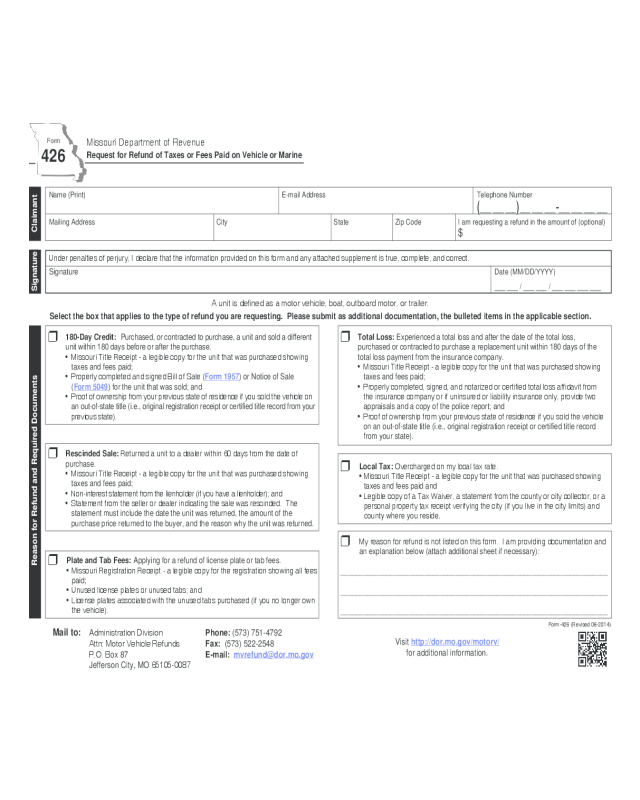

Fillable Printable Car Tax Refund Form - Missouri

Fillable Printable Car Tax Refund Form - Missouri

Car Tax Refund Form - Missouri

Name (Print) E-mail Address Telephone Number

(___ ___ ___)___ ___ ___-___ ___ ___ ___

Mailing Address City State Zip Code I am requesting a refund in the amount of (optional)

$

r 180-Day Credit: Purchased, or contracted to purchase, a unit and sold a different

unit within 180 days before or after the purchase.

• MissouriTitleReceipt-alegiblecopyfortheunitthatwaspurchasedshowing

taxes and fees paid;

• ProperlycompletedandsignedBillofSale(Form 1957) or Notice of Sale

(Form 5049) for the unit that was sold; and

•Proofofownershipfromyourpreviousstateofresidenceifyousoldthevehicleon

an out-of-state title (i.e., original registration receipt or certified title record from your

previousstate).

r Total Loss: Experienced a total loss and after the date of the total loss,

purchased or contracted to purchase a replacement unit within 180 days of the

total loss payment from the insurance company.

• MissouriTitleReceipt-alegiblecopyfortheunitthatwaspurchasedshowing

taxes and fees paid;

• Properlycompleted,signed,andnotarizedorcertifiedtotallossaffidavitfrom

theinsurancecompanyorifuninsuredorliabilityinsuranceonly,providetwo

appraisals and a copy of the police report; and

• Proofofownershipfromyourpreviousstateofresidenceifyousoldthevehicle

on an out-of-state title (i.e., original registration receipt or certified title record

from your state).

r Local Tax: Overchargedonmylocaltaxrate.

•MissouriTitleReceipt-alegiblecopyfortheunitthatwaspurchasedshowing

taxes and fees paid and

•LegiblecopyofaTaxWaiver,astatementfromthecountyorcitycollector,ora

personalpropertytaxreceiptverifyingthecity(ifyouliveinthecitylimits)and

county where you reside.

r Rescinded Sale: Returnedaunittoadealerwithin60daysfromthedateof

purchase.

• MissouriTitleReceipt-alegiblecopyfortheunitthatwaspurchasedshowing

taxes and fees paid;

• Non-intereststatementfromthelienholder(ifyouhavealienholder);and

• Statementfromthesellerordealerindicatingthesalewasrescinded.The

statement must include the date the unit was returned, the amount of the

purchase price returned to the buyer, and the reason why the unit was returned.

r Plate and Tab Fees: Applying for a refund of license plate or tab fees.

•MissouriRegistrationReceipt-alegiblecopyfortheregistrationshowingallfees

paid;

•Unusedlicenseplatesorunusedtabs;and

•Licenseplatesassociatedwiththeunusedtabspurchased(ifyounolongerown

thevehicle).

Form

426

MissouriDepartmentofRevenue

Request for Refund of Taxes or Fees Paid on Vehicle or Marine

Form-426(Revised06-2014)

Mail to: AdministrationDivision Phone: (573) 751-4792

Attn:MotorVehicleRefunds Fax: (573) 522-2548

Jefferson City, MO 65105-0087

Claimant

Aunitisdefinedasamotorvehicle,boat,outboardmotor,ortrailer.

Select the box that applies to the type of refund you are requesting. Please submit as additional documentation, the bulleted items in the applicable section.

Reason for Refund and Required Documents

r Myreasonforrefundisnotlistedonthisform.Iamprovidingdocumentationand

an explanation below (attach additional sheet if necessary):

______________________________________________________________________

______________________________________________________________________

______________________________________________________________________

Underpenaltiesofperjury,Ideclarethattheinformationprovidedonthisformandanyattachedsupplementistrue,complete,andcorrect.

Signature

Date (MM/DD/YYYY)

___ ___ / ___ ___ / ___ ___ ___ ___

Signature

Visit http://dor.mo.gov/motorv/

for additional information.

“Unit”asusedbelowreferstomotorvehicle,trailer,boat,oroutboardmotor.

