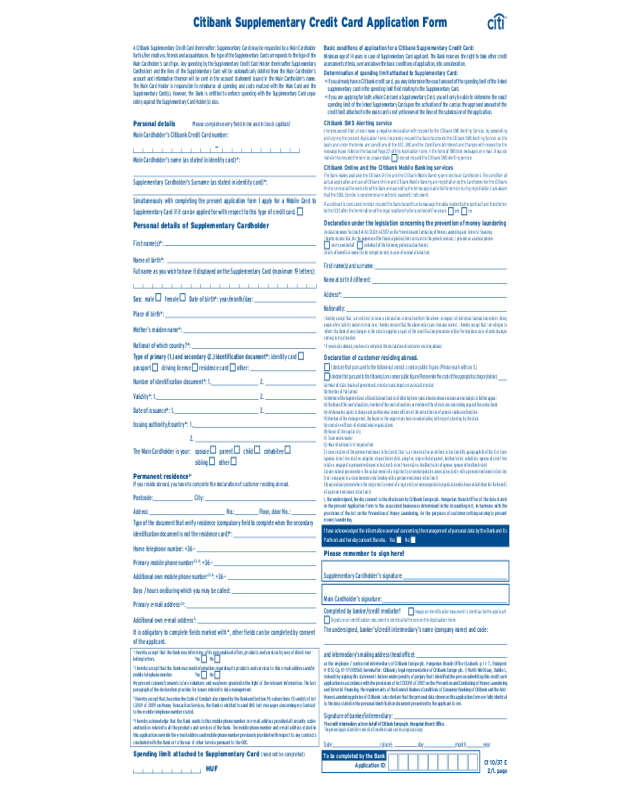

Fillable Printable Citibank Supplementary Credit Card Application Form

Fillable Printable Citibank Supplementary Credit Card Application Form

Citibank Supplementary Credit Card Application Form

A Citibank Supplementary Credit Card (hereinafter: Supplementary Card) may be requested by a Main Cardholder

for his/her relatives, friends and acquaintances. The type of the Supplementary Card corresponds to the type of the

Main Cardholder’s card type. Any spending by the Supplementary Credit Card Holder (hereinafter Supplementary

Cardholder) and the fees of the Supplementary Card will be automatically debited from the Main Cardholder’s

account and information thereon will be sent in the account statement issued in the Main Cardholder’s name.

The Main Card Holder is responsible to reimburse all spending and costs realized with the Main Card and the

Supplementary Card(s), however, the Bank is entitled to enforce spending with the Supplementary Card sepa-

rately against the Supplementary Card Holder(s) also.

Basic conditions of application for a Citibank Supplementary Credit Card:

Minimum age of 14 years in case of Supplementary Card applicant. The Bank reserves the right to take other credit

assessment criteria, over and above the basic conditions of application, into consideration.

Determination of spending limit attached to Supplementary Card:

• If you already have a Citibank credit card, you may determine the exact amount of the spending limit of the linked

supplementary card in the spending limit field relating to the Supplementary Card.

• If you are applying for both a Main Card and a Supplementary Card, you will only be able to determine the exact

spending limit of the linked Supplementary Card upon the activation of the card as the approved amount of the

credit limit attached to the main card is not yet known at the time of the submission of the application.

®

Citibank Supplementary Credit Card Application Form

Cf 10/37 E

2/1. page

Application ID:

To be completed by the Bank

Personal details Please complete every field in ink and in block capitals!

Main Cardholder’s Citibank Credit Card number:

Main Cardholder’s name (as stated in identity card)*:

Supplementary Cardholder’s Surname (as stated in identity card)*:

Simultaneously with completing the present application form I apply for a Mobile Card to

Supplementary Card if it can be applied for with respect to this type of credit card.

Personal details of Supplementary Cardholder

First name(s)*:

Name at birth*:

Full name as you wish to have it displayed on the Supplementary Card (maximum 19 letters):

Sex: male

female Date of birth*: year/month/day:

Place of birth*:

Mother’s maiden name*:

National of which country?*:

Type of primary (1.) and secondary (2.) identification document*: identity card

passport driving license residence card other:

Number of identification document*: 1. 2.

Validity*: 1. 2.

Date of issuance*: 1. 2.

Issuing authority/country*: 1.

2.

The Main Cardholder is your: spouse

parent child cohabitee

sibling other

Permanent residence

1*

If you reside abroad, you have to complete the declaration of customer residing abroad.

