Fillable Printable Cbp Form 3299

Fillable Printable Cbp Form 3299

Cbp Form 3299

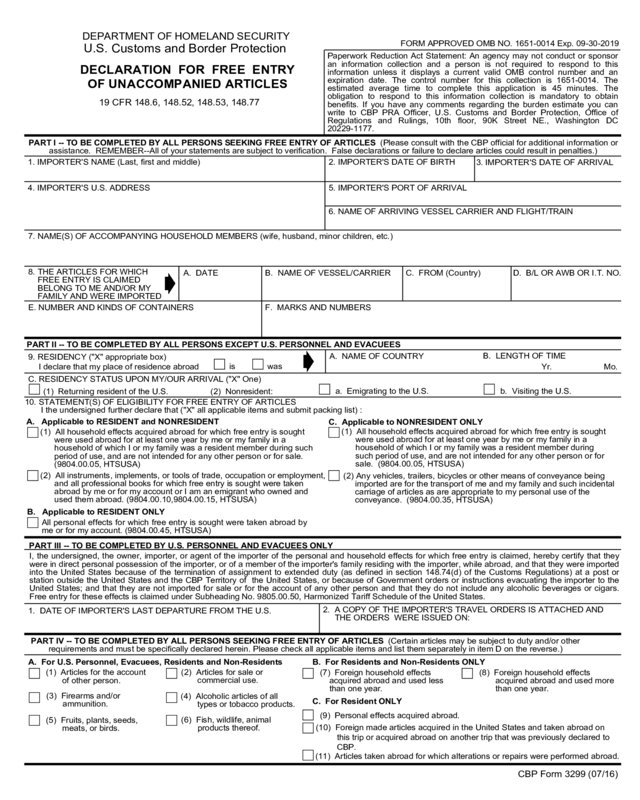

FORM APPROVED OMB NO. 1651-0014 Exp. 09-30-2019

PART I -- TO BE COMPLETED BY ALL PERSONS SEEKING FREE ENTRY OF ARTICLES (Please consult with the CBP official for additional information or

assistance. REMEMBER--All of your statements are subject to verification. False declarations or failure to declare articles could result in penalties.)

3. IMPORTER'S DATE OF ARRIVAL

2. IMPORTER'S DATE OF BIRTH

1. IMPORTER'S NAME (Last, first and middle)

5. IMPORTER'S PORT OF ARRIVAL

6. NAME OF ARRIVING VESSEL CARRIER AND FLIGHT/TRAIN

4. IMPORTER'S U.S. ADDRESS

7. NAME(S) OF ACCOMPANYING HOUSEHOLD MEMBERS (wife, husband, minor children, etc.)

A. DATE B. NAME OF VESSEL/CARRIER C. FROM (Country)

F. MARKS AND NUMBERS

PART II -- TO BE COMPLETED BY ALL PERSONS EXCEPT U.S. PERSONNEL AND EVACUEES

B. LENGTH OF TIME

A. NAME OF COUNTRY

I declare that my place of residence abroad

Yr. Mo.

C. RESIDENCY STATUS UPON MY/OUR ARRIVAL ("X" One)

10. STATEMENT(S) OF ELIGIBILITY FOR FREE ENTRY OF ARTICLES

I the undersigned further declare that ("X" all applicable items and submit packing list) :

C. Applicable to NONRESIDENT ONLY

B. Applicable to RESIDENT ONLY

All personal effects for which free entry is sought were taken abroad by

me or for my account. (9804.00.45, HTSUSA)

PART III -- TO BE COMPLETED BY U.S. PERSONNEL AND EVACUEES ONLY

1. DATE OF IMPORTER'S LAST DEPARTURE FROM THE U.S.

2. A COPY OF THE IMPORTER'S TRAVEL ORDERS IS ATTACHED AND

THE ORDERS WERE ISSUED ON:

PART IV -- TO BE COMPLETED BY ALL PERSONS SEEKING FREE ENTRY OF ARTICLES

(Certain articles may be subject to duty and/or other

requirements and must be specifically declared herein. Please check all applicable items and list them separately in item D on the reverse.)

A. For U.S. Personnel, Evacuees, Residents and Non-Residents B. For Residents and Non-Residents ONLY

C. For Resident ONLY

(9) Personal effects acquired abroad.

