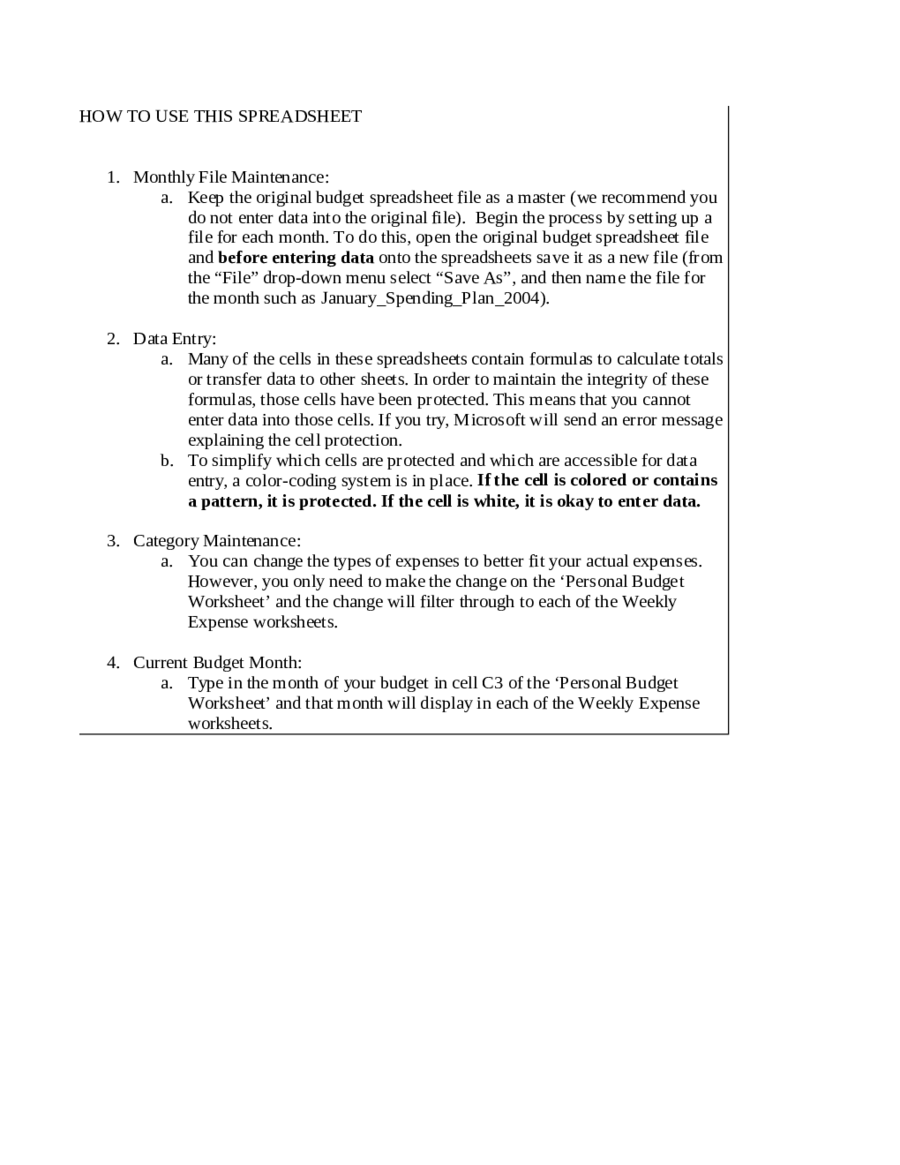

How to use a Budget Template

- Understand you budgetary needs.

- Select the Template that suits your needs.

- Choose a convenient format (MS Word/ MS Excel/ PDF).

- Download the template in that format.

- Fill in your personal details and budgetary data.

- Organize your income and expenditure.

- Compute your data and incorporate any required changes.

Where can you use a Budget Template?

