Fillable Printable Child support determination form - Quebec

Fillable Printable Child support determination form - Quebec

Child support determination form - Quebec

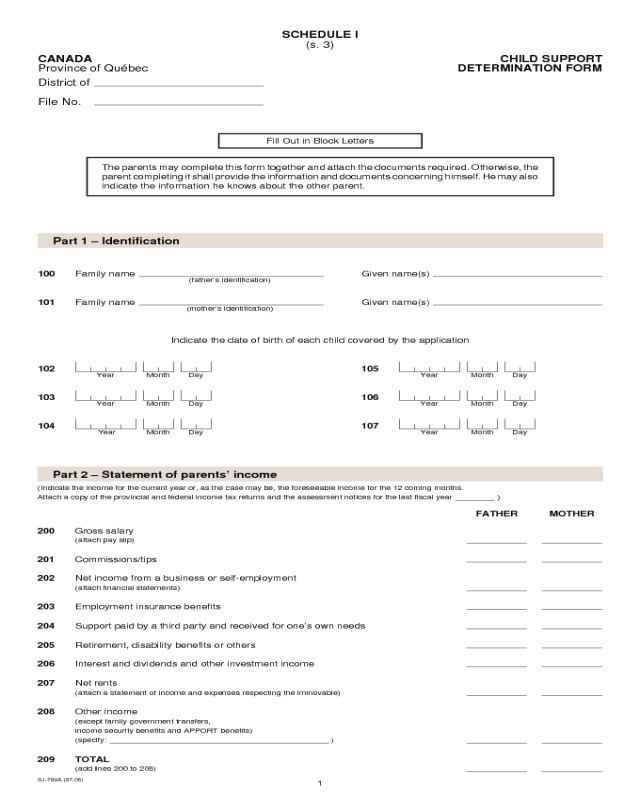

SCHEDULE I

(s. 3)

CANADA CHILD SUPPORT

Province of Québec DETERMINATION FORM

District of

File No.

Fill Out in Block Letters

The parents may complete this form together and attach the documents required. Otherwise, the

parent completing it shall provide the information and documents concerning himself. He may also

indicate the information he knows about the other parent.

Part 1 – Identification

100 Family name Given name(s)

(father’s identification)

101 Family name Given name(s)

(mother’s identification)

Indicate the date of birth of each child covered by the application

102 105

Year Month Day Year Month Day

103 106

Year Month Day Year Month Day

104 107

Year Month Day Year Month Day

Part 2 – Statement of parents’ income

(Indicate the income for the current year or, as the case may be, the foreseeable income for the 12 coming months.

Attach a copy of the provincial and federal income tax returns and the assessment notices for the last fiscal year )

FATHER MOTHER

200 Gross salary

(attach pay slip)

201 Commissions/tips

202 Net income from a business or self-employment

(attach financial statements)

203 Employment insurance benefits

204 Support paid by a third party and received for one’s own needs

205 Retirement, disability benefits or others

206 Interest and dividends and other investment income

207 Net rents

(attach a statement of income and expenses respecting the immovable)

208 Other income

(except family government transfers,

income security benefits and APPORT benefits)

(specify: )

209 TOTAL

(add lines 200 to 208)

SJ-789A (97-05)