Postcode: City:

Address

: No.: Floor, door No.:

Type of the document that verify residence (compulsory field to complete when the secondary

identification document is not the residence card)*:

Home telephone number: +36 –

Primary mobile phone number

2,3,4

: +36 –

Additional own mobile phone number

2,3,4

: +36 –

Days / hours on/during which you may be called:

Primary e-mail address

2,4

:

Additional own e-mail address

2

:

It is obligatory to complete fields marked with *, other fields can be completed by consent

of the applicant.

1

I hereby accept that the Bank may inform me of its personalised offers, products and services by way of direct mar-

keting letters. Yes

No

2

I hereby accept that the Bank may send information regarding its products and services to this e-mail address and/or

mobile telephone number. Yes

No

My present consent/consents is/are voluntary and was/were granted in the light of the relevant information. The last

paragraph of the declaration provides for issues related to data management.

3

I hereby accept that, based on the Code of Conduct also signed by the Bank and Section 39, subsections (5) and (6) of Act

LXXXV of 2009 on Money Transaction Services, the Bank is entitled to send SMS text messages concerning my Contract

to the mobile telephone number stated.

4

I hereby acknowledge that the Bank sends to this mobile phone number or e-mail address provided all security codes

and notices related to all the products and services of the Bank. The mobile phone number and e-mail address stated in

this application override the e-mail address and mobile phone number previously provided with respect to any contracts

concluded with the Bank or to the use of other Service pursuant to the GBC.

Spending limit attached to Supplementary Card (need not be completed)

HUF

Citibank SMS Alerting service

I hereby accept that unless I make a negative declaration with respect to the Citibank SMS Alerting Service, by completing

and signing the present Application Form, I expressly request the Bank to provide the Citibank SMS Alerting Service on the

basis and under the terms and conditions of the GTC, GBC and the Conditions of Interest and Charges with respect to the

message types listed on the back of Page 2/1 of this Application Form, in the form of SMS text messages or e-mail. If you do

not wish to request the service, please state:

I do not request the Citibank SMS Alerting service

Citibank Online and the Citibank Mobile Banking services

The Bank makes available the Citibank Online and the Citibank Mobile Banking services to all Cardholders. The condition of

actual application and use of Citibank Online and Citibank Mobile Banking are registration by the Cardholder for the Citibank

Online service at the web site of the Bank and accepting the terms applicable to the service during registration. I am aware

that the CBOL Service is considered an electronic payment instrument.

If a contract is concluded hereby I request the Bank to continue to manage the data related to the contract and transferred

to the CCIS after the termination of the legal relationship for a period of five years.

yes no

Declaration under the legislation concerning the prevention of money laundering

Declaration under Section 8 of Act CXXXVI of 2007 on the Prevention and Combating of Money Laundering and Terrorist Financing.

I hereby declare that, for the purposes of the financial product/service stated in the present contract, I proceed as a natural person

on my own behalf

on behalf of the following person (actual holder.

Details of beneficial owner (to be completed only in case of second alternative):

First name(s) and surname:

Name at birth if different:

Address*:

Nationality:

I hereby accept that I am entitled to issue a declaration in deviation from the above in respect of individual transaction orders. Being

aware of my liability under criminal law, I hereby declare that the above details are true and correct. I hereby accept that I am obliged to

inform the Bank of any changes in the details supplied as part of the identification procedure within five business days of such changes

coming to my attention.

*If you reside abroad, you have to complete the declaration of customer residing abroad

Declaration of customer residing abroad.

I declare that pursuant to the following I am not a senior public figure. (Please mark with an X.)

I declare that pursuant to the following I am a senior public figure (Please enter the code of the appropriate category below):

1a) Head of state, heads of government, ministers and deputy or assistant minister

1b) Member of Parliament

1c) Member of the Supreme Court, of Constitutional Court or of other high level judicial bodies whose decisions are not subject to further appeal

1d) the head of the court of auditors, member of the courts of auditors, or member of the ultimate decision making organ of the central bank

1e) Ambassador, agent in charge and professional senior officers of the armed forces of general ranks and function

1f) Member of the management, the board or the supervisory body in undertaking with majority holding by the state

1g) executive officers of international organizations

1h) Mayor of the capital city

1i) Trade union leader

1j) Head of national civil organization

2) close relative of the person mentioned in Section 1), that is, a close relative as defined in Section 685, paragraph b) of the Civil Code

(spouse, direct-line relative, adopted, step or foster child, adoptive, step or foster parent, brother/sister, cohabitee, spouse of direct-line

relative, engaged to person mentioned in Section 1), direct-line relative, brother/sister of spouse, spouse of brother/sister)

3a) any natural person who is the actual owner of a legal entity or unincorporated association jointly with a person mentioned in Section

1) or is engaged in a close business relationship with a person mentioned in Section 1)

3b) any natural person who is the single-entity owner of a legal entity or unincorporated organization which was established for the benefit

of a person mentioned in Section 1)

I, the undersigned, hereby consent to the disclosure by Citibank Europe plc. Hungarian Branch Office of the data stated

in the present Application Form to the associated businesses determined in the Accounting Act, in harmony with the

provisions of the Act on the Prevention of Money Laundering, for the purposes of customer vetting serving to prevent

money laundering.