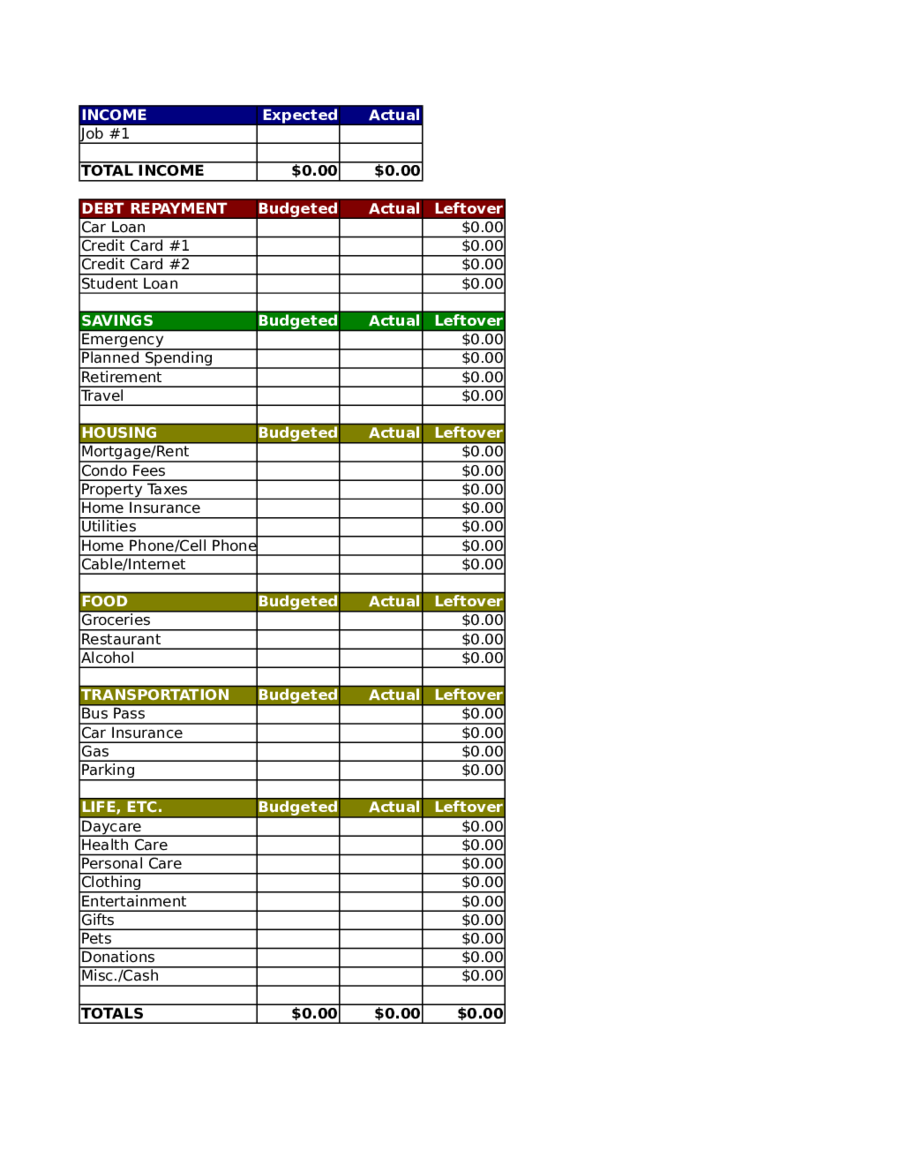

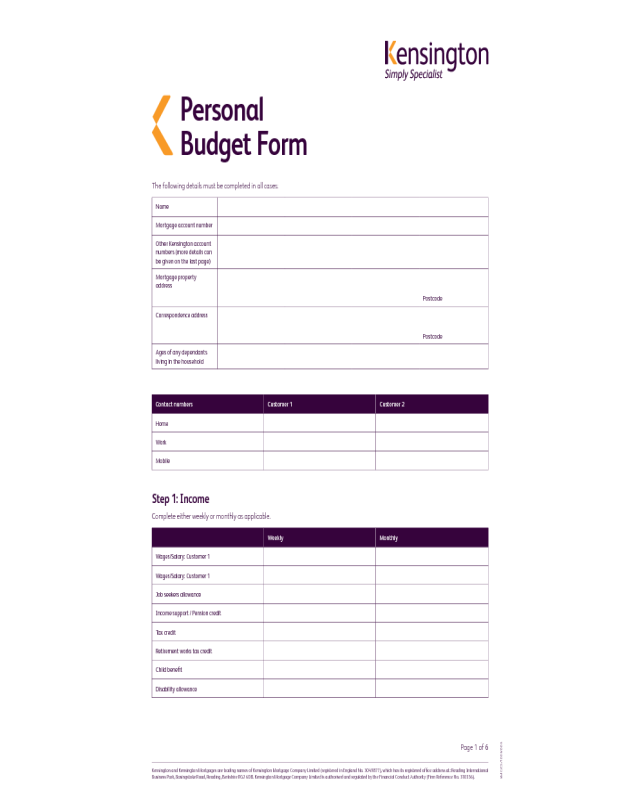

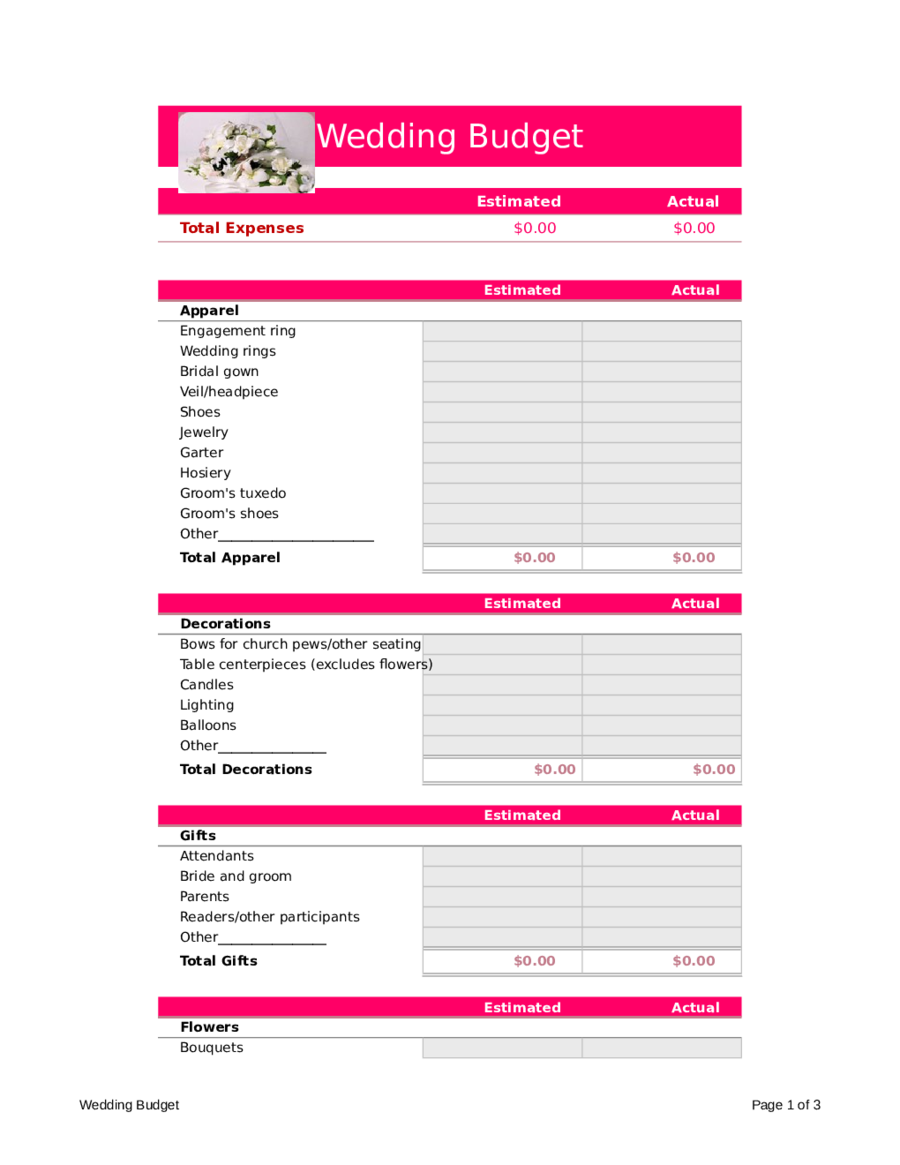

