Fillable Printable Compliance With Statement Of Benefits Personal Property

Fillable Printable Compliance With Statement Of Benefits Personal Property

Compliance With Statement Of Benefits Personal Property

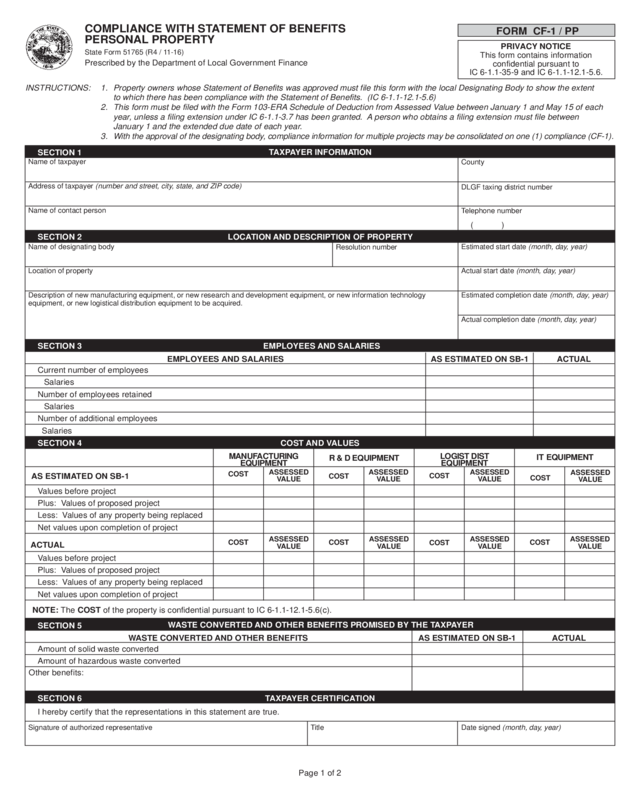

PRIVACY NOTICE

This form contains information

confidential pursuant to

IC 6-1.1-35-9 and IC 6-1.1-12.1-5.6.

COMPLIANCE WITH STATEMENT OF BENEFITS

PERSONAL PROPERTY

State Form 51765 (R4 / 11-16)

Prescribed by the Department of Local Government Finance

TAXPAYER INFORMATION

SECTION 1

Name of taxpayer

Address of taxpayer (number and street, city, state, and ZIP code)

Name of contact person

( )

LOCATION AND DESCRIPTION OF PROPERTYSECTION 2

Name of designating body

Location of property

Description of new manufacturing equipment, or new research and development equipment, or new information technology

equipment, or new logistical distribution equipment to be acquired.

Estimated start date (month, day, year)

Actual start date (month, day, year)

Estimated completion date (month, day, year)

Actual completion date (month, day, year)

County

EMPLOYEES AND SALARIESSECTION 3

AS ESTIMATED ON SB-1 ACTUAL

Current number of employees

Number of employees retained

Number of additional employees

Salaries

Salaries

Salaries

ACTUAL

COST AND VALUESSECTION 4

R & D EQUIPMENT

COST

ASSESSED

VALUE

SECTION 5

AS ESTIMATED ON SB-1 ACTUAL

TAXPAYER CERTIFICATIONSECTION 6

I hereby certify that the representations in this statement are true.

Signature of authorized representative Title Date signed (month, day, year)

NOTE: The COST of the property is confidential pursuant to IC 6-1.1-12.1-5.6(c).

Amount of solid waste converted

Amount of hazardous waste converted

Other benefits:

WASTE CONVERTED AND OTHER BENEFITS PROMISED BY THE TAXPAYER

Values before project

Plus: Values of proposed project

Less: Values of any property being replaced

Net values upon completion of project

Plus: Values of proposed project

Less: Values of any property being replaced

Net values upon completion of project

Values before project

AS ESTIMATED ON SB-1

COST

ASSESSED

VALUE

MANUF ACTURING

EQUIPMENT

COST

ASSESSED

VALUE

COST

ASSESSED

VALUE

COST

ASSESSED

VALUE

COST

ASSESSED

VALUE

IT EQUIPMENT

COST

ASSESSED

VALUE

COST

ASSESSED

VALUE

FORM CF-1 / PP

EMPLOYEES AND SALARIES

WASTE CONVERTED AND OTHER BENEFITS

Telephone number

LOGIST DIST

EQUIPMENT

INSTRUCTIONS: 1. Property owners whose Statement of Benefits was approved must file this form with the local Designating Body to show the extent

to which there has been compliance with the Statement of Benefits. (IC 6-1.1-12.1-5.6)

2. This form must be filed with the Form 103-ERA Schedule of Deduction from Assessed Value between January 1 and May 15 of each

year, unless a filing extension under IC 6-1.1-3.7 has been granted. A person who obtains a filing extension must file between

January 1 and the extended due date of each year.

3. With the approval of the designating body, compliance information for multiple projects may be consolidated on one (1) compliance (CF-1).

