Fillable Printable School Budget Form - Indiana

Fillable Printable School Budget Form - Indiana

School Budget Form - Indiana

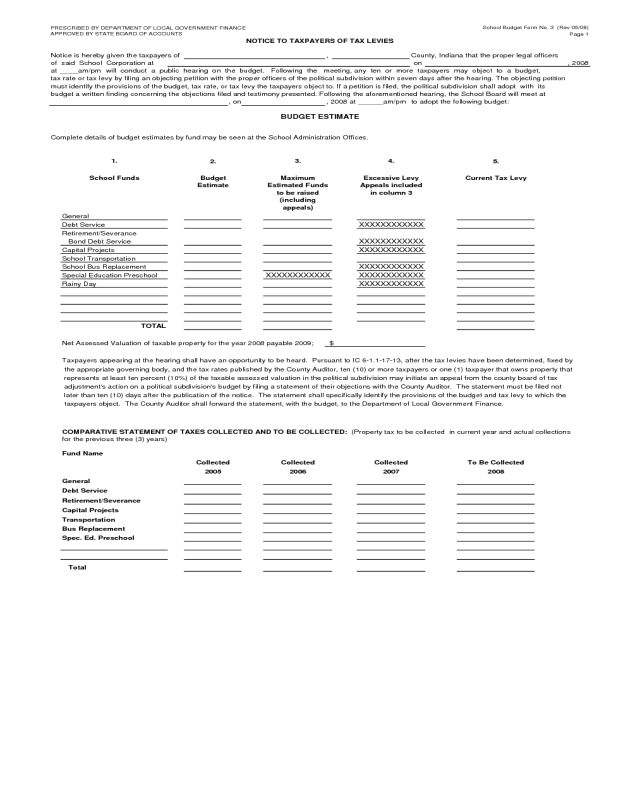

PRESCRIBED BY DEPARTMENT OF LOCAL GOVERNMENT FINANCE

School Budget Form No. 3 (Rev 05/08)

APPROVED BY STATE BOARD OF ACCOUNTS

Page 1

Notice is hereby given the taxpayers of , County, Indiana that the proper legal officers

of said School Corporation at on

at will conduct a public hearing on the budget. Following the meeting, any ten or more taxpayers may object to a budget,

tax rate or tax levy by filing an objecting petition with the proper officers of the political subdivision within seven days after the hearing. The objecting

petition

must identify the provisions of the budget, tax rate, or tax levy the taxpayers object to. If a petition is filed, the political subdivision shall adopt with its

budget a written finding concerning the objections filed and testimony presented. Following the aforementioned hearing, the School Board will meet at

, on

, 2008 at

______am/pm to adopt the following budget:

2. 5.

Bond Debt Service

Net Assessed Valuation of taxable property for the year 2008 payable 2009;

Taxpayers appearing at the hearing shall have an opportunity to be heard. Pursuant to IC 6-1.1-17-13, after the tax levies have been determined, fixed by

the appropriate governing body, and the tax rates published by the County Auditor, ten (10) or more taxpayers or one (1) taxpayer that owns property that

represents at least ten percent (10%) of the taxable assessed valuation in the political subdivision may initiate an appeal from the county board of tax

adjustment's action on a political subdivision's budget by filing a statement of their objections with the County Auditor. The statement must be filed not

later than ten (10) days after the publication of the notice. The statement shall specifically identify the provisions of the budget and tax levy to which the

taxpayers object. The County Auditor shall forward the statement, with the budget, to the Department of Local Government Finance.

COMPARATIVE STATEMENT OF TAXES COLLECTED AND TO BE COLLECTED: (Property tax to be collected in current year and actual collections

for the previous three (3) years)

Fund Name

To Be Collected

2008

Collected

2005

Debt Service

Retirement/Severance

Capital Projects

CollectedCollected

Transportation

Bus Replacement

Spec. Ed. Preschool

General

Total

2006 2007

Special Education Preschool

Rainy Day

$

TOTAL

4.

Excessive Levy

Appeals included

in column 3

Current Tax Levy

BUDGET ESTIMATE

Complete details of budget estimates by fund may be seen at the School Administration Offices.

Budget

Estimate

3.

Maximum

Estimated Funds

to be raised

(including

appeals)

1.

School Funds

General

Debt Service

Retirement/Severance

Capital Projects

School Transportation

School Bus Replacement

, 2008

_____am/pm

XXXXXXXXXXXX

NOTICE TO TAXPAYERS OF TAX LEVIES

XXXXXXXXXXXX

XXXXXXXXXXXX

XXXXXXXXXXXX

XXXXXXXXXXXX

XXXXXXXXXXXX

XXXXXXXXXXXX