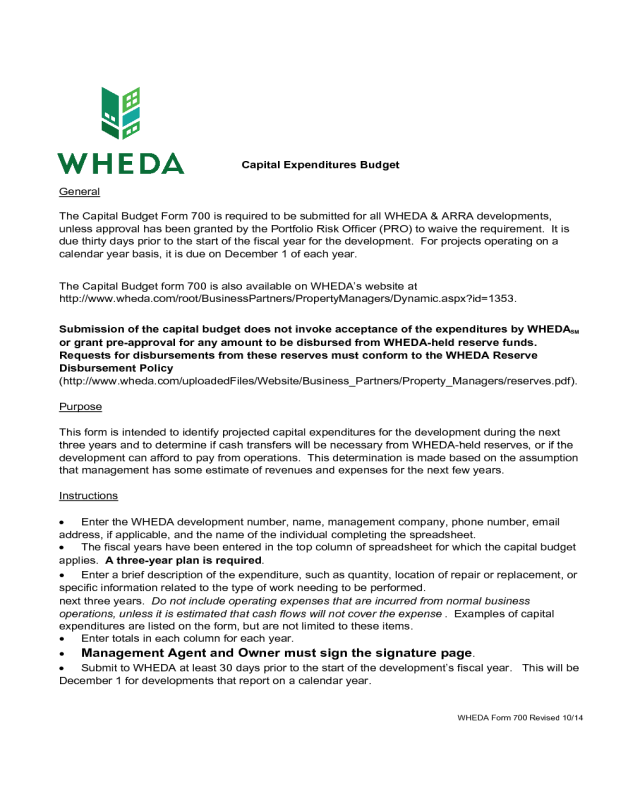

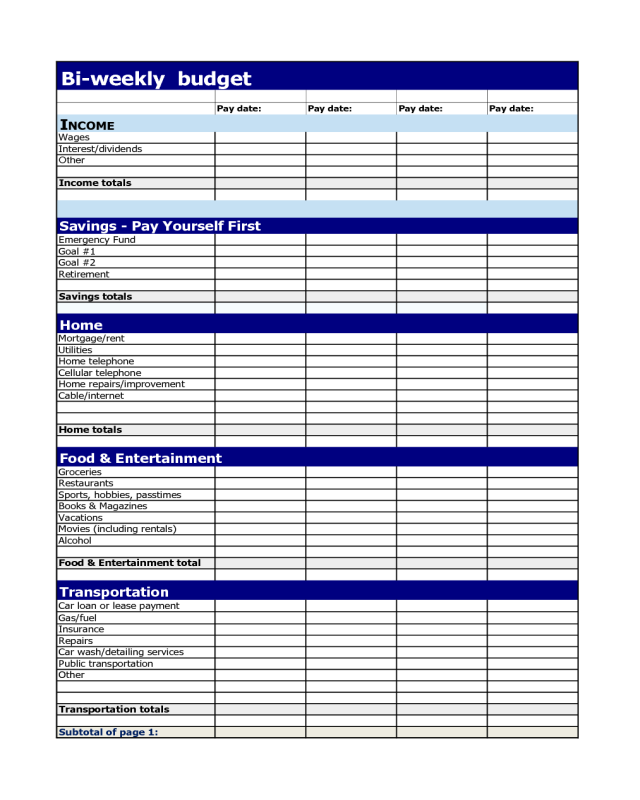

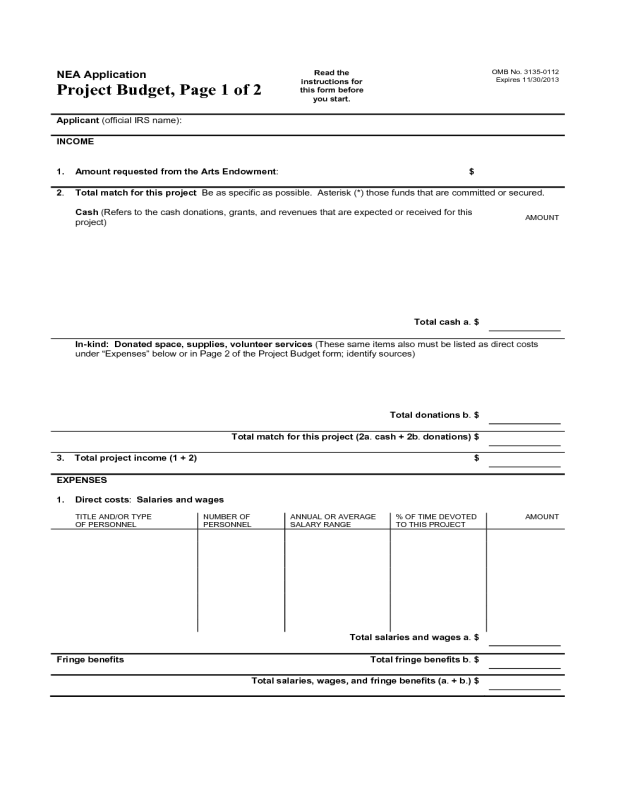