1

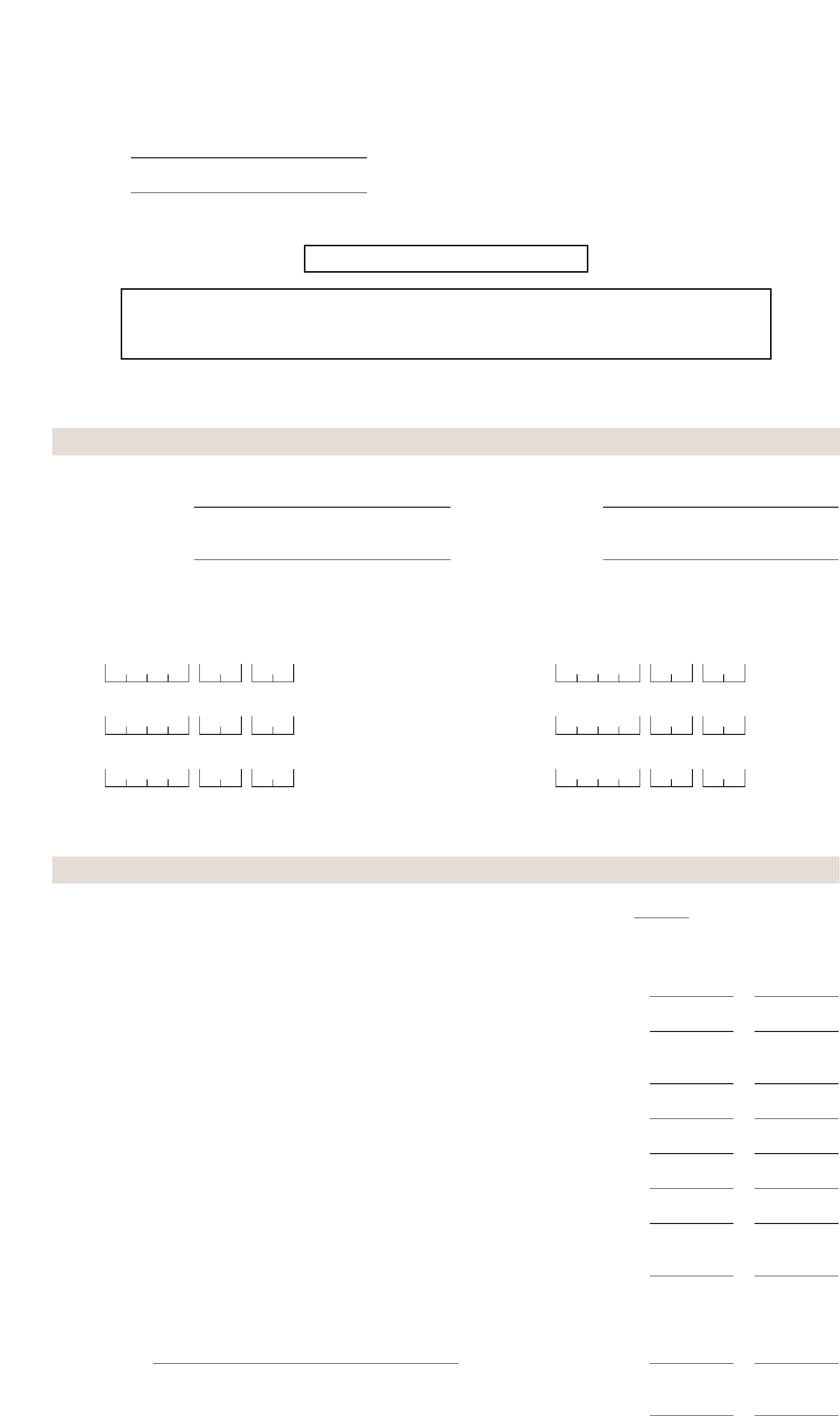

Part 3 – Calculation of parents’ disposable income

FATHER MOTHER

300 Annual income

(line 209)

301 Basic deduction

302 Deduction for union dues

303 Deduction for professional dues

304 Total of deductions

(add lines 301 to 303)

305 Disposable income of each parent

(line 300 – line 304) Enter 0 if negative

306 Disposable income of both parents

(add the amounts of line 305)

307 Distribution factor (%) of income

Disposable income of father (line 305

÷

line 306 x 100) %

Disposable income of mother (line 305

÷

line 306 x 100) %

Part 4 – Calculation of annual parental contribution

400 Number of children covered by the application

401 Basic parental contribution according to disposable income

or both parents (line 306) and the number of children (line 400)

See table in Schedule II

402 Basic parental contribution of each parent

(line 401 x line 307)

403 Child care expenses

404 Post-secondary education expenses

405 Special expenses

(specify: )

406 Total expenses

(add lines 403 to 405)

407 Contribution of each parent to expenses

(line 406 x line 307)

Part 5 – Calculation of annual support according to custody time

(Mark the division corresponding to your situation and fill out that division only. The support payable calculated under this Part assumes that the total expenses

are paid by the parent receiving support. Otherwise, make the adjustments required in line 512.1, 518.1, 526.1, 534.1 or 552.1 according to your situation

and give reasons.)