I have acknowledged the information overleaf concerning the management of personal data by the Bank and its

Partners and hereby consent thereto. Yes

No

Please remember to sign here!

Supplementary Cardholder’s signature:

Main Cardholder’s signature:

Completed by banker/credit mediator!

Image on identification document is identical to the applicant

Signature on identification document is identical to the one on the Application Form.

The undersigned, banker’s/credit intermediary’s name (company name) and code:

and intermediary’s mailing address (head office):

as the employee / contracted intermediary of Citibank Europe plc. Hungarian Branch Office (Szabadság tér 7., Budapest

H-1051, Cg. 01-17-000560; hereinafter: Citibank), legal representative of Citibank Europe plc. (1 North Wall Quay, Dublin 1.,

Ireland) by signing this statement I declare under penalty of perjury that I identified the person submitting this credit card

application in accordance with the provisions of Act CXXXVI of 2007 on the Prevention and Combating of Money Laundering

and Terrorist Financing, the requirements of the General Business Conditions of Consumer Banking of Citibank and the Anti-

Money Laundering policies of Citibank. I also declare that the personal data shown on this application form are fully identical

to the data stated in the personal identification document presented by the applicant to me.

Signature of banker/intermediary:

The credit intermediary acts on behalf of Citibank Europe plc. Hungarian Branch Office.

The present application form consists of two sheets and carries a duplicate copy.

Date: (place), day month year

I hereby submit my application for a credit card issued by Citibank Europe plc. (registered offices: 1 North Wall Quay, Dublin 1, Ireland, corporate registry nr.:132781, issuer and date of operating license: Central Bank of Ireland, 01

May, 2001) acting through Citibank Europe plc. Hungarian Branch Office (registered offices: H-1051 Budapest, Szabadság tér 7.; corporate registry nr.: Cg.01-17-000560) (hereinafter: Bank), the type of credit card applied for is stated

on page 5/1 and/or for a Mobile Card to the credit card herein applied for if it is available for the credit card applied for and I do apply for it. By signing the present Application Form I hereby declare that I have familiarized myself

with the provisions of the General Business Conditions of Consumer Banking (GBC) of Citibank Europe plc. Hungarian Branch Office, the General Terms and Conditions of Citibank’s HUF-based Individual Credit Cards (GTC) and the

Citibank Conditions of Credit Card Interests and Charges (Conditions of Interests and Charges), which the issuer Bank will place at my disposal simultaneously with the receipt of the credit card and/or Mobile Card. The provisions

of the above documents govern the main card, all supplementary cards and the Mobile Card linked to the credit cards. The main card, the supplementary card and the Mobile Card applied for with respect to them hereinafter are

jointly referred to as credit card.

By the signing of the present Application Form I hereby declare that the Banker or the credit intermediary has provided verbal information on the minimum and maximum credit amount, the PTI (payment to income ratio), the way

of calculation of interests, the APR, the amount and the frequency of the instalments, the available tenors of the credit. If a credit intermediary is involved, I have also received the information on the right of representation of the

credit intermediary and the fees, costs and other payment obligations payable to the credit intermediary. I have accurately read and understood the annexes of this Application Form.

I hereby acknowledge and accept that, by virtue of the validation of the credit card, the GBC, the GTC and the Conditions of Interests and Charges will take effect, and validation simultaneously constitutes express and full accept-

ance of the provisions of the GBC, the GTC and the Conditions of Interests and Charges previously made available. I hereby accept that the GBC, the GTC and the Conditions of Interests and Charges as in force may also be viewed

in the Bank’s branches. Fees, interests, costs applicable to certain credit card types and grades and the Average Percentage Rate (APR) of credit cards are stated in the prevailing Conditions of Interests and Charges.

I hereby accept that if, at this point in time, I do not wish to use the automatic Citibank Online Internet Banking (CBOL) service or the setting of the Citibank SMS Alerting (CitiAlert) service, I do not exclude myself from the use at

any time in the future of either of the said services, provided that I state my request for either service in a Citibank branch, via the CitiPhone Telephone Customer Service or, for the setting of the CitiAlert service, via the Citibank

Online interface. I hereby accept that if I did not make a negative statement with respect to the CBOL service, the Bank shall, within 5 days of the activation of the credit card, at the latest, make this service qualifying as an

electronic payment instrument available to me under the terms and conditions set forth in the GBC and GTC as in force.

