Fillable Printable Export Declaration - Australia

Fillable Printable Export Declaration - Australia

Export Declaration - Australia

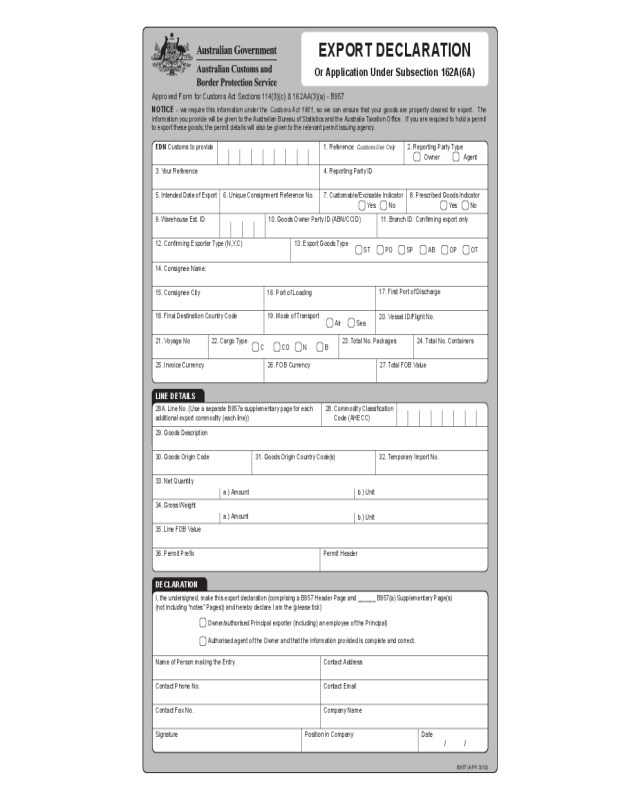

EXPORT DECLARATION

Or Application Under Subsection 162A(6A)

NOTICE - we require this information under the Customs Act 1901, so we can ensure that your goods are property cleared for export. The

information you provide will be given to the Australian Bureau of Statistics and the Australia Taxation Ofce. If you are required to hold a permit

to export these goods, the permit details will also be given to the relevant permit issuing agency.

Approved Form for Customs Act Sections 114(3)(c) & 162AA(3)(a) - B957

B957 (APR 2010)

EDN Customs to provide 1. Reference: Customs Use Only 2. Reporting Party Type

Owner Agent

4. Reporting Party ID

3. Your Reference

5. Intended Date of Export

9. Warehouse Est. ID

7. Customable/Excisable Indicator 8. Prescribed Goods Indicator

Yes

No

6. Unique Consignment Reference No.

10. Goods Owner Party ID (ABN/CCID) 11. Branch ID: Conrming export only

12. Conrming Exporter Type (N,Y,C) 13. Export Goods Type

Yes

No

ST PO SP AB OP OT

14. Consignee Name:

15. Consignee City 16. Port of Loading

17. First Port of Discharge

20. Vessel ID/Flight No.

19. Mode of Transport

Air

Sea

18. Final Destination Country Code

21. Voyage No

22. Cargo Type

23. Total No. Packages

24. Total No. Containers

C CO N B

25. Invoice Currency

26. FOB Currency 27. Total FOB Value

LINE DETAILS

28. Commodity Classication

Code (AHECC)

28A. Line No. (Use a separate B957a supplementary page for each

additional export commodity (each line))

29. Goods Description

30. Goods Origin Code 31. Goods Origin Country Code(s)

32. Temporary Import No.

33. Net Quantity

a.) Amount b.) Unit

b.) Unit

a.) Amount

34. Gross Weight

35. Line FOB Value

36. Permit Prex Permit Header

DECLARATION

I, the undersigned, make this export declaration (comprising a B957 Header Page and ______ B957(a) Supplementary Page(s)

(not including “notes” Pages)) and hereby declare I am the (please tick)

Owner/authorised Principal exporter (including) an employee of the Principal)

Authorised agent of the Owner and that the information provided is complete and correct.

Name of Person making the Entry Contact Address

Contact Phone No.

Contact Fax No.

Signature

Contact Email

Company Name

Date

Position in Company

/ /

B957 (APR 2010)

Notes for Completing an Export Declaration

1. Customs File Reference

Customs Use. Leave Blank.

2. Reporting Party Type (mandatory)

Tick either the Owner or Agent box to identify the Reporting Party

Type.

3. Your Reference (mandatory)

This reference must be unique and be used for both your les and

to differentiate between consignments.

4. Reporting Party ID (mandatory)

The Customs identier of the party lodging the declaration.

The identier must be either an Australian Business Number (ABN)

or Customs Client Identier (CCID).

5. Intended date of Export (mandatory)

Expressed as DD/MM/YYYY.

6. Unique Consignment Reference No. (Optional)

For use as an alternative release process, where a Contingency

Customs Authority Number (C-CAN) is quoted to Customs and

Border Protection.

7. Customable/Excisable Indicator (mandatory)

Show whether or not the goods would be subject to Customs and

Border Protection Excise duty if they were to be delivered into

home consumption rather than being exported.

Tick Y for ‘Yes’

Tick N for ‘No’

8. Prescribed Goods Indicator (mandatory)

The code indicating whether or not goods covered by the declaration

are prescribed goods under section 102A of the Customs Act 1901

(the Act):

Tick Y for ‘Yes’

Tick N for ‘No’

9. Warehouse Establishment ID (mandatory if Customable /

Excisable Indicator is Yes)

Establishment code of the warehouse or excise place from which

the goods are to be removed.

