Fillable Printable Commuting Rule And Cents-Per-Mile Rule

Fillable Printable Commuting Rule And Cents-Per-Mile Rule

Commuting Rule And Cents-Per-Mile Rule

EMPLOYEE STATEMENT OF EMPLOYER PROVIDED VEHICLE USE

(Commuting Rule and Cents-Per-Mile Rule)

State Form 49632 (R2 / 3-17)

Approved by State Board of Accounts, 2017

Approved by Auditor of State, 2017

INSTRUCTIONS FOR STATE FORM 49632

Your agency has developed a policy on the use of state vehicles based on the guidelines

established by the Internal Revenue Service

(IRS). Please contact the payroll clerk or designated person in your agency for a

copy of the policy and instructions to be used in the

preparation of this form.

If your agency’s policy is “commuting use only”, then you will use the “Commuting Rule” – State Form 49632 (Section 4 is not

applicable, fill out all other sections of the form), to determine the fringe benefit provided to the employee. See IRS Publication 15-

B: https://www.irs.gov/publications/p15b/index.html for the federal requirements for using the Commuting Rule.

If your agency’s policy is “allowable personal use”, then you need to select one of two fringe benefit valuation rules used in

computing the fringe benefit

provided to the employee. See IRS Publication 15-B: https://www.irs.gov/publications/p15b/index.html

to determine which fringe benefit valuation rule to use below and their applicable federal requirements.

The “Cents-Per-Mile Rule” – State Form 49632 (Section 3 is not applicable, fill out all other sections of the form).

The “Lease Value Rule” – State Form 49631. (MUST be used by elected officials.)

Failure to submit State Form 49632 fifteen (15) days after the submission period end date based on the form submission frequency

selected in Section 1, will result in a default taxation that considers all miles to be 100% personal usage based upon an estimate of the

prior period total mileage or odometer reading.

Fill out the information noted on State Form 49632. The rates used on State Form 49632 are subject to be changed by the IRS. See

IRS Publication 15-B: https://www.irs.gov/publications/p15b/index.html, to obtain the IRS’s current rates. Additional instructions to

assist with filling out the form are listed below:

SECTION 1

State Form 49632 can be submitted biweekly, monthly or quarterly. The form submission frequency must be chosen by circling

or highlighting the frequency you wish to use during the calendar year.

Once a submission frequency is selected, it cannot be changed until the next calendar year.

The “SUBMISSION PERIOD END DATE” is the last day of the submission period the form is being submitted, based on the

form submission frequency selected above.

SECTION 2

Document the date and the Fair Market Value (FMV) of the automobile, by recording the date and the value of the automobile

on the first date it was available to any employee for personal use. If this is not applicable due to the automobile has only been

used for commuting use only, note “N/A” in both fields. If unsure contact your agency’s representative for assistance.

The State vehicle’s odometer reading is as of the last day of the submission period and should agree with what was entered on

the State vehicle’s mileage log at the end of the submission period.

SECTION 3

Document the number of one-way commutes (from home to work or work to home) during the form submission period.

To

determine the Commuting Rule “Taxable fringe benefit” for the employee identified in Section 1, multiply the number of

one-way commutes by the

“Current federal rate for commuting *”, which can be found under the Commuting Rule per the IRS

Publication 15-B: https://www.irs.gov/publications/p15b/index.html.

SECTION 4

** The “Current Federal Standard Mileage Rate” can be found at the IRS website: https://www.irs.gov/tax-

professionals/standard-mileage-rates/, by using the Business rate listed.

A fuel adjustment can only be taken per the Cents-Per-Mile Rule if the employee identified in section 1, paid for all fuel used in

the automobile noted in Section 1. If the agency provided fuel, reimbursed the employee identified in Section 1 or it was

charged to the agency, a fuel adjustment cannot be taken, therefore record $0.00 in the field, “Fuel adjustment”.

*** The “Current Federal rate for fuel purchased by employee” can be found under the Lease Value Rule per the IRS

Publication 15-B: https://www.irs.gov/publications/p15b/index.html.

To determine the Cents-Per-Mile Rule “Taxable fringe benefit” for the employee identified in Section 1, subtract the “Fuel

Adjustment” from the “Taxable personal miles” computed earlier in this section.

SECTION 5

The employee whose name is documented in Section 1 is required to sign and date the form.

Submit State form 49632 to your agency payroll representative.