By signing this Application Form, I declare that I am the legal representative of the 14-18 year-old minor designated by me, and I hereby authorize Citibank plc. Hungarian Branch Office to issue the supplementary card, at my liability,

to the minor concerned. OR: since I am not the legal representative of the 14-18 year-old minor designated as supplementary card holder, I enclose herewith a statement and authorization from the minor’s legal representative to

the effect that the card may be issued.

I hereby accept that if, at this point in time, I do not wish to use the automatic Citibank Online Internet Banking and Citibank Mobile Banking service (hereinafter: CBOL service) or the setting of the Citibank SMS Alerting (CitiAlert)

service, I do not exclude myself from the use at any time in the future of either of the said services, provided that I state my request for either service in a Citibank branch, sales centre, via the CitiPhone Telephone Customer

Service or, for the setting of the CitiAlert service, via the Citibank Online interface.I can state my request for Citibank SMS Alerting Service in a Citibank branch, via the CitiPhone Telephone Customer Service or via Citibank Online.

The Bank makes available the Citibank Online and the Citibank Mobile Banking services to all Cardholders without the obligation of use. The condition of actual application and use of Citibank Online and Citibank Mobile Banking

are registration by the Cardholder for the Citibank Online service at the web site of the Bank and accepting the terms applicable to the service during registration.

I hereby accept that if I did not make a negative statement with respect to the Citibank SMS Alerting service, the request for the Citibank SMS Alerting service shall relate to the primary mobile telephone number and primary e-mail

address stated in the present contract and to the credit card issued on the basis of the present contract, in respect of the message types available at the time of the application as follows. I may request changes to the settings at

any time following the placement at my disposal of the Citibank SMS Alerting service via the CitiPhone Banking telephone customer service or if I have the CBOL service at my disposal, I myself may change the settings. By default

SMS messages and e-mail will be sent to inform you on transactions effected with your credit card, the due dates of repayment, the renewal of your card; only e-mails will be sent to inform you on incoming credit transfers in

addition to these transactions. The Citibank SMS Alerting service is not an electronic payment instrument. The SMS and e-mail messages sent as part of the service only serve information purposes and do not qualify as accounts

or account statements. The terms and conditions attached to the service are stated in the General Business Conditions of the Retail Banking Services of the Bank.

By signing this Application Form, I warrant that I shall assume liability with respect to the spending of the Supplementary Cardholder, and for all debts that arise in relation to the Supplementary Card. I hereby further accept that

the Bank is entitled to grant or to refuse my/our application for a credit card without stating its reasons. By completing the present Application Form, I hereby declare that all data items stated by me in the documents forming

part of and related to the present application are true, accurate and complete. I hereby declare that I shall supply true and correct data to the Bank until the payment in full of the debt arising from the credit card contract, and

hereby expressly accept the following and authorize the Bank:

a) to manage, store and process all my personal data supplied by me upon the submission of the application for the given Service or during the term of the contract in writing, verbally or in any other manner as well as all my

personal data disclosed to the Bank in any other manner in compliance with the legal rules regarding data protection, within the relevant statutory period of limitation or for the period of time determined in any other mandatory

statutory regulation, in the interest of the enforcement of the rights and the fulfillment of the obligations arising from the contract, for risk analysis and risk minimization purposes, in the interest of enabling the Bank to inform

me directly of the services provided by it (unless I expressly objected to the latter) and for the purposes determined in other parts of the contract;

b) to verify the correctness of the data supplied by me in compliance with the relevant legal rules;

c) to process and to manage, as part of its work processes, my data generated/managed in connection with the contract within the units of Citigroup in compliance with the legal rules regarding data protection (drafting of

statistics, printing of bank cards, printing of account statements), to forward and to share the same for the purposes of processing and management to and with other units forming part of the Citibank/Citigroup Group, whether

in Hungary or abroad, and further to disclose the said data to the Bank’s banking and/or investment agents and/or to insurance agents in contact with the Bank for the purpose of the sale of the Bank’s services and the settlement

related thereto;

d) to disclose to third parties data relating to my person in connection with services provided for me for the purpose of the printing of postal orders, bank cards and bank account statements, consumer research conducted with

respect to the Bank’s products, the enforcement of the Bank’s due receivables and data management and processing in conjunction with the above;

e) if I am a taxpayer in the United States of America (hereinafter „USA”), to file the report under the tax laws of the USA with the competent USA authorities, and in this context, I hereby exempt the Bank from its obligation of

confidentiality;

f) to use automated individual decisions upon the assessment of applications for various services, in particular, credit-type services, and the extension thereof, as part of which the Bank shall evaluate my personal data via

automated data processing involving the use of only IT devices. In respect of any automated individual decision, the Bank will enable me to state my opinion and further, at my request, the Bank will provide information on the

mathematical method used and the essence thereof.

