Fillable Printable De 1378A

Fillable Printable De 1378A

De 1378A

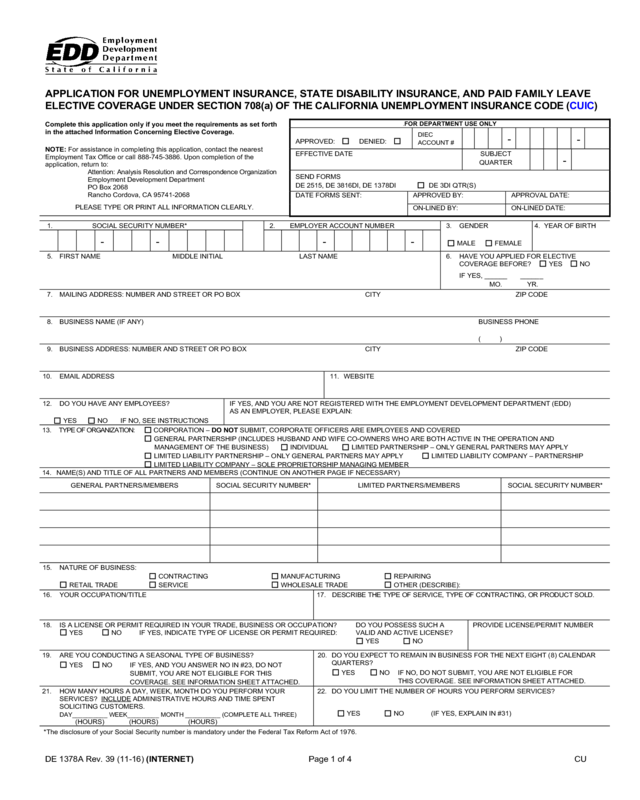

DE 1378A Rev. 39 (11-16) (INTERNET) Page 1 of 4 CU

APPLICATION FOR UNEMPLOYMENT INSURANCE, STATE DISABILITY INSURANCE, AND PAID FAMILY LEAVE

ELECTIVE COVERAGE UNDER SECTION 708(a) OF THE CALIFORNIA UNEMPLOYMENT INSURANCE CODE (CUIC)

Complete this application only if you meet the requirements as set forth

in the attached Information Concerning Elective Coverage.

NOTE: For assistance in completing this application, contact the nearest

Employment Tax Office or call 888-745-3886. Upon completion of the

application, return to:

Attention: Analysis Resolution and Correspondence Organization

Employment Development Department

PO Box 2068

Rancho Cordova, CA 95741-2068

PLEASE TYPE OR PRINT ALL INFORMATION CLEARLY.

0B

FOR DEPARTMENT USE ONLY

APPROVED: DENIED:

DIEC

ACCOUNT #

-

-

EFFECTIVE DATE SUBJECT

QUARTER

-

SEND FORMS

DE 2515, DE 3816DI, DE 1378DI DE 3DI QTR(S)

DATE FORMS SENT:

APPROVED BY:

APPROVAL DATE:

ON-LINED BY:

ON-LINED DATE:

1. SOCIAL SECURITY NUMBER*

2. EMPLOYER ACCOUNT NUMBER

3. GENDER

4. YEAR OF BIRTH

- - - -

MALE FEMALE

5. FIRST NAME MIDDLE INITIAL LAST NAME 6. HAVE YOU APPLIED FOR ELECTIVE

COVERAGE BEFORE?

YES NO

IF YES, ______ ______

MO. YR.

7. MAILING ADDRESS: NUMBER AND STREET OR PO BOX CITY ZIP CODE

8. BUSINESS NAME (IF ANY) BUSINESS PHONE

( )

9. BUSINESS ADDRESS: NUMBER AND STREET OR PO BOX CITY ZIP CODE

10. EMAIL ADDRESS 11. WEBSITE

12. DO YOU HAVE ANY EMPLOYEES?

YES NO IF NO, SEE INSTRUCTIONS

IF YES, AND YOU ARE NOT REGISTERED WITH THE EMPLOYMENT DEVELOPMENT DEPARTMENT (EDD)

AS AN EMPLOYER, PLEASE EXPLAIN:

13. TYPE OF ORGANIZATION: CORPORATION – DO NOT SUBMIT, CORPORATE OFFICERS ARE EMPLOYEES AND COVERED

GENERAL PARTNERSHIP (INCLUDES HUSBAND AND WIFE CO-OWNERS WHO ARE BOTH ACTIVE IN THE OPERATION AND

MANAGEMENT OF THE BUSINESS) INDIVIDUAL LIMITED PARTNERSHIP – ONLY GENERAL PARTNERS MAY APPLY

LIMITED LIABILITY PARTNERSHIP – ONLY GENERAL PARTNERS MAY APPLY LIMITED LIABILITY COMPANY – PARTNERSHIP

LIMITED LIABILITY COMPANY – SOLE PROPRIETORSHIP MANAGING MEMBER

14. NAME(S) AND TITLE OF ALL PARTNERS AND MEMBERS (CONTINUE ON ANOTHER PAGE IF NECESSARY)

GENERAL PARTNERS/MEMBERS SOCIAL SECURITY NUMBER* LIMITED PARTNERS/MEMBERS SOCIAL SECURITY NUMBER*

15. NATURE OF BUSINESS:

CONTRACTING MANUFACTURING REPAIRING

RETAIL TRADE SERVICE WHOLESALE TRADE OTHER (DESCRIBE):

16. YOUR OCCUPATION/TITLE

17. DESCRIBE THE TYPE OF SERVICE, TYPE OF CONTRACTING, OR PRODUCT SOLD.

18. IS A LICENSE OR PERMIT REQUIRED IN YOUR TRADE, BUSINESS OR OCCUPATION? DO YOU POSSESS SUCH A

YES NO IF YES, INDICATE TYPE OF LICENSE OR PERMIT REQUIRED: VALID AND ACTIVE LICENSE?

YES NO

PROVIDE LICENSE/PERMIT NUMBER

19. ARE YOU CONDUCTING A SEASONAL TYPE OF BUSINESS?

YES NO IF YES, AND YOU ANSWER NO IN #23, DO NOT

SUBMIT, YOU ARE NOT ELIGIBLE FOR THIS

COVERAGE. SEE INFORMATION SHEET ATTACHED.

20. DO YOU EXPECT TO REMAIN IN BUSINESS FOR THE NEXT EIGHT (8) CALENDAR

QUARTERS?

YES NO IF NO, DO NOT SUBMIT, YOU ARE NOT ELIGIBLE FOR

THIS COVERAGE. SEE INFORMATION SHEET ATTACHED.

21. HOW MANY HOURS A DAY, WEEK, MONTH DO YOU PERFORM YOUR

SERVICES? INCLUDE ADMINISTRATIVE HOURS AND TIME SPENT

SOLICITING CUSTOMERS.

DAY__________ WEEK_________ MONTH __________ (COMPLETE ALL THREE)

(HOURS) (HOURS) (HOURS)

22. DO YOU LIMIT THE NUMBER OF HOURS YOU PERFORM SERVICES?

YES NO (IF YES, EXPLAIN IN #31)

*The disclosure of your Social Security number is mandatory under the Federal Tax Reform Act of 1976.

