- Certified Weekly Payroll Report - New Jersey

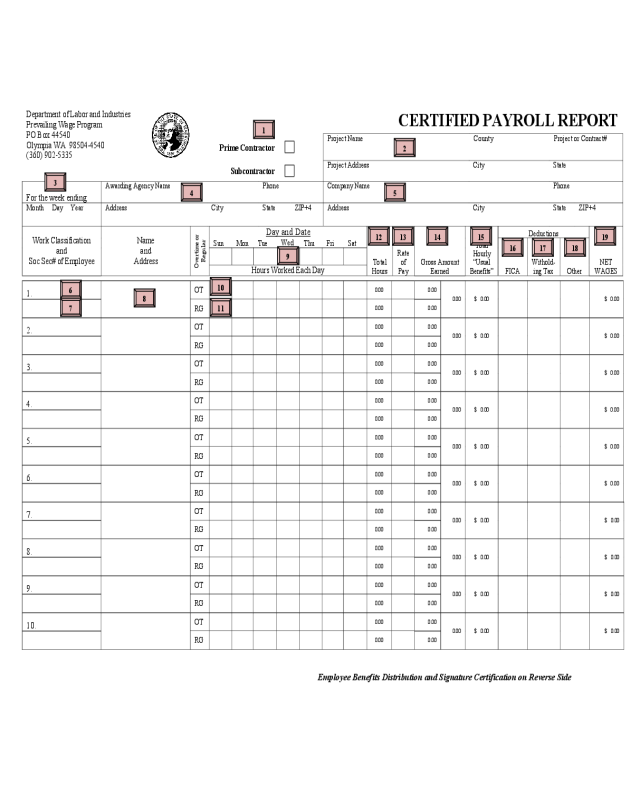

- Certified Payroll Report - Washington Department of Labor and Industries

- Labor Certified Transcript of Payroll - Illinois

- Public Works Payroll Reporting Form - California

- Weekly Payroll Certification for Public Works Projects - Pennsylvania

- Certified Transcript of Payroll - Illinois

Fillable Printable Certified Payroll Report - Washington

Fillable Printable Certified Payroll Report - Washington

Certified Payroll Report - Washington

Employee Benefits Distribution and Signature Certification on Reverse Side

Department of Labor and Industries

Prevailing Wage Program

PO Box 44540

Olympia WA 98504-4540

(360) 902-5335

CERTIFIED PAYROLL REPORT

Prime Contractor

Project Name

County

Project or Contract#

Subcontractor

Project Address

City

State

For the week ending:

Awarding Agency Name

Phone

Company Name

Phone

Month Day Year

Address

City

State

ZIP+4

Address

City

State

ZIP+4

Work Classification

and

Soc Sec# of Employee

Name

and

Address

Overtime or

Regular

Day and Date

Total

Hours

Rate

of

Pay

Gross Amount

Earned

Total

Hourly

“Usual

Benefits”

Deductions

NET

WAGES

Sun Mon Tue

Wed

Thu Fri Sat

FICA

Withold-

ing Tax Other

Hours Worked Each Day

1.

OT

0.00 0.00

0.00 $ 0.00 $ 0.00

RG

0.00

0.00

2.

OT

0.00

0.00

0.00 $ 0.00 $ 0.00

RG

0.00

0.00

3.

OT

0.00

0.00

0.00 $ 0.00 $ 0.00

RG

0.00

0.00

4.

OT

0.00

0.00

0.00 $ 0.00 $ 0.00

RG

0.00

0.00

5.

OT

0.00

0.00

0.00 $ 0.00 $ 0.00

RG

0.00

0.00

6.

OT

0.00

0.00

0.00 $ 0.00 $ 0.00

RG

0.00

0.00

7.

OT

0.00

0.00

0.00 $ 0.00 $ 0.00

RG

0.00

0.00

8.

OT

0.00

0.00

0.00 $ 0.00 $ 0.00

RG

0.00

0.00

9.

