Fillable Printable Criminal Offenses Statement

Fillable Printable Criminal Offenses Statement

Criminal Offenses Statement

1of 1 Disclosure of Criminal Offenses Last updated 01/2015

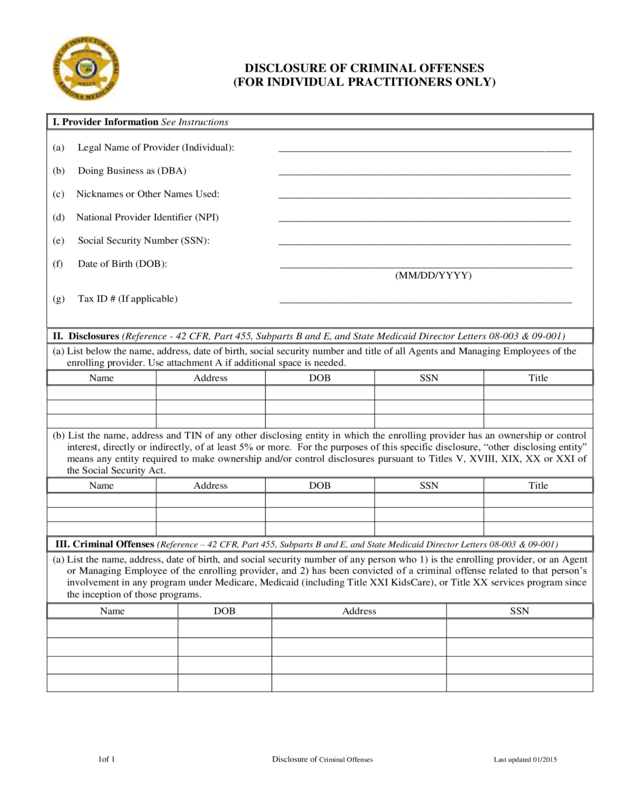

DISCLOSURE OF CRIMINAL OFFENSES

(FOR INDIVIDUAL PRACTITIONERS ONLY)

I. Provider Information See Instructions

(a) Legal Name of Provider (Individual): ________________________________________________________

(b) Doing Business as (DBA) ________________________________________________________

(c) Nicknames or Other Names Used: ________________________________________________________

(d) National Provider Identifier (NPI) ________________________________________________________

(e) Social Security Number (SSN): ________________________________________________________

(f) Date of Birth (DOB): ________________________________________________________

(MM/DD/YYYY)

(g) Tax ID # (If applicable) ________________________________________________________

II. Disclosures (Reference - 42 CFR, Part 455, Subparts B and E, and State Medicaid Director Letters 08-003 & 09-001)

(a) List below the name, address, date of birth, social security number and title of all Agents and Managing Employees of the

enrolling provider. Use attachment A if additional space is needed.

Name

Address

DOB

SSN

Title

(b) List the name, address and TIN of any other disclosing entity in which the enrolling provider has an ownership or control

interest, directly or indirectly, of at least 5% or more. For the purposes of this specific disclosure, “other disclosing entity”

means any entity required tomake ownership and/or control disclosures pursuant toTitles V, XVIII, XIX, XX or XXI of

the Social Security Act.

Name

Address

DOB

SSN

Title

III. Criminal Offenses (Reference –42 CFR, Part 455, Subparts B and E, and State Medicaid Director Letters 08-003 & 09-001)

(a) List the name, address, date of birth, and social security number of any person who 1) is the enrolling provider, or an Agent

or Managing Employee of the enrolling provider,and 2) has been convicted of a criminal offense relatedto that person’s

involvement in any program under Medicare, Medicaid (including Title XXI KidsCare), or Title XX services program since

the inception of those programs.

Name

DOB

Address

SSN

1of 1 Disclosure of Criminal Offenses Last updated 01/2015

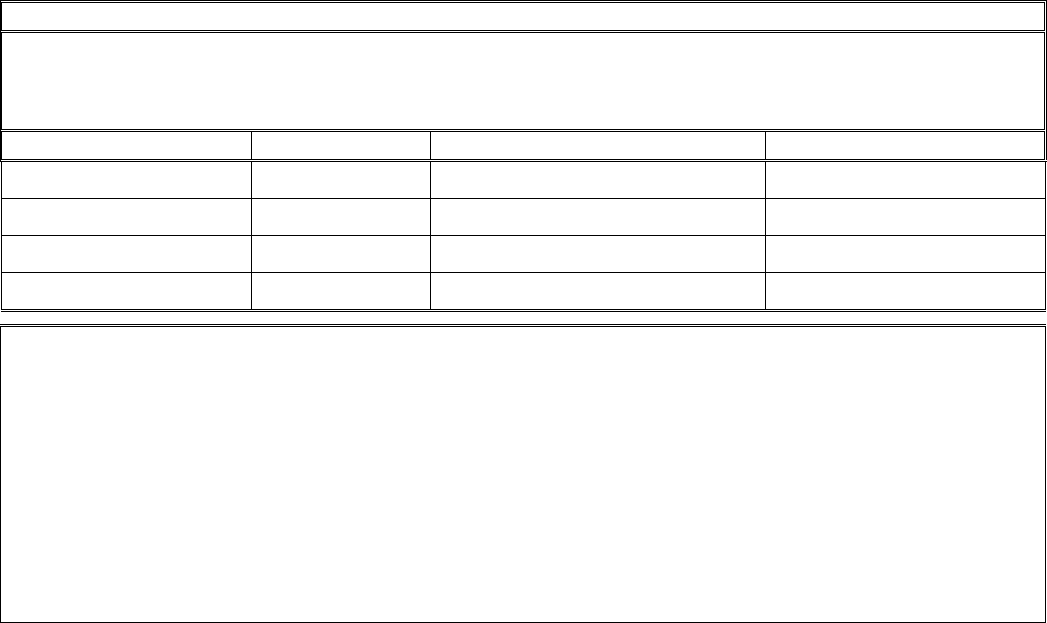

III. Criminal Offenses (Reference-42CFR, Part 455, Subparts B and E, and SMLD 08-003 & 09-001)

(b) List the name, DOB, address and SSN of any person who 1) is the enrolling provider,oris an Agent or Managing