I hereby accept and agree that

a) the Bank may process any of my personal data disclosed to the Bank in any Citibank unit in the following countries in compliance with the Hungarian data protection laws: Germany, Singapore, Poland, Greece, United States

of America, United Kingdom, India, United Arab Emirates, and the Philippines. I hereby accept and agree that any data forwarding to the member states of the European Union shall be construed as data forwarding within the

territory of the Republic of Hungary.

b) -in the case of data managed abroad the Bank also allows me to exercise the rights related to my personal data as determined in Act CXII of 2011 on Informational Self-Determination and Freedom of Information.

c) based on the rules of law, the Bank may be entitled / obliged to supply data in certain instances which will not constitute a breach of confidentiality.

I hereby accept that the Bank will state in the Conditions of Interest and Charges the range of outsourced activities, as defined in Act CXII of 1996 on Credit Institutions and Financial Enterprises, and the names of the entities engaged

in such outsourced activities. The Bank will additionally provide information on its Internet website on any third parties that may, as part of their other activities pursued on behalf of the Bank, manage, store or process my data.

The Cardholder shall notify the Bank in writing, via CitiPhone Banking or Citibank Online if there is a change in his/her mobile telephone number or e-mail address, in such a way that the written notice shall be received by the Bank

before the change takes effect. Until due notification, the Bank shall continue to send messages to the mobile telephone number or e-mail address stated earlier. No responsibility shall lie with the Bank for any loss that may so arise.

I hereby accept and grant my consent to the following

- in the interest of concluding the present contract and preventing the unauthorized use of identity cards, the Bank shall verify, based on the data supplied by the Ministry of the Interior, Central Records and Election Office, the

personal data stated by me and shall determine the reason for and date of any possible removal from the records. If, based on Section 2, subsection (1) of Act LXVI of 1992 on the Registration of the Personal and Residence Data

of Citizens, I exercise my right to have my data blocked, by virtue of my present declaration, I also authorize for a single instance the disclosure of the data blocked.

- the Bank shall disclose to the international card company and the merchant network the customer data necessary for the entry into force of credit card cancellations in the network of the international card company and I

hereby exempt the Bank from confidentiality.

- the Bank shall record the conversations conducted as part of the CitiPhone Banking service and may use the recordings in disputes covered by such conversations as evidence.

- the Bank may install cameras on its own premises open to customers, in ATMs and on the premises of ATMs which may make video recordings of me, and the Bank may use such video recordings as evidence for the settlement

of any dispute.

I hereby accept that, in the case of insurance services requested with the mediation of the Bank, the Bank shall be entitled to hand over to the given insurer data related to the conclusion and registration of the insurance contract

and the insurer’s service. Data management may be necessary for the purpose of the conclusion and amendment of the insurance contract, the maintenance thereof in the insurer’s portfolio and the assessment of claims arising

from the insurance policy, or may serve any other purpose determined by law.

I hereby additionally accept that if the present contract is not concluded subsequent to the submission of the present service application, I may demand the return of any documentation containing my personal data handed

over to the Bank within eight days of the frustration of the conclusion of the contract, on the basis of which the Bank shall return such documentation. Following the time limit available for demanding the return of documenta-

tion containing personal data, the Bank shall destroy the documentation containing such data, unless the Bank stores, manages and processes such documentation for direct marketing purposes in full compliance with the data

protection regulations set forth in the relevant legal rules. Bank’s data management identification number: 344-0002.

I am aware that, on request, the Bank shall provide information within 30 days on the data managed by the Bank and/or processed by an agent engaged by the Bank, the purpose of and legal grounds for data management, term of

data management, name and address (head office) of the data processing agent and its activities related to data management as well as on the persons that receive or received the data and the purpose of the disclosure of data.

The information is provided free of charge, provided that I have not yet submitted to the Bank a request for information with respect to the same area in the same year. In other cases, the Bank reserves the right to determine a

cost allowance in connection with the provision of information. I am further also aware that I may object to the management of my personal data if (i) the management (forwarding) of the personal data is solely necessary for the

enforcement of the rights or lawful interests of the Bank or the data recipient, unless data management is required by law; (ii) the personal data is used or forwarded for the purposes of direct marketing, public opinion research

or scientific research; (iii) raising an objection is otherwise permitted by law. In the event of the violation of my rights, I may turn to a court of law or may file a complaint with the data protection commissioner.