Division 1 Sole custody

(Fill out this division if a parent assumes more than 60% of the custody time of all children)

510 Identify the non-custodial parent (“X”)

511 Annual contribution of both parents

(line 401 + line 406)

512 Annual support payable by non-custodial parent

(line 511 x line 307)

512.1 Adjusted annual support payable

Reason:

2

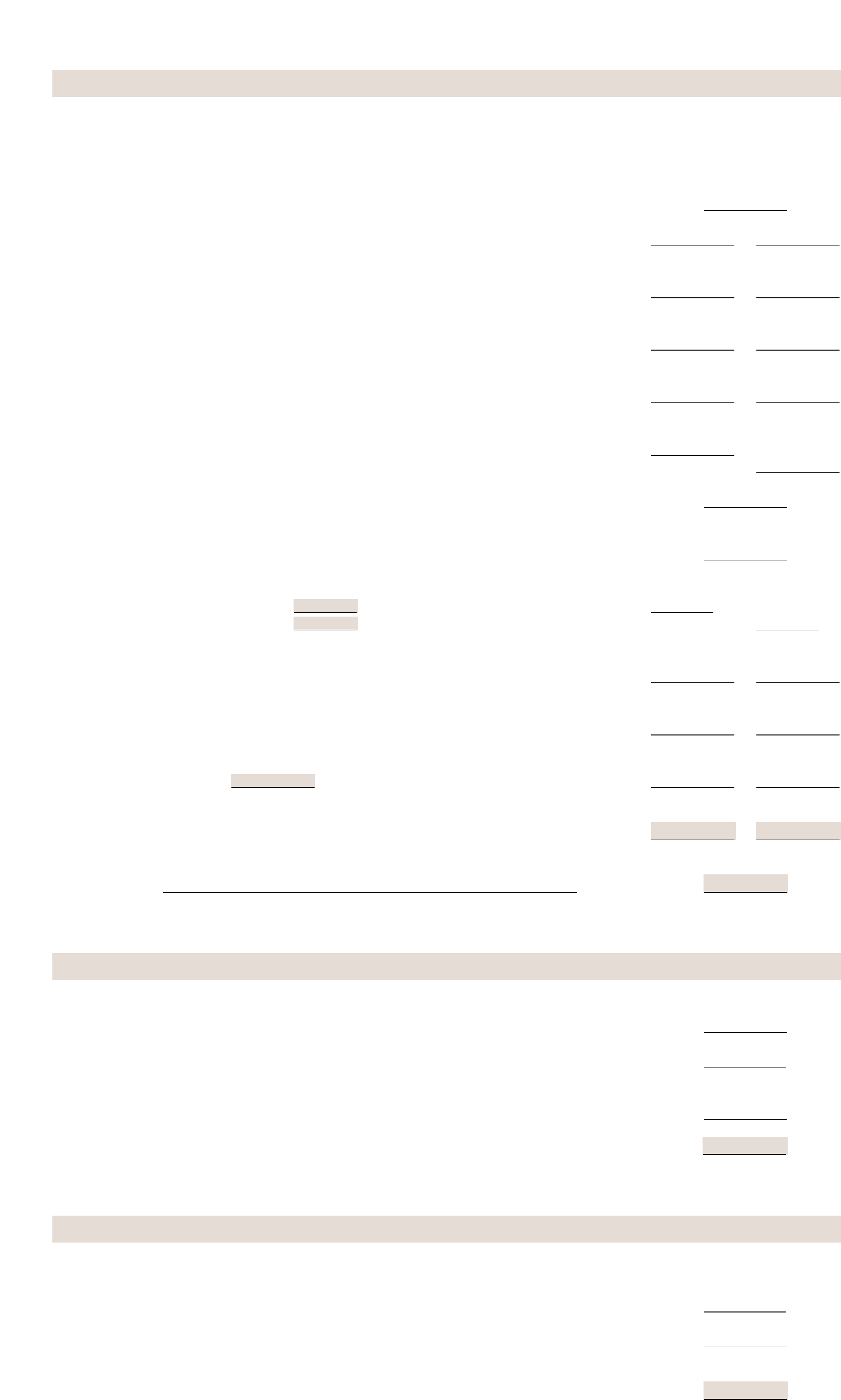

$ 9 000 $ 9 000

3

Division 2 Sole custody granted to each parent

(Fill out this division if each parent has sole exclusive custody of at least one child)

520 Indicate the number of children in the father’s custody

521 Indicate the number of children in the mother’s custody

522 Basic parental contribution of each parent

(line 402)

523 Average cost per child

(line 401

÷

line 400)

524 Child care cost for each parent

(father: line 523 x line 520)

(mother: line 523 x line 521)

525 Basic annual support

(line 522 – line 524) Enter 0 if negative

526 Annual support payable

(line 525 + line 407) Enter 0 if line 525 is 0

526.1 Adjusted annual support payable

Reason:

Division 1.1 Adjustment for visiting and prolonged outing rights FATHER MOTHER

(Fill out this division if the non-custodial parent has visiting and outing

rights between 20% and 40% of custody time)

513 Identify the non-custodial parent (“X”)

514 Annual contribution of both parents

(line 401 + line 406)

