Fillable Printable Cost Effectiveness Analysis

Fillable Printable Cost Effectiveness Analysis

Cost Effectiveness Analysis

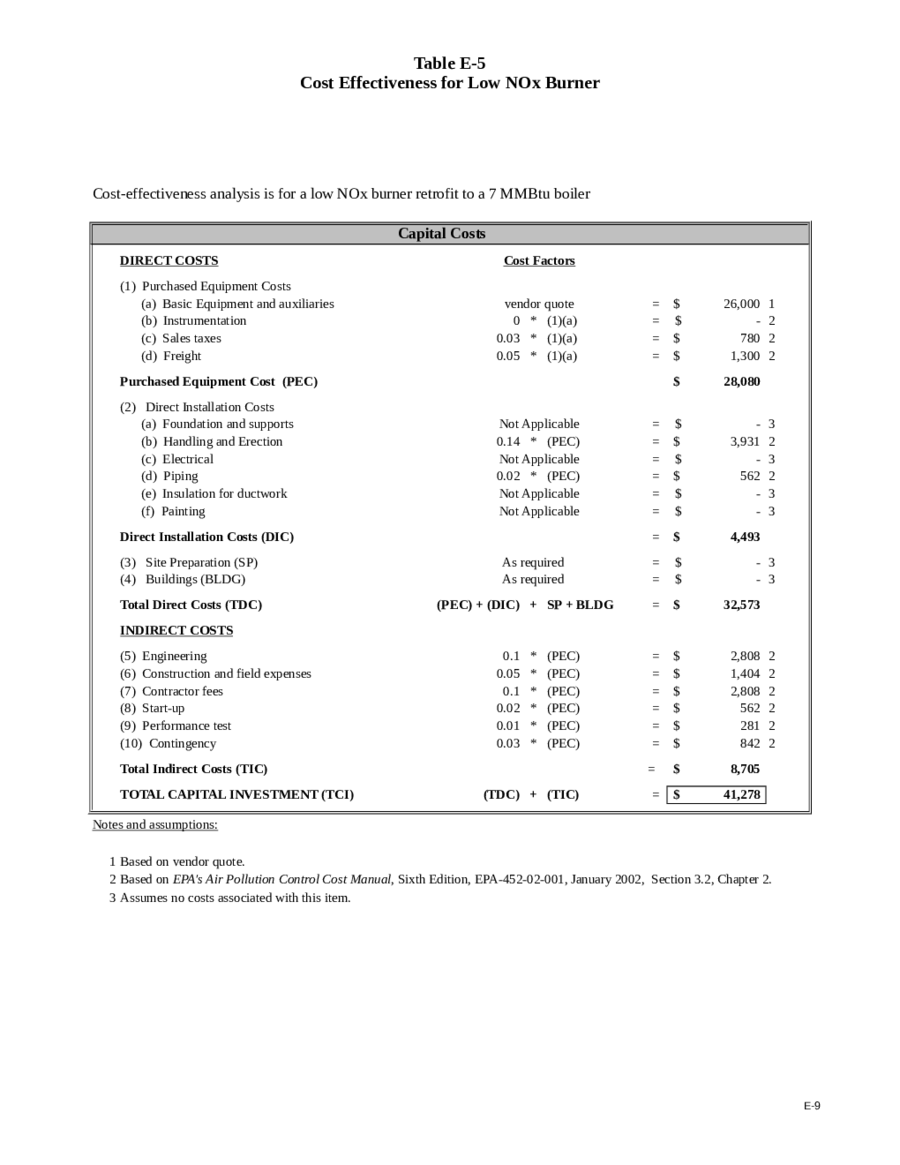

Table E-5

Cost Effectiveness for Low NOx Burner

E-9

Cost-effectiveness analysis is for a low NOx burner retrofit to a 7 MMBtu boiler

Capital Costs

DIRECT COSTS Cost Factors

(1) Purchased Equipment Costs

(a) Basic Equipment and auxiliaries vendor quote = $ 26,000 1

(b) Instrumentation 0 * (1)(a) = $ - 2

(c) Sales taxes 0.03 * (1)(a) = $ 780 2

(d) Freight 0.05 * (1)(a) = $ 1,300 2

Purchased Equipment Cost (PEC) $ 28,080

(2) Direct Installation Costs

(a) Foundation and supports Not Applicable = $ - 3

(b) Handling and Erection 0.14 * (PEC) = $ 3,931 2

(c) Electrical Not Applicable = $ - 3

(d) Piping 0.02 * (PEC) = $ 562 2

(e) Insulation for ductwork Not Applicable = $ - 3

(f) Painting Not Applicable = $ - 3

Direct Installation Costs (DIC) = $ 4,493

(3) Site Preparation (SP) As required = $ - 3

(4) Buildings (BLDG) As required = $ - 3

Total Direct Costs (TDC) (PEC) + (DIC) + SP + BLDG = $ 32,573

INDIRECT COSTS

(5) Engineering 0.1 * (PEC) = $ 2,808 2

(6) Construction and field expenses 0.05 * (PEC) = $ 1,404 2

(7) Contractor fees 0.1 * (PEC) = $ 2,808 2

(8) Start-up 0.02 * (PEC) = $ 562 2

(9) Performance test 0.01 * (PEC) = $ 281 2

(10) Contingency 0.03 * (PEC) = $ 842 2

Total Indirect Costs (TIC) = $ 8,705

TOTAL CAPITAL INVESTMENT (TCI) (TDC) + (TIC) = $ 41,278

Notes and assumptions:

1 Based on vendor quote.

2

3 Assumes no costs associated with this item.

Based on EPA's Air Pollution Control Cost Manual, Sixth Edition, EPA-452-02-001, January 2002, Section 3.2, Chapter 2.

Table E-5

Cost Effectiveness for Low NOx Burner

E-10

Annualized Costs

DIRECT ANNUAL COSTS Cost Factors

(1) Operating Labor 8 hours/year * $75 = $ 600

(2) Supervisory Labor 15% of (1) = $ 90 4

(3) Maintenance Labor 8 hours/year * $75 = $ 600

(4) Maintenance Materials 100% of (3) = $ 600 4

(6) Utilities

Fuel: 0 MMcf/yr * $0 = $ - 6

Electricity: 0 kW-hr * $0 = $ - 6

Total Direct Annual Costs (TDAC) = $ 1,890

INDIRECT ANNUAL COSTS

(7) Overhead 60% of (1)+(2)+(3)+(4) = $ 1,134 4

(8) Administrative Charges 2% of (TCI) = $ 826 4

(9) Property Tax 1% of (TCI) = $ 413 4

(10) Insurance 1% of (TCI) = $ 413 4

(11) Capital Recovery $41,278 * 0.142 = $ 5,861

Total Indirect Annual Costs (TIAC) = $ 8,647

TOTAL ANNUALIZED COSTS (TAC) (TDAC) + (TIAC) = $ 10,537

Cost Effectiveness Summary

TOTAL TONS NOx REMOVED PER YEAR = 2 8

COST EFFECTIVENESS ($ per ton removed) (TAC) / TPY) = $ 5,268

Notes and assumptions:

4

5 Annual operating and maintenance labor costs are assumed.

6 Assumes no costs associated with increased fuel and electrical consumption.

7 Based on the Total Capital Investment (TCI) and a capital recovery factor based on a 10-year equipment life

and a 7% interest rate.

8 Emissions reduction based on vendor information.

4,5

4, 5

4, 7

Based on EPA's Air Pollution Control Cost Manual, Sixth Edition, EPA-452-02-001, January 2002, Section 3.2, Chapter 2.