Fillable Printable Customs Declaration - Great Britain

Fillable Printable Customs Declaration - Great Britain

Customs Declaration - Great Britain

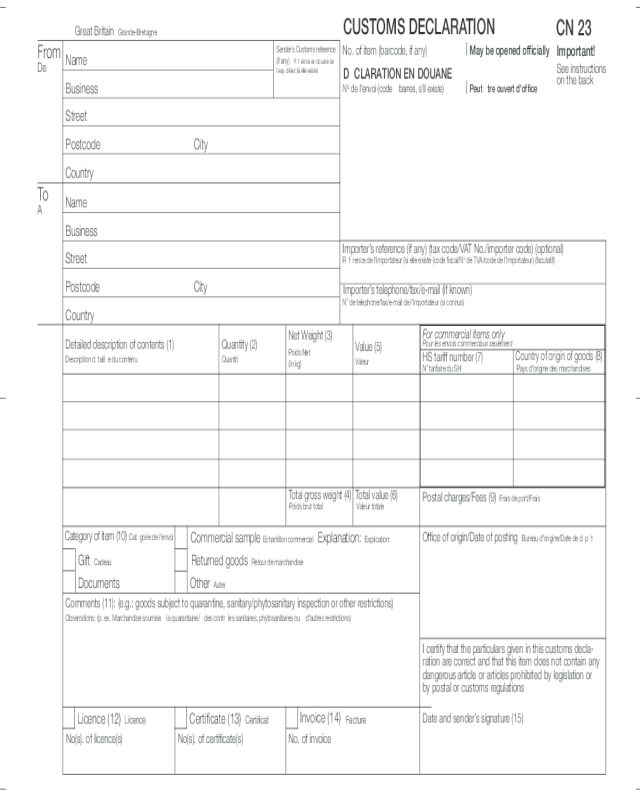

CUSTOMS DECLARATION

No. of item (barcode, if any)

CN 23

Detailed description of contents (1)

Country of origin of goods (8)

HS tariff number (7)

Office of origin/Date of posting

Bureau d'origine/Date de dépôt

May be opened officially

Great Britain Grande-Bretagne

Fr

De

A

om

To

Sender’s Customs reference

(if any) Référence en douane de

l'expéditeur (si elle existe)

I certify that the particulars given in this customs decla-

ration are correct and that this item does not contain any

dangerous article or articles prohibited by legislation or

by postal or customs regulations

Date and sender’s signature (15)

DÉCLARATION EN DOUANE

N

o

de l'envoi (code à barres, s'il existe) Peut être ouvert d'office

For commercial items only

Pour les envois commerciaux seulement

N

o

tarifaire du SH Pays d'origine des marchandises

Importer’

Référence de l'importateur (si elle existe (code fiscal/

N

o

de TVA/code de l'importateur) (facutatif)

N

o

de telephone/fax/e-mail de l'importateur (si connus)

s reference (if any) (tax code/VAT No./importer code) (optional)

Comments (11): (e.g.: goods subject to quarantine, sanitary/phytosanitary inspection or other r

Obserrations: (p. ex. Marchandise soumise à la quarantaine/à des contrôles sanitaires, phytosanitaires ou à d'autres restrictions)

estrictions)

Name

Business

Street

Postcode

Country

City

Name

Business

Street

Postcode City

Country

No(s). of certificate(s)No(s). of licence(s)

Value (5)

Certificate (13) Certificat Facture

Documents

Returned goods

Retour de marchandise

Importer’s telephone/fax/e-mail (if known)

Net Weight (3)

Licence (12) Licence

Category of item (10) Catégorie de l'envoi

Other Autre

Total gross weight (4)

T

Valeur totalePoids brut total

otal value (6)

Gift Cadeau

Explanation: Explication:

No. of invoice

Invoice (14)

Commercial sample

Echantillon commercial

Quantity (2)

Description détaillée du contenu

Valeur

Poids Net

(in kg)

Quantité

Postal charges/Fees (9) Frais de port/Frais

Important!

