Fillable Printable RF100 Motor Tax Application Form for a Vehicle

Fillable Printable RF100 Motor Tax Application Form for a Vehicle

RF100 Motor Tax Application Form for a Vehicle

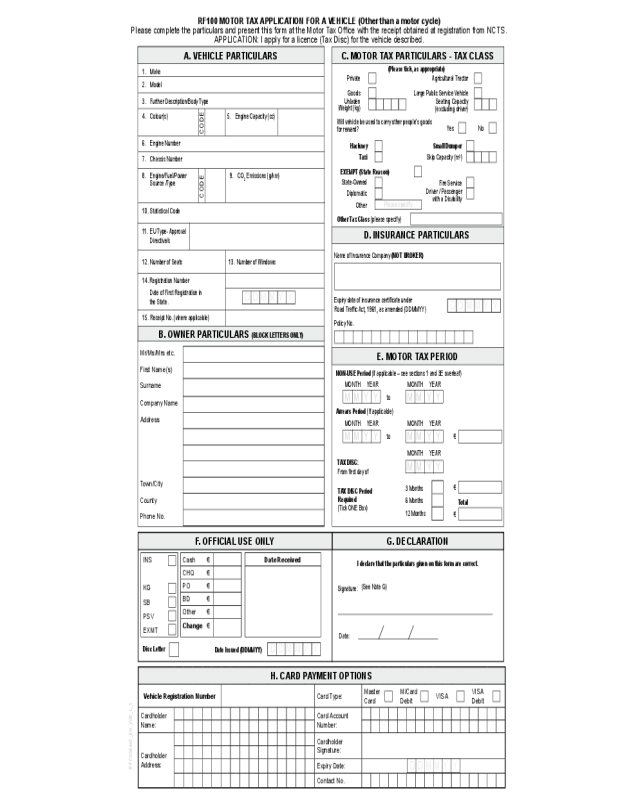

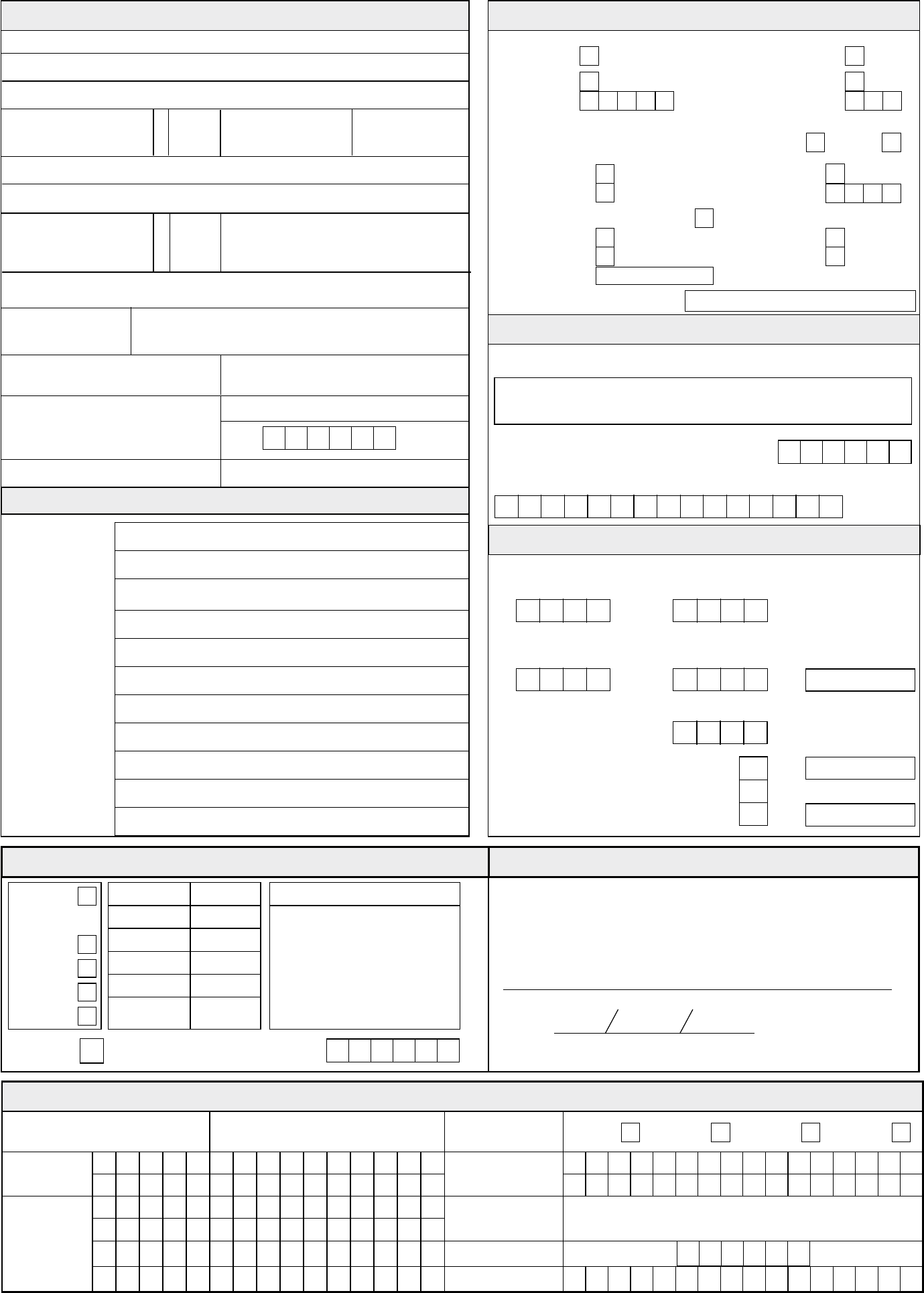

RF100 MOTOR TAX APPLICATION FOR A VEHICLE (Other than a motor cycle)

Please complete the particulars and present this form at the Motor Tax Ofce with the receipt obtained at registration from NCTS.

APPLICATION: I apply for a licence (Tax Disc) for the vehicle described.

A. VEHICLE PARTICULARS

B. OWNER PARTICULARS

(BLOCK LETTERS ONLY)

C. MOTOR TAX PARTICULARS - TAX CLASS

D. INSURANCE PARTICULARS

E. MOTOR TAX PERIOD

G. DECLARATION

10. Statistical Code

1. Make

2. Model

3. Further Description/Body Type

4. Colour(s)

6. Engine Number

8. Engine/Fuel/Power

Source /Type

9. CO

2

Emissions (g/km)

14. Registration Number

15. Receipt No. (where applicable)

F. OFFICIAL USE ONLY

(Please tick, as appropriate)

Expiry date of insurance certicate under

Road Trafc Act, 1961, as amended (DDMMYY)

NON-USE Period (if applicable – see sections 1 and 3E overleaf)

MONTH YEAR

to

to

€

€

Arrears Period (If applicable)

TAX DISC:

From rst day of

I declare that the particulars given on this form are correct.

Signature:

12. Number of Seats

Private Agricultural Tractor

Goods

Unladen

Weight (kg)

Will vehicle be used to carry other people’s goods

for reward?

Other Tax Class (please specify)

Name of Insurance Company (NOT BROKER)