DLGF taxing district number

Resolution number

Page 1 of 2

Reset Form

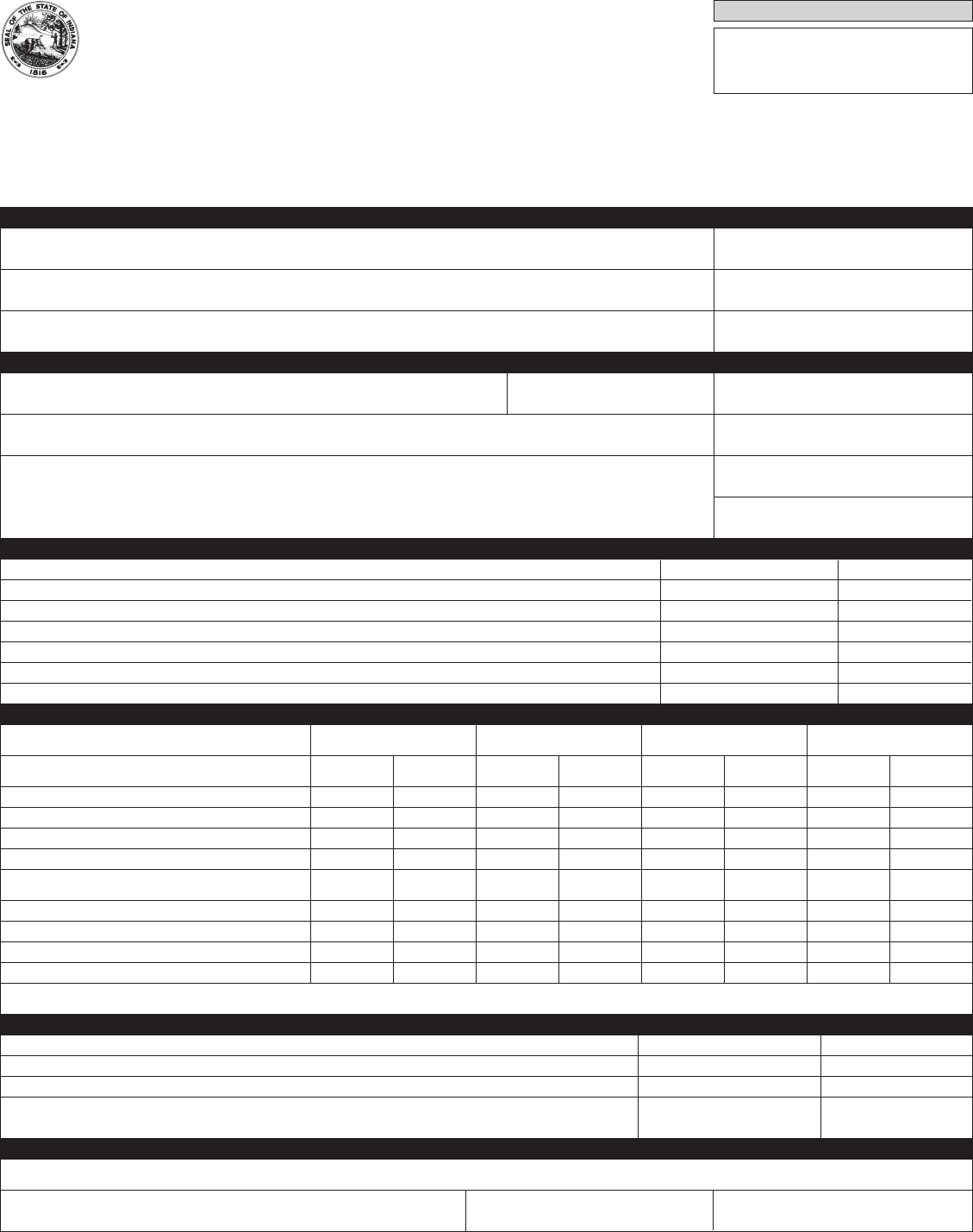

OPTIONAL: FOR USE BY A DESIGNATING BODY WHO ELECTS TO REVIEW THE COMPLIANCE WITH STATEMENT OF BENEFITS (FORM CF-1)

THAT WAS APPROVED AFTER JUNE 30, 1991.

INSTRUCTIONS: (IC 6-1.1-12.1-5.9)

1. This page does not apply to a Statement of Benefits filed before July 1, 1991; that deduction may not be terminated for a failure to comply with the

Statement of Benefits.

2. Within forty-five (45) days after receipt of this form, the designating body may determine whether or not the property owner has substantially complied with

the Statement of Benefits.

3. If the property owner is found NOT to be in substantial compliance, the designating body shall send the property owner written notice. The notice must

include the reasons for the determination and the date, time and place of a hearing to be conducted by the designating body. If a notice is mailed to a

property owner, a copy of the written notice will be sent to the County Assessor and the County Auditor.

4. Based on the information presented at the hearing, the designating body shall determine whether or not the property owner has made reasonable effort to

substantially comply with the Statement of Benefits and whether any failure to substantially comply was caused by factors beyond the control of the

property owner.

5. If the designating body determines that the property owner has NOT made reasonable effort to comply, then the designating body shall adopt a resolution

terminating the deduction. The designating body shall immediately mail a certified copy of the resolution to: (1) the property owner; (2) the County Auditor;

and (3) the County Assessor.

We have reviewed the CF-1 and find that:

the property owner IS in substantial compliance

the property owner IS NOT in substantial compliance

other (specify)

Reasons for the determination (attach additional sheets if necessary)

If the property owner is found not to be in substantial compliance, the property owner shall receive the opportunity for a hearing. The following date and

time has been set aside for the purpose of considering compliance.

AM

PM

HEARING RESULTS (to be completed after the hearing)

Approved Denied (see instruction 5 above)

Reasons for the determination (attach additional sheets if necessary)

Signature of authorized member

Attested by:

Date signed (month, day, year)

APPEAL RIGHTS [IC 6-1.1-12.1-5.9(e)]

A property owner whose deduction is denied by the designating body may appeal the designating body’s decision by filing a complaint in the office of the

clerk of Circuit or Superior Court together with a bond conditioned to pay the costs of the appeal if the appeal is determined against the property owner.

Designating body

Time of hearing Date of hearing (month, day, year) Location of hearing

Signature of authorized member

Attested by: Designating body

Date signed (month, day, year)

Page 2 of 2