Employee of the enrolling provider, and 2) has been suspended or debarred from participation in Medicare, Medicaid

(including Title XXI KidsCare) or Title XX services program since the inception of those programs, or has been listed by

the U.S. Department of Health and Human Services as an excluded provider.

Name

DOB

Address

SSN

I affirm under penalty of law that the information I have provided for this form is true, accurate and complete to the best of my

knowledge. If the provider is using an Authorized Representative, the SSN and DOB are mandatory fields.

_______________________________________________________________________________ _____________

Print Name of provider or Authorized RepresentativeSSNDOB

______________________________________________________________________________________

Signature of Provider or Authorized RepresentativeDate

Reset

1of 1 Disclosure of Criminal Offenses Last updated 01/2015

Instructions for Criminal Offenses Disclosures

These instructions are for use with the Disclosure of Criminal Offenses form.This form may be used solely by individual practitioners and not by

any business organization. Definitions of the terms used in this form are included at the end of this document. Please answer all questions as of the

current date.

Completion and submission of this form is a federal andstate requirement, and a condition of participation in the Medicaidprogram. Failure to

submit complete and accurate information may cause AHCCCS to refuse to enter into an agreement or contract with the individual practitioner, or

to terminate existing agreements. These disclosures are required under 42 CFR Part 455, Subparts B and E.

I. Enrolling Provider Information

Complete this section with information about yourself as the provider entity. Specify the provider’s name, (legal name reported

to the IRS), other names used, the Federal Tax ID associated with the provider (FEIN or SSN), the National ProviderIdentifier (NPI),and the

Doing Business As (DBA) name, as applicable.

II.Disclosures

The disclosures of agents and managing employees, along with the Enrolling Provider’s information, are necessary for AHCCCS tocomplete its

screening obligations under 42 CFR Part 455, Subpart E. AHCCCS also requires disclosures regarding the Enrolling Provider’s ownership or

control interests in other disclosing entities.

III.Criminal Offenses

Thissection is about yourself asindividual provider and any person who is associatedwith your practice or who is associated with you for

purposes of the provision of services under the terms of the provider agreement with AHCCCS.

Definitions

Agent means a person who has been delegated the authority to obligate or act on behalf of the entity.

Control interest is defined as the operation direction or management of disclosing entity which may be maintained by any or all of the following

devices: the ability or authority, expressed or reserved, to amend or change the corporate identity (i.e., joint venture agreement, unincorporated

business status) of the disclosing entity; the ability orauthority to nominate or name members of the Board of Director or Trustees of the

disclosing entity; the ability orauthority, expressed or reserved, to amend or change the bylaws, constitution, or other operating or management

direction of the disclosing entity; the right to control any or all of the assets or other property of the disclosing entity upon the sale or dissolution

of that entity; the ability or authority, expressed or reserved, to control the sale of any or all or the assets, to encumbersuch assets by way of

mortgage or other indebtedness, to dissolve the entity or to arrange for the sale or transfer of the disclosing entity to new ownership or control.

Disclosing Entity:A Medicaid provider other than an individual practitioner or group of practitioners.

Direct ownership/control interestis defined as the possession of stock, equity in capital or any interest in the profits in the profits of the

disclosing entity.

Group of Practitioners: Two or more health care practitioners who practice their professionat acommon location (whether or not they share

common facilities, common supporting staff, or common equipment.

Indirect ownershipis defined as ownership interest in an entity that had direct or indirect ownership interest in the disclosing entity. The amount

of indirect ownership in the disclosing entity that is held by any other entity is determined by multiplying thepercentage of ownership interest at

each level. An indirect ownership interest must be reported if it equates toan ownership interest of 5percent or more in the disclosing entity.

Example: IfA owns 10 percent of the stock in a corporation that owns80percent of the stock of the disclosing entity. A’s interest equates to an 8

percent indirect ownership and must be reported.

Managing employeemeans a general manager, business manager, administrator, director or other individual who exercises operational or

managerial control over, or who directly or indirectly conducts the day to day operation of the disclosing entity.

Other Disclosing Entity: any entity required to make ownership and/or control disclosures pursuant to Titles V, XVIII, XIX, XX or XXI of the

Social Security Act.

Person with an ownership or control interest is a person or corporation that:

(a) Has an ownership interest totaling 5 percent or more in a disclosing entity.

(b) Has an indirect ownership interest equal to 5 percent or more in a disclosing entity.

(c) Has a combination of direct and indirect ownership interests equal to 5 percent or more in a disclosing entity.

(d) Owns an interest of 5 percent or more in any mortgage, deed of trust, note, or other obligationsecuredby thedisclosing entity if that interest

equals at least 5 percent of the value of the property or assets of the disclosing entity.

(e) Is an officer or director of a disclosing entity that is organized as a corporation.

(f) Is a partner in a disclosing entity that is organized as a partnership.