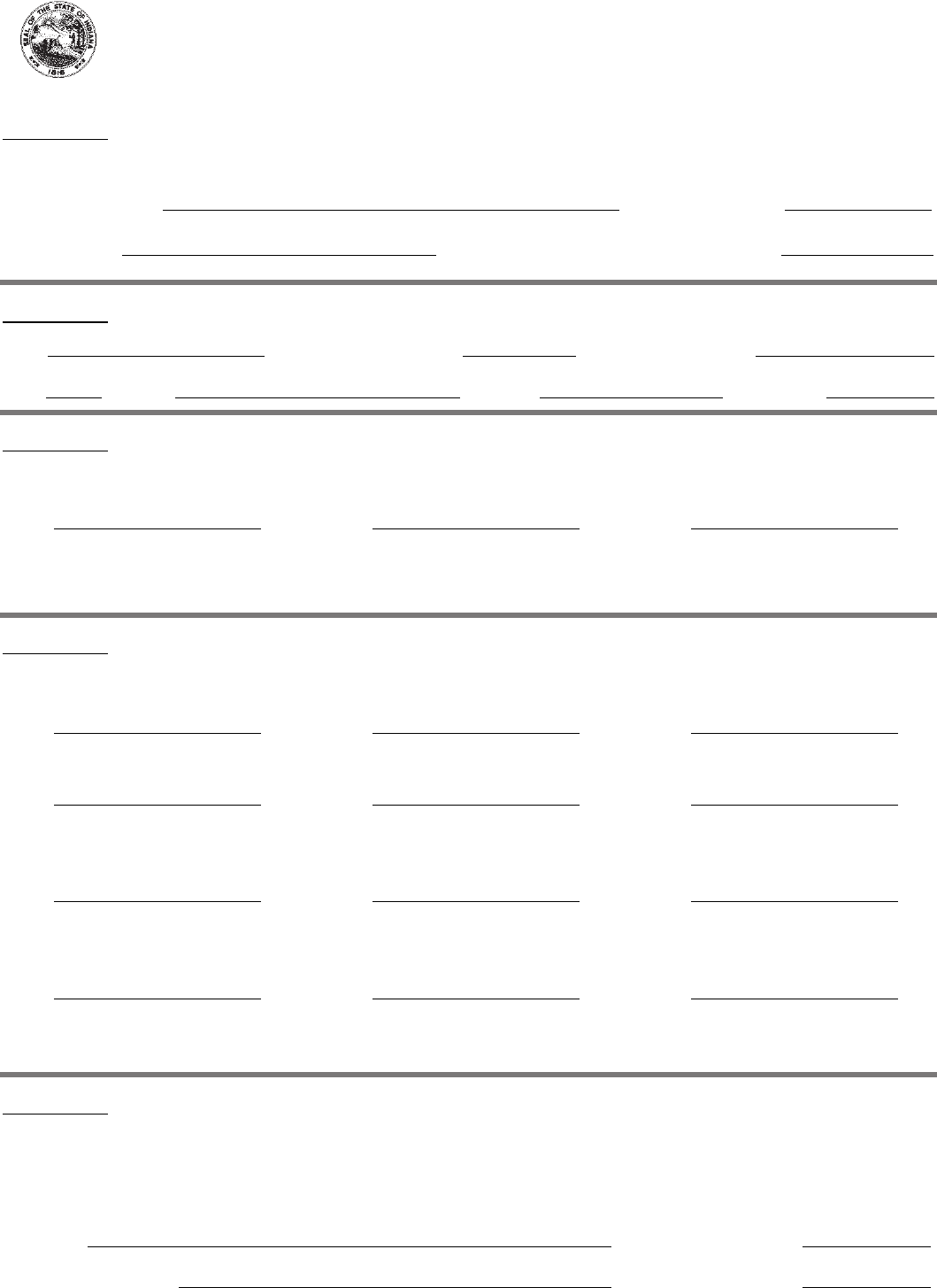

EMPLOYEE STATEMENT OF EMPLOYER PROVIDED VEHICLE USE

(Commuting Rule and Cents-Per-Mile Rule)

State Form 49632 (R2 / 3-17)

Approved by State Board of Accounts, 2017

Approved by Auditor of State, 2017

SECTION 1

Select form submission frequency (circle or highlight one): Biweekly or Monthly or Quarterly.

Name of Employee:

Agency Number:

PeopleSoft ID:

Submission Period End Date (mm/dd/yy):

SECTION 2

VIN: Date of FMV (mm/dd/yy): FMV of automobile: $

Year: Make: Model: Odometer:

SECTION 3

Commuting Rule:

x

$

=

$

Number of one-way commutes Current Federal rate for Taxable fringe benefit

commuting

* for Commuting Rule

to be added to Pay File (C2)

SECTION 4

Cents-Per-Mile Rule:

+

=

Business miles Personal miles Total mileage

x

$

=

$

Personal miles Current Federal Taxable personal miles

Standard Mileage Rate

**

$

x

$

=

$

Personal miles Current Federal rate for Fuel adjustment

fuel purchased by employee

***

$

–

$

=

$

Taxable personal miles Fuel adjustment Taxable fringe benefit

for Cents-Per-Mile Rule

to be added to Pay File (C2)

SECTION 5

I certify the above information is true and correct to the best of my knowledge. The necessary logs and documentation are being

kept and will be available for inspection by my agency, Auditor of State/designee, State Board of Accounts, and the Internal

Revenue Service.

Signatures:

Employee:

Agency Representative:

Date (mm/dd/yy):

Date (mm/dd/yy):

Reset Form