Fillable Printable Cash Flow Statement Template

Fillable Printable Cash Flow Statement Template

Cash Flow Statement Template

Cash Flows - 1

CAS H FLOW STATEM ENT

On the statemen t, cash flow s are segregated based on source:

Operating activities: involve the cash effect s of transactions that

enter into the determination of net income.

Investing activities: conc ern with buying (and selling) property, plants,

and equipment (PPE); acquiring and disposing of

securities of ot her entities;

Financing activit ies: include issuance and reacquisition of a firm's debt

and capital stock, and divi dend payments.

• Operating cash flows information indicates the business' ability to

generate sufficient ca sh from its continuing operatio ns

• Investing cash flows information indicates how the business plans to

expand

Information about financing cash flows illustrates how the business plans to

finance its expansion/reward shareholders.

Cash Flows - 2

Cash from operations: The statement of cash flows typically arrives at

cash from operations by adding to (or subtracting from) net income two

types of adjustments:

1. “Non-cash” expenses’

2. Changes in operating (working capital)

e.g.:

Net Income $30,000

Non Cash Expenses:

e.g. Depreciation 5,000

$35,000

Change in operating accounts:

Decrease in inventory 15,000

Cash from operations $50,000

The format illustrated above follows the indirect method of pres entation.

For analytical purposes, (as we shall see), the direct method is more

useful;