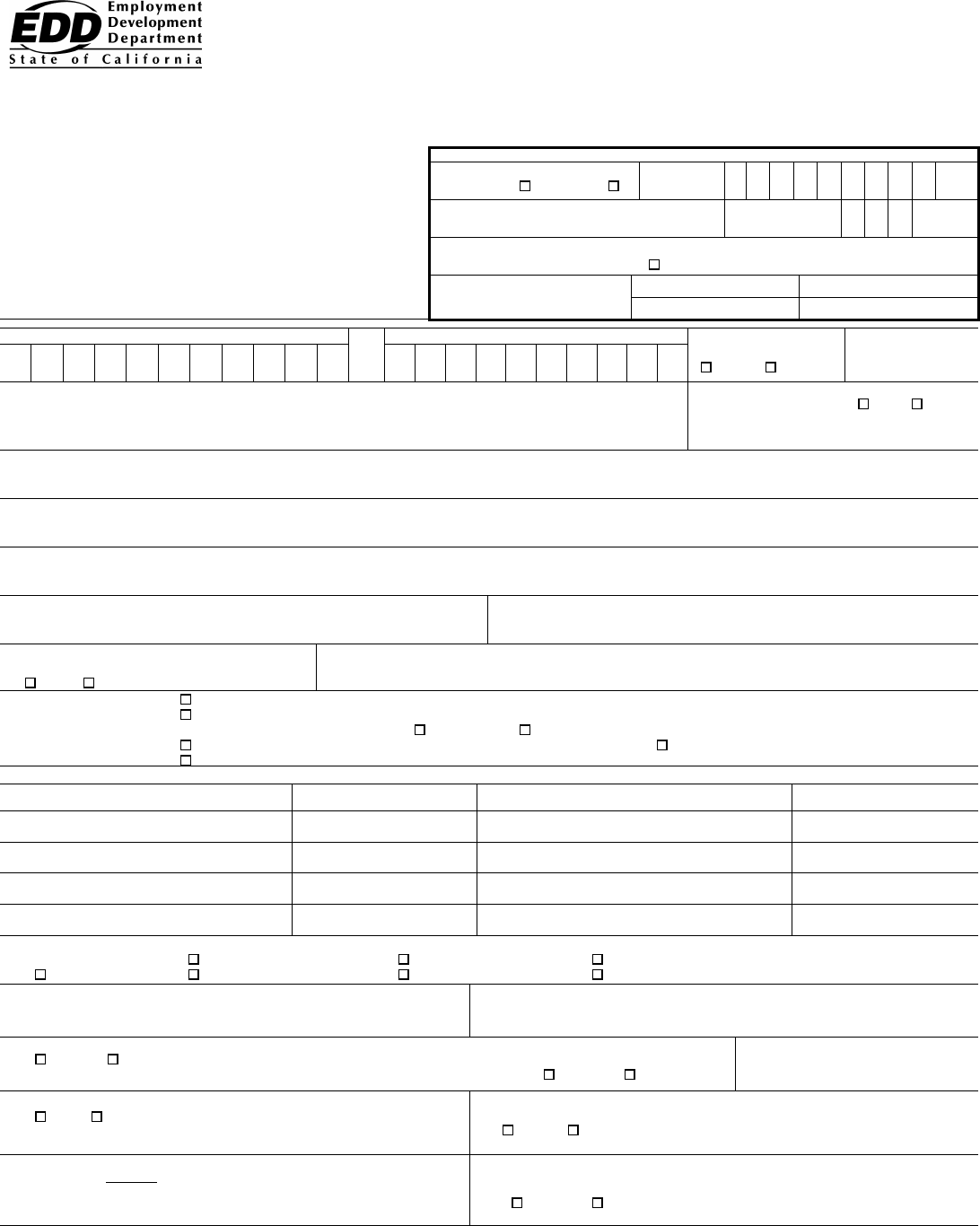

DE 1378A Rev. 39 (11-16) (INTERNET) Page 2 of 4

23. DO YOU PERFORM SERVICES IN YOUR TRADE, BUSINESS, OR

OCCUPATION CONTINUOUSLY THROUGHOUT THE YEAR? (INCLUDE TIME

SPENT DOING OFFICE WORK, SOLICITING CUSTOMERS AND MAINTAINING

MACHINERY AND EQUIPMENT.)

YES NO

IF NO, EXPLAIN.

24. HOW LONG HAVE YOU HAD EMPLOYEES WORKING FOR YOU?

YEAR(S) MONTH(S) IF LESS THAN ONE YEAR, GIVE DATE FIRST EMPLOYEE WAS HIRED ____/____/_________

25. IF YOU ARE SELF-EMPLOYED AND ALSO AN EMPLOYEE, DO YOU RECEIVE THE MAJOR PART OF YOUR INCOME FROM YOUR SELF-EMPLOYMENT?

YES IF YES, WHAT PERCENTAGE? %

NO IF NO, EXPLAIN MAJOR SOURCE OF REMUNERATION.

26. IF YOU WERE SELF-EMPLOYED DURING THE LAST TWO YEARS, WHAT

WAS YOUR NET PROFIT AS SHOWN ON YOUR IRS SCHEDULE SE, LINE 3?

