Fillable Printable Child Support Automatic Withdrawal Authorization Form - Missouri

Fillable Printable Child Support Automatic Withdrawal Authorization Form - Missouri

Child Support Automatic Withdrawal Authorization Form - Missouri

STAT E OF MISSOURI

FAMILY SUPPORT PAYMENT CENTER

AUTOMATIC WITHDRAWAL AUTHORIZATIO N

INSTRUCTIONS

Child and/or spousal support payments that you pay to the Family Support Payment Center (FSPC) may be

automatically withdrawn f r om your bank account and paid t o t he FSPC. Car efully read the enclosed Frequently

Asked Questions About Automatic Withdrawal to learn more about this payment method before completing

this authorization. If you want your support payments automatically withdrawn from your bank account and

paid to the FSPC, complete the Automatic Withdrawal Authorization using the following instructions. If you

want support payments withdrawn f or more than one support order, you must complete a separate Automatic

Withdr awal Authorization for each order .

With t he exception of your sig natur e, type or pr int the r equest ed inf ormat ion. Retur n t he orig inal application to:

FAMILY SUPPORT PAYMENT CENTER, PO BOX 109006, JEFFERSON CITY, MO 65110–9006. Keep a

copy of the application and these instructions for your records. If you do not provide all the information

requested, the FSPC may not be able to process your authorization. If you need help completing the

Automatic Withdrawal Authorization, contact the FSPC between 8:00 a.m. and 5:00 p.m., Monday through

Friday at 1–888–761–3665. You may also write to the FSPC at the above address.

ORIGINAL OR CHANGED AUTHORIZATION

In the top r ight–hand corner of the form, c heck one box to indicate whether this aut hor ization is:

• An original automatic withdrawal authorization (you do not currently make support payments to the FSPC

by automatic withdrawal but are completing t his aut hor ization to do s o) ; or

• A request to change your existing automatic withdrawal authorization (you currently make support

payments to t he FSPC by autom atic withdrawal but want to change the payment f r eq uency, payment date,

payment amount, financial institut ion, and/ or ac count from which your payments are withdrawn).

SECTION A — PAYOR INFORMATION

1. Enter your name (if you are the person oblig at ed t o pay support ).

2. Enter your Social Security number.

3. Enter your home address .

4. Enter your e–mail a ddr es s if you wish to receive electronic payment confir m at ion not ices from t he FSPC.

5. Enter your telephone number , including t he area code. A daytime telephone number is pr eferred.

6. Enter your eight –dig it cas e num ber .

7. Enter your court or der number. If you want support payments withdrawn for more t han one support order ,

you must complete a separ at e Aut omatic Wit hdr aw al Aut hor ization for each order.

8. Enter the count y in which your support order was entered.

SECTION B — FINANCIAL INSTITUTION INFORMATION

You must attach a voided check or deposit slip to the authorization in the space indicated, or the

FSPC WILL NOT process your authorization.

1. Enter the com plet e nam e of the financial institution where you have your account.

2. Enter the financial institution’s telephone num ber , including t he area code.

3. Check the box that describes the type of acc ount from which you want support payments withdrawn.

4. Enter your financial institution’s nine–digit routing number. The routing number is printed on the bottom

left–hand portion of your checks and deposit slips ( see Examples 1 and 2 on reverse side) .

5. Enter your deposit or account number. If your account is a checking account, the account number is

printed on the bottom of your personal checks following your routing number. It may be the first series of

digits after the routing num ber (see Example 1 on reverse side), or it m ay be the ser ies of digits t hat follow

your check number (see Example 2 on reverse side). Do not include your check number in the account

number.

NOTE

: Enter only numbers for your routing and account numbers. Sometimes there are special symbols

before or after the routing and account numbers on your check. Those special symbols should not

be included.