1)IfIdecidetosellmyunittoanotherpersonratherthanuseitasatrade-inwhenIpurchaseareplacement,amIentitledtoreceiveataxcreditbaseduponthesalespriceofmy

original unit?

Youareentitledtoreceiveataxcreditbaseduponthesalespriceofyouroriginalunitifyoupurchaseareplacementwithin180daysbeforeorafterthedateofsaleofyouroriginalunit.The

tax credit cannot exceed the tax due on the purchase price of the replacement unit. The unit being purchased or contracted to purchase must be titled in the same owner’s name as the unit

being sold.

2) How may I claim my tax credit for my original unit when I sell it to another person and purchase a replacement rather than use it as a trade-in for a replacement?

If you sell your original unit within 180 days beforeyoupurchaseyourreplacement,youmaypresenttotheLicenseOfficeacopyofyourbillofsalefortheoriginalunit.Youwillbegiven

credit against the tax due on the replacement unit. If you sell your original within 180 days after you purchase your replacement unit or if you sold the original within 180 days prior to

purchasingthereplacementandyoudidnotreceivethetaxcreditwhenyoutitledyourreplacement,youmayfilearequestforrefundwiththeMissouriDepartmentofRevenue.The

request for refund must be filed within three years from the date of payment of the tax on the replacement.

3)IfItradeinmyoriginalunitwhenIpurchaseareplacementandthetrade-invalueismorethanthepurchasepriceofthereplacement,doIreceiveataxcreditbaseduponthefull

amountofthetrade-invalue?

Youwill receiveatax credit only up to thetax dueonthe purchase priceof thereplacement unit. Thereisnocredit forthe trade-invalueinexcess of thepurchase price ofthe

replacementunit.Example:Ifyoupurchasedavehiclefromadealerfor$12,000andreceivedatrade-invalueof$15,000onyouroriginalvehicle,thevalueofthetrade-inoffsetsthe

purchasepriceofthereplacementandresultsinnotaxduewhenyoutitlethereplacement.Youarenotentitledtoacreditorrefundbasedupontheexcess$3,000trade-invalue.

4)IfIsellmyoriginalunitratherthantradeitforareplacementandthesalepriceoftheoriginalunitismorethanthecostofareplacement,doIreceiveataxcreditbaseduponthefull

amountIreceivedformyoriginalunit?

As with a trade-in, you will be entitled to a tax credit only up to the tax due on the purchase price of the replacement unit. You are not entitled to a credit or refund based upon the

difference between the sale price of your original unit and your replacement.

5) If I purchase a unit and decide to sell it within 180 days, am I entitled to the tax refund?

You are not entitled to the tax refund if you purchase and sell the same unit. You must purchase a replacement unit to be entitled to a credit or refund.

6)Iftheoriginalunitbeingsoldistitledinanotherperson’sname,mayIreceiveataxcreditorrefundwhenIpurchaseanotherunit?

In order for the tax credit or refund to be allowed, at least one owner listed on the title of the original unit being sold must also be listed on the title of the replacement unit.

7) May I claim the tax credit or refund if a unit titled in the name of my personal trust is sold and the replacement unit is titled in my name?

You are not entitled to claim the tax credit or refund. A trust is considered to be a separate legal entity or person. Since at least one owner listed on the title of the original unit must

be listed on the title of the replacement, the trust must be named on the title of the replacement unit for the tax credit or refund to apply.

8)Ifmyunitisdeterminedbymyinsurancecompanytobeatotallossduetotheftorcasualtyloss,howlongdoIhavetopurchaseareplacementunitinordertoclaimthetaxcreditor

refund?

Youmustpurchaseareplacementunitwithin180daysofthedateofpaymentbytheinsurancecompany.Ifyoudonothaveinsurancecoverage,youmaystillreceivethetaxcredit

or refund if you purchase or contract to purchase a replacement unit within 180 days after the date of the loss. Note: The replacement unit must be a like unit, i.e., replacing a boat for

a boat, trailer for trailer, etc. At least one of the titled owners of the total loss unit must be an owner of the replacement unit, regardless of any other name(s) listed on the insurance

statement.

9)MayIreceivearefundoflicenseplatefees?

Licenseplatefeesmayberefundediftheplateshavenotbeenaffixedtothevehicle.Iftheplateshavebeenaffixed,norefundwillbeallowedonanyunusedportionofthelicense

platefees,exceptforlicenseplatesforcommercialmotorvehicleslicensedforagrossweightinexcessof54,000pounds.

10)MayIreceivearefundoflicenseplatetabfees?

LicenseplatetabfeesmayberefundediftheunusedtabsandtheassociatedlicenseplatesarereturnedtotheDepartment.Duplicaterenewalsonunusedtabscanberefunded

without the license plates being returned.

11) If my claim for a tax credit or refund is denied, may I appeal that decision?

YoumayappealanydecisionbytheDepartmentdenyingataxcreditorrefund.Toappealthedenial,youmustfileapetitionwiththeAdministrativeHearingCommissionlocatedat301

WestHighStreet,HarrySTrumanStateOfficeBuilding,P.O.Box1557,JeffersonCity,Missouri65102,within60daysafterthedatethedecisionwasmailedorthedateitwasdelivered,

whicheverdatewasearlier.Ifanysuchpetitionissentbyregisteredmailorcertifiedmail,itwillbedeemedfiledonthedateitismailed.Ifitissentbyanyothermethodotherthan

registeredorcertifiedmail,itwillbedeemedfiledwiththeCommissiononthedateitisreceivedbytheCommission.

Frequently Asked Questions

StatuteofLimitations

Aclaimfortaxesmustbefiledwithinthreeyearsfromdateofoverpayment.Aclaimforfeesmustbefiledwithintwoyears.Aclaimforarescindedsalemustbefiledwithinoneyear.

Form-426(Revised06-2014)