515 Percentage of custody time for exercising visiting and prolonged outing rights

(number of days

÷

365 x 100) %

516 Compensation for visiting and prolonged outing rights

(percentage of line 515 – 20% = % x line 401)

517 Adjusted annual contribution of both parents

(line 514 – line 516)

518 Annual support payable by the non-custodial parent

(line 517 x line 307)

518.1 Adjusted annual support payable

Reason:

Division 3 Shared custody

(Fill out this division if each parent assumes at least 40% of custody time in respect of all children)

530 Distribution factor (%) of custody

(father: number of days of custody

÷

365 x 100) %

(mother: number of days of custody

÷

365 x 100) %

531 Basic parental contribution of each parent

(line 402)

532 Child care cost for each parent

(line 401 x line 530)

533 Basic annual support

(line 531 – line 532) Enter 0 if negative

534 Annual support payable

(line 533 + line 407) Enter 0 if line 533 is 0

534.1 Adjusted annual support payable

Reason:

Part 5 – Calculation of annual support according to custody time (cont’d)

4

Division 4 Both sole and shared custody FATHER MOTHER

(Fill out this division if at least one parent has sole custody of at least one child

and if both parents have joint custody of at least another child)

540 Average cost per child

(line 401

÷

line 400)

541 Number of children in sole custody

542 Cost for the care of children in sole custody

(line 540 x line 541)

543 Basic contribution of parents

(line 542 x line 307)

544 Difference between the cost of custody and the basic contribution

(line 542 – line 543) Enter 0 if negative

545 Basic annual support payable for children in sole custody

(father: line 544 of mother – line 544 of father) Enter 0 if result is negative

(mother: line 544 of father – line 544 of mother) Enter 0 if result is negative

546 Number of children in shared custody

547 Cost for the care of children in shared custody

(line 540 x line 546)

548 Distribution factor (%) of shared custody

(father: number of days of custody

÷

365 x 100) %

(mother: number of days of custody

÷

365 x 100) %

549 Basic parental contribution of each parent for children in shared custody

(line 547 x line 307)

550 Cost of shared custody for each parent

(line 547 x line 548)

551 Basic annual support

(line 545 + line 549 = – line 550) Enter 0 if negative

552 Support payable

(line 551 + line 407) Enter 0 if line 551 is 0

552.1 Adjusted annual support payable

Reason:

Part 6 – Capacity to pay of debtor

600 Disposable income of parent required to pay support

(line 305)

601 Multiply line 600 by 50%

602 Annual support payable according to calculations under a division of Part 5

603 Annual support payable

(enter the lesser amount between lines 601 and 602)

Part 5 – Calculation of annual support according to custody time (cont’d)

Part 7 – Agreement between parents

(Complete this part of both parents agree on an amount of support payable that departs from the amount calculated

under any division of Part 5 or Part 6 of this form)

700 Annual support payable

701 Annual support payable according to agreement between parents

702 Difference between the 2 amounts

(line 700 – line 701)

