- Workers Compensation Inclusion/Exclusion Form - Minnesota

- Employer's First Report of Injury or Occupational Disease - Alabama

- Workers' Compensation Claim Form - California

- Workers' Compensation Commission Application for Ajustment Claim - Illinois

- Worker's Report of Injury - Arizona

- Worker's Compensation Form - Georgia

Fillable Printable Contractor's Certificate of Workers' Compensation Insurance - Virginia

Fillable Printable Contractor's Certificate of Workers' Compensation Insurance - Virginia

Contractor's Certificate of Workers' Compensation Insurance - Virginia

61A rev 070114

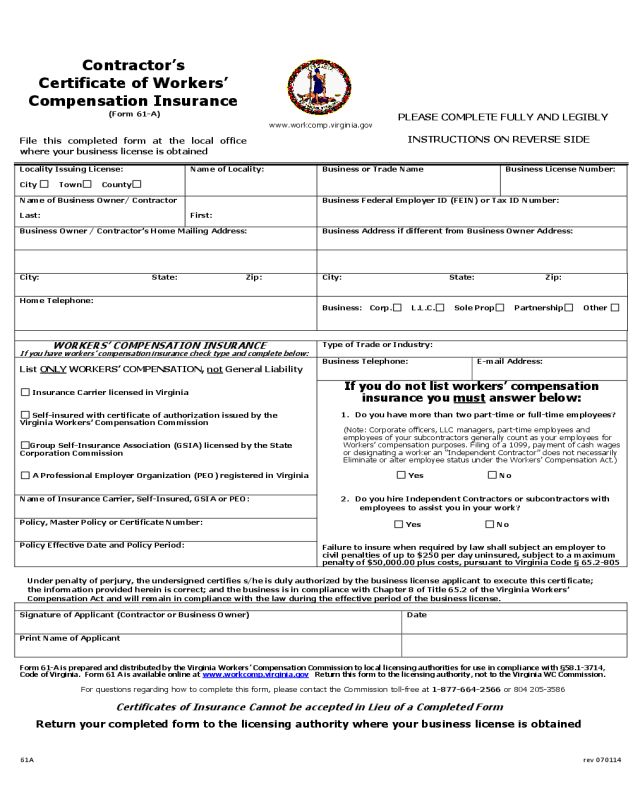

Contractor’s

Certificate of Workers’

Compensation Insurance

(Form 61-A)

File this completed form at the local office

where your business license is obtained

www.workcomp.virginia.gov

PLEASE COMPLETE FULLY AND LEGIBLY

INSTRUCTIONS ON REVERSE SIDE

Locality Issuing License:

City Town County

Name of Locality:

Business or Trade Name

Business License Number:

Name of Business Owner/ Contractor

Last:

First:

Business Federal Employer ID (FEIN) or Tax ID Number:

Business Owner / Contractor’s Home Mailing Address:

Business Address if different from Business Owner Address:

City: State: Zip:

City: State: Zip:

Home Telephone:

Business: Corp. L.L.C. Sole Prop Partnership Other

WORKERS’ COMPENSATION INSURANCE

If you have workers’ compensation insurance check type and complete below:

Type of Trade or Industry:

List ONLY WORKERS’ COMPENSATION, not General Liability

Insurance Carrier licensed in Virginia

Self-insured with certificate of authorization issued by the

Virginia Workers’ Compensation Commission

Group Self-Insurance Association (GSIA) licensed by the State

Corporation Commission

A Professional Employer Organization (PEO) registered in Virginia

Business Telephone:

E-mail Address:

If you do not list workers’ compensation

insurance you must answer below:

1. Do you have more than two part-time or full-time employees?

(Note: Corporate officers, LLC managers, part-time employees and

employees of your subcontractors generally count as your employees for

Workers’ compensation purposes. Filing of a 1099, payment of cash wages

or designating a worker an “Independent Contractor” does not necessarily

Eliminate or alter employee status under the Workers’ Compensation Act.)

Yes No

2. Do you hire Independent Contractors or subcontractors with

employees to assist you in your work?