OT

0.00

0.00

0.00 $ 0.00 $ 0.00

RG

0.00

0.00

10.

OT

0.00

0.00

0.00 $ 0.00 $ 0.00

RG

0.00

0.00

1

2

3

4 5

6

7

8

9

10

11

12

13

14 15

16 17 18

19

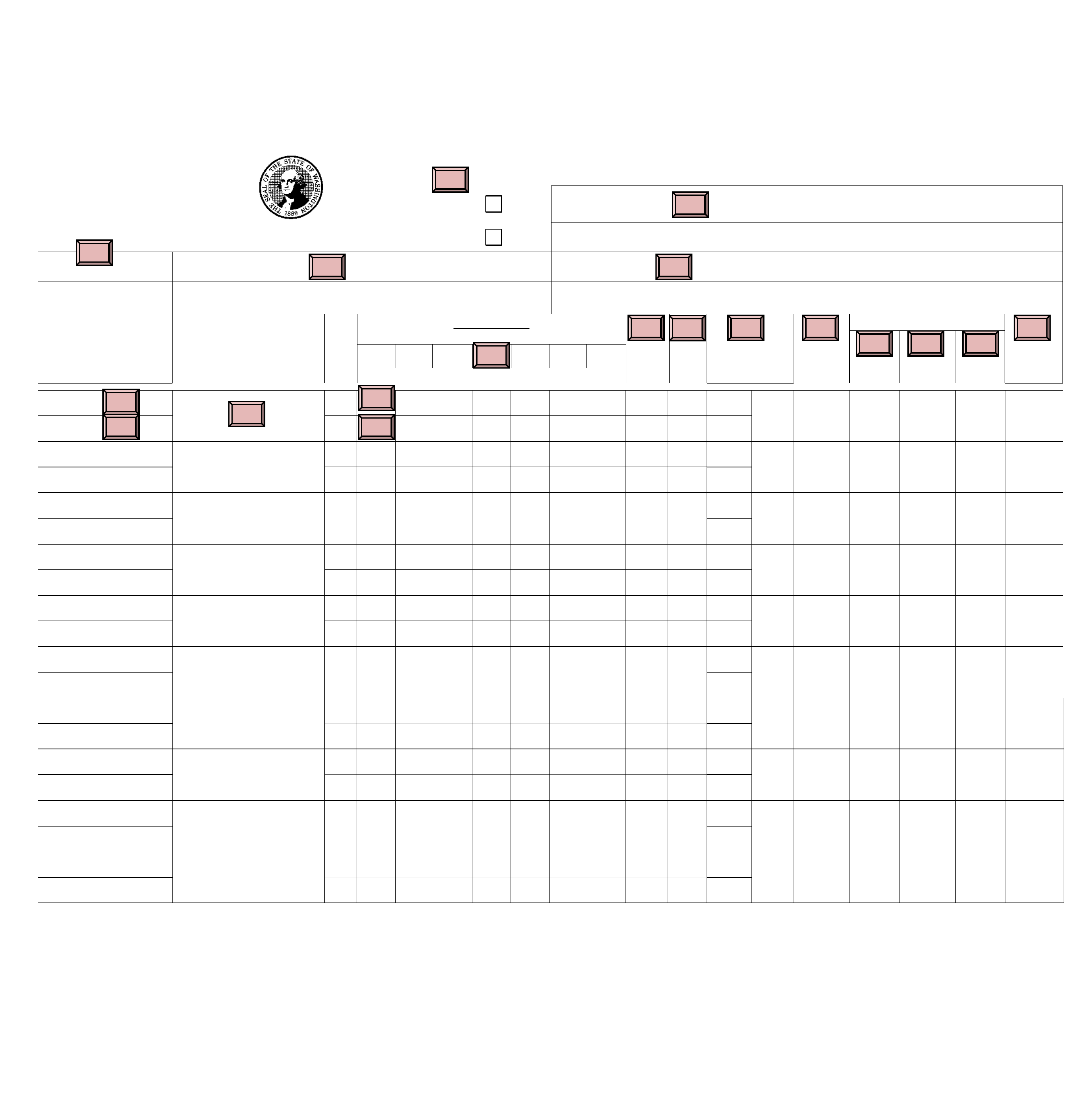

Department of Labor and Industries

Prevailing Wage Program

PO Box 44540

Olympia WA 98504-4540

AFFIRMATION

Today’s Date

Printed name of party signing this report

Title

The party signing this report pays or supervises the

payment of the persons employed by:

(Name of contractor or subcontractor)

Project Name:

For the week starting:

For the week ending:

The party signing below AFFIRMS the following:

(1)

All information contained in this Certified Payroll Report, including any addenda, is correct and complete.

(2)

The wage rates for workers, laborers or mechanics as reported above are not less than the applicable wage rates contained in any wage determination related to the

contract; and the classifications as reported above for each worker, laborer or mechanic conform with the actual work performed by such worker, laborer or mechanic.

(3)

The payments of usual benefits as listed above have been or will be made to appropriate approved plans, funds or programs for the benefit of such employees.

(4)

All persons employed on the above-referenced project(s) have been paid the full weekly wages earned, and no rebates have been or will be made either directly or

indirectly to or on behalf of the above-named contractor or subcontractor from the weekly wages earned by any person. No deductions, other than those which are legally

permissible, have been made by any person either directly or indirectly from the full wages earned.

(5)

Any apprentices employed in the above period are duly registered in a bona fide apprenticeship program registered with the Washington State Apprenticeship and

Training Council.

Falsification of any of the above statements is a violation of RCW 39.12.050 subject to prosecution, sanctions, and penalties.

Print or type name of party signing this report

Title

Signature

“USUAL BENEFITS” DISTRIBUTION (Please report in “per hour” terms)

Work Classification

Total Hourly

“Usual Benefits”

(A + B + C + D + E)

(A) Hourly Pension (B) Hourly Medical (C) Hourly Vacation (D) Hourly Holiday

(E) Approved

Apprentice Program

1.

$ 0.00

2. $ 0.00

3.

$ 0.00

4.

$ 0.00

5.

$ 0.00

6.

$ 0.00

7.

$ 0.00

8.

$ 0.00

9.

$ 0.00

10. $ 0.00

20

21

22

23

6

15

15a

15b

15c

15d

15e

24

Department of Labor & Industries

Prevailing Wage Program

P.O. Box 44540

Olympia Washington 98504-4540

Phone (360) 902-5335 / Fax (360) 902-5300

Phone (360) 902-5335 / Fax (360) 902-5300

INSTRUCTIONS

CERTIFIED PAYROLL REPORT

FOR PUBLIC WORKS PROJECTS

**PLEASE NOTE**

PAYROLL REPORT AFFIRMATIONS MUST BE SUBMITTED ON L&I FORMS

Note: The completion of a Certified Payroll Report requires an affirmation which is a statement certifying

that the information reported is true. Falsification of information provided may subject the signing party

and the contractor to civil or criminal penalties.

GENERAL INSTRUCTIONS:

Certified payroll records are required to be filed with the Department of Labor & Industries (L&I) only if

requested by L&I or by an interested party. Within 10 days of receiving such request, the completed forms

must be sent directly to L&I (see mailing information below) and to the Awarding Agency, but not directly

to an interested party. In order to protect employee privacy, L&I will remove from the information you

provide all employee Social Security numbers before sending the report to an interested party. The

Awarding Agency or Prime Contractor may require you to provide this information and/or additional

information directly to them. If that is the case, use the forms they designate (which may be L&I forms) and

you do not need to send that report to L&I. Please contact L&I (see contact information below) if you have

any questions regarding this process.

You may use your own payroll accounting form for submitting information for the first page of the report,

provided you still report all the required information.