MO 886–3953 (8–14) (OVER) CS–161 (Rev. 8–14)

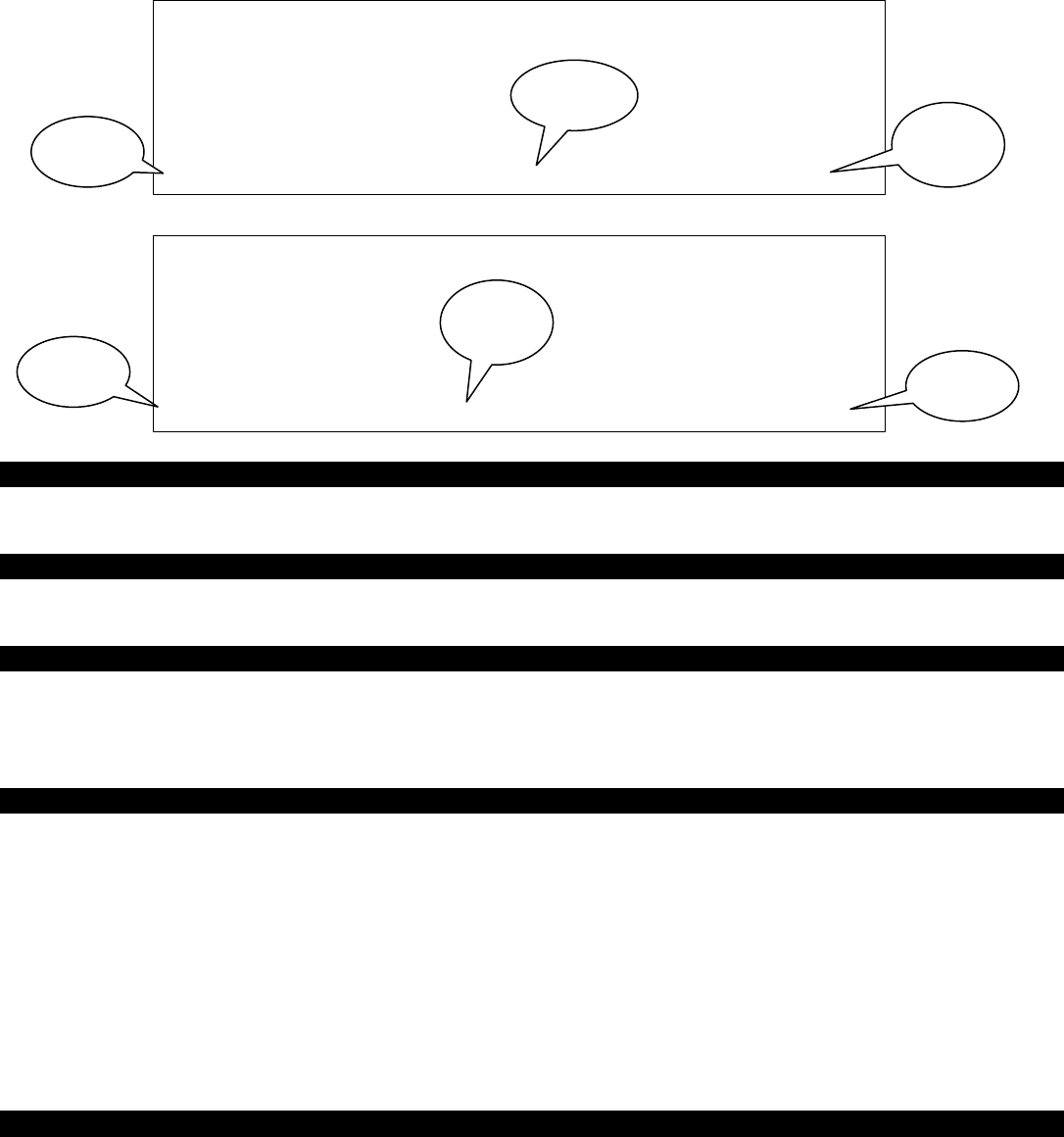

EXAMPLE 1

CATHY SMITH 123

123 STREET

ANYTOWN, MO 65000 DATE___________

PAY TO T HE ORDE R OF _______________________________| $_______________

______________________________________________________________DOLLARS

MEMO_____________________ ___________________________

123456789 98765432111234 123

EXAMPLE 2

CATHY SMITH 123

123 STREET

ANYTOWN, MO 65000 DATE___________

PAY TO T HE ORDE R OF _________________________________| $_______________

______________________________________________________________DOLLARS

MEMO_____________________ ___________________________

123456789 123 98765432111234

SECTION C — W ITHDRAWAL AMOUNT AND FREQUENCY

Check one box in Section C to indicate how often you want support payments withdrawn from your bank