__________ $_____________ __________ $_____________

YEAR NET PROFIT YEAR NET PROFIT

IF YOU HAVE NEVER FILED A SCHEDULE SE WITH THE IRS, DID YOU HAVE NET PROFIT

IN EXCESS OF $4,600 LAST YEAR?

YES NO

IF YOU HAVE BEEN IN BUSINESS FOR LESS THAN ONE YEAR, DID YOUR AVERAGE NET

PROFIT EXCEED $1,150 PER QUARTER?

YES NO

IF YOU HAVE BEEN IN BUSINESS LESS THAN ONE QUARTER, DO YOU EXPECT YOUR

AVERAGE NET PROFIT TO EXCEED $1,150 PER QUARTER DURING THE FIRST YEAR IN

BUSINESS?

YES NO

PLEASE SUBMIT COPIES OF YOUR IRS SCHEDULE SE FOR THE LAST TWO YEARS. IF ONLY IN BUSINESS ONE YEAR, ENTER ZERO FOR THE OTHER YEAR.

IF YOU ANSWERED NO TO ALL THREE QUESTIONS, DO NOT SUBMIT THIS APPLICATION UNTIL YOU EARN THE REQUIRED MINIMUM NET PROFIT IN YOUR TRADE,

BUSINESS, OR OCCUPATION.

27. WERE YOU CONVICTED OF A MISDEMEANOR UNDER THE CALIFORNIA UNEMPLOYMENT INSURANCE CODE DURING THE LAST EIGHT (8) CALENDAR QUARTERS?

(SEE ATTACHED INFORMATION SHEET) YES NO

28. DO YOU PRESENTLY HAVE AN ILLNESS, FAMILY CARE NEED, OR DISABILITY BONDING NEED WHICH PREVENTS YOU FROM CURRENTLY PERFORMING ALL YOUR

REGULAR AND CUSTOMARY SERVICES IN CONNECTION WITH YOUR TRADE, BUSINESS OR OCCUPATION?

YES NO IF YES, WAIT TO SUBMIT UNTIL YOU ARE ABLE TO PERFORM ALL DUTIES.

29. HAVE YOU BEEN DISABLED OR ON LEAVE TO BOND

WITH A NEW CHILD OR TO CARE FOR A SERIOUSLY

ILL FAMILY MEMBER DURING THE LAST THREE

MONTHS?

YES NO

IF YES, DID YOU FILE A CLAIM FOR BENEFITS?

YES NO

WHEN DID YOU RESUME YOUR USUAL DUTIES?

(DO NOT FILE THIS APPLICATION IF YOU ARE

CURRENTLY DISABLED.) ______/______/_________

30. ON WHAT DATE DO YOU WISH ELECTIVE COVERAGE TO COMMENCE? KEEP IN MIND THAT THE COMMENCEMENT DATE OF AN ELECTIVE COVERAGE

AGREEMENT SHALL NOT BE PRIOR TO THE FIRST DAY OF THE CALENDAR QUARTER IN WHICH THE APPLICATION IS FILED, NOR LATER THAN THE FIRST DAY OF

THE FOLLOWING CALENDAR QUARTER.