5

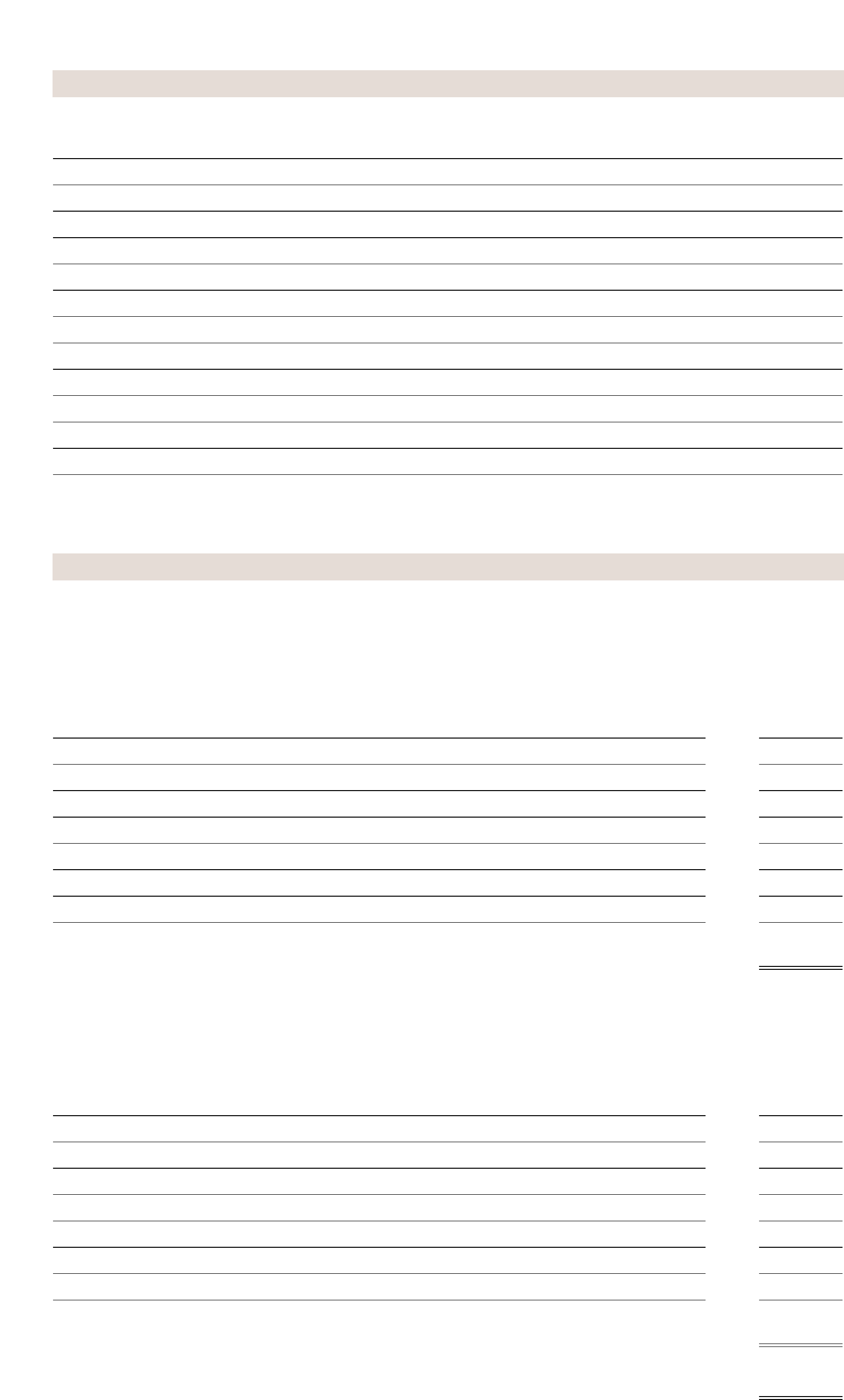

Part 7 – Agreement between parents (cont’d)

703 State precisely the reasons for that difference:

Part 8 – Statement of each parent’s assets and liabilities

Division 1 Statement of father’s assets and liabilities

Assets VALUE

Give cash, amounts deposited in bank accounts or in other financial institutions and the market value of property

in each of the following categories (regardless of any debt related thereto): immovables, furniture, automobiles,

works of art, jewelry, shares, bonds, interests in a business, other investments, pension plans, retirement savings plans,

debts owing, etc.

TOTAL

Liabilities VALUE

Give debts or financial commitments of any nature in the form of loans or credit (mortgage, personal loan, credit line,

credit cards, instalment sales, security, etc.) or that you must pay under a statute (fiscal debts, assessments, dues and

other unpaid duties, etc.) or a decision by a Court (damages, support, employment insurance or income security

overpayments, fines, etc.)

TOTAL

Summary (assets – liabilities)

6

Part 9 – Declaration under oath

I declare that the above information is accurate I declare that the above information is accurate

and complete for my part and I sign: and complete for my part and I sign:

at at

on the day of on the day of

Father’s signature Mother’s signature

Declaration sworn to before me Declaration sworn to before me

at at

on the day of on the day of

Signature of person empowered to administer oath Signature of person empowered to administer oath

Part 8 – Statement of each parent’s assets and liabilities (cont’d)

Division 2 Statement of mother’s assets and liabilities

Assets VALUE

Give cash, amounts deposited in bank accounts or in other financial institutions and the market value of property

in each of the following categories (regardless of any debt related thereto): immovables, furniture, automobiles,

works of art, jewelry, shares, bonds, interests in a business, other investments, pension plans, retirement savings plans,

debts owing, etc.

TOTAL

Liabilities VALUE

Give debts or financial commitments of any nature in the form of loans or credit (mortgage, personal loan, credit line,

credit cards, instalment sales, security, etc.) or that you must pay under a statute (fiscal debts, assessments, dues and

other unpaid duties, etc.) or a decision by a Court (damages, support, employment insurance or income security

overpayments, fines, etc.)

TOTAL

Summary (assets – liabilities)