account. Enter the amount of each withdrawal and when withdrawals should occur.

SECTION D — I MPORTANT INFORMATION REGARDING WI THDRAWAL DATES

Carefully read the informat ion in Section D regarding withdrawal dates. If you do not want payments withdrawn

fr om your account as indicated in Sect ion D, do not complete the Aut om atic Withdr aw al Authorization.

SECTION E — AUTOMATIC WITHDRAWAL AUTHORIZATION

Carefully read the information included in Section E and sign and date the form to agree to the terms of the

automatic withdrawal. If you do not agree to the terms of the automatic withdrawal, do not complete the

Automatic Withdrawal Authorization. For joint accounts, the joint account holder must also sign and date the

form.

WHAT YOU SHOULD E XPECT

• Your automat ic payment authorization will be processed when it is received at the FSPC.

• The FSPC will send a “pre note” or test of your automatic withdrawal to your bank to ensure routing and

account numbers ar e acc ur at e.

• You will begin having payments withdrawn from your account once the pre note is complete. This should

be approximately five business days after the FSPC receives your application. The actual time will depend

on how often you request ed payment s be withdrawn fr om your account.

• During the time it takes to process the authorization and pre note the automatic withdrawal, you must

continue to make support payments by another m et hod.

• If your bank does not honor your withdrawal because of insufficient funds, a stop payment or a closed

account, the FSPC may term inate your autom atic withdrawal enrollment. Any resulting debt to t he FSPC is

subject to collection action.

CHANGING OR TERMINATING YOUR AUTOMATIC WITHDRAWAL AUTHORIZATION

Support payments will continue to be withdrawn from your desig nated account at your f inancial institution until

you notify the FSPC that you wish to terminate the withdrawals or change the financial institution and/or

account f r om which your payments are withdrawn. To c hange t he payment f req uency, payment dat e, payment

amount, financial institution, and/or account from which your support payments are withdrawn, you must

complete a new Automatic Withdrawal Authorization. To terminate your automatic withdrawal authorization

and/or to obtain an additional Automatic Withdrawal Authorization, contact the FSPC at 1–888–761–3665. It

will take approximately 30 days to process your termination request and/or your new Automatic Withdrawal

Authorization.

Routing

Number

Routing

Number

Account

Number

Account

Number

Check

Number

Check

Number

MO 886–3953 (8–14) CS–161 (Rev. 8–14)