Yes No

Failure to insure when required by law shall subject an employer to

civil penalties of up to $250 per day uninsured, subject to a maximum

penalty of $50,000.00 plus costs, pursuant to Virginia Code § 65.2-805

Name of Insurance Carrier, Self-Insured, GSIA or PEO:

Policy, Master Policy or Certificate Number:

Policy Effective Date and Policy Period:

Under penalty of perjury, the undersigned certifies s/he is duly authorized by the business license applicant to execute this certificate;

the information provided herein is correct; and the business is in compliance with Chapter 8 of Title 65.2 of the Virginia Workers’

Compensation Act and will remain in compliance with the law during the effective period of the business license.

Signature of Applicant (Contractor or Business Owner)

Date

Print Name of Applicant

Form 61-A is prepared and distributed by the Virginia Workers’ Compensation Commission to local licensing authorities for use in compliance with §58.1-3714,

Code of Virginia. Form 61 A is available online at www.workcomp.virginia.gov Return this form to the licensing authority, not to the Virginia WC Commission.

For questions regarding how to complete this form, please contact the Commission toll-free at 1-877-664-2566 or 804 205-3586

Certificates of Insurance Cannot be accepted in Lieu of a Completed Form

Return your completed form to the licensing authority where your business license is obtained

INSTRUCTIONS FOR COMPLETING THE VWC FORM 61-A

To be completed by the official issuing the business license.

1. Check one. City, Town or County.

Provide the name of locality issuing the license.

Provide business license number including any prefix or suffix.

To be completed by the contractor. All information requested is required.

2. Enter the Business owner / Contractor’s name, mailing address and phone number, all information is required.

3. Enter the complete name of business. Additionally list the trade name under which the business operates if a trade name is used.

4. Enter the business address that is used to receive mail by the U.S. Postal Service, if this address is different from the business

owner / contractor’s address.

5. Provide the Federal Employer Identification Number (FEIN) for the business. If one has not been issued, list the Temporary FEIN

issued by the Virginia Tax Dept. If you are a sole proprietor with neither, list your social security number; however it is best to

obtain a FEIN, given the restrictions on the use of social security numbers.

6. Check the legal status of the business.

7. Provide the type of trade or industry in which the business is classified.

8. Enter the business phone number if there is one and the business e-mail if there is one.

9. Provide the workers’ compensation insurance information if you have coverage. Enter

only

workers’ compensation insurance.

No other form of insurance substitutes. Provide the complete name of the insurance company or other insuring entity providing

workers’ compensation insurance coverage for the business. Also enter the policy or member number and policy effective dates.

Do not list the name of an insurance agent or agency. If you do not know or recall the name of your insurance company or

insuring entity, please contact your agent to obtain this information.

10. Out of state employers, please note, Virginia requires valid Virignia workers’ compensation coverage for work performed in

Virginia. For a business that has a valid policy based outside Virginia, if the business either performs or subcontracts work in

Virginia, the business needs valid Virginia coverage and may usually secure valid Virginia coverage with the proper Virginia

Amendatory Endorsement, adding Virginia to Item 3A of the policy. An employer from a monopolistic state must usually obtain

separate coverage from a Virginia licensed insurance carrier.

11. If you do not have / list workers’ compensation insurance on your form you must answer additional questions,

please answer whether you have more than two employees and whether you hire subcontractors to assist in your work. A

response to these questions is required.

12. Virginia workers’ compensation insurance coverage requirements. Virginia law requires that every employer who

regularly employs more than two part-time or full-time employees purchase and maintain workers' compensation insurance. A

business that hires subcontractors to assist in the work of the business or fulfill a contract of the business must count the

subcontractor’s employees when counting employees to determine if / when coverage is required. This is true even if the

subcontractor has their own workers’ compensation coverage. A contractor should gather proof of coverage from all

subcontractors hired and should not be charged insurance premium for subcontractors that have their own coverage.

Regardless, a contractor that hires subcontractors with employees must count the subcontractor’s employees when counting total

employees and determining when and whether the contractor is required to carry coverage.

13. Please ensure that the form is signed, the name of the person signing the form is printed on it and the form is properly dated.

14. For workers’ compensation insurance questions please contact the Virginia Workers’ Compensation Commission at 804 205-3586.

15. Return your completed form to the licensing authority where your business license was obtained.

Note: The state funds of West Virginia and Maryland are not authorized to write workers’ compensation insurance in Virginia.

www.workcomp.virginia.gov

DO NOT ATTACH ANY DOCUMENTS TO THE CONTRACTOR’S CERTIFICATE.