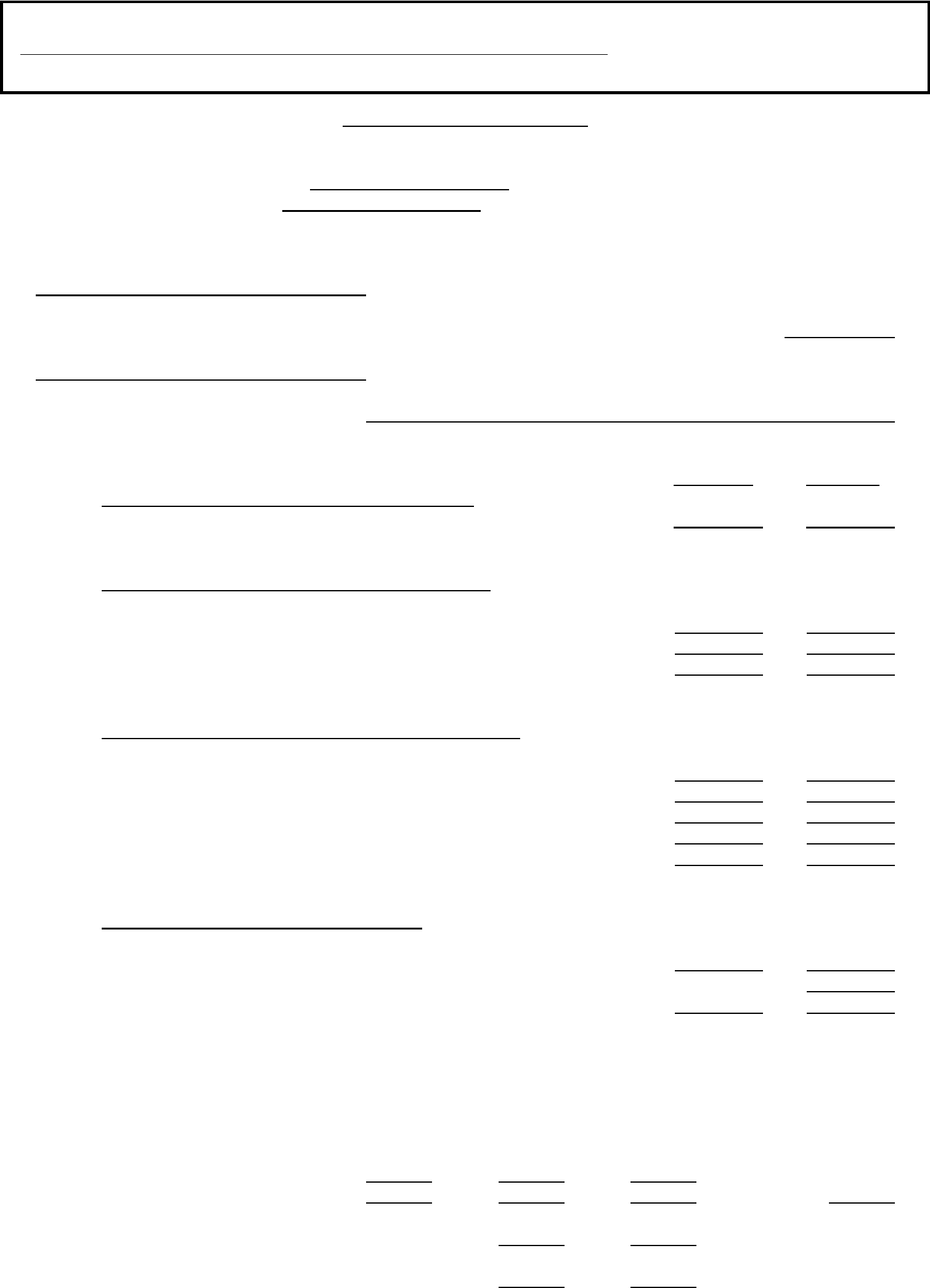

Fillable Printable Child Support Worksheet - Kansas

Fillable Printable Child Support Worksheet - Kansas

Child Support Worksheet - Kansas

Rev. 07/2012 by KSJC

1 of 2

Child Support Worksheet

IN THE JUDICIAL DISTRICT

COUNTY, KANSAS

IN THE MATTER OF:

and CASE NO.

