Fillable Printable Corporate Investment Declaration Form

Fillable Printable Corporate Investment Declaration Form

Corporate Investment Declaration Form

1

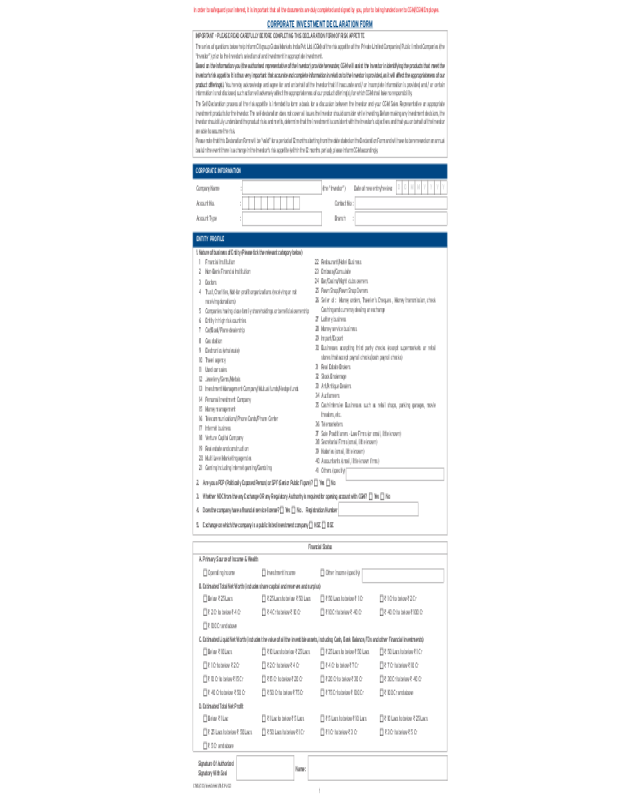

CORPORATE INVESTMENT DECLARATION FORM

CORPORATE INFORMATION

D D M M Y Y Y Y

Company Name : __________________________________________ (the “Investor”) Date of new entry/review:

Account No. : Contact No :

Account Type : Branch :

IMPORTANT – PLEASE READ CAREFULLY BEFORE COMPLETING THIS DECLARATION FORM OF RISK APPETITE

The series of questions below help inform Citigroup Global Markets India Pvt. Ltd. (CGM) of the risk appetite of the Private Limited Companies/ Public limited Companies (the

“Investor”) prior to the Investor’s selection of and investment in appropriate investment.

Based on the information you (the authorised representative of the Investor) provide hereunder, CGM will assist the Investor in identifying the products that meet the

Investor’s risk appetite. It is thus very important that accurate and complete information in relation to the Investor is provided, as it will affect the appropriateness of our

product offering(s). You hereby acknowledge and agree for and on behalf of the Investor that if inaccurate and / or incomplete information is provided, and / or certain

information is not disclosed, such action will adversely affect the appropriateness of our product offering(s), for which CGM shall take no responsibility.

The Self-Declaration process of the risk appetite is intended to form a basis for a discussion between the Investor and your CGM Sales Representative on appropriate

investment products for the Investor. The self-declaration does not cover all issues the Investor should consider while investing. Before making any investment decisions, the

Investor should fully understand the product risks and merits, determine that the investment is consistent with the Investor’s objectives and that you on behalf of the Investor

are able to assume the risk.

Please note that this Declaration Form will be “valid” for a period of 12 months starting from the date stated on the Declaration Form and will have to be renewed on an annual

basis.In the event there is a change in the Investor's risk appetite (within the 12 months period), please inform CGM accordingly.

In order to safeguard your interest, it is important that all the documents are duly completed and signed by you, prior to being handed over to CGM/CGM Employee.

ENTITY PROFILE

1. Nature of business of Entity (Please tick the relevant category below)

1 Financial Institution

2 Non-Bank Financial Institution

3 Doctors

4 Trust, Charities, Not-for-profit organizations (receiving or not

receiving donations)

5 Companies having close family shareholdings or beneficial ownership

6 Entity in high risk countries

7 Car/Boat/Plane dealership

8 Gas station

9 Electronics (wholesale)

10 Travel agency

11 Used car sales

12 Jewellery/Gems/Metals

13 Investment Management Company/Mutual funds/Hedge funds

14 Personal Investment Company

15 Money management

16 Telecommunications/Phone Cards/Phone Center

17 Internet business

18 Venture Capital Company

19 Real estate and construction

20 Multi Level Marketing agencies

21 Gaming including internet gaming/Gambling

22 Restaurant/Hotel Business

23 Embassy/Consulate

24 Bar/Casino/Night clubs owners

25 Pawn Shop/Pawn Shop Owners

26 Seller of : Money orders, Traveler’s Cheques , Money transmission, check

Cashing and currency dealing or exchange

27 Lottery business

28 Money service business

29 Import/Export

30 Businesses accepting third party checks (except supermarkets or retail

stores that accept payroll checks/cash payroll checks)

31 Real Estate Brokers

32 Stock Brokerage

33 Art/Antique Dealers

34 Auctioneers

35 Cash-Intensive Businesses such as retail shops, parking garages, movie

theaters, etc.

36 Telemarketers

37 Sole Practitioners - Law Firms (or small, little known)

38 Secretarial Firms (small, little known)

39 Notaries (small, little known)

40 Accountants (small, little known firms)

41 Others (specify)

2. Are you a PEP (Politically Exposed Person) or SPF (Senior Public Figure)? Yes No

3. Whether NOC from the any Exchange OR any Regulatory Authority is required for opening account with CGM? Yes No

4. Does the company have a financial service license? Ye s No . Registration Number

5. Exchange on which the company is a public listed investment company NSE BSE

CWA/CID/Investment/11/13-V4.0

Financial Status

A. Primary Source of Income & Wealth

Operating income Investment income Other income (specify)

B. Estimated Total Net Worth (includes share capital and reserves and surplus)

Below ` 25 Lacs ` 25 Lacs to below ` 50 Lacs ` 50 Lacs to below ` 1 Cr ` 1 Cr to below ` 2 Cr

` 2 Cr to below ` 4 Cr ` 4 Cr to below ` 10 Cr ` 10 Cr to below ` 40 Cr ` 40 Cr to below ` 100 Cr

` 100 Cr and above

C. Estimated Liquid Net Worth (includes the value of all the investible assets, including Cash, Bank Balance, FDs and other Financial Investments)

Below ` 10 Lacs ` 10 Lacs to below ` 25 Lacs ` 25 Lacs to below ` 50 Lacs ` 50 Lacs to below ` 1 Cr

` 1 Cr to below ` 2 Cr ` 2 Cr to below ` 4 Cr ` 4 Cr to below ` 7 Cr ` 7 Cr to below ` 10 Cr

` 10 Cr to below ` 15 Cr ` 15 Cr to below ` 20 Cr ` 20 Cr to below ` 30 Cr ` 30 Cr to below ` 40 Cr

` 40 Cr to below ` 50 Cr ` 50 Cr to below ` 75 Cr ` 75 Cr to below ` 100 Cr ` 100 Cr and above

D. Estimated Total Net Profit

Below ` 1 Lac ` 1 Lac to below ` 5 Lacs ` 5 Lacs to below ` 10 Lacs ` 10 Lacs to below ` 25 Lacs

` 25 Lacs to below ` 50 Lacs ` 50 Lacs to below ` 1 Cr ` 1 Cr to below ` 3 Cr ` 3 Cr to below ` 5 Cr

` 5 Cr and above

Name :

Signature Of Authorized

Signatory With Seal

2

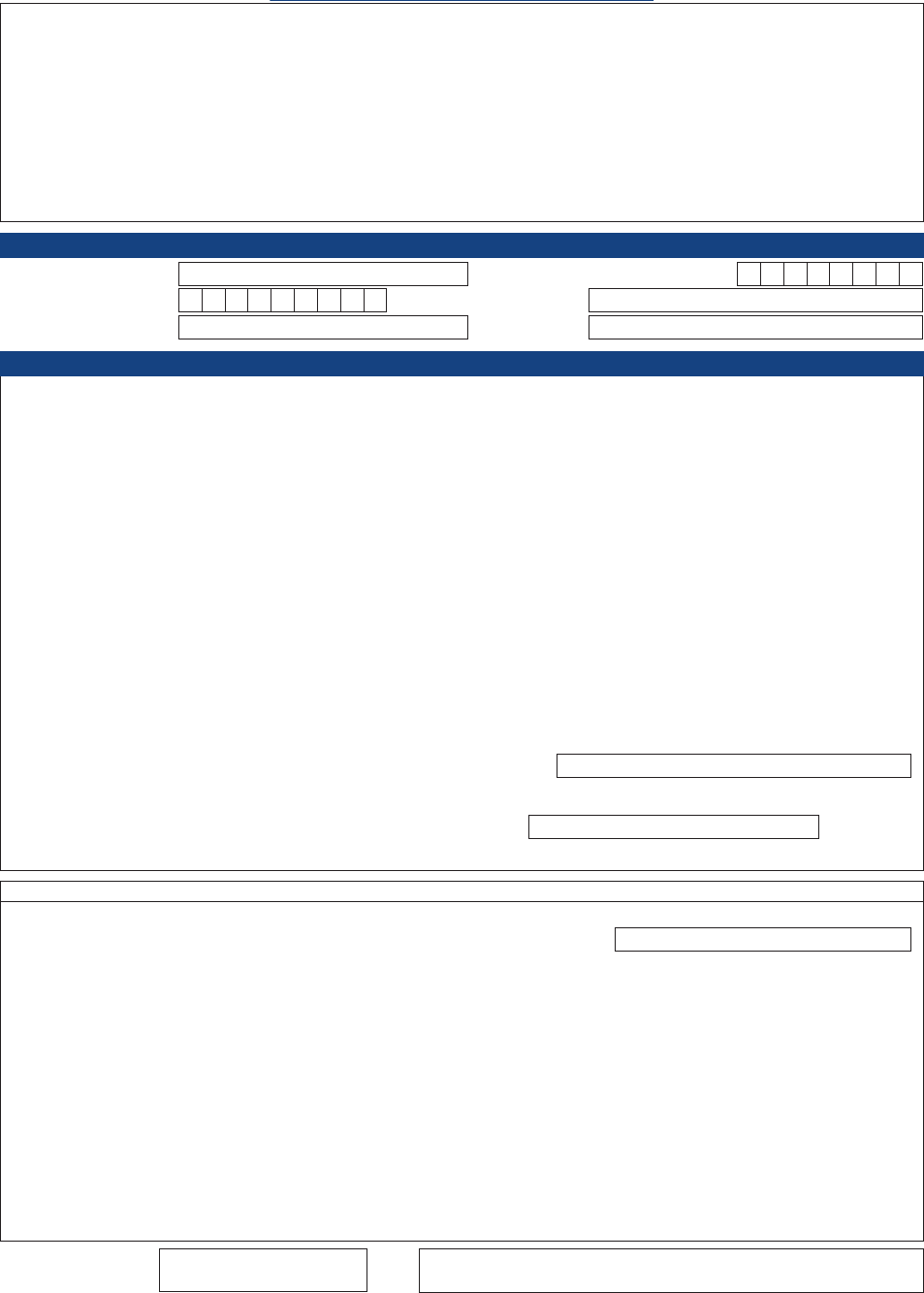

KNOWLEDGE & EXPERIENCE

Please indicate which of the following products you have prior

Knowledge and/or Experience (K&E) in

Please indicate the method of acquiring Knowledge and/or Experience below

I have Knowledge & Experience in this prod-

uct area based on past investment Experi-

ence / Education / Professional Knowledge

/other external source

(Section A)

I have been provided with

Knowledge about this product by CGM

(Section B)

Kindly tick your response under Yes or No Yes No Yes No

Mutual Funds

Bonds, Bills and Notes

Gold

Hybrid Securities (Preferred Stock, Perpetuals, convertibles)

Equities / Stocks and Shares

Structured Products (structured notes, structured deposits, ELN)

Private Equity

Derivatives (Futures, Options, Swaps)

Variable Annuities / Investment-Linked Insurance

Currency Derivatives

To be filled in separately by each person authorised to deal in securities

You as the authorised representative of the “Account” are legally empowered to make investment decisions on behalf of the Account and hence we would like to evaluate the extent

of your knowledge and familiarity with different types of investment products. “Account” means name of Entity in whose name the relationship is proposed to be opened wth CGM.

In case you have chosen your response as ‘Yes’ to any of the products under Section ‘B’ above, kindly select the most appropriate option/(s) below.

Mutual Funds

Bonds, Bills and Notes

Gold

Hybrid Securities (Preferred Stock, Perpetuals, convertibles)

Equities / Stocks and Shares

Structured Products (structured notes, structured deposits, ELN)

Private Equity

Derivatives (Futures, Options, Swaps)

Variable Annuities / Investment-Linked Insurance

Currency Derivatives

Based on your knowledge and experience, you are eligible to invest in the following categories highlighted

Kindly tick the most

appropriate option for

products where applicable

(Multiple selection allowed)

Mutual

Funds

Bonds, Bills

and Notes

Gold Hybrid

Securities

(Preferred

Stock, Per-

petuals,

convert-

ibles)

Equities /

Stocks and

Shares

Structured

Products

(structured

notes,

structured

deposits,

ELN)

Private

Equity

Derivatives

(Futures,

Options,

Swaps)

Variable

Annuities /

Invest-

ment-

Linked

Insurance

Currency

Derivatives

1. Explanation on general

product foundation given

based on training material

I/We have read and understood the investment product education materials as detailed in the General Information Document of the product category(ies). I/We

acknowledge that the risks, disclosures and other information are not an exhaustive description of

the risks involved in invest- ment transactions and will consult my

legal, regulatory, tax, financial and/or accounting advisors to the extent considered necessary, and read the offer documents or other marketing materials pertaining

to the specific product prior to entering into a financial transaction.

2. Explanation on specific

product features given

based on product fact-

sheet / marketing material

/ KIM

3. Risk disclosure explained

in detail

4. Risk and Return payoff

clearly explained with

examples

5. Prospectus given

6. Others (Please explain)

Name :

Signature Of Authorized

Signatory With Seal

CWA/CID/Investment/11/13-V4.0

3

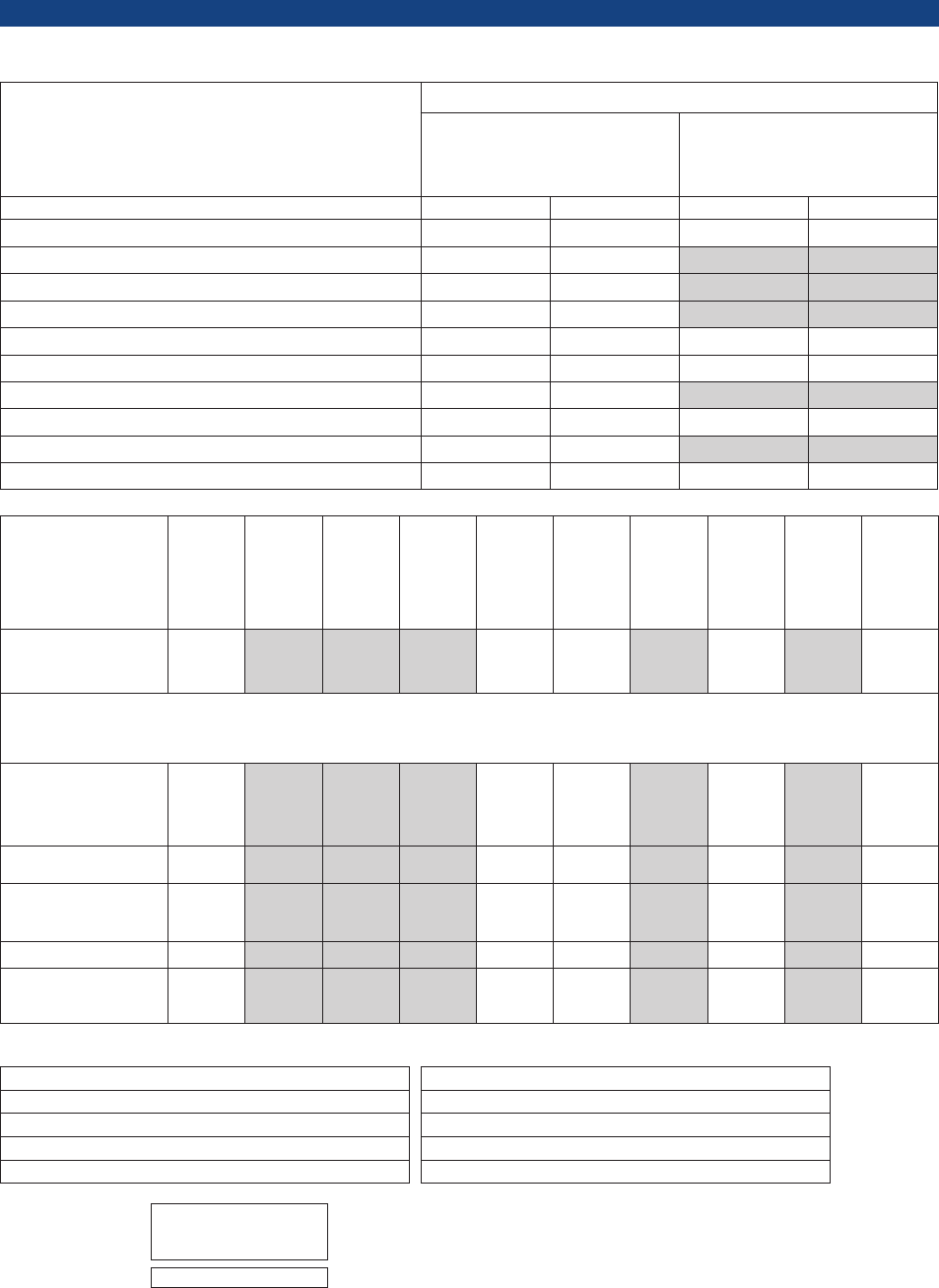

RISK APPETITE AND INVESTOR ACKNOWLEDGEMENT

Please tick one of the following that best describes the Investor’s current investment objectives and acceptable levels of fluctuation in the value of the investment:

Kindly note that the list of products shared below is indicative of the products that are commensurate with the corresponding investors risk profile and that some of the

products listed below are not currently offered by us

Please

Tick

3.A – Investment Risk Appetite

Indicative Investment and Treasury Products

IP 1 : Safety Oriented - limited to investments with no or negligible price

movements, which can be sold at short notice (less than a week in normal

circumstances) or promise to repay what you invest within a year. This

investor rating is compatible with investments or investment strategies that

aim to protect capital and generate interest income in line with money

market rates.

• Money Market Funds.

• Commercial paper rated A1P1, government bills rated BBB- or higher,

up to 1 yr maturity, local currency government securities up to 1 yr to

domestic investors.

• Transactional spot FX, Forward FX identified as hedges matching the

maturity of a loan or deposit.

IP 3 : Moderate - investment strategies with a risk of moderate negative

price movements that can be sold at short notice (less than a week in

normal circumstances) for a price that is certain and close to the recent

market average. This investor rating is compatible with investments or

investment strategies that aim to provide both regular income returns and

capital appreciation.

• Fixed rate government and corporate bonds rated A- or higher, over

10yrs to maturity, fixed rate government and corporate bonds rated

BBB- to BBB+, large cap developed market equities.

• Mutual funds, ETFs: multi-asset developed balanced growth, multi-asset

emerging market conservative, developed market large ca equity,

developed market convertible bonds, emerging market bonds, >3 yrs,

investment grade bonds, > 10 yrs, non-investment grade bonds,

long/short equity, real estate funds (liquid).

• Structured products: principal protected 90% or > protected over 5 yrs,

less than 90% protected; non-principal protected: interest rate-linked,

large cap developed market equity linked (single, basket, or indices).

IP 2: Conservative - investment strategies with a risk of limited negative

price movements that can be sold at short notice (less than a week in

normal circumstances) for a price that is certain and close to the recent

market average. This investor rating is compatible with investments or

investment strategies that aim primarily to provide regular income returns

and may provide some capital appreciation as a secondary consideration.

• Commercial paper rated below A1P1, floating rate government and

corporate bonds rated BBB- or higher, fixed rate government and

corporate bonds rated A- or higher, up to 10 yrs to maturity, local

currency government securities over 1 yr to domestic investors.

• Multi-asset developed conservative funds, investment grade bonds, <10

yrs, enhanced money market funds, emerging market bonds, <3 yrs.

• Structured products – 90% or > principal protected, up to 5 yrs, other

derivatives identified as hedges of specific underlying transactions.

IP 4: Aggressive - investment strategies with a risk of substantial

negative price movements and that you can buy investments that have a

small risk of losing their entire value, may be difficult to sell or have an

uncertain price at any given time, such that they may only be sold at a price

below the recent market average. This investor rating is compatible with

investments or investment strategies that typically aim to provide only

capital appreciation and no or little regular income returns.

• Government and corporate bonds rated BB- to BB+, convertible bonds,

all other publicly traded equities.

• Mutual funds, ETFs: multi-asset–emerging market balanced/growth,

commodities, developed market small and mid-cap equity, emerging

market equity, other hedge fund-like strategies.

• Structured products: non-principal protected commodity-linked, other

equity-linked (single, basket, or indices).

• Alternative investments: diversified strategy fund -of-hedge funds.

IP 6: Specialized Investing - Investments or financial contracts that

may have a high risk of losing their entire value or may even lose more

than your initial investment. They may also be very difficult to sell or have

a highly uncertain value at any given time, or it may not be allowable to

sell them over an extended period. This investor rating is compatible with

long term specialist investments or investment strategies that may not be

liquidated before maturity and which aim to provide very aggressive

capital appreciation over time.

• Government and corporate bonds rated CCC+ and below, all other

Public traded Equities, Futures & Options.

• Alternative investments: private equity: single manager fund, multiple

private equity investments, individual private equity investments;

private real estate: single manager, multiple property investments.

IP 5 : Very aggressive - investments or financial contracts with a risk of

substantial negative price movements, that have a significant risk of losing

their entire value, that may be difficult to sell or have an uncertain value at

any given time, or it may not be allowable to sell them over an extended

period. This investor rating is compatible with specialist investments or

investment strategies that may require an extended period to liquidate and

which seek to provide aggressive capital appreciation over time.

• Government and corporate bonds rated B- to B+.

• Structured products: non-principal protected equity or other

underlyer ‘worst of’ structures.

• Alternative investments: private equity fund- of-funds investing in

multiple sectors and vintage years; private real estate fund-of-funds

investing in multiple properties and vintage years.

• All other Public Traded Equities.

For IP6 Client who has opted for Futures & Options

a. Are F&O suitable for Investment Objectives? Yes No

b. Do you wish to enable F&O for your Account? Yes No

c. For F&O through CGM:

i. Do you want to use F&O for speculation? Yes No

ii. Do you want to use F&O for hedging / yield enhancements? Yes No

d. Are you aware of the financial risks of trading in F&O? Yes No

I represent that, for the purpose of my relationship with Citigroup Global Markets India Private Limited (CGM) under the brand Citi Wealth Advisors

(hereinafter referred to as CGM), the aforementioned contents in this form gives an accurate description of my Net Worth, Investment Objectives and Risk

profile. I represent and agree that for the purposes of my relationship with CGM, the representations made in this document are final and CGM is authorized

to ignore any other representations or outcome of analysis in any other document given by me/us to CGM.

I confirm that I have the requisite knowledge and experience in the products mentioned earlier on the form. My knowledge and experience in this/these

product(s) is based on past investment experience/education/professional knowledge and/or external sources or education provided by CGM.

I do hereby agree, declare and confirm that I shall use the services of CGM only for Equity / F&O / Third Party Products transactions ("Investment Transac-

tions") and 100% of my investments made through CGM will be in for Equity/F&O/Third Party Products related instruments. I am aware and understand that

the recommendations/advices, if any provided by CGM are solely restricted to the Investment Transactions only. I am aware and fully understand the risks

associated with Investment Transactions and related investments and I shall take appropriate and independent advice regarding the suitability of such

investments. I understand that services provided by CGM to client are non-discretionary in nature.

CWA/CID/Investment/11/13-V4.0

4

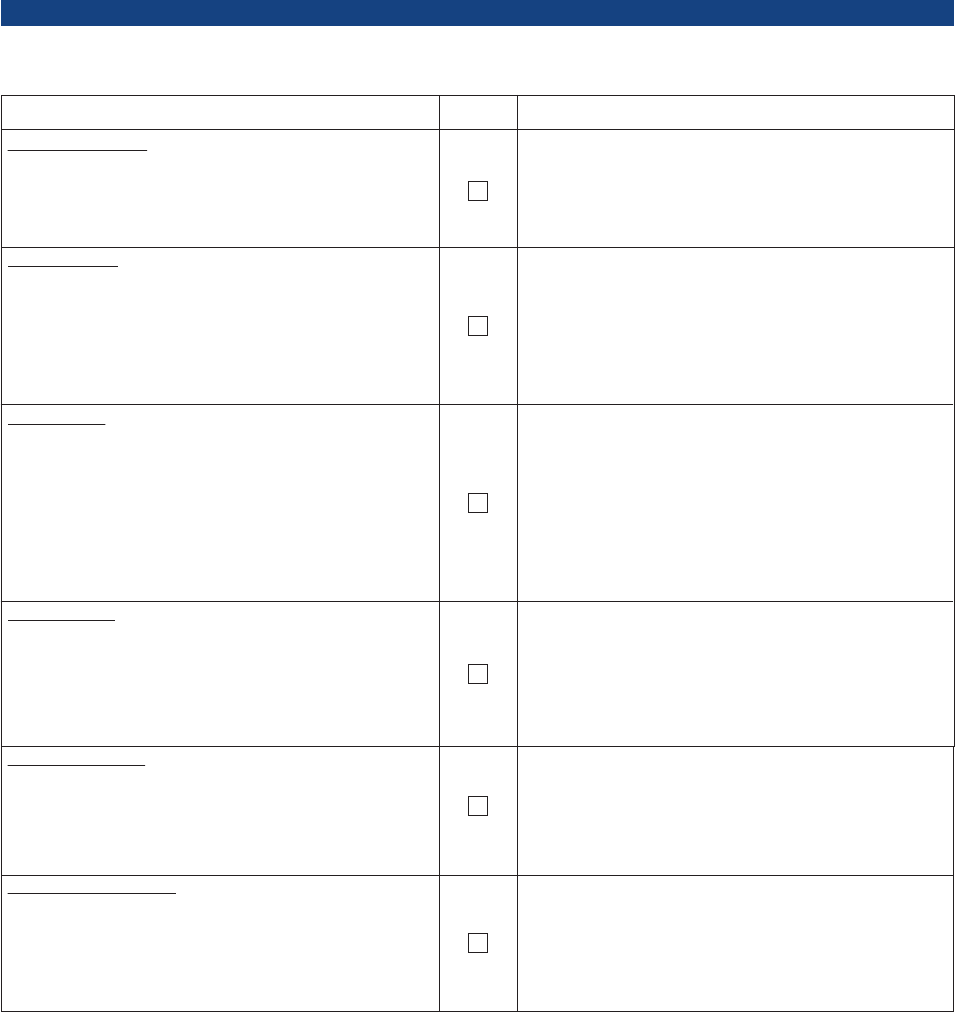

CGM USE ONLY

Section 2 - Sales and Supervisor Checks

1. Has the customer’s investment risk profile changed upwards by 2 or more risk ranks? Yes No (e.g: The customer was previously IP3 and based on the current evaluation has the

rating of IP5 or IP6)

2. Has the client opted for profile upgrade basis response in Question 1 of the profiling section Yes No

If Yes – Total number of notches upgraded in Question 1 of the profiling section 1 2

Incase any of the above is answered as ”Yes” then the supervisor must review and sign off. Reason ______________________________________________________________________

Verified by RP/BDM/EA Signature and Name Date Supervisor’s Signature

Section 4 - Service Checks

All signatories as per the BR to have signed the form

PB/RP and Supervisor to have signed in Section 1 and Section 2 above where applicable

Signatures of the authorised representatives verified

K&E confirmation by the Client on page 2 matches confirmation by the RP on the same page

In case customer has accepted (1) as the appropriate option used by the RP for imparting K&E in the K&E Section, customer acknowledgement in (1) and RP confirmation in

Section 1(3) available.

Verified by SRM Signature and Name Date

1. In case Client does not have prior experience of investing in F&O, please provide rationale why F&O trading privileges should be provided to the Client.

__________________________________________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________________________________________

2. Rationale for mismatch in Business Rules :

__________________________________________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________________________________________

3. Other remarks, if any : ______________________________________________________________________________________________________________________________

Verified by: ____________________________________________ __________________________ _____________________________

RP/BDM/EA Name & Signature Date Supervisor’s Signature

Section 3 - Equity and F&O Check

Section 1 - Sales Checks.

1. This is to confirm that I am ultimately responsible for the determination and accuracy of the Investor Rating and attest to the completion of the Client Assessment

questionnaire and the reasonableness of its results.

2. In the event that you have imparted Knowledge on Complex Products (Structured Products, Derivatives) to the concerned Investor, kindly provide a detailed assessment

of the discussion so completed by you with the Investor. ___________________________________________________________________________________________________

__________________________________________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________________________________________

3. Please tick below in the event that you have educated the investor on a product category(ies) basis product education/training materials provided by the CGM-

This is to acknowledge that I have provided the General Information document that is updated and approved by the CGM to educate the investor on the product category(ies)

Verified by RP/BDM/EA Signature and Name Date

CWA/CID/Investment/11/13-V4.0

1. A. First time profiling B. Profile Renewal Please answer the below incase you have selected B :

Your previous Corporate Investment Risk Profile is : _____________________________________________________________________________________________

Based on the information that you have provided above

Your current Corporate Investment Risk Appetite is : ____________________________________________________________________________________________

and your Risk Profile is : ____________________________________________________________________________________________

I/We are fully aware and understand the associated risks arising from my/our investment decision made for and on behalf of the Investor. I/We confirm that I/we have

given you the instruction to proceed with my/our investment made for and on behalf of the Investor. I/We understand that the Investor’s investment risk profile is valid

for a period of 12 months from the date of profiling and is renewable at least once in 12 months.

Your Account with CWA will be classified as a ‘Recommended’ Account’. In the Recommended Account you/your authorized representative will be able to perform two

types of transactions i.e.- Advised and Non- Advised Transactions.

• Advised Transactions- Such transactions result from a specific investment idea described in materials or otherwise shared by CWA.

• Non- Advised Transactions- Such transactions imply that you/your authorized representative may define all the material terms and instruct CWA to execute the

transaction at your request. You/your authorized representative may also choose to materially modify a specific transaction or investment proposition that CWA

proposes, which CWA shall then execute at your/your authorized representative’s express request subject to relevant terms and conditions and on a best effort basis.

• CWA may from time to time recommend that you/your authorized representative desist from executing certain transactions. In the event that you/your authorized

representative elect to proceed nonetheless, CWA may note the transaction appropriately and in all such cases CWA will not perform suitability assessment of such

transactions. You/your authorized representative understand that the same may affect the assessment of your risk rating, as well as investment recommendations

that may be made to you/your authorized representative by CWA from time to time.

Please note that CWA is not obliged to provide periodic Portfolio Reviews.

The form should be signed after all the details are completely filled.

Name :

Signature of authorised

signatories (with stamp)

1. 2. 3. 4.

Investment products are not bank deposits or obligations of or guaranteed by Citigroup Global Markets India Pvt. Ltd., Citigroup, Inc or any of its affiliates or subsidiaries,

are not insured byany governmental agency and are subject to investment risks, including the possible loss of the principal amount invested. Past performance is not

indicative of future results, prices can go up or down. Investors investing in funds denominated in non-local currency should be aware of the risk of exchange rate fluctua-

tions that may cause a loss of principal. This document does not constitute the distribution of any information or the making of any offer or solicitation by anyone in any

jurisdiction in which such distribution or offer is not authorised or to any person to whom it is unlawful to distribute such a document or make such an offer or solicitation.

Investment products are not available to US Persons, Residents of Canada and may not be availablein all jurisdictions. Mutual Funds are subject to market risk. Please

read the Key Information Memorandum(s)/Scheme Investment Document(s) & Statement of Additional Information/ Term Sheet/ Prospectus carefully before investing.

Investors should ensure that they understand and accept the identities of different parties and the roles that they play in relation to the various Investment Product(s).

There may bevarious actual or potential conflicts of interest between Citigroup Global Markets India Pvt. Ltd., Citigroup Capital Markets Ltd., Citigroup Inc. or their

affiliates or subsidiaries (collectively“ConnectedPersons”) and an investor of the Investment Product(s), as a result of the various investment and/or commercial

businesses and/or activities of the Connected Persons.You shallbe deemed to accept, on purchasing/subscribing/investing to a particular Investment Product(s), that any

such conflict may exist and may be prejudicial to an investment in the InvestmentProduct(s).

Portfolio diversification is an important tool to consider while making investment decisions. Concentrated positions, in particular stock/contract, may entail greater risks

than a diversified portfolio. The fact that your overall investment portfolio is sufficiently diversified may not be evident from a review that only includes your CWA

account(s). It is therefore important that you carefully review your entire investment portfolio to ensure that it meets your investment goals and is well within your risk

tolerance level, including your objectives for asset and issuer diversification. To discuss potential strategies to reduce the risk and/or volatility of a concentrated position,

please contact your Equity Advisor or contact us on care.cw[email protected]

*IRS Circular 230 Disclosure: Citigroup, Inc., its affiliates, and its employees are not in the business of providing tax or legal advice to any taxpayer outside of Citigroup,

Inc. and its affiliates. This email and any attachments are not intended or written to be used, and cannot be used or relied upon, by any such taxpayer for the purpose of

avoiding tax penalties. Tax benefits are subject to changes in the tax laws.Any such taxpayer should seek advice based on the taxpayer’s particular circumstances from

an independent tax advisor.

For more details on risk factors, terms and conditions please read the Key Information Memorandum(s)/Scheme Investment Document(s) and Statement of Additional

Information/Term Sheet/Prospectus/Sales Brochure carefully before concluding the sale.

Market Risk

The underlying Fund’s unit Price will be affected by interest rates and the performance of the underlying stocks. The funds unit price may go up or down reflecting the

market value of the underlying assets.

Citi Wealth Advisors is a retail business unit of Citigroup Global Markets India Pvt. Ltd (CGM). CGM and Citibank N.A. are separate and distinct legal entities. This document

only serves to make the reader aware of products and services available from Citi Wealth Advisors in CGM. This document does not constitute the making of any offer, or

a solicitation by anyone in any jurisdiction including in which such offer or solicitation is not authorized or to any person to whom it is unlawful to make an offer or solicita-

tion. Investments made through Citi Wealth Advisors in CGM, are not bank deposits or obligations or assurances of or guaranteed by CGM, Citibank N.A., Citigroup Inc., or

any of their respective affiliates or subsidiaries, are not insured by any governmental agency, and your investments in any product or services distributed by Citi Wealth

Advisors are subject to investment risks, and market risks, including but not limited to the possible loss of the principal amount invested. Past performance is not

indicative of future results; prices can go up or down. Citi Wealth Advisors’ products/services are available subject to applicable laws and regulations, only to Resident

Indians in select cities in India and to Non Resident Indians in select markets, and are not available to US and Canada persons. CITI and Arc Design is a service mark of

Citigroup Inc. and is used and registered throughout the world.

Registered Address:

1202, 12th Floor, First International Financial Centre, G Block, Bandra Kurla Complex, Bandra East, Mumbai – 400 051; Contact Number: 022-61759999

SEBI Registration Numbers: NSE- INB/INF/INE 231141335, BSE- INB/INF 011141331, Depository Participant Number: IN-DP-NSDL-268-

2006, DP ID for NSDL: IN303245/ SEBI PMS Registration No:- INP000001919, AMFI ARN No. 38363

Compliance Officer Details:

Name: Mr. Pankaj Gupta; email id:cgmc[email protected]om ; Contact No.: 022-61759999; Investor grievance e-mail ID:investors.[email protected]om:

Disclaimer:

CWA/CID/Investment/11/13-V4.0