Fillable Printable Car Tax Application Form - Massachusetts

Fillable Printable Car Tax Application Form - Massachusetts

Car Tax Application Form - Massachusetts

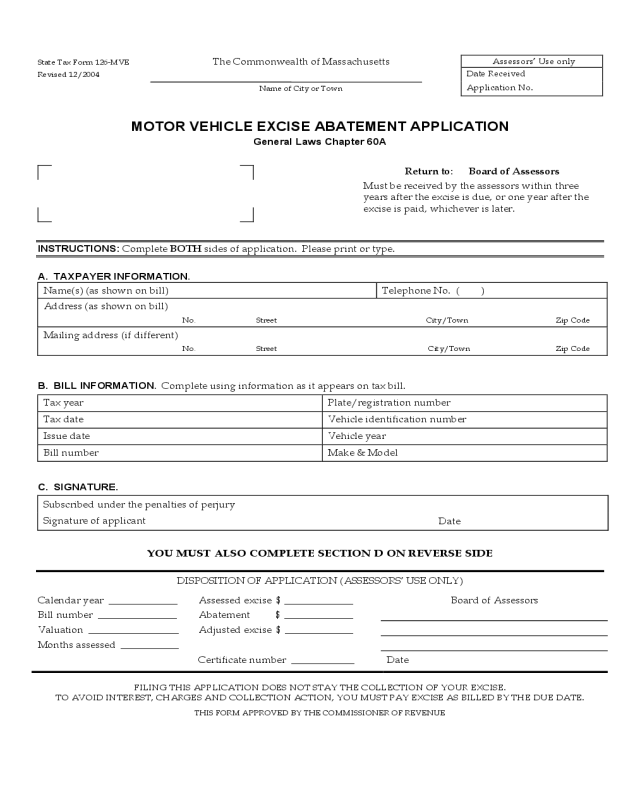

State Tax Form 126-MVE

The Commonwealth of Massachusetts

Assessors’ Use only

Revised 12/2004

Date Received

Name of City or Town

Application No.

MOTOR VEHICLE EXCISE ABATEMENT APPLICATION

General Laws Chapter 60A

Return to: Board of Assessors

Must be received by the assessors within three

years after the excise is due, or one year after the

excise is paid, whichever is later.

INSTRUCTIONS: Complete BOTH sides of application. Please print or type.

A. TAXPAYER INFORMATION.

Name(s) (as shown on bill) Telephone No. ( )

Address (as shown on bill)

No. Street City/Town Zip Code

Mailing address (if different)

No. Street City/Town Zip Code

B. BILL INFORMATION. Complete using information as it appears on tax bill.

Tax year Plate/registration number

Tax date Vehicle identification number

Issue date Vehicle year

Bill number Make & Model

C. SIGNATURE.

Subscribed under the penalties of perjury

Signature of applicant

Date

YOU MUST ALSO COMPLETE SECTION D ON REVERSE SIDE

DISPOSITION OF APPLICATION (ASSESSORS’ USE ONLY)

Calendar year _____________ Assessed excise $ _____________ Board of Assessors

Bill number _______________ Abatement $ _____________

Valuation _________________ Adjusted excise $ _____________

Months assessed ___________

Certificate number ____________ Date

FILING THIS APPLICATION DOES NOT STAY THE COLLECTION OF YOUR EXCISE.

TO AVOID INTEREST, CHARGES AND COLLECTION ACTION, YOU MUST PAY EXCISE AS BILLED BY THE DUE DATE.