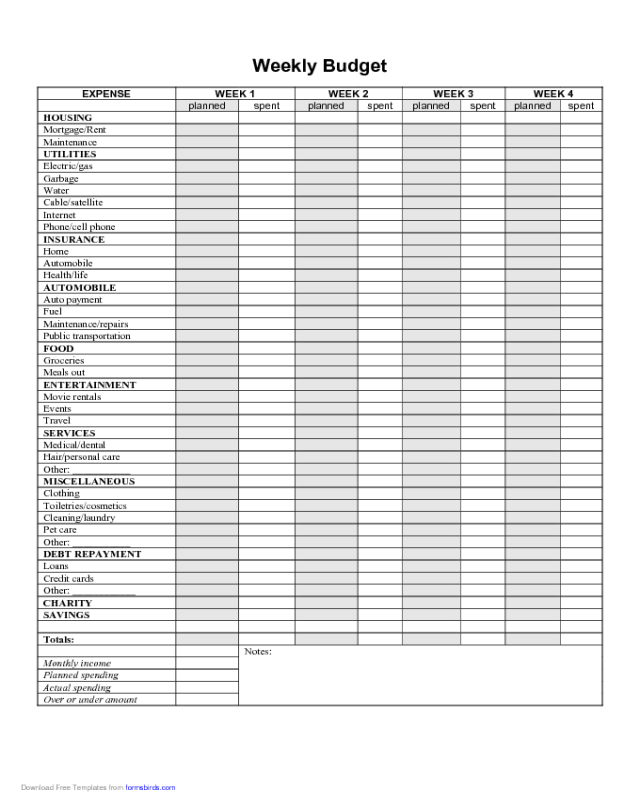

Being versatile, such Budget Templates can cater to a variety of budgets that include:Personal Budget