CHILD SUPPORT WORKSHEET OF

(name)

MOTHER FATHER

A. INCOME COMPUTATION – WAGE EARNER

1. Domestic Gross Income $ $

(Insert on Line C.1. below)*

B. INCOME COMPUTATION – SELF-EMPLOYED

1. Self-Employment Gross Income*

2. Reasonable Business Expenses (-)

3. Domestic Gross Income

(Insert on Line C.1. below)

C. ADJUSTMENTS TO DOMESTIC GROSS INCOME

1. Domestic Gross Income

2. Court-Ordered Child Support Paid (-)

3. Court-Ordered Maintenance Paid (-)

4. Court-Ordered Maintenance Received (+)

5. Child Support Income

(Insert on Line D.1. below)

D. COMPUTATI ON OF CHILD SUPPORT

1. Child Support Income +

=

2. Proportionate Shares of Co mbined Income % %

(Each parent’s income divided by combined income)

3. Gross Child Support Obligation**

(Using the combined in come from Line D.1.,

find the amount for each child and enter total for

all children)

Age of Children 0-5 6-11 12-18 Total

Number Per Age Category

Total Amount + + =

* Interstate Pay Differential Adjustment? Yes No

**Multiple Family Application? Yes No

Instructions to complete the Child Support Worksheet may be found on the Kansas Judicial Branch website,

http://www.kscourts.org/programs/Child-Support-Guidelines/default.asp, or by visiting your local law library.

The Child Support Worksheet must be completed prior to your hearing.