THIS FORM APPROVED BY THE COMMISSIONER OF REVENUE

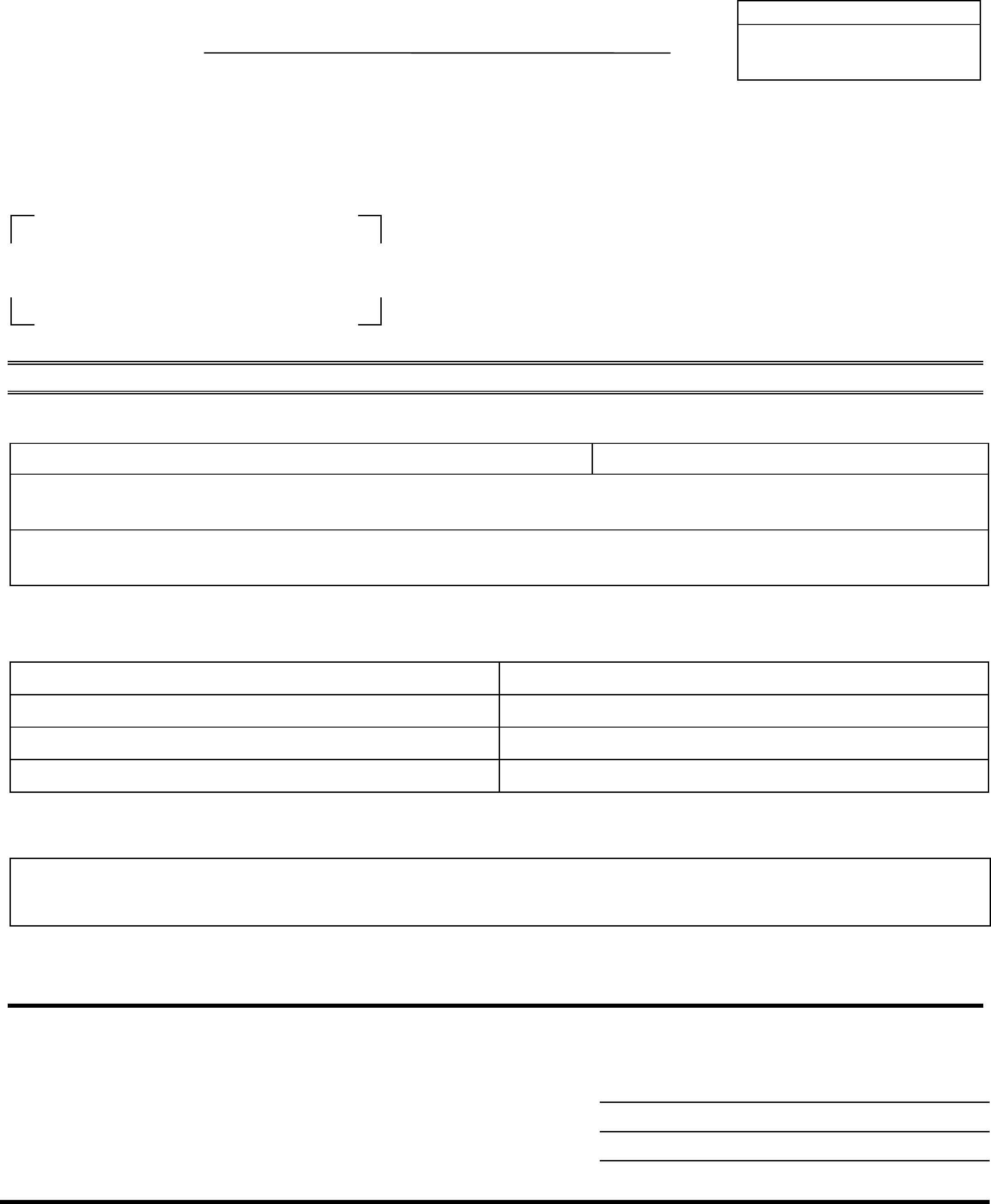

D. REASON(S) ABATEMENT SOUGHT. Check reason(s) you are applying and provide the specified documentation.

Vehicle sold or traded

Bill of sale and plate return receipt from Registry of Motor Vehicles (RMV) or new

registration form if plate transferred to another vehicle

Vehicle stolen or total loss

Police report or insurance settlement letter and plate return receipt, C-19 Form

(Affidavit of Lost or Stolen Plate from RMV) or new registration form

Vehicle repossessed

Notice from lienholder and plate return receipt, C-19 Form or new registration form