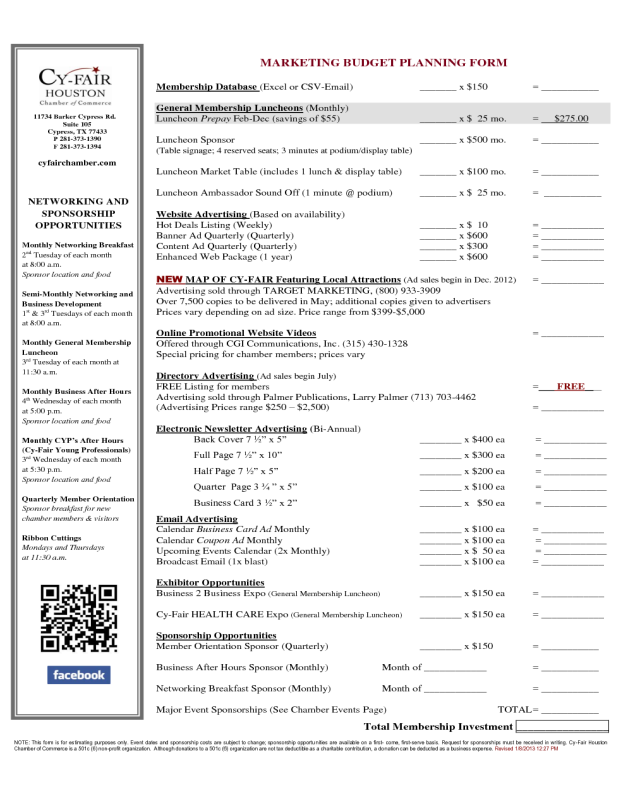

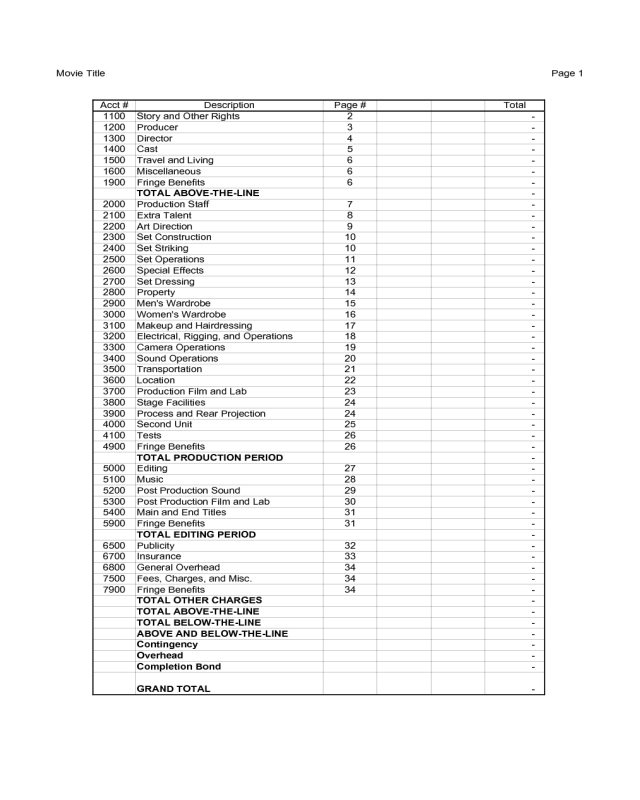

Business Budget

Subcategories

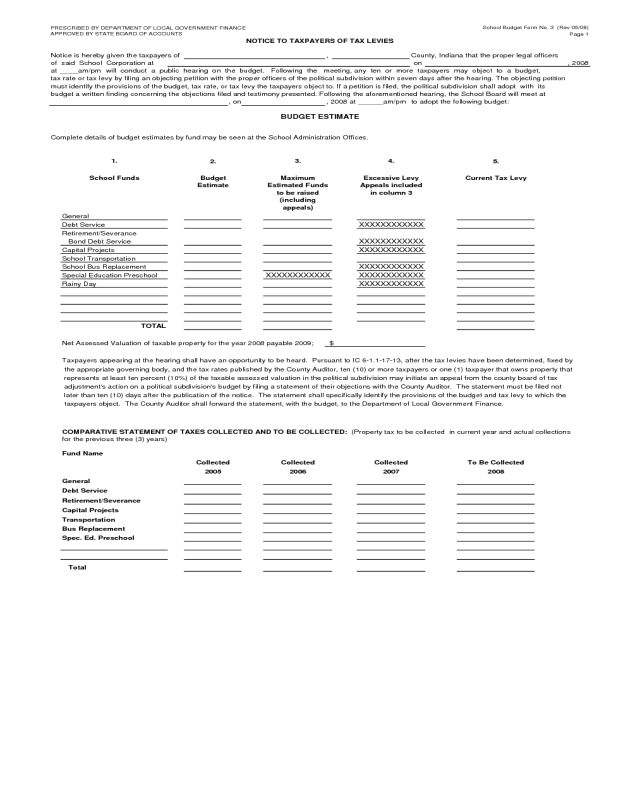

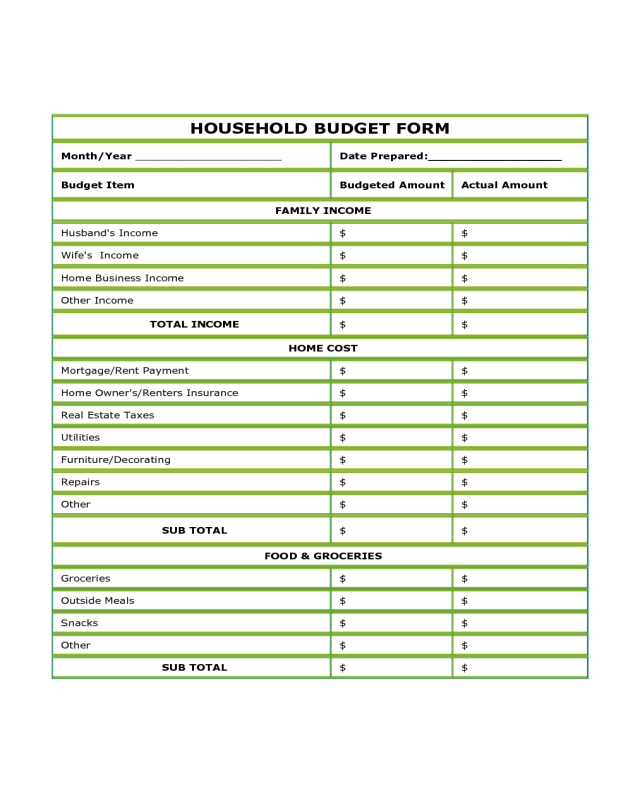

Budget Loan FormDave Ramsey Budget FormHousehold Budget FormMonthly Budget FormWedding Budget FormCapital Budget FormChild Care Budget FormConstruction Budget FormDaily Budget FormDocumentary Budget FormEvent Budget FormFilm Budget FormFortnightly Budget FormLine Item Budget FormMarketing Budget FormPersonal Budget FormProject Budget FormRestaurant Budget FormSchool Budget FormStudent Budget FormTravel Budget FormWeekly Budget FormYearly Budget FormBi-Weekly Budget TemplateBudget Proposal TemplateBusiness Budget TemplateCollege Budget Template