Fillable Printable Car Tax Refund Form - Texas

Fillable Printable Car Tax Refund Form - Texas

Car Tax Refund Form - Texas

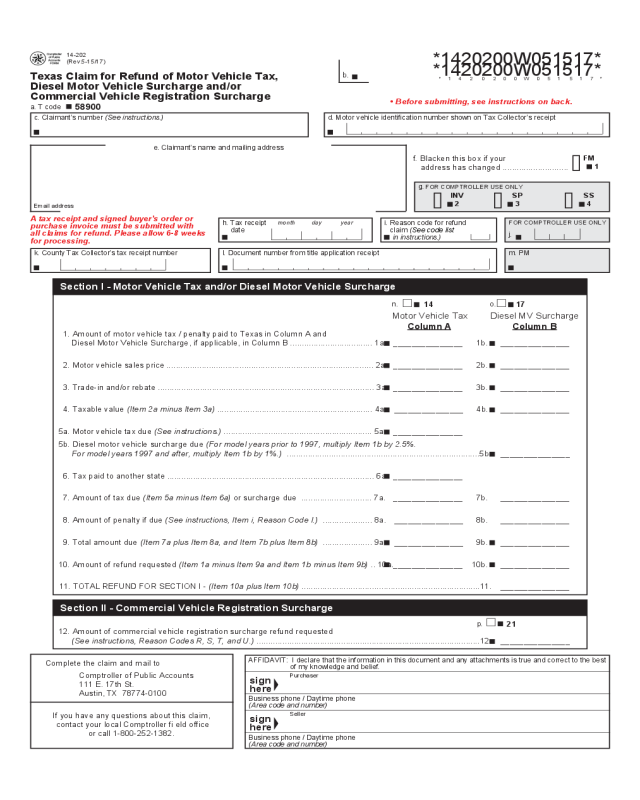

14-202

(Rev.5-15/17)

*1420200W051517*

*1420200W051517*

b.

Texas Claim for Refund of Motor Vehicle Tax,

* 1 4 2 0 2 0 0 W 0 5 1 5 1 7 *

Diesel Motor Vehicle Surcharge and/or

Commercial Vehicle Registration Surcharge

•

Before submitting, see instructions on back

.

a. T code

58900

e. Claimant’s name and mailing address

d. Motor vehicle identification number shown on Tax Collector’s receipt c. Claimant’s number (See instructions.)

k. County Tax Collector’s tax receipt number

h. Tax receipt

date

i. Reason code for refund

claim (See code list

in instructions.)

month day year

f. Blacken this box if your

address has changed ............................

g.

FOR COMPTROLLER USE ONLY

FM

1

SS

4

SP

3

INV

2

12. Amount of commercial vehicle registration surcharge refund requested

(See instructions, Reason Codes R, S, T, and U.) ...............................................................................................12. _______________

FOR COMPTROLLER USE ONLY

j.

Email address

m. PMl. Document number from title application receipt

p.

21

A tax receipt and signed buyer’s order or

purchase invoice must be submitted with

all claims for refund. Please allow 6-8 weeks

for processing.

Section II - Commercial Vehicle Registration Surcharge

1. Amount of motor vehicle tax / penalty paid to Texas in Column A and

Diesel Motor Vehicle Surcharge, if applicable, in Column B ................................... 1a. _______________ 1b. _______________

2. Motor vehicle sales price ........................................................................................ 2a. _______________ 2b. _______________

3. Trade-in and/or rebate ............................................................................................ 3a. _______________ 3b. _______________

4. Taxable value (Item 2a minus Item 3a) .................................................................. 4a. _______________ 4b. _______________

5a. Motor vehicle tax due (See instructions.) ............................................................... 5a. _______________

5b. Diesel motor vehicle surcharge due (For model years prior to 1997, multiply Item 1b by 2.5%.

For model years 1997 and after, multiply Item 1b by 1%.) ..................................................................................5b. _______________

6. Tax paid to another state ........................................................................................ 6a. _______________

7. Amount of tax due (Item 5a minus Item 6a) or surcharge due .............................. 7a. _______________ 7b. _______________

8. Amount of penalty if due (See instructions, Item i, Reason Code I.) ..................... 8a. _______________ 8b. _______________

9. Total amount due (Item 7a plus Item 8a, and Item 7b plus Item 8b) ..................... 9a. _______________ 9b. _______________

10. Amount of refund requested (Item 1a minus Item 9a and Item 1b minus Item 9b) .. 10a. _______________ 10b. _______________

11. TOTAL REFUND FOR SECTION I - (Item 10a plus Item 10b) ............................................................................11. _______________

n.

14

o.

17

Motor Vehicle Tax Diesel MV Surcharge

Column A Column B

Section I - Motor Vehicle Tax and/or Diesel Motor Vehicle Surcharge

AFFIDAVIT: I declare that the information in this document and any attachments is true and correct to the best

of my knowledge and belief.