Vehicle junked

Receipt from junk yard and plate return receipt, C-19 Form or new registration form

Vehicle returned (Lemon Law) Letter from dealer certifying return and plate return receipt or new registration form

Moved from billing city/town

before January 1 of tax year

Date of move: ________/________/_________

Proof of residency before January 1 of tax year of bill (e.g., utility bill, voter registration,

lease) and

proof RMV was notified before January 1 of address change for registration

NOTE: You are not entitled to an abatement if you moved to another Massachusetts city or town

during the same calendar year of the excise tax. You must notify the RMV within 30 days

of moving and before January 1 to be billed by your new city or town next year.

Moved from Massachusetts

Date of move: ________/________/_________

Registration from new state or country

Exemption Type: _______________________________ Documentation establishing qualifications

Other Explain: ____________________________________________ Relevant documentation

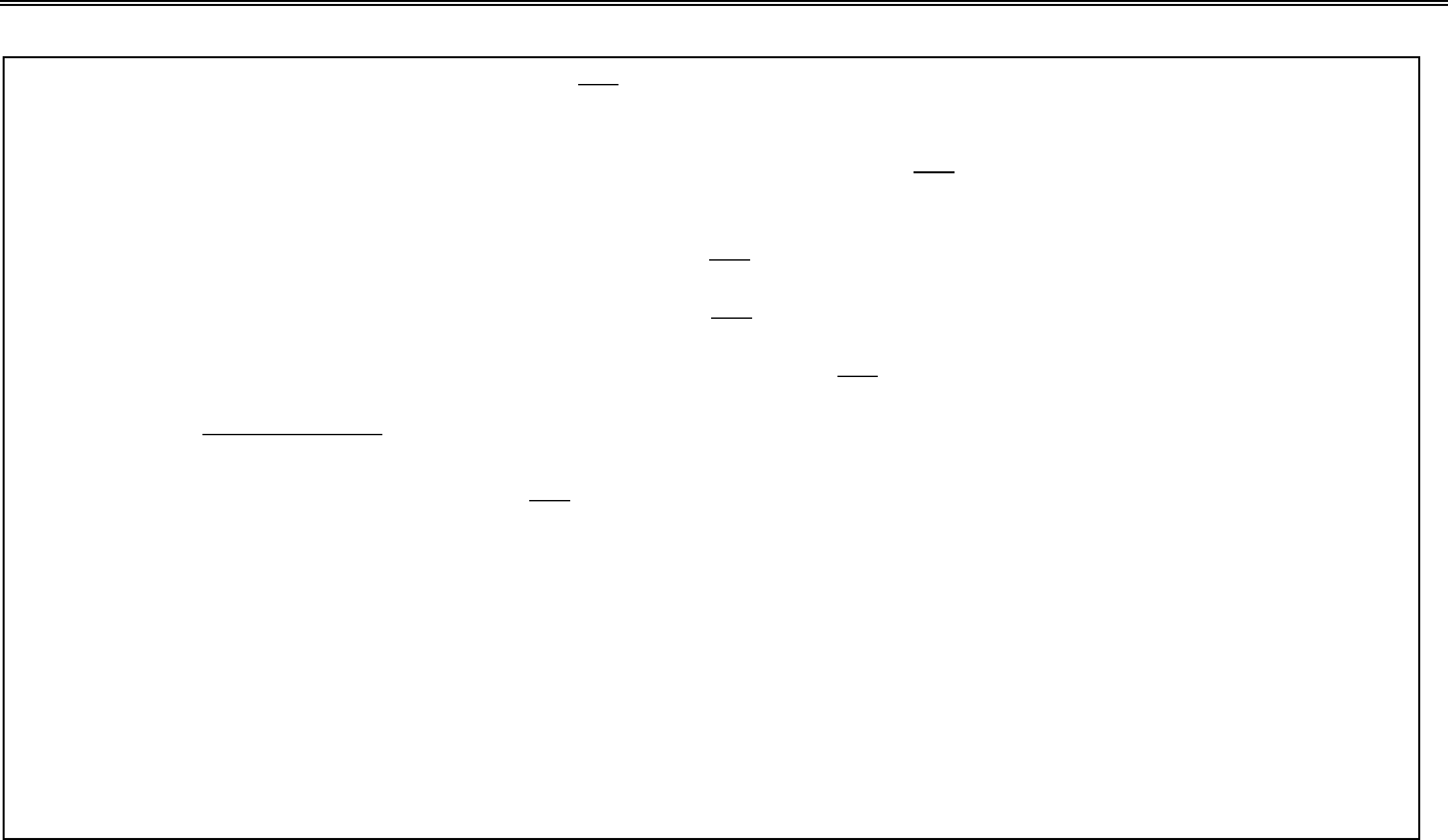

INFORMATION ABOUT YOUR MOTOR VEHICLE EXCISE

MOTOR VEHICLE EXCISE: You must pay an excise tax for any calendar year you own and register a motor vehicle in Massachusetts.

The excise is assessed as of January1, or the first day of the month the vehicle is registered if registered after January 1. Bills are

issued by the city or town where you reside or have your principal place of business based on Registry of Motor Vehicle registration

records as of that assessment date. The excise valuation is a percentage of the manufacturer's recommended list price of the vehicle

when new (not the sales price or current market value). The percentages are: 50% for the calendar y ear before the model y ear, 90%

for the model year, 60% for the second year, 40% for the third year, 25% for the fourth year, and 10% for the fifth and following years.

Excises for vehicles registered after January 1 are pro-rated by the number of months in the calendar year the vehicle is registered.

ABATEMENTS. You may be entitled to an abatement (or a refund if the excise has been paid) if the vehicle is valued at more than the