Policy No.

Date:

(See Note G)

MONTH YEAR

MONTH YEAR MONTH YEAR

MONTH YEAR

RPC004441_EN_WB_L_1

M M Y Y M M Y Y

M M Y Y

M M Y YM M Y Y

CODE

CODE

7. Chassis Number

Date of First Registration in

the State.

D D M M Y Y

D D M M Y Y

Total

€

Mr/Ms/Mrs etc.

First Name(s)

Surname

Company Name

Address

Town/City

County

Phone No.

Cash €

CHQ €

PO €

BD €

Other €

Change €

INS

KG

SB

PSV

EXMT

Date Received

Disc Letter

Date Issued (DDMMYY)

D D M M Y Y

H. CARD PAYMENT OPTIONS

Vehicle Registration Number Card Type:

Master

Card

M/Card

Debit

VISA

VISA

Debit

Cardholder

Name:

Card Account

Number:

Cardholder

Address:

Cardholder

Signature:

Expiry Date:

Contact No.

D D M M Y Y

11. EU Type- Approval

Directive/s

13. Number of Windows

5. Engine Capacity (cc)

Large Public Service Vehicle

Seating Capacity

(excluding driver)

Yes No

Hackney

Taxi

Small Dumper

Skip Capacity (m

3

)

State-Owned

Diplomatic

Other

Fire Service

Driver / Passenger

with a Disability

EXEMPT (State Reason)

TAX DISC Period

Required

(Tick ONE Box)

3 Months

6 Months

12 Months

Please specify

NOTES [To the completion of the RF100]

Please contact your local Motor Tax Ofce if you need any assistance completing this form.

1. When to use this form

This form may be used to apply for a Motor Tax Disc for a vehicle which has already been registered by the Revenue Commissioners. This form should be brought or posted to

the Motor Tax Ofce of the District where the vehicle is ordinarily kept.