I am aware that I may announce in person, in any bank branch or credit center, in writing, via the CitiPhone Banking customer service and electronically via the relevant menu item of the Citibank Online customer service if I do

not wish to receive information concerning the Bank’s personalised offers, products and services by way of direct marketing. I may issue a waiver to the above effect at any time, unconditionally, without stating my reasons, free

of charge. However, also in the event of a request to the above effect, the Bank shall be obliged to send information required under the present contract or the rules of law to me.

®

Cf 10/37 E

2/1. back side

To be completed by the Bank

12345678

Customer ID:

Source code:

Program ID 2:

Banker/

Location code: 1.

2.

3.

Declaration related to the Central Credit Information System

In light of the information provided regarding the Central Credit Information System, unless statement to the contrary is made, I hereby state:

• I grant my consent for the Bank to retrieve from the CCIS and store, for the purpose of assessing my current loan application, the full range of my reference data relating to the „positive debtor list“, managed in the CCIS:

I don’t accept

By signing this Application Form I hereby consent to the Bank sending the information on the result of queries in the Central Credit Information System (hereinafter: CCIS) (data taken over from the CCIS) electronically, as an

encrypted document, to my primary e-mail address stated on Page 1 of this Application Form. In this case the Bank will send the decryption password in a text message to the primary mobile phone number I provided on Page 1 of

this Application Form. If I did not indicate my e-mail address or mobile phone number or the electronic messages sent to me cannot be delivered for any reason, the Bank shall send the information by post, to the mailing address

stated by me on this Application Form.

Date: (place), day month year

* The CCIS Operator in contact with the Bank is, at present, Bankközi Informatika Szolgáltató Zrt., head office: 1205 Budapest, Mártonffy u. 25-27/. www.bisz.hu

**The amount of the monthly minimum wage as at any time is determined in the legal rules in force as at any time.

CitiPhone Banking: +36 1 288 88 88

Citibank Europe plc. Hungarian Branch Office (registered offices: H-1051 Budapest, Szabadság tér 7.;

registration court and court number: Municipal Court of Budapest, acting as Court of Registration 01-17-000560);

acting in the name and on behalf of Citibank Europe plc. (registered office: 1 North Wall Quay, Dublin 1,

registration court and court number: Companies Registration Office, no. 132781) an entity registered in Ireland)

1. The Central Credit Information System and its purpose

The Central Credit Information System (hereinafter: CCIS) is a closed system database. The purpose of submit-

ting data to and requesting data from the CCIS (data forwarding) is to assure a sounder assessment of creditwor-

thiness, to meet the conditions of responsible lending, and to reduce lending risk in the interests of the security

of debtors and reference data providers.

2. Cases of data provision to the CCIS, data that is to be provided by data providers in every case on an

obligatory basis, as well as data that is to be provided upon the occurrence of specifically defined cases,

and the duration of data storage

2.1. Only the data specified in the CCIS Act may be managed in the CCIS (hereinafter: reference data). The refer-

ence data provider hands over to the financial enterprise* that operates the CCIS (hereinafter: CCIS Operator)

the reference data of the natural person who

a) enters into a contract with the reference data provider

• for the provision of credit or a cash loan,

• financial leasing services, or

• for the issuance of electronic money or a cash-substitute payment instrument (e.g. paper-based traveller’s

cheques, bills of exchange), and the provision of the service related thereto which does not qualify as a pay-

ment service,

• for the provision of surety or a bank guarantee, or some other banker’s commitment, or

• who concludes a student loan contract as defined in a separate statutory regulation, or

• a contract for the provision of an investment loan to an investor, or

• for securities lending/borrowing (hereinafter: “positive debtor list”), within two workings days following con-

tract conclusion. Prior to the handover to the CCIS of the reference data related to the “positive debtor list”, the

natural-person customer is entitled to issue a statement as to whether he/she consents to having his/her data

forwarded from the CCIS to other reference data providers. This consent may be refused by the natural-person

customer at any time during the period of recordkeeping of the data in the CCIS. If the natural-person customer

does not consent to the forwarding from the CCIS of his/her data, the refusal to give consent and the data

related to the refusal [the date (date and place) of the declaration, the identification data of the reference data

provider, the customer’s identification data and a comment indicating that consent was denied] will be recorded

in the CCIS. The natural person customer’s written declaration shall apply to all the natural-person customer’s

contracts constituting the object of data provision. If the customer changes the substance of his/her declaration

later on, and withdraws or refuses his/her written consent, then in all cases the natural person customer’s most

recently made written declaration shall apply in respect of all his/her contracts constituting the object of data

provision. Furthermore, we would like to inform you that a registered natural-person customer may request in

writing from the financial enterprise operating the CCIS, at the time of contract conclusion or during the term of

the contract – via the reference data provider – that the financial enterprise operating the CCIS manage his/her

data related to the “positive debtor list” for no more than five years following the termination of the contractual

legal relationship. The consent for the management of data after termination of the legal relationship may be

withdrawn at any time in writing via the reference data provider prior to termination of the legal relationship,

and after that directly via the financial enterprise operating the CCIS.