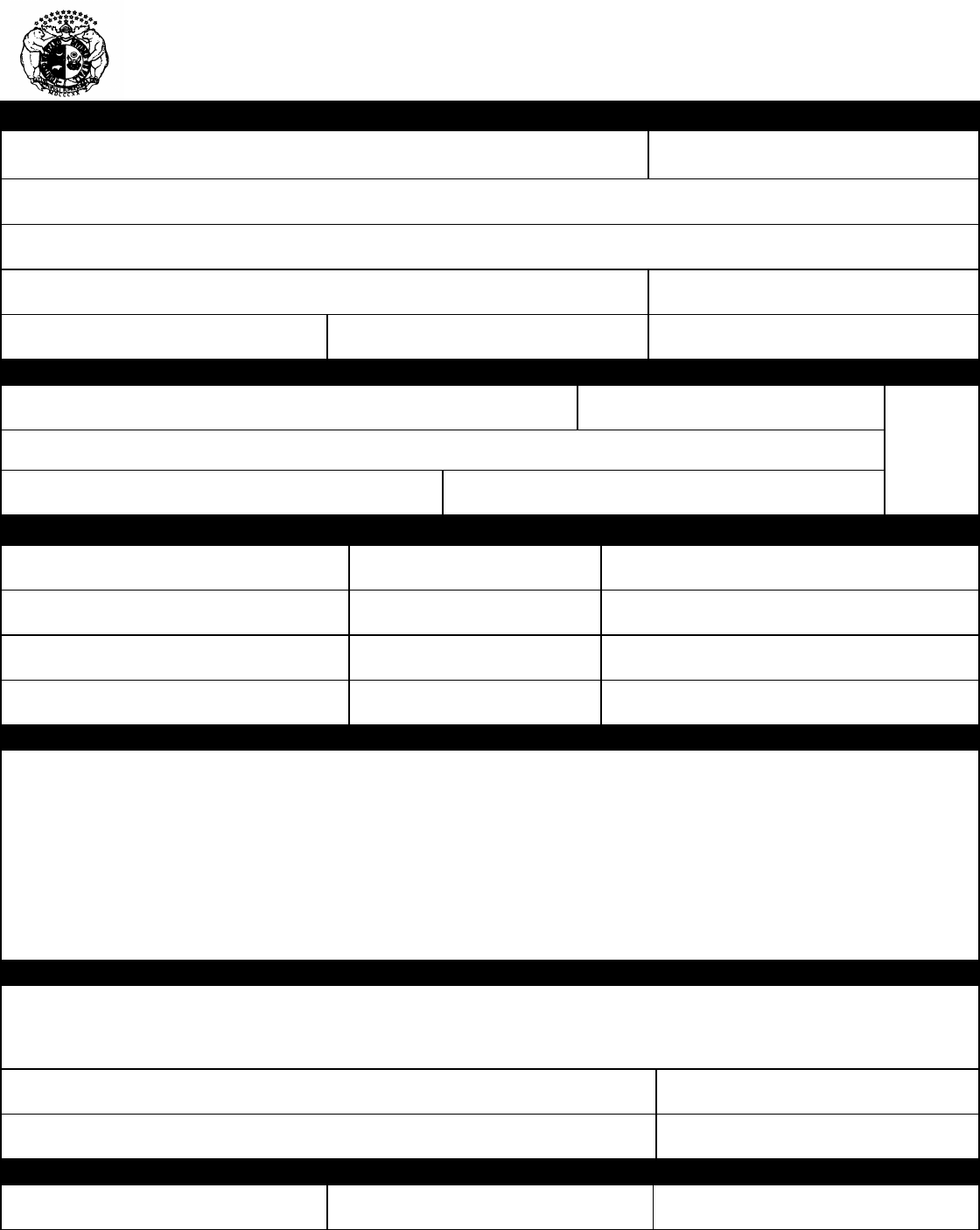

STAT E OF MISSOURI

FAMILY SUPPORT PAYMENT CENTER

This is an original authorization

AUTOMATIC WITHDRAWAL AUTHORIZ ATION

This is a change to an existing authorization

SECTION A — PAYOR INFORMATION

NAME (LAST, FIRST, MIDDLE)

SOCIAL SECURITY NUMBER

ADDRESS (PO BOX OR STREET ADDRESS) (APT NUMBER)

(CITY) (STATE) (ZIP CODE)

E–MAIL ADDRESS (PROVIDE IF YOU WISH TO RECEI VE ELECTRONIC PAYMENT CONFIRMATION NOTICES)

TELEPHONE NUMBER (INCLUDING AREA CODE)

CASE NUM BER (EIGHT DIGITS)

COURT ORDER NUMBER

COUNTY OF ORDER

SECTION B — FINANCIAL INSTITUTION INFORMATION (VOIDED CHECK OR DEPOSIT SLIP MUST BE ATTACHED)

FINANCIAL INSTITUTION NAME

TELEPHONE NUMBER (INCLUDING AREA CODE)