Cas h Flows - 3

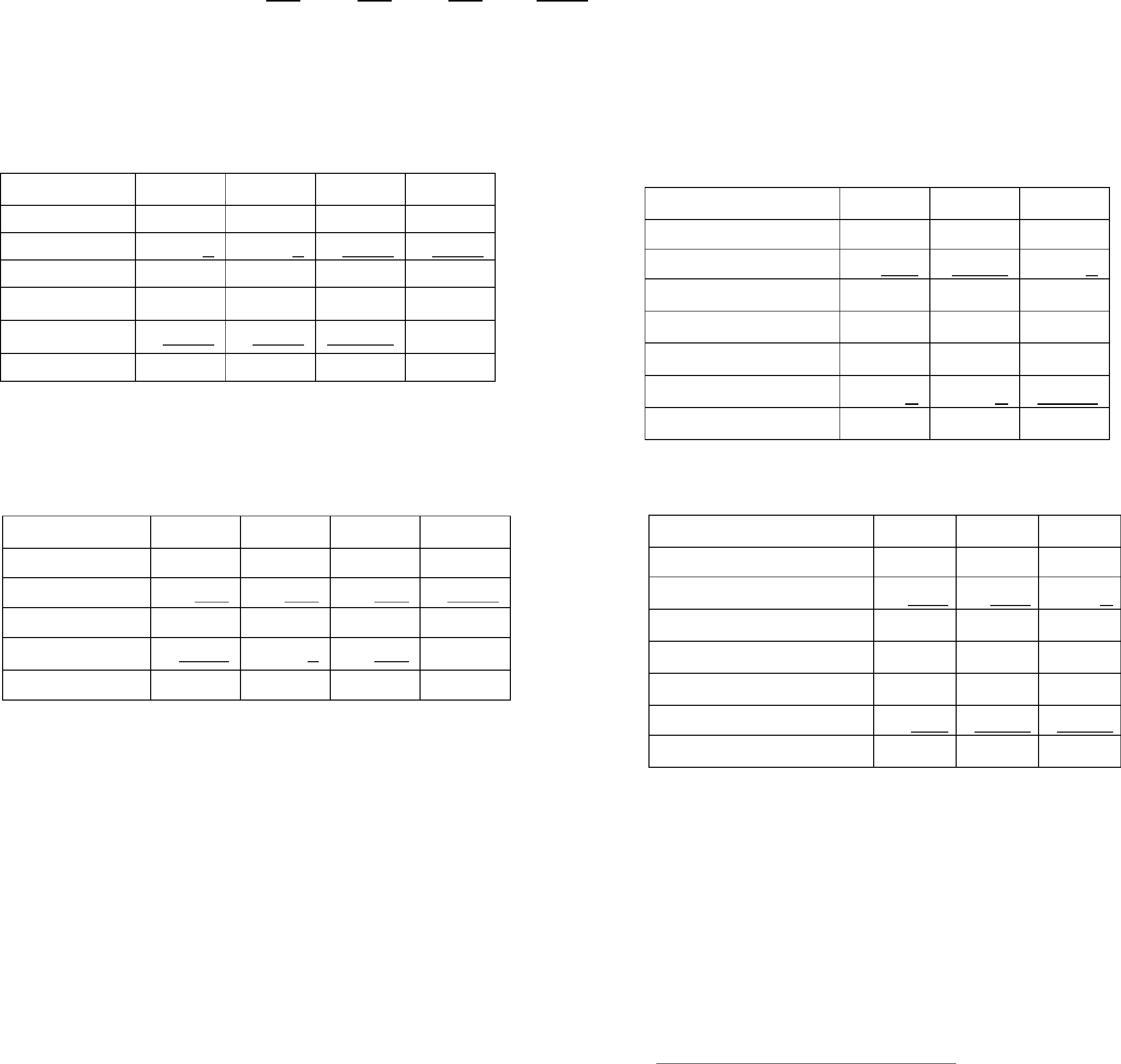

5.[Cash flow, transactional analysis; 1990 CFA

adapted] The following financial statements are from

the 19X2 Annual Report of the Niagara Company:

Income Statement for Year Ended December 31, 19X2

Sales $1,000

Cost of goods sold (650)

Depreciation expense (100)

Sales and general expense (100)

Interest expense (50)

Income tax expense (40)

Net income $60

Balance Sheets at December 31, 19X1 and 19X2

19X1 19X2

Assets

Cash $50 $60

Accounts receivable 500 520

Inventory 750 770

Current assets $1,300 $1,350

Fixed assets (net) 500 550

Total assets $1,800 $1,900

Liabilities and equit y

Notes payable to banks $100 $75

Accounts payable 590 615

Int erest payable 10 20

Current liabilities $700 $710

Long-term debt 300 350

Def erre d income tax 300 310

Capital stock 400 400

Retained earnings 100 130

Tot a l liabilit ies & eq uit y $1,800 $1,900

Prepare a statement of cash flows for the year ended Decem ber 31, 19X2.

Use the direct method.

19X1 19X2

∆

O

Sales A/R

P

E

COGS Inventory

R

A/P

A

T Sales & General

I

O

Interest Int Payable

N

S

Tax Expense Def Tax

I

N

Depreciation

VESTMENT

PP&E Purchase Fixed Assets

F

Debt Payment

Notes Payable

I

LTD

N

A

Stock Issue

Capital Stock

N

C

Dividend

Ret Earnings

ING

Net Income

Cash Flows - 4

Niagara Company

Sales $1,000

Cost of goods sold (650)

Depreciation expense (100)

SGA (100)

Inte rest expense (50)

Income tax expense (40)

INDIRECT METHOD

Cash from Operations

Net Income 60

Non Cash Items

Depreciation 100

Deferred taxes 10

in operating accounts

A/R (20)

Inventory (20)

Inte rest payable 10

A/P 25

165

Cash for Investment

Capital Ex penditures (150)

Cash for Financing

ST Debt repayment (25)

LT Debt borrowing 50

Dividends (30)

( 5)

Change in Cash 10

DIRECT METHOD

Cash from Operations

Cash collections 980

Cash for inpu ts (645)

Cash SGA (100)

Cash for Interest ( 40)

Cash for Taxes ( 30)

165

Cash for Investment

Capital Ex penditures (150)

Cash for Financing

ST Debt repayment (25)

LT Debt borrowing 50

Dividends (30)

( 5)

Change in Cash 10

Cash Flows - P. 5

Changes Included in Cash Flow from Operating Activities (CFO)

Balance Sheet Account Cash Flow Description

Accounts receivable Cash received from customers

Inventories Cash paid for inputs (materials)

