Fillable Printable De 1245W

Fillable Printable De 1245W

De 1245W

DE 1245W Rev. 1 (1-17) (INTERNET) Page 1 of 1 CU

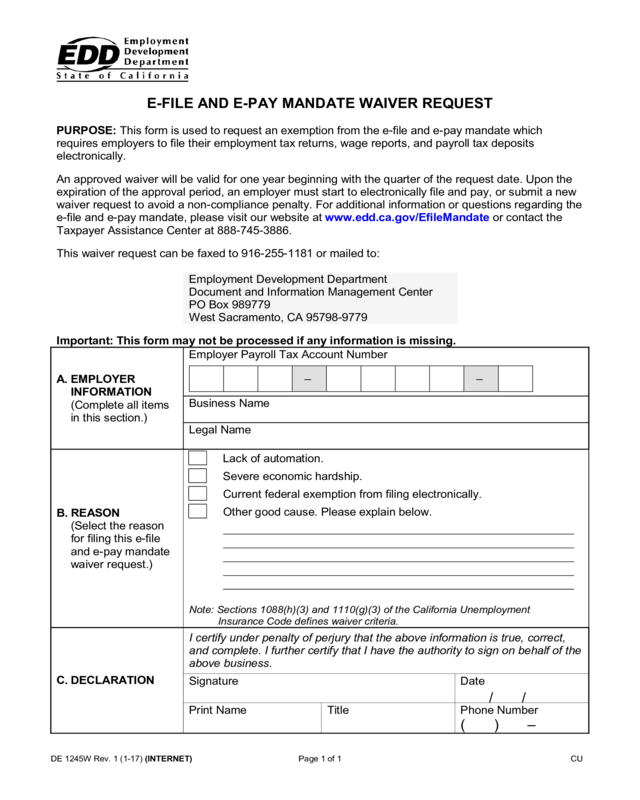

E-FILE AND E-PAY MANDATE WAIVER REQUEST

PURPOSE: This form is used to request an exemption from the e-file and e-pay mandate which

requires employers to file their employment tax returns, wage reports, and payroll tax deposits

electronically.

An approved waiver will be valid for one year beginning with the quarter of the request date. Upon the

expiration of the approval period, an employer must start to electronically file and pay, or submit a new

waiver request to avoid a non-compliance penalty. For additional information or questions regarding the

e-file and e-pay mandate, please visit our website at www.edd.ca.gov/EfileMandate or contact the

Taxpayer Assistance Center at 888-745-3886.

This waiver request can be faxed to 916-255-1181 or mailed to:

Employment Development Department

Document and Information Management Center

PO Box 989779

West Sacramento, CA 95798-9779

Important: This form may not be processed if any information is missing.

A. EMPLOYER

INFORMATION

(Complete all items

in this section.)

Employer Payroll Tax Account Number

– –

Business Name

Legal Name

B. REASON

(Select the reason

for filing this e-file

and e-pay mandate

waiver request.)

Lack of automation.

Severe economic hardship.

Current federal exemption from filing electronically.

Other good cause. Please explain below.

Note: Sections 1088(h)(3) and 1110(g)(3) of the California Unemployment

Insurance Code defines waiver criteria.

C. DECLARATION

I certify under penalty of perjury that the above information is true, correct,

and complete. I further certify that I have the authority to sign on behalf of the

above business.

Signature

Date

/ /

Print Name

Title

Phone Number

( ) –