CBP Form 3299 (07/16)

DECLARATION FOR FREE ENTRY

OF UNACCOMPANIED ARTICLES

19 CFR 148.6, 148.52, 148.53, 148.77

D. B/L OR AWB OR I.T. NO.

is was

(1) Returning resident of the U.S.

a. Emigrating to the U.S.

b. Visiting the U.S.

(2) Nonresident:

DEPARTMENT OF HOMELAND SECURITY

U.S. Customs and Border Protection

8. THE ARTICLES FOR WHICH

FREE ENTRY IS CLAIMED

BELONG TO ME AND/OR MY

FAMILY AND WERE IMPORTED

E. NUMBER AND KINDS OF CONTAINERS

9. RESIDENCY ("X" appropriate box)

A. Applicable to RESIDENT and NONRESIDENT

(1) All household effects acquired abroad for which free entry is sought

were used abroad for at least one year by me or my family in a

household of which I or my family was a resident member during such

period of use, and are not intended for any other person or for sale.

(9804.00.05, HTSUSA)

(2) All instruments, implements, or tools of trade, occupation or employment,

and all professional books for which free entry is sought were taken

abroad by me or for my account or I am an emigrant who owned and

used them abroad. (9804.00.10,9804.00.15, HTSUSA)

(1) All household effects acquired abroad for which free entry is sought

were used abroad for at least one year by me or my family in a

household of which I or my family was a resident member during

such period of use, and are not intended for any other person or for

sale. (9804.00.05, HTSUSA)

(2) Any vehicles, trailers, bicycles or other means of conveyance being

imported are for the transport of me and my family and such incidental

carriage of articles as are appropriate to my personal use of the

conveyance. (9804.00.35, HTSUSA)

(1) Articles for the account

of other person.

(2) Articles for sale or

commercial use.

(3) Firearms and/or

ammunition.

(5) Fruits, plants, seeds,

meats, or birds.

(4) Alcoholic articles of all

types or tobacco products.

(6) Fish, wildlife, animal

products thereof.

(7) Foreign household effects

acquired abroad and used less

than one year.

(8) Foreign household effects

acquired abroad and used more

than one year.

(10) Foreign made articles acquired in the United States and taken abroad on

this trip or acquired abroad on another trip that was previously declared to

CBP.

(11) Articles taken abroad for which alterations or repairs were performed abroad.

I, the undersigned, the owner, importer, or agent of the importer of the personal and household effects for which free entry is claimed, hereby certify that they

were in direct personal possession of the importer, or of a member of the importer's family residing with the importer, while abroad, and that they were imported

into the United States because of the termination of assignment to extended duty (as defined in section 148.74(d) of the Customs Regulations) at a post or

station outside the United States and the CBP Territory of the United States, or because of Government orders or instructions evacuating the importer to the

United States; and that they are not imported for sale or for the account of any other person and that they do not include any alcoholic beverages or cigars.

Free entry for these effects is claimed under Subheading No. 9805.00.50, Harmonized Tariff Schedule of the United States.

Paperwork Reduction Act Statement: An agency may not conduct or sponsor

an information collection and a person is not required to respond to this

information unless it displays a current valid OMB control number and an

expiration date. The control number for this collection is 1651-0014. The

estimated average time to complete this application is 45 minutes. The

obligation to respond to this information collection is mandatory to obtain

benefits. If you have any comments regarding the burden estimate you can

write to CBP PRA Officer, U.S. Customs and Border Protection, Office of

Regulations and Rulings, 10th floor, 90K Street NE., Washington DC

20229-1177.