10. Goods Owner Party ID (mandatory)

The Customs Owner Party ID of the common law owner of the

goods. This must be either an Australian Business Number (ABN)

or a Customs Client Identier (CCID). If Reporting Party Type

is ‘Agent’, the ABN or CCID for this item cannot be the same as

Reporting Party ID.

11. Branch ID

An identier that is linked to the Goods Owner Party ID, used to

further identify the party within that organisation.

12. ConrmingExporterType(mandatory)

A code indicating whether the exporter has conrming export

status and proposes to rely on that status in relation to goods in

the declaration.

Conrming: Y

Non Conrming: N

Conrmed: C

13. Export Goods Type (mandatory)

Please tick the appropriate box.

Stores: ST

Postal: PO

Spares: SP

Accompanied Baggage: AB

Own Power: OP

Other: OT

14. Consignee Name (mandatory)

The name of the person/organisation taking physical possession

of the goods. This should be the principal, not a bank, freight

forwarder, etc.

15. Consignee City (mandatory)

The city/town in which the person/organisation who takes nal

physical possession of the goods is located

16. Port of Loading (mandatory)

The port in Australia where the goods are loaded on board a vessel

to begin their international voyage.

17. First Port of Discharge (mandatory)

The name of the rst port of discharge overseas.

18. Final Destination Country Code (mandatory)

The name of the country that is to be the nal destination of the

goods.

19. Mode of Transport (mandatory unless Export Goods Type is

PO, then leave blank)

Tick the appropriate box

20. Vessel ID/Flight No (mandatory if Export Goods is ‘ST’, ‘SP’ or

‘AB’)

The Lloyd’s identity number, registration number of the aircraft, or

Customs identier.

21. Voyage No (mandatory if Vessel Id/Flight No. requires a Vessel

ID) A unique voyage number of the vessel carrying the goods.

22. Cargo Type

Please tick the appropriate box.

Containerised: C

Co-Combination: CO

Non-Containerised: N

Bulk: B

23. Total No Packages (mandatory if Mode of Transport is air or if

Mode of Transport is sea and Cargo Type is ‘N’ or ‘CO’)

24. Total No Containers (mandatory if Mode of Transport is ‘S’

and Cargo Type is ‘C’ or ‘CO”)

“Containers” refers to the Sea Cargo Containers.

25. Invoice Currency (mandatory)

26. FOB Currency (mandatory)

i/e. Australian dollars, etc.

27. Total FOB Value (mandatory)

The total free on board (FOB) value of the goods, including all

costs incidental to the sale and delivery of the goods on to the

exporting vessel/aircraft. No discount given is to be deducted from

the true value of the goods. The FOB value should be expressed

to the nearest dollar. It should be noted that FOB does not include

overseas freight and insurance. The FOB values of samples must

be shown as the market value of the goods as if they were for

sale.

28A. Line No (mandatory)

A supplementary page must be completed for each separate

commodity as identied by the AHECC code (see Commodity

Classication). If the goods to be exported are minerals requiring

an assay, use the B957a supplementary page.

28. CommodityClassication(mandatory)

Australian Harmonized Export Commodity Classication (AHECC)

code is statistical classication for the particular commodity being

exported. This code may be obtained from Customs and Border

Protection.

29. Goods Description (mandatory)

A description of the goods.

30. Goods Origin Code (mandatory)

The code used to identify the Australian (or foreign) state of origin

of goods, as listed below:

NSW: AU-NS

TAS: AU – TS

VIC: AU-VI

NT: AU-NT

QLD: AU-QL

ACT: AU-CT

SA: AU-SA

WA: AU-WA

FOREIGN: YY-FO

31. Goods Origin Country Code (mandatory if Goods Origin

Code is “Foreign”)

The name of the primary country where the goods were

manufactured or produced.

32. Temporary Import No (mandatory if the AHECC is for the

export of goods originally imported on a temporary basis)

A number identifying the export of goods which are temporarily

imported under section 162 or 162A of the Customs Act 1901.

33. Net Quantity (mandatory)

The net quantity of goods is described in terms of the units

prescribed in the AHECC, (e.g. KG, T, NO). If the unit prescribed

by the AHECC is ‘NR’, the quantity details are not required, but NR

must be shown in the units box. Net quantity should not include

the weight of any additional packaging.

34. Gross Weight (mandatory)

The gross weight is, in effect, the shipping weight of the goods. It

should include the weight of any immediate packaging but not the

weight of the container. Show weight in grams (G), Kilograms (KG)

or tonnes (T).

35. Line FOB Value

The FOB value of the goods quoted on this export declaration line,

(see Item 25). The FOB value should be expressed to the nearest

dollar. (Also see Line FOB Value of the B957a supplementary

page).

36. PermitDetails(prex/PermitNo)

A wide range of goods are prohibited from exportation unless an

export permit is obtained from the appropriate agency. Details of

export restrictions are contained in various Commonwealth laws.

Further advice can be obtained from your legal adviser, agent,

etc, or Customs and Border Protection. Input the permit number

given by the relevant permit issuing authority. Each permit issuing

authority has its own permit prex. The correct prex must be

included for all permits.