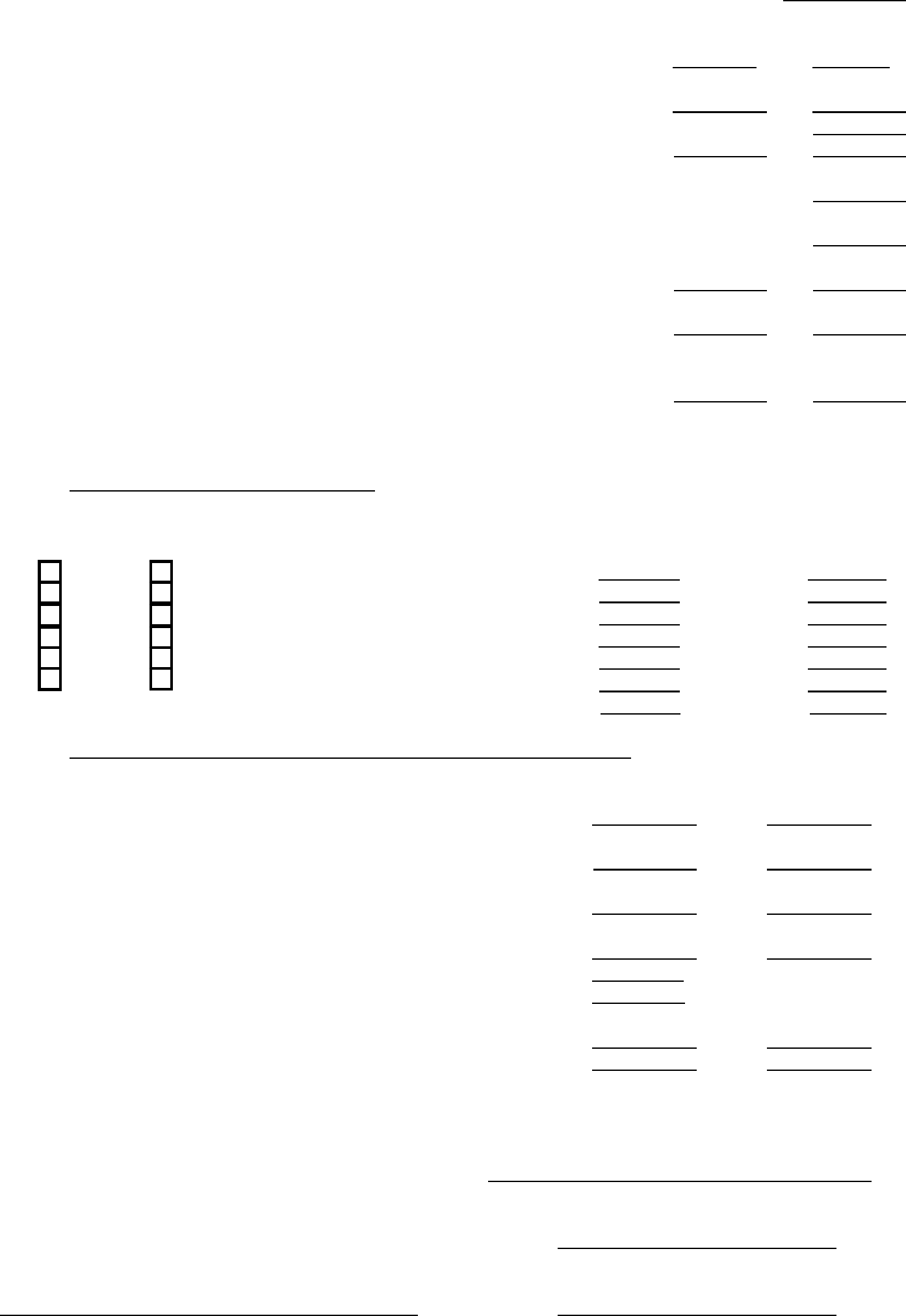

Rev. 07/2012 by KSJC

2 of 2

Case No.

MOTHER FATHER

4. Health and Dental Insurance Premium $ + $

=

5. Work-Related Child Care Costs

Formula: Amt. – ((Amt. X %) + (.25 x (Amt. x %)))

for each child care credit =

Example: 200 – ((200 x .30%) + (.25 x (200 x .30%)))

6. Parents’ Total Child Supp ort Obligation

(Line D.3. plus Lines D.4. & D.5.)

7. Parental Child Support Obligation

(Line D.2. times Line D.6. for each parent)

8. Adjustment for Insurance and Child Care (-)

(Subtract for actual payment made for items

D.4. and D.5.)

9. Basic Parental Child Sup port Obligation

(Line D.7. minus Line D.8.;

Insert on Line F.1. below)

E. CHILD SUPPORT ADJUSTMENTS

AMOUNT ALLOWED

APPLICABLE N/A CATEGORY MOTHER FATHER

1. Long Distance Parenting Time Costs (+/-) (+/-)

2. Parenting Time Adjustment (if b. %___) (+/-) (+/-)

3. Income Tax Considerations (+/-) (+/-)

4. Special Needs/Extraordinary Exp. (+/-) (+/-)

5. Agreement Past Majority (+/-) (+/-)

6. Overall Financial Condition (+/-) (+/-)

7. TOTAL (Insert on Line F.2. below)

F. DEVIATION(S) FROM REBUTTABLE PRESUMPTION AMOUNT

AMOUNT ALLOWED

MOTHER FATHER

1. Basic Parental Child Sup port Obligation

(Line D.9. from above)

2. Total Child Support Adjustments (+/-)

(Line E.7. from above)

3. Adjusted Subtotal (Line F.1. +/- Line F.2.)

4. Equal Parenting Time Obligation

(EPT worksheet Line 12 or 14)

5. Enforcement Fee Allowance** Percentage %

(Applied only to Nonresidential Parent) Flat Fee $

((Line F.3. x Collection Fee %) x .5)

or (Monthly Flat Fee x .5) (+) (+)

6. Net Parental Child Support Obligation

(Line F.3. + Line F.4.)

**Parent with nonprimary residency. Use local percentage.

Judge/Hearing Officer Signature

Date Signed

Prepared By Date Approved