FIRST DAY OF CURRENT QUARTER DAY FIRST EMPLOYEE HIRED FIRST DAY OF NEXT QUARTER

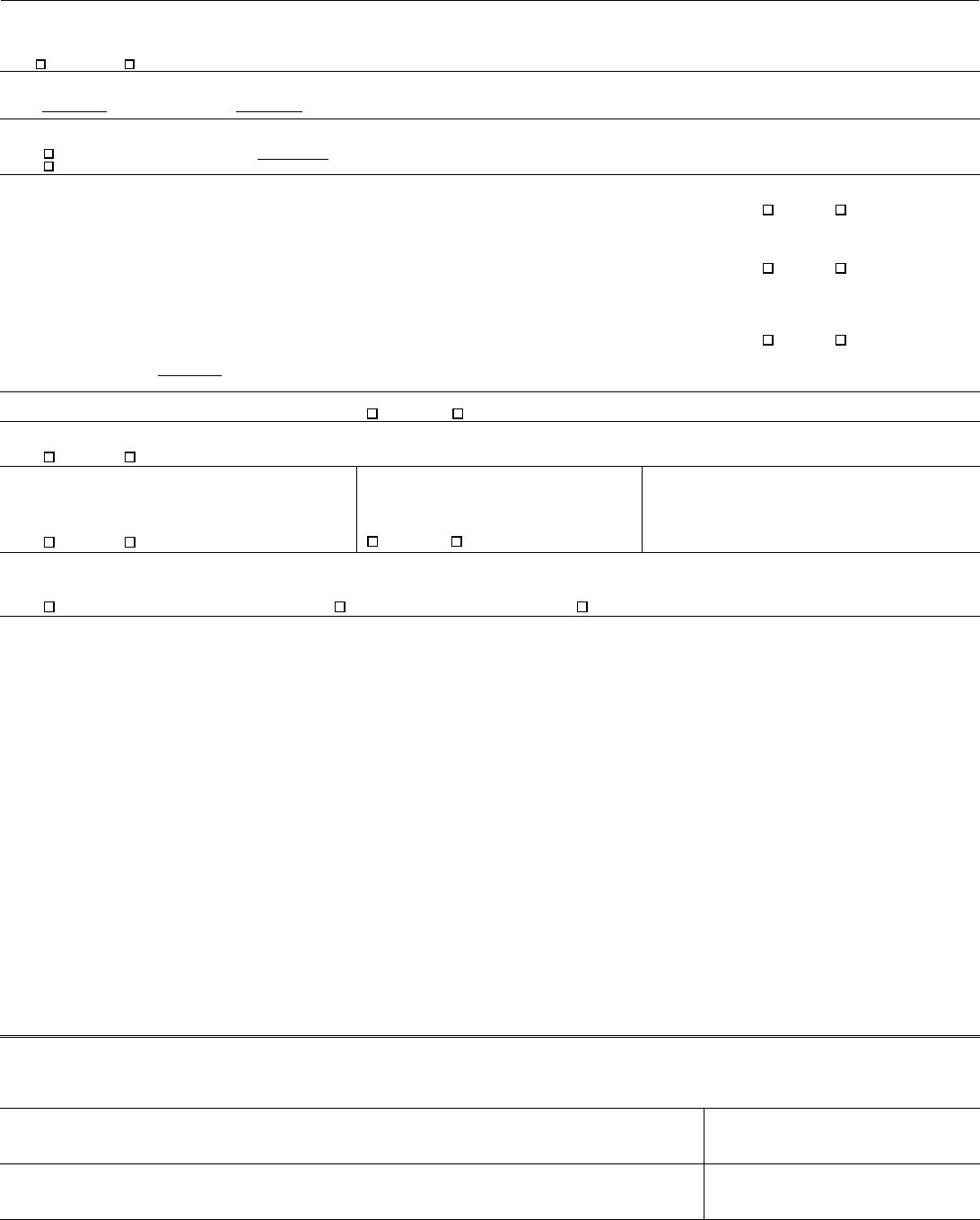

31. ADDITIONAL INFORMATION (USE THIS SPACE TO MORE FULLY DISCUSS THE ABOVE QUESTIONS).

NOTE: DO NOT SEND PAYMENT WITH THIS APPLICATION. IF APPROVED, YOU WILL BE NOTIFIED WHEN PAYMENT IS DUE. IF

YOU ARE ILLEGALLY IN THE UNITED STATES, YOU ARE NOT ELIGIBLE FOR BENEFITS AND ARE LIABLE TO REPAY

ANY BENEFITS PAID TO YOU. IF YOU NEED ADDITIONAL INFORMATION, PLEASE SEE PAGE 1 OF THIS FORM FOR

CONTACT INFORMATION.

I, the undersigned, declare that the statements made on this application are true and correct to my best knowledge and belief. I understand that providing false information will result in

denial or termination of coverage. I hereby elect and make application to have my services considered as employment subject to the California Unemployment Insurance Code (CUIC)

for Unemployment Insurance, State Disability Insurance, and Paid Family Leave. I hereby authorize the verification of any information provided by me on this application. I understand

that this election must remain in effect for two complete calendar years unless I no longer meet all of the eligibility requirements of Section 704 of the CUIC or I meet the conditions for

termination of coverage under Section 704.