b) a person who fails to comply with his/her payment obligations under one or more of the contracts listed in

section a) in such manner that the amount of overdue and unpaid debt exceeds the statutory monthly minimum

wage** effective as at the time of the delay and such overdue debt in excess of the minimum wage has been

outstanding continuously for more than ninety days;

c) the person that provides false data upon requesting the conclusion of the contract related to the services

stated in a) and there is documentary evidence thereto and for the use of false or forged documents the final

judicial decision establishes the crime stated in Sections 342-343., 345-346. of Act C of 2012 on the Criminal code

(forgery of public document, forgery of private document, misuse of document).

d) a person who, due to the use of a cash-substitute payment instrument, is found by the court, in a legally

binding ruling, to have committed a crime specified in Article 393 of the Civil Code (abuse of a cash-substitute

payment instrument) (sections b)–d) hereinafter together: “negative debtor list”).

2.2. In the course of the handover specified in section 2.1, the Bank hands over to the CIS Operator the identifica-

tion data of the natural person [name, name at birth, date and place of birth, mother’s maiden name, number of

personal identification document (passport) or the number of a certificate that is, in accordance with Act LXVI

of 1992 on the Registration of the Personal Data and Address of Citizens, suitable for the verification of identity,

address, correspondence address, email address], and a) in the case of section 2.1 a), the contractual data of the

contract specified therein [contract type and identification (number), the date of contract conclusion, expiry,

termination, classification of the customer (debtor, co-debtor), the contract amount and currency, the method

and frequency of repayment, the installment amount and currency of the contract amount], and furthermore, in

the course of the data provision specified in section 2.1 b), the date on which the conditions specified in section

2.1 b) are met, the amount of overdue and unpaid debt at the time that the conditions specified in section 2.1 b)

are met, the manner and date of the termination of the overdue and unpaid debt, the assignment of the claim to

another reference data provider, reference to litigation, the occurrence and time of any prepayment, the amount

of the prepayment, and the amount and currency of the remaining principal debt,

b) in the case of section 2.1. c), the data pertaining to the initiation of the contract specified in section 2.1. a),

[the date and reason for the rejection of the application, documentary evidence, number of legally binding court

resolution, name of acting court, content of the operative section of the resolution],

c) in the case of subsection 2.1 d), the data pertaining to the use of the cash-substitute payment instrument

[the type and identification (number) of the cash-substitute payment instrument, the date of blocking, the date,

number and amount of any transactions performed with the blocked cash-substitute payment instrument, the

number of unauthorized uses, the amount of the damage caused, the date on which the court ruling became

legally binding, reference to litigation],

d) the reference-data provider shall, by the fifth working day following the month concerned, specify to the CCIS

Operator the amount and currency of the outstanding capital debt, the amount and currency of the repayment

installment of the contractual amount and further, if the registered natural person performs prepayment during

the term of the contract, it shall provide to the CCIS Operator, within five working days following the prepayment,

the data related to the prepayment [fact and date of the prepayment, the prepaid amount, and the amount and

currency of the outstanding principal debt].

2.3. The reference data handed over in accordance with section 2.2 is deleted by the CCIS Operator immediately

after the termination of the contractual relationship in the case specified in section 2.1, or if the consent speci-

fied in section 2.1 a) has been given, manages it for five years after termination of the contractual relationship,

and in the case specified in section 2.1 b) for a year after the repayment of the debt, or for five years if the debt

has not been repaid, and in the cases specified in sub-sections 2.1 c)–d) also for five years, after the expiry of

which period it finally and irreversibly deletes the reference data. In the cases specified in section 2.1. b)–d), with

respect to calculating the period, the starting date shall be:

a) in the case specified in section 2.1 b), the date of the elimination of the past-due debt, and if the debt has not

been eliminated, the end of the fifth year following the date of data provision,

b) the date of data provision in the cases specified in section 2.1. c)–d).