Purchaser

sign

here

Business phone / Daytime phone

(Area code and number)

Seller

sign

here

Business phone / Daytime phone

(Area code and number)

Complete the claim and mail to

Comptroller of Public Accounts

111 E. 17th St.

Austin, TX 78774-0100

If you have any questions about this claim,

contact your local Comptroller fi eld office

or call 1-800-252-1382.

Form 14-202 (Back)(Rev.5-15/17)

Instructions for Filing Texas Claim for Refund of Motor Vehicle Tax,

Diesel Motor Vehicle Surcharge and/or Commercial Vehicle Registration Surcharge

Under Ch. 559, Government Code, you are entitled to review, request and correct information we have on file about you, with limited exceptions in accordance with

Ch. 552, Government Code. To request information for review or to request error correction, contact us at the address or phone number listed on this form.

Instructions for Refund Requests

Who May File - The person that paid the tax qualifies to request a refund claim of motor vehicle sales or use tax paid on motor vehicles according to Comptroller’s Rule 3.75, Refunds,

Payments Under Protest, Payment Instruments and Dishonored Payments.

When to File - Claims for refund of Motor Vehicle Tax must be postmarked within four years of the date tax was due. Tax is due on the 30th calendar day after the day the vehicle is

delivered to the purchaser or brought into this state for use.

Documentation Required for All Refund Requests (Send a copy of each of the following.):

1. Title Application Receipt issued by the Tax Assessor-Collector (TAC).

2. Signed buyer’s order or purchase invoice.

3. Documentation required under the specific refund reasons listed below.

4. Additional documentation may be requested.

Specifi c Instructions

Items b, g, j & m - Leave blank (For Comptroller Use Only).

Item c - Enter the 11-digit taxpayer number assigned by the State of Texas. If you do

not have a number previously assigned by the state, use the following:

•

Social Security Number* if you are an individual recipient or sole owner of a

business.

• Federal Employer Identification Number if set up as a corporation, partnership or

other entity.

*Disclosure of your social security number (SSN) is required and authorized under 42

U.S.C. Sec. 405(c)(2)(C)(i) and Tex. Govt. Code. Secs. 403.011.403.015, and 403.176.

The number will be used for tax administration and identification of any individual affected

by the law. The number may also be used to assist in the administration of laws relating

to child support enforcement and the identification of individuals who may be indebted

to or owe delinquent taxes to this state. Release of information on this form in response

to a public information request will be governed by the Public Information Act, Chapter 552,

Government Code.

Item d - Enter the vehicle identification number indicated on the Tax Assessor-Collector’s

Receipt for Vehicle Tax.

Items h, k & l - Enter the number shown at the top left of the long form Tax Collector’s

Receipt (Item l) or top right of the short form Tax Collector’s Receipt. Enter the date

shown on either the long form or short form TAC receipts.

Item i - Select the refund reason code from the list below that best describes the reason

for your refund request.

A - Failure of Sale (“unwound deal”): claimant must show proof the sale was never

completed, and ALL money has been returned to the purchaser. Proof may be shown by

sending copies of refund checks issued to purchaser (front/back) or lien holder (LH) payoff

(front/back) or LH letter stating no payments received and/or deal never funded.

B - Tax Collector Correction: claimant must provide a statement (on letterhead) issued

from the TAC, confirming/explaining why tax should be refunded.

C - Sales or Use Tax Paid In Error: if the claimant paid sales or use tax when the New

Resident Use Tax, Gift Tax or Even Trade Tax was due.

•

New Residents: must show proof the vehicle was registered previously in the new

resident’s name in other state or foreign country.

•

Gift: recipient or donor must submit, in person at a Comptroller fi eld office, a notor-

ized Form 14-317, Affidavit of Motor Vehicle Gift Transfer.

•

Even Trade Tax: see Reason Code B, Tax Collector Correction.

D - Stolen Vehicle: claimant must include a copy of the police report.

E - Tax Paid on Incorrect Sales Price or Taxable Value: if the claimant paid sales

or use tax on the incorrect sales price or tax should have been calculated based on

Standard Presumptive Value (SPV) or Certifi ed Apprised Value:

•

Incorrect Sales Price: claimant must send a copy of the original bill of sale, signed

by both seller and purchaser.

•

SPV: if the TAC calculated tax based on the incorrect SPV, see Reason Code B,

Tax Collector Correction.

•

Certifi ed Apprised Value: claimant must provide Form 14-128, Used Motor Vehicle

Certifi ed Appraisal Form. Appraisal must be obtained within 30 calendar days of

purchase. (See instructions on Form 14-128.)

F - Credit Not Given For Tax Paid Out of State: claimant must show proof tax was

paid to another state.