percentage of manufacturer’s list price that applies for the calendar year. Abatements may also be granted if you do any of the

following during the same calendar year: (1) transfer ownership of the vehicle, (2) move out of Massachusetts, (3) re-register the

vehicle, or (4) report the theft of the vehicle. Abatements for those reasons may also require you to cancel or transfer the registration,

report the plate lost or stolen, or take other action in that year. You are not entitled to an abatement if you (1) cancel your registration

and retain ownership of the vehicle, or (2) move to another Massachusetts city or town, during the same calendar year. Abatements are

pro-rated by the number of months in the calendar y ear after the month the last eligibility requirement takes place. No excise may be

reduced to less than $5.00. No abatement or refund of less than $5.00 may be made.

DEADLINE. Your abatement application must be received by the board of assessors within three years after the excise was due

, or

or one year after the excise was paid, whichever is later.

To preserve your right to an abatement and to appeal, you must

file on time. By law, assessors may only act on late applications in limited circumstances where the excise is still unpaid and their

decision in those cases is final.

PAYMENT. Filing an application does not stay the collection of your excise. F ailure to pay the excise w hen due may subject you to

interest, charges and collection action, including non-renewal of your registration and driver’s license. To avoid any collection charges

or action, you must pay the excise in full within 30 days of the bill’s issue date. You will receive a refund if an abatement is granted.

DISPOSITION. The assessors have 3 months from the application filing date to act unless you agree in writing to their request to

extend the action period for a specific time. If the assessors do not act on your application within the original or extended period, it is

deemed denied. You will be notified in writing if an abatement has been granted or denied.

CONTACT THE ASSESSORS’ OFFICE IF YOU HAVE ANY QUESTIONS ABOUT YOUR EXCISE BILL OR ABATEMENT RIGHTS