For the second page of the report “Affirmation,” you must use the form provided by the Prevailing Wage

Office of L&I. DO NOT USE ANY OTHER FORM FOR REPORTING THIS USUAL BENEFIT

INFORMATION AND THE AFFIRMATION. DO NOT ALTER THE FORM. If you use any other

form, it will not satisfy our reporting requirements and a Notice of Violation may be filed against you for

failure to provide a required report. Issuance of a Notice of Violation may subject the contractor to civil

penalties. You will not be permitted to bid on any public works projects until such penalties are paid.

Additionally, a second violation within a two year period will cause you to be barred from bidding on any

public works project for a period of one year.

Use the latest publication of Certified Payroll Report F700-065-000 (04/09). The form number and date are

located in the lower left-hand corner of the form.

It is recommended that you complete the form on line at http://www.lni.wa.gov/Forms/pdf/700065af.pdf,

then print it out and sign it before mailing it to L&I. We have made every effort to make this an easy

method for you to provide the required information. If you wish, you may print out the form and manually

complete it. We will provide you with a printed copy of the form upon request.

An interested party may request certified payroll records specific to a project. Please provide that

information to L&I and to the awarding agency. If you choose to report work on multiple projects or private

jobs in that same certified payroll record, please break out each job/project individually by name on separate

lines on the certified payroll record. Note: If necessary, L&I may request records on all work in a pay period

as part of an L&I investigation.

INSTRUCTIONS

CERTIFIED PAYROLL REPORT FOR PUBLIC WORKS PROJECTS (Continued)

P a g e | 2

If your company utilizes a “Ten Hour Workday (4-10) Agreement,” provide a statement to that effect and

include with your report a copy of the signed agreement for each affected employee. Each agreement must

state the specific public works project for which you are submitting the accompanying Certified Payroll

Report.

The employee information requested is required by Washington law (WAC 296-127-320), including

employee Social Security numbers. This information is NOT optional. Do not list employee information

regarding ethnic origin, marital status, and/or number of exemptions.

If you are an owner/operator performing all the work on-site, with no employees, state this on the report and

list only the daily hours worked. You do not need to submit wage information for yourself.

If requested, continue to submit the Certified Payroll Report on a regular basis until your company has

completed the contract or project. Unlike procedures for Davis-Bacon (federal) projects, there is no

requirement that you submit a Certified Payroll Report unless it is requested.

For purposes of completing this form, “deductions” means withholdings from an employee’s pay, such as

FICA, withholding tax, and any payment the employee has authorized to be subtracted from the employee’s

paycheck. It does not include fringe or “usual benefits,” which are employer-paid items.

DETAILED INSTRUCTIONS: (See sample completed form at pages 4 and 5 of these instructions.)

1

Check one box only, Prime Contractor or Subcontractor, as appropriate.

Insert Project Name, the County where the project is located, and the Project or Contract

Number, as provided by the Awarding Agency. Also insert in this area, where indicated, the

Address, City and State for the Project.

Specify in this section the Month, Day and Year on which the week ends for which you are

providing information in this report.

Provide in this area the Name, Phone Number and Address for the Awarding Agency

Your Company Name, Phone Number and Address are to be provided in this section.

In this column, list on the top line of each numbered block the Work Classification for the

employee. If you are completing the form on line, this information will automatically be entered in

column 6 on the second (Affirmation) page of the Certified Payroll Report. If you complete the form

manually, you will also need to insert this same information on the corresponding numbered line on

the second (Affirmation) page of the report.

In this section insert the same Employee’s Social Security Number. Complete a section for each

employee who performed work on the public works project during the week for which you are

reporting.

Provide in this column the Name and Address for each employee included in the report.

Insert in this row the Overtime Hours (OT) worked by the Employee listed in this same row.

Insert in this row the Regular Hours (RG) worked by the Employee listed in this same row.