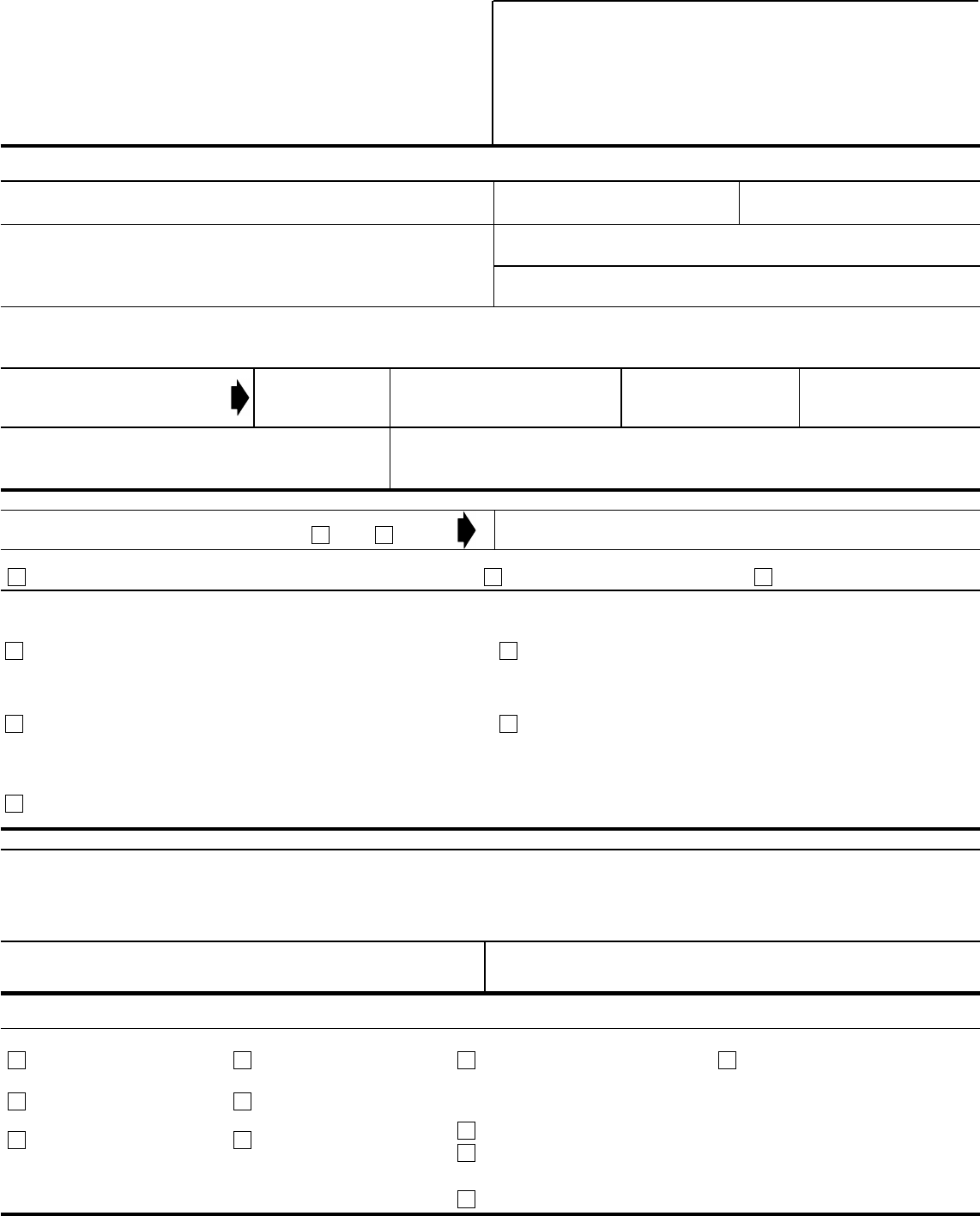

D. LIST OF ARTICLES

(2) DESCRIPTION OF MERCHANDISE

PART V -- CARRIER'S CERTIFICATE AND RELEASE ORDER

2. SIGNATURE OF AGENT (Print and sign)

Date

PART VI -- CERTIFICATION TO BE COMPLETED BY ALL PERSONS SEEKING FREE ENTRY

1. "X" One

2. SIGNATURE

3. DATE

*An Authorized Agent is defined as a person who has actual knowledge of the facts and who is specifically empowered under a power of attorney to execute this

declaration (see 19 CFR 141.19, 141.32, 141.33).

1. SIGNATURE OF CBP OFFICIAL

2. DATE

PART VII -- CBP USE ONLY

(Inspected and Released)

CBP Form 3299 (07/16)

A. Authorized Agent* (From facts obtained from the importer) B. Importer

(1) ITEM NUMBER

CHECKED IN PART

IV, A., B., C.

(3) VALUE OF

COST OF

REPAIRS

(4) FOREIGN MERCHANDISE TAKEN ABROAD THIS

TRIP: State where in the U.S. the foreign merchandise

was acquired or when and where it was previously

declared to CBP.

The undersigned carrier, to whom of upon whose order the articles described in PART I, 8., must be released, hereby certifies that the person named in Part I,

1., is the owner or consignee of such articles within the purview of section 484(h), Tariff Act of 1930.

In accordance with provisions of section 484(h), Tariff Act of 1930, authority is hereby given to release the articles to such consignee.

1. NAME OF CARRIER

I, the undersigned, certify that this declaration is correct and complete.