STAPLE VOIDED

CHECK OR

DEPOSIT SLIP

HERE

TYPE OF ACCOUNT (CHECK ONE BOX)

CHECKING

SAVINGS

ROUTING NUMBER (9 DIGITS)

ACCOUNT NUMBER

SECTION C — WITHDRAWAL AMOUNT AND FREQUENCY (INDICATE ONE OF THE FOLLOWING OPTIONS)

WITHDRAW MY PAYMENT ONCE A MONTH

AMOUNT OF WITHDRAWAL DATE OF WITHDRAWAL

WITHDRAW MY PAYMENT TWICE A MONTH

AMOUNT OF EACH WITHDRAWAL DATES OF WITHDRAWAL

1ST 2ND

WITHDRAW MY PAYMENT EVERY TW O WEEKS

AMOUNT OF EACH WITHDRAWAL

DAY OF WITHDRAWAL (FOR EXAMPLE, MONDAY)

WITHDRAW MY PAYMENT ONCE A WEEK

AMOUNT OF EACH WITHDRAWAL

DAY OF WITHDRAWAL (FOR EXAMPLE, MONDAY)

SECTION D – IMPORTANT INFORMATION REGARDING WITHDRAWAL DATES (PLEASE READ CAREFULLY)

• If a withdrawal date falls on a Saturday, Sunday or banking holiday, the Family Support Payment Center (FSPC) will

withdraw the payment on the following banking business day.

• If a withdrawal date f alls on the last day of the m onth and t hat day is a Saturday, Sunday or banking holiday, the FSPC will

deduct the payment on the last banking business day of the month.

• If a withdrawal date does not occur in each month (for example, the 31st), the FSPC will deduct the payment on the last

banking business day of the month during months in which that date does not occur.

• Twice–monthly withdrawals must be based on one of the following schedules: 1st

and 16th; 2nd and 17th; 3rd and 18th;

4th and 19th; 5th and 20th; 6th and 21st; 7th and 22nd; 8th and 23rd; 9th and 24th; 10th and 25th; 11th and 26th; 12th and

27th; 13th and 28th; 14th and 29th; or 15th and 30th.

•

The FSPC will apply the payment to your support order on the day it is withdraw n from your account.

SECTION E — AUTOMATIC WITHDRA WAL AUTHORIZATION

I hereby authorize the above withdrawals from my account for payment to the FSPC. I understand this authorization does

not exem pt me f rom any enforcem ent actions allowable under st ate and federal law. I understand the FSPC m ay terminate

my automatic withdrawal enrollment if my financial institution does not honor my withdrawal authorization because of

insufficient funds, a stop payment or a closed account. Any resulting debt to the FSPC is subject to collection action.

ACCOUNT HOLDER’S SIGNATURE

DATE SIGNED

SECOND ACCOUNT HOLDER’S SIGNATURE (REQUIRED FOR JOINT ACCOUNTS)

DATE SIGNED

SECTION F — FOR FSPC USE ONLY

MEMBER NUMBER

DATE AUTHORIZATION RECEIVED

DATE WITHDRAWALS WILL START

MO 886–3953 (8–14) CS–161 (Rev. 8–14)

MO 886–3954 (Rev. 8–05) (Over) CSE –161A (Rev. 8–05)

FREQUENTLY ASKED QUESTIONS ABOUT AUTOMATIC WITHDRAWAL

1. What is Automatic Withdrawal Authorization?

Automatic Withdrawal Authorization is your permission for the Family Support Payment Center (FSPC) to

withdraw child and/or spousal support from your checking or savings account by electronic funds transfer.

2. What are the benefits of automatic withdrawal?

Automatic withdrawal allows money to be electronically transferred from your bank account to the FSPC’s

bank account. Automatic withdrawal eliminates the possibility of lost payments and mail delays.

3. Can I pay all of my child and/or spousal support by automatic withdrawal?

Child and/or spousal support payments you pay to the FSPC may be paid by automatic withdrawal. If you

have more than one support order, you must complete a separate Automatic Withdrawal Authorization for

each support order.