Prepaid expenses Cash expenses

Accounts payable Cash paid for inputs/expenses

Advances from customers Cash received from customers

Rent payable Cash expenses

Interest payable Interest paid

Income tax payable Income taxes paid

Deferred income taxes Income taxes paid

Changes Included in Cash Flow from Investing Activities (CFI)

Balance Sheet Account Cash Flow Description

Property, plant, and equipment Capital expenditures

Proceeds from property sales

Investment in affiliates Cash paid for acquisitions and

investments

Changes Included in Cash Flow from Financing Activities (CFF)

Balance Sheet Account Cash Flow Description

Notes payable Increase or decrease in debt

Short-term debt Increase or decrease in debt

Long-term debt Increase or decrease in debt

Bonds payable Increase or decrease in debt

Common stock Equity financing or repurchase

Retained earnings Dividends paid

The relationship between balance sheet changes and cash flows can be

summarized as follows:

• Increases (decreases) in assets represent net cash outflows (inflows). If an

asset increases, the firm must have paid cash in exchange.

• Increases (decreases) in liabilities represent net cash inflows (outflows).

When a liability increases, the firm must have received cash in exchange.

Cash Flows - P. 6

Converting Indirect Method Cash Flows to Direct Method:

(Creating CFO from FFO)

Cash Flows = Income Statement +/- Balance Sheet Changes

From Customer Sales

∆ A/R

∆ Advances

To Supp liers COGS

∆ A/P

∆ Inventory

For Expenses SG&A

∆ Accrued expense

∆ Prepaid Expense

The Income Statement and the Cash Flow from Operations portion of the Statement of

Cash Flows of the XYZ Compan y follow:

Sales 90,000 Net Income 30,000

COGS 20,000 Add:

Depreciation 10,000 Depreciation 10,000

Wages 12,000 ∆ in A/R 3,000

Rent 5,000 ∆ in A/P 2,000

Interest 3,000 Less:

Taxes 10,000 60,000 ∆ in Inventory (4,000)

30,000 ∆ in Rent Payable (3,000)

∆ in Tax Payable (2,000 )

36,000

Prepare the Cash Flow from Operations using the Direct Method:

Cash Flows - P. 7

Cash Flow Classification Issues

While the classification of cash flows into the three main categories is

important, we must recognize that

classification guidelines can be arbitrary.

Although total cash flow is not subje ct to manipulation

CFO (and CFF and CFI) is affected by re porting methods that alter the

classification of cash fl ows among opera ting, i nvesting, and financing

categories

1. Cash flows involving Property Plant and Equipment

2. Differenc es due to some accounting methods

3. Interest and dividends re ceived

4. Interest paid

5. Noncash transactions

Drawbacks of cash from operations (analyst point of view).

• Cash from operations does not include charges for the use of long-lived

assets; depreciation is added back into income in arriving at cash from

operations.

• Cash from operations does not include cash outlays for replacing old

equipment (required to en sure uninterrupted operating activ ities) .

• Identical firms that make different accounting choices may report different

cash from operations.

Examples:

1. Leasing firms report lower cash from operations than purchasing firms as

lease rentals reduce cash from operations whereas payments for

purchas ing reduce cash from investing ac tivities.

2. Capitalizing expenditures-firms report higher cash from operations than

expensing-firms.

Cash Flows - P. 8

Example:

Assumptions:

Proj ect -3 year life

Cash disbursements m easur e progress.