G - Title Error/Tax Paid Twice: see Reason Code B, Tax Collector Correction.

H - Tax Paid On An Exempt Vehicle: tax was paid, but vehicle qualified (at time of

purchase) for one of the following exemptions as provided by Tax Code Chapter 152:

•

Church or Religious Society: claimant must show proof they purchased a vehicle

designed to carry more than six passengers and a statement of how the vehicle

will be use primarily (at least 80% of the time) to provide transportation to and from

church or religious services or meetings.

•

Foreign NATO Military Personnel: claimant must provide a copy of military travel

orders and a copy of Foreign NATO military ID.

•

Driver Training Vehicles: claimant must provide a letter signed by both the public

school and the dealership stating the vehicle is loaned free of charge and a state-

ment the vehicle is used in an approved driver training course and displays exempt

license plates.

•

Farm/Timber Use: claimant must provide a statement from the farmer, rancher or

timber operator describing the operation and how the vehicle will be used primarily

(at least 80% of the time) for an exempt use. Beginning January 1, 2012, the state-

ment must include the Comptroller Ag/Timber Number.

•

Off Road Vehicles: claimant must provide MSO showing vehicle is designed for

off road use.

•

Vehicle Taken Out Of State: claimant must send a copy of bill of lading from the

steam liner or copy of motor vehicle transport carrier bill of lading and copy of

completed Form 14-312, Texas Motor Vehicle Sales Tax Exemption Certificate,

presented to dealer. If vehicle was registered in Texas claimant must prove vehicle

was not used in Texas.

•

Vehicle Sold or Leased To A Public Agency: claimant must show the vehicle was

sold or leased to a federal organization; or a state agency or volunteer fi re depart-

ment and the vehicle is operated with exempt plates.

I - Refund of Tax Penalty Paid: claimant must send a written explanation for the refund

request for penalty paid and documentation, if available, to support refund request.

J - Interstate Use (IRP) Exemption: claimant must send copies of cab card(s) that

proves the unit was operated continuously for 12 months for interstate use.

K - Orthopedically Handicapped Exemption: vehicle must be operated 80% of time

by an orthopedically handicapped driver or used 80% of the operating time to transport

an orthopedically handicapped person. Claimant must submit Form 14-318, Texas

Motor Vehicle Orthopedically Handicapped Exemption Certificate, and the following

documentation:

•

For Driver Exemption: send a copy of a restricted Texas driver license, issued

to the qualified orthopedically handicapped person(s), which requires a qualified

modification; copy of medical documentation/statement signed by a practitioner

of the healing arts describing driver’s orthopedic handicap and date orthopedic

handicap occurred; and documentation that the vehicle has been or will be modified

by altering acceleration, steering or braking systems.

•

For Transportation Exemption: copy of medical documentation/statement signed

by a practitioner of the healing arts describing passenger’s orthopedic handicap

and date orthopedic handicap occurred; and documentation the vehicle has been

or will be modified by installing a wheelchair lift, hoist, raised roof, attached ramp,

wheelchair hold-down clamps or special seat restraints other than conventional

seat belts to allow for the transportation of an orthopedically handicapped person

in a reasonable manner.

L - Lemon Law: claimant must send a copy of the cancellation worksheet, settlement

agreement, refund check, lien holder payoff check and assignment of right to refund if

claimant is not the original purchaser.

M - Child Care Facilities Exemption: claimant must send a copy of license issued by

the Texas Department of Protective and Regulatory Services for 24-hour residential care

for children with emotional disorders.

N - Fair Market Value Deduction (FMVD): claimant must send a copy of the title his-

tory obtained from www.TXDMV.gov for each vehicle being claimed as a tax credit/

FMVD.

O - Other: claimant must send a written statement detailing the reason for the refund

request and documentation, if any, to support refund claim.

Item 5 - Column A - Multiply the amount in Item 4 by the tax rate of 0.0625.

For Reason Codes A, D, G, H, J, K, L or M, enter zero.

Item 8 - Enter penalty shown on the tax collector receipt.

Item 11 - Refer to Commercial Vehicles and Truck Tractor registration surcharge refund

Reason Codes R, S, T and U.

Instructions for Section II

R - IRP Registration Refunds: claimant must include a copy of the cab card and a

copy of the IRP Refund Supplement Sheet provided by Texas Department of Motor

Vehicles (TxDMV).

S - Combination Registration Refunds: claimant must include a copy of a validated

Registration Renewal Receipt and the Registration Fee Refund Request/Authorization

Form, VTR-304, provided by TxDMV.

T - Forestry Registration Refunds: claimant must include a copy of the cab card and

a copy of the Forestry IRP Refund Supplement Sheet provided by TxDMV.

U - IRP Audits: claimant must include a copy of the IRP Billing Notice validated by

TxDMV.