2. Before completing this form

Ensure that the REGISTRATION MARK AND NUMBER assigned to the vehicle have been inserted clearly and legibly at Section A, item 14 on the form.

3. How to complete this form

• Section A All the vehicle information in this Section should already have been completed by the motor dealer or the person who paid the Vehicle Registration Tax (VRT)

to the Revenue Commissioners.

• Section B If not already completed enter the name and address of the registered owner, i.e. the keeper in whose name the vehicle is being licensed (taxed). In the case

of a LEGAL ENTITY, the full and correct legal title must be given, e.g. in the case of a registered company, the name should be stated as per the Certicate of

Incorporation. In the case of a private rm, the name by which it is ordinarily known and the names of the partners must be given, e.g. “John and Mary Murphy

trading as J & M Suppliers”.

• Section C Tick the box opposite the Tax Class under which you wish to tax the vehicle. If the class required is not listed, please write the required class in the box

provided. You must provide all required information and include any necessary documentation as detailed in Note 4 below. IMPORTANT See tax class

denitions at your local Motor Tax Ofce and ensure that the vehicle is eligible to be taxed in the class selected.

• Section D Enter details of your Insurance, i.e. Name of Insurer, Policy No. and Date of Expiry of cover - Your insurance must be current when the tax disc comes into force

and the Insurance must be appropriate to the declared use of the vehicle.

• Section E First Licence (Tax Disc) - Liability for Motor Tax

i. Road Tax liability arises from the date the vehicle is rst used in a public place after registration with the Revenue Commissioners. If your application for motor tax does

not commence from the date of registration because of non-use of the vehicle in a public place, please insert the period of non-use specied by you on Form RF150 –

Declaration of Non-Use of a Motor Vehicle (see note in section 1 above). Motor Tax Discs are issued for periods of 3, 6 or 12 whole calendar months and are not issued

in respect of months already elapsed. Vehicles with an annual Tax of €119 or less can only be taxed for a 12 month period.

ii. If arrears are due, enter in the boxes the start and end month of the arrears period and the relevant amount of money.

iii. Insert the commencement month/year and tick the relevant box for the tax disc period required. Insert the amount of the fee and complete the total box.

• Section G The signature on the application must be that of the keeper of the vehicle (Under section 130 of the Finance Act 1992 the ‘Owner’ is the ‘Keeper’).

• Section H Complete this section if payment is being made by Credit Card or Debit Card.

4. What must accompany this form

You MUST include the following:

i. Fee - You must include a cheque or postal order for the correct fee, made payable to the appropriate County Council/Corporation and crossed “Motor Tax Account”.

Do not send cash through the post. Contact your local Motor Tax Ofce for clarication of the appropriate fees and other payment methods.

ii. In cases where the Goods Tax Class is required and the vehicle does not exceed 1,524 kg unladen weight, a declaration should be made on the appropriate form

available from the Motor Tax Ofce stating the vehicle will not be used for non-commercial (private) purposes. A weight docket from an approved weighbridge is required

if the vehicle exceeds 1,524 kg unladen weight.

iii. PSV (plate) Licence - only applies to public service vehicles.

iv. Article 60 licence - only applies to school buses.

v. Certicate of Exemption (e.g. Certicate of Approval from the Revenue Commissioners for Drivers/Passengers with Disabilities) - only applies to vehicles exempt from

Motor Tax.

5. Change of Ownership Prior to First Taxing

On the sale of the vehicle to a new owner (other than to a motor dealer) the registered owner selling the vehicle must forward this form RF100 and details in writing of the

name/address of the new owner and date of transfer of ownership to the Department of Transport, Tourism and Sport, Driver and Vehicle Computer Services Division,

Shannon, Co Clare. (If sale is to a motor dealer, completed form RF105 must be forwarded.)

RF100 MOTOR TAX APPLICATION FOR A VEHICLE (Other than a motor cycle)

If you are not using the vehicle immediately following registration, you should not complete this Form. Instead, you should

complete Form RF150 – Declaration of Non-Use of a Motor Vehicle and submit it to your motor tax ofce within 10 days of

registration of the vehicle. You should retain this form for rst taxing of the vehicle following the period of non-use.

WARNING - FALSE DECLARATIONS

Any person making a false declaration, or who subsequently fails to notify any changes in the licensing

particulars now furnished, including disposal of the vehicle, is liable to heavy penalties. A licensing authority

may require appropriate evidence as to the accuracy of particulars declared.