Year 1 2 3 Total

Cash Receipts 1,000 1,000 1,000 3,000

Disbursements 900 600

300 1,800

∆ cash 100 400 700 1,200

∆ cash cumul 100 500 1,200

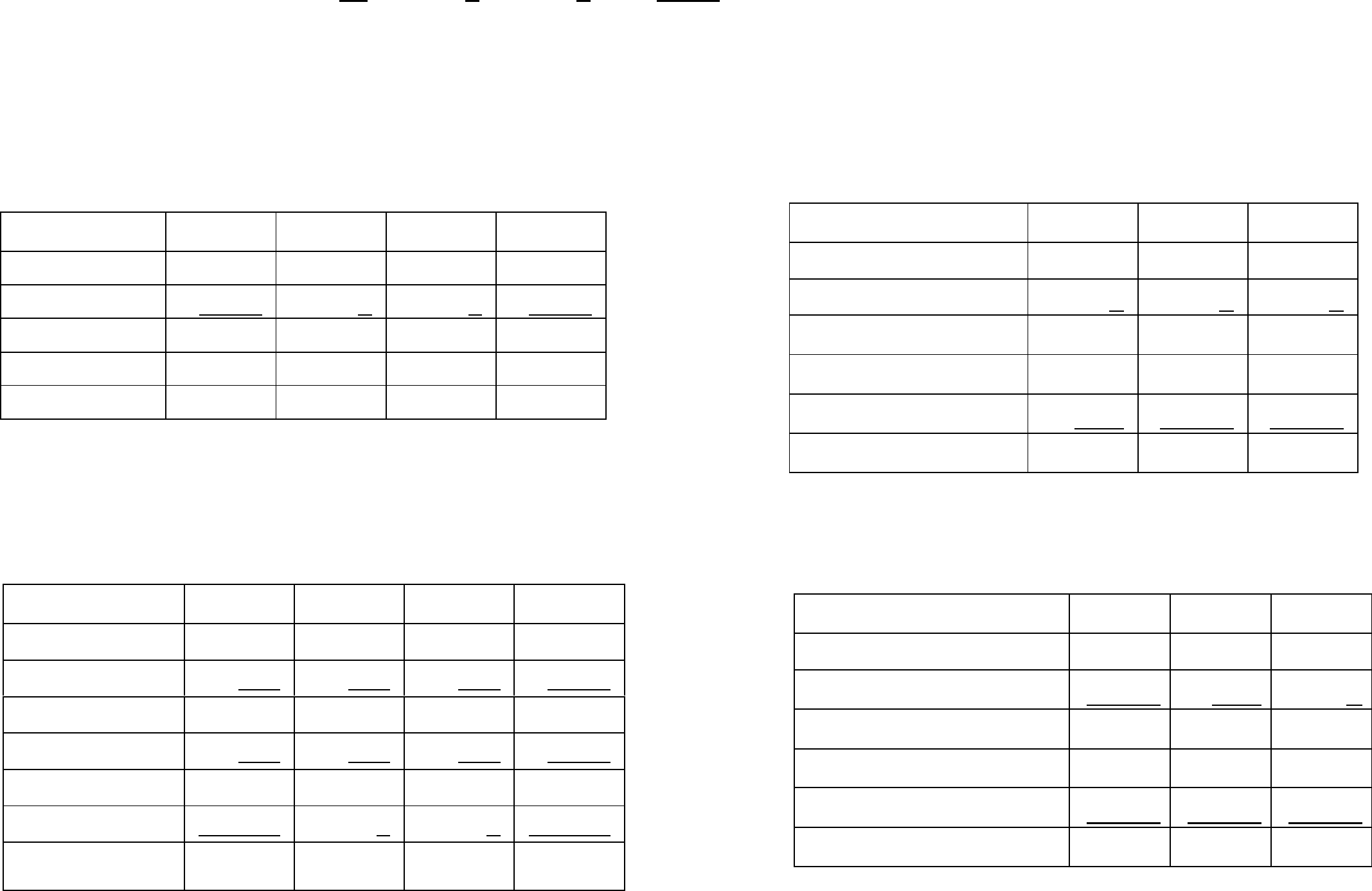

INCOME & CASH FLOW

Completed Contract

Year

123Total

Revenues

0 0 3,000 3,000

Expenses

0

0 1,800 1,800

Income

0 0 1,200 1,200

∆ Inventory

(900) (600) 1,500

∆Advances

1,000 1,000 (2,000)

CFO

100 400 700 1,200

Percentage of Completion

Year

123Total

Revenues

1,500 1,000 500 3,000

Expenses

900 600 300 1,800

Income

600 400 200

∆ A/R

(500) 0 500

CFO

100 400 700 1,200

BALANCE SHEET

Completed Contract

Year

123

Cash

100 500 1,200

Inventory

900 1,500 0

Current As s ets

1,000 2,000 1,200

Advances (CL)