4. How do I sign up for automatic withdrawal?

To sign up for automatic withdrawal, complete the enclosed Automatic Withdrawal Authorization.

Instructions are attached to the Automatic Withdrawal Authorization to assist you in completing this form.

Make sure you include the financial institution routing number, account number and a deposit slip or voided

check with your authorization.

5. How often can I have support payments withdrawn from my bank account?

You choose the dates on which the FSPC will withdraw your payments. You may have payments

withdrawn once a month, twice a month, every two weeks or once a week. You should choose a payment

frequency and dates that correspond with the frequency and dates required in your support order. Twice–

monthly withdrawals must be based on one of the following schedules:

1st and 16th 6th and 21st 11th and 26th

2nd and 17th 7th and 22nd 12th and 27th

3rd and 18th 8th and 23rd 13th and 28th

4th and 19th 9th and 24th 14th and 29th

5th and 20th 10th and 25th 15th and 30th

6. Will support payments ever be withdrawn from my account on a date other than a date I indicate on

the Automatic Withdrawal Authorization form?

Your support payments will be withdrawn on the date or dates you indicate unless one of the following

occurs:

• If the withdrawal date you indicate falls on a Saturday, Sunday or banking holiday, the FSPC will

withdraw the payment on the following banking business day.

• If the withdrawal date you indicate falls on the last day of the month and that day is a Saturday,

Sunday, or banking holiday, the FSPC will deduct the payment on the last banking business day of the

month.

• If the withdrawal date you indicate does not occur in each month (for example, the 31st), the FSPC will

deduct the payment on the last banking business day of the month during months in which that date

does not occur.

7. How can I verify that I have received credit for a payment once it has been withdrawn from my

account?

The FSPC will apply the payment to your support order on the day the withdrawal occurs. If you enter your

e–mail address on the Automatic Withdrawal Authorization form, the FSPC will send you an electronic

payment confirmation notice when the payment is credited. Otherwise, you can verify on the day following

the withdrawal date that the FSPC has credited your payment by calling the Payment Information Line at

1–800–225–0530. When making this call, you must enter your eight–digit case number to receive payment

information. If you do not know your eight–digit case number, contact the FSPC at 1–888–761–3665 to

obtain this number.

8. What if my bank does not honor my automatic withdrawal authorization?

If your bank does not honor your withdrawal authorization because of insufficient funds, a stop payment or

a closed account, the FSPC will terminate your automatic withdrawal enrollment. Any resulting debt to the

FSPC is subject to collection action. A debt to the FSPC results when the FSPC disburses a support

payment to the payee (the person to whom you owe support) based on your withdrawal authorization, and

your bank does not honor the withdrawal for one of the above reasons.

9. How do I stop or change the automatic withdrawal of my support payments?

To change the payment frequency, payment date, payment amount, financial institution and/or account

from which your support payments are withdrawn, you must complete a new Automatic Withdrawal

Authorization. To stop your automatic withdrawal and/or obtain an additional Automatic Withdrawal

Authorization, contact the FSPC at 1–888–761–3665. It will take approximately 30 days to process your

termination request and/or your new Automatic Withdrawal Authorization.

10. If I have my support payment withdrawn from my bank account, am I exempt from enforcement

actions such as income withholding (also known as wage withholding or garnishment)?

No, automatic withdrawal does not exempt you from any enforcement actions allowable under state and

federal law including, but not limited to, income withholding.

If you are already paying support through income withholding, the income withholding will not terminate

because you complete an Automatic Withdrawal Authorization. You should only complete an Automatic

Withdrawal Authorization if you want to pay more support than your employer is already withholding.

If the Family Support Division (FSD) issues an income withholding order for support you owe after you

have completed an Automatic Withdrawal Authorization, FSD cannot stop payments from being withdrawn

from your bank account. If you no longer want support payments automatically withdrawn from your bank

account, you must contact the FSPC at 1–888–761–3665 to request that your Automatic Withdrawal

Authorization be terminated.