1

2

3

4

5

6

7

8

10

11

INSTRUCTIONS

CERTIFIED PAYROLL REPORT FOR PUBLIC WORKS PROJECTS (Continued)

P a g e | 3

This column represents the Total Hours worked for each day in the corresponding row. If you

complete the form online, this number will be automatically filled in for you. If you complete the

form manually, add up all the hours for each day to the immediate left of this column and insert that

number in this column in the corresponding row.

Insert in this column the Rate of Pay for each corresponding employee. Rate of Pay means the

prevailing wage rate paid (regular and overtime) and does not include fringe/usual benefits which

are employer-paid amounts as described in Item #15.

Example: The Prevailing Wage Rate is $35.00 per hour. An employer provides $5.00

in “Usual Benefits.” The Rate of Pay is $30.00 ($35.00 - $5.00 = $30.00). In this

example you would put $30.00 in box 13.

This column automatically calculates the Gross Amount Earned for the week based on the

information supplied in the columns to the left. If you complete the forms manually, you will need to

calculate these amounts. To do this, multiply the number in the Total Hours column (see 11 above)

by the corresponding number in the Rate of Pay column (see 12 above) separately for the OT and

RG amounts. Place the result of this calculation in the separate OT and RG sections of this Gross

Amount Earned column (left portion). Add together the OT and RG sections of the left portion of

this Gross Amount Earned column and place that total in the right portion of this column.

This corresponds to the Total Hourly “Usual Benefits” column with the same number on the

second (Affirmation) page of the report. You will provide this information only if you provide the

employee with the following employer paid benefits: (a) health and welfare payments; (b) pension

and retirement payments; (c) vacation payments; (d) apprentice training fund; and/or (e) paid

holidays. These benefits include only those provided at employer expense and do not include any

amounts paid by the employer as required by law (i.e., do not include the employer share of FICA,

industrial insurance or similar payments). If you are completing the form on line, this number will

be automatically calculated based on information you provide in items 15A through 15E on the

second page (Affirmation). If you are manually completing the form, place here the total of the

numbers entered in the corresponding rows for columns 15A through 15E on the second

(Affirmation) page. For items 15A through 15E, enter hourly amounts you provide for each

employee for the benefits listed. Insert a zero or leave blank each segment for which no benefit is

provided for the corresponding employee.

Insert here the FICA amount which is deducted from the corresponding employee’s gross amount

earned for the week reported.

Insert in this column the Withholding Tax deducted from the corresponding employee’s gross

amount earned for the week reported.

In this column insert the amount deducted from the employee’s gross amount earned for the week

for any other deductions not included in the FICA and Withholding Tax columns.

If you complete the report on line, this column for Net Wages will be automatically calculated. If

you manually complete the form, the amount you insert in this column is the amount indicated in the

right portion of the Gross Amount Earned column (14) minus Deductions columns (16-18).

12

13

14

15

16

17

18

19

INSTRUCTIONS

CERTIFIED PAYROLL REPORT FOR PUBLIC WORKS PROJECTS (Continued)

P a g e | 4

In this section at the top of the second (Affirmation) page of the report, insert the current date in the

Today’s Date section, the Printed Name of the Party Signing the Report, that person’s Title, and

the name of the Contractor or Subcontractor.

Insert here the Name of the Public Works Project. This name must match the name provided in

Section 2 of the first page.

Insert in this section the Starting Date for the reported pay period.

Insert in this section the Ending Date for the reported pay period. This date must match the date

entered in Section 3 from the first page.

In this section, type or print the name of the person signing the report and that person’s title. Print

out the form, carefully review it for accuracy, read carefully the Affirmation on the second

(Affirmation) page of the report and have the form signed by the appropriate party. The person

signing the form affirms or certifies the accuracy of each and every element of the completed form.

MAILING INSTRUCTIONS

Mail the completed, signed form to:

Department of Labor & Industries

Prevailing Wage Program

P. O. Box 44540

Olympia, WA 98504-4540

FURTHER INFORMATION

If you have questions or would like

assistance in completing the form,

please call us at (360) 902-5335 or

email the Prevailing Wage office at

20

21

22

23

24