1,000 2,000 0

Retained Earnings

0 0 1,200

Lia bi lity & Equity

1,000 2,000 1,200

Percentage of Completion

Year

123

Cash

100 500 1,200

Accounts Receivable

1

500 500 0

Current As s ets

600 1,000 1,200

Advances (CL)

Retained Earnings

600 1,000 1,200

Lia bi lity & Equity

600 1,000 1,200

1

May be called Inventory: Work in

Process at Contract P r ice and may be

reported a t ti mes net of advances

Cash Flows - P. 9

Example:

Assumptions:

Proj ect -3 year life

Up fr ont item (UFI) cost of $1,500 m a y be capitalized or

expensed immediately.

Year 1 2 3 Total

Cash / Income Pre 2,000 2,000 2,000 6,000

"Up front item" 1,500 0

0 1,500

∆ cash 500 2,000 2,000 4,500

∆ cash cumul 500 2,500 4,500

INCOME & CASH FLOW

Expense

Year

123Total

Revenues

2,000 2,000 2,000 6,000

Expenses

1,500

0 0 1,500

Income

500 2,000 2,000 4,500

CFO

500 2,000 2,000 4,500

Capitaliz e / Am orti z e

Year

123Total

Revenues

2,000 2,000 2,000 6,000

Expenses

500 500 500 1,500

Income

1,500 1,500 1,500 4,500

Add Deprec

500 500 500 1,500

CFO

2,000 2,000 2,000 6,000

CFI

(1,500) 0 0 (1,500)

∆ Cash

500 2,000 2,000 4,500

BALANCE SHEET

Expense

Year

123

Cash

500 2,500 4,500

UFI

0 0 0

Assets

500 2,500 4,500

Retained Earnings

500 2,500 4,500

Lia bi lity & Equity

500 2,500 4,500

Capitaliz e / Am orti z e

Year

123

Cash

500 2,500 4,500

UFI

1,000 500 0

Assets

1,500 3,000 4,500

Retained Earnings

1,500 3,000 4,500

Lia bi lity & Equity

1,500 3,000 4,500

Cash Flows - P. 10

FREE CASH FLOWS

To overcome these problems, analysts typically use free cash flows

as an alternative measure for cash from operations defined as:

CFO less net cash outla ys for the repl acement of operating capacity.

Although the definition implies that only net investment in replacing old

equipment is subtracted from cash from operations, in practice total

investment appearing in the cash used by investing activity section of the

statement of cash flows is used. This may overstate (understate) the net

investment in replacing equipment because some of the investment

reported under cash used by investing activities may represent expansion

(downsizing). Thus, the free cash flow may overstate or understate true

cash from operations.

Free cash flows still shares two drawbacks of cash from operations

• Interest and dividends received, which are classified as operating cash

flows, should be reclassified (using the after-tax numbers) as investing

cash flows. This has the advantages of reporting operating cash flows

that reflect only operating activities of the firm's core business

• Interest payments, which are classified as operating cash flows, should

be reclassified (using the after-tax numbers) as cash used by financing

activities. This has the advantage of reporting identical cash from

operations by two firms with different capital structure but otherwise

identical.

• Significant Noncash transactions

Cash Flows - P. 11

Alternatively CFO provides information as to

Liquidity

• The cash flow statement provides information about the firm's liquidity

and its ability to finance its growth from internally generated funds.

The Effect of Accounting Policies

• The cash flow statement allows the analyst to distinguish between the

actual events that have occurred and the accounting assumptions that

have been used to report these events.

The (Validi t y) of the Going Concer n Assumpti on

• the statement of cash flows serves as a “check” on the assumptions

inherent in the income statement.

Analysis of Cash Fl ow Trends

The data con tained in the statement of cash flow s can be used to

1. Revie w individual cash flow items for analytic significance

2. Examine the trend of different cash flow components over time and their

relati onship to relat ed income stat ement items.

3. Consider the interrelationship between cash flow components over time