See instructions

on the back

P400/0096/19 8/15/03 1:32 PM Page 1

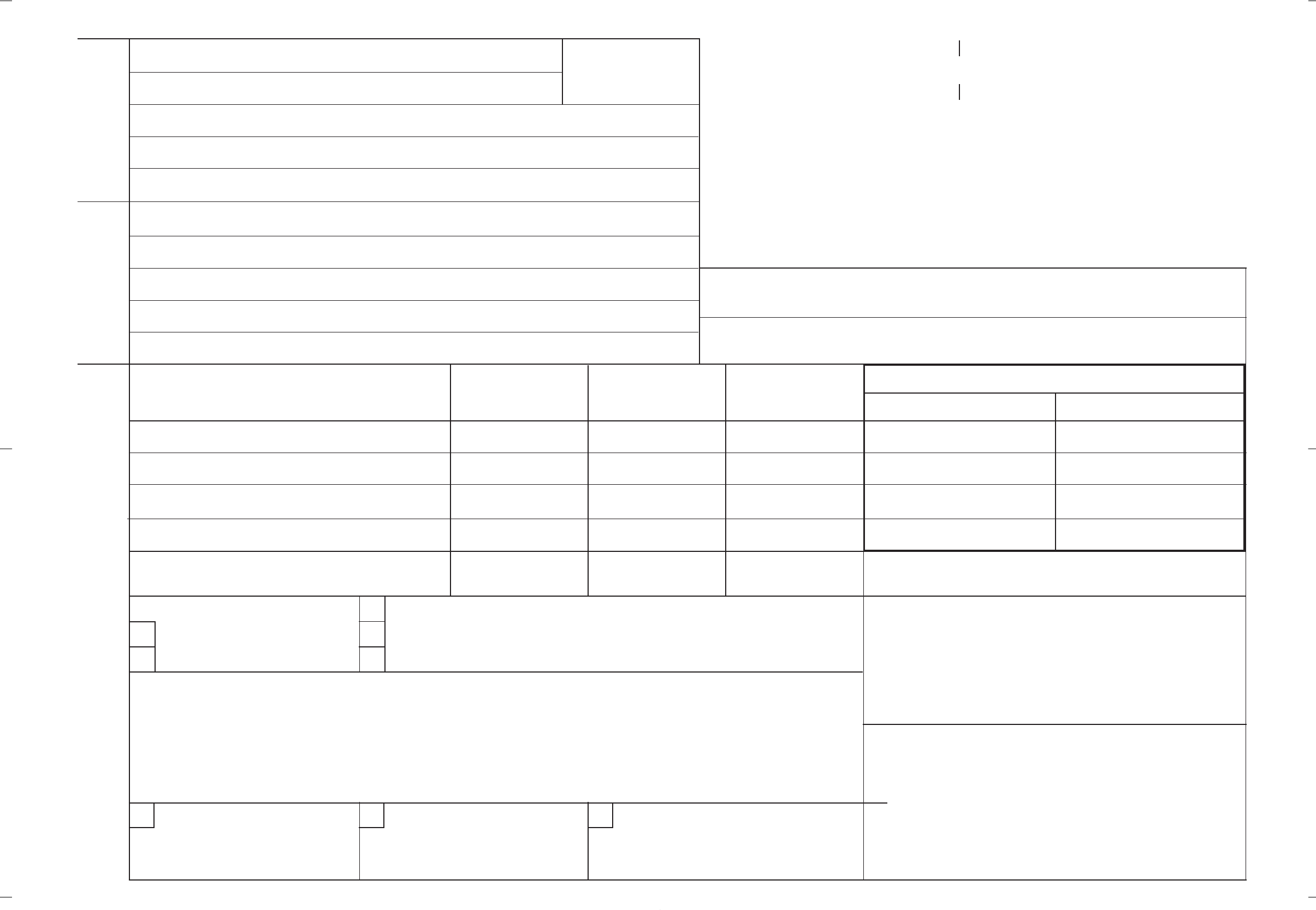

Instructions

You should attach this Customs declaration and accompanying documents securely to the outside of the item, preferably in an adhesive transparent envelope.

If the declaration is not clearly visible on the outside, or if you prefer to enclose it inside the item, you must fix a label to the outside indicating the presence of a

customs declaration.

To accelerate customs clearance, complete this declaration in English, French or in a language accepted in the destination country.

To clear your item, the Customs in the country of destination need to know exactly what the contents are. You must therefore complete your declaration fully and

legibly; otherwise, delay and inconvenience may result for the addressee. A false or misleading declaration may lead to a fine or to seizure of the item.

Your goods may be subject to restrictions. It is your responsibility to enquire into import and export regulations (prohibitions, restrictions such as quarantine,

pharmaceutical restrictions, etc.) and to find out what documents, if any (commercial invoice, certificate of origin, health certificate, licence, authorization for goods

subject to quarantine (plant, animal, food products, etc.) are required in the destination country.

Commercial item means any goods exported/imported in the course of a business transaction, whether or not they are sold for money or exchanged.

(1) Give a detailed description of each article in the item, e.g. “men’s cotton shirts”. General descriptions, e.g. “spare parts”, “samples” or “food products” are not

permitted.

(2) Give the quantity of each article and the unit of measurement used.

(3) and (4)

Give the net weight of each article (in kg). Give the total weight of the item (in kg), including packaging, which corresponds to the weight used to

calculate the postage.

(5) and (6) Give the value of each article and the total, indicating the currency used (e.g. GBP for pounds sterling).

(7) and (8)

The HS tariff number (6-digit) must be based on the Harmonized Commodity Description and Coding System developed by the World Customs

Organization. “Country of origin” means the country where the goods originated, e.g. were produced/manufactured or assembled. Senders of commercial items

are advised to supply this information as it will assist Customs in processing the items.

(9) Give the amount of postage paid to the Post for the item. Specify separately any other charges, e.g. insurance.

(10) Tick the box or boxes specifying the category of item.

(11) Provide details if the contents are subject to quarantine (plant, animal, food products, etc.) or other restrictions.

(12), (13) and (14) If your item is accompanied by a licence or a certificate, tick the appropriate box and state the number. You should attach an invoice for all

commercial items.

(15) Your signature and the date confirm your liability for the item.

P400/0096/19 8/15/03 1:32 PM Page 2