2.4. In a departure from the provisions of section 2.3, the CCIS Operator shall immediately and irreversibly delete

the reference data if the reference data provider has ceased to exist without a legal successor and the claim

under the contract pertaining to the data provision was not transferred to another reference data provider, or

if the reference data provider transferred the claim under the contract pertaining to data provision to an entity

that is not a reference data provider. Furthermore, the CCIS Operator shall immediately and irreversibly delete

the reference data if it was entered into the CCIS unlawfully.

3. Data request from the CCIS

3.1. Based on the data provision specified in section 2, the CCIS Operator registers the data in the CCIS, following

which the data becomes retrievable and available for provision to other reference data providers on the basis of

a data request submitted by them; in the case specified in section 2.1 this only applies if the Customer has given

his/her written consent thereto. The CCIS Operator may only accept the reference data provided by the Bank

and by other reference data providers, and may only make the reference data managed by it available to the

reference data providers based on the data request submitted by them. In addition to the reference data pertain-

ing to the registered person indicated in the data request, no other data may be provided from the CCIS to the

reference data provider. The data request may only be used for the purpose of making decisions that serve as

the basis for concluding such contracts as are specified in section 2.1 a), or for complying with the requirement

of responsible lending or providing information, as specified in section 3.2, to the person concerned.

3.2. Anyone may request information from any reference data provider (including the Bank) about their data contained

in the CCIS and about the identity of the reference data provider that made the data available. The Bank forwards to

the CCIS Operator, within two working days, the request for information submitted by you; the CCIS Operator sends the

requested data in a sealed manner to the Bank within three days, and after receipt the Bank forthwith, but no later than

within two working days, forwards the data to you, again, in a sealed manner, by registered mail. The information is free

of charge for the person requesting it and no reimbursement or other fee may be charged for it.

4. Legal remedies

4.1. If you believe that the Bank has handed over your data to the CCIS Operator unlawfully and/or the manage-

ment of such data in the CCIS is unlawful, the following legal remedies are available to you:

4.2. You may submit an objection to the Bank or the CCIS Operator requesting the correction or the deletion of

the reference data. The Bank and/or the CCIS Operator will review the objection within five working days of the

receipt thereof, and shall notify you of the result of the review, in writing by means of registered mail, forthwith

but no later than within two working days after the review is completed. If the Bank accepts the objection, it shall

hand over forthwith, the reference data to be corrected or deleted to the CCIS Operator while simultaneously

notifying you, and the CCIS Operator shall make the required change to the records forthwith.

4.3. You may file a claim against the Bank and the CCIS Operator at the competent local court for unlawful provi-

sion and management of reference data, or for the purpose of having the reference data corrected or deleted,

if you disagree with the result of the review of the objection (in this case, within 30 days of receipt of the notice

regarding the review of the objection), and/or if the Bank or the CCIS Operator fails to comply with its obligation

to provide information as specified in section 3.2 (in this case within 30 days after the expiry of the deadline

stipulated with respect to the obligation to provide information.)

4.4. The CCIS Operator shall keep on record the fact that legal action has been launched, together with the

disputed reference data, until the matter is resolved in a legally binding manner. I the undersigned confirm that

Citibank Europe plc. Hungarian Branch Office, in its capacity as reference data provider, has met its obligation to

provide information prior to the initiation of the conclusion of a contract, or prior to the actual conclusion of the

contract, in relation to the Central Credit Information System, as prescribed in the CCIS Act, by handing over this

written Notice and the publication entitled “Information from the Hungarian Financial Supervisory Authority for

private individuals regarding the Central Credit Information System”, and – if the customer is present in person

– by providing the relevant oral explanations, and that I acknowledge the information thus communicated to me.

Notice to retail customers about the Central Credit Information System

Dear Customer,

In accordance with Act CXXII of 2011 on the Central Credit Information System (hereinafter: CCIS Act), and especially pursuant to the provisions of Articles 9 (2) and 15 (1) thereof, Citibank Europe plc. (registered offices: 1 North

Wall Quay, Dublin 1, Ireland, corporate registry nr.:132781, issuer and date of operating license: Central Bank of Ireland, 01 May, 2001) acting trough Citibank Europe plc. Hungarian Branch Office (registered offices: H-1051 Budapest,

Szabadság tér 7.; corporate registry nr.: Cg.01-17-000560) (hereinafter: Bank) herewith provides the following information to you regarding the rules applicable to the Credit Information System, especially with regard to the

purpose of data recording and to your rights.

Please read the information and the publication entitled “Information from the Hungarian Financial Supervisory Authority for private individuals regarding the Central Credit Information System” constituting an annex thereto

carefully, and if you are present in person, please listen to the oral explanation of our employee, and confirm your acknowledgment that such has taken place by signing a copy of this Notice.

®

Cf 10/37 E

2/2. page

Customer’s signature