Fillable Printable Submission of Investment Delcaration/ Proof - Year 2015-2016

Fillable Printable Submission of Investment Delcaration/ Proof - Year 2015-2016

Submission of Investment Delcaration/ Proof - Year 2015-2016

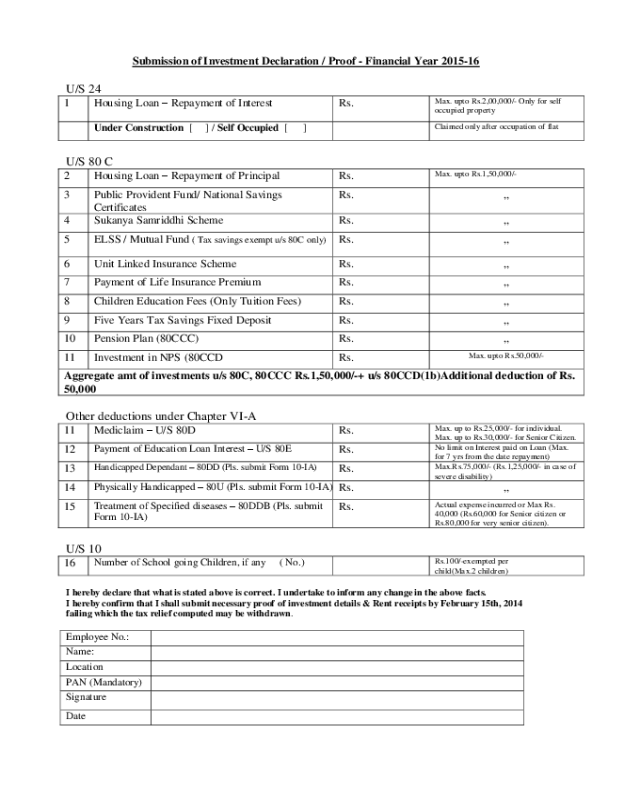

Submission of Investment Declaration / Proof - Financial Year 2015-16

U/S 24

1

Housing Loan – Repayment of Interest

Rs.

Max. upto Rs.2,00,000/- Only for self

occupied property

Under Construction [ ] / Self Occupied [ ]

Claimed only after occupation of flat

U/S 80 C

2

Housing Loan – Repayment of Principal

Rs.

Max. upto Rs.1,50,000/-

3

Public Provident Fund/ National Savings

Certificates

Rs.

,,

4

Sukanya Samriddhi Scheme

Rs.

,,

5

ELSS / Mutual Fund ( Tax savings exempt u/s 80C only)

Rs.

,,

6

Unit Linked Insurance Scheme

Rs.

,,

7

Payment of Life Insurance Premium

Rs.

,,

8

Children Education Fees (Only Tuition Fees)

Rs.

,,

9

Five Years Tax Savings Fixed Deposit

Rs.

,,

10

Pension Plan (80CCC)

Rs.

,,

11

Investment in NPS (80CCD

Rs.

Max. upto Rs.50,000/-

Aggregate amt of investments u/s 80C, 80CCC Rs.1,50,000/-+ u/s 80CCD(1b)Additional deduction of Rs.

50,000

Other deductions under Chapter VI-A

11

Mediclaim – U/S 80D

Rs.

Max. up to Rs.25,000/- for individual.

Max. up to Rs.30,000/- for Senior Citizen.

12

Payment of Education Loan Interest – U/S 80E

Rs.

No limit on Interest paid on Loan (Max.

for 7 yrs from the date repayment)

13

Handicapped Dependant – 80DD (Pls. submit Form 10-IA)

Rs.

Max.Rs.75,000/- (Rs.1,25,000/- in case of

severe disability)

14

Physically Handicapped – 80U (Pls. submit Form 10-IA)

Rs.

,,

15

Treatment of Specified diseases – 80DDB (Pls. submit

Form 10-IA)

Rs.

Actual expense incurred or Max Rs.

40,000 (Rs.60,000 for Senior citizen or

Rs.80,000 for very senior citizen).

U/S 10

16

Number of School going Children, if any ( No.)

Rs.100/-exempted per

child(Max.2 children)

I hereby declare that what is stated above is correct. I undertake to inform any change in the above facts.

I hereby confirm that I shall submit necessary proof of investment details & Rent receipts by February 15th, 2014

failing which the tax relief computed may be withdrawn.

Employee No.:

Name:

Location

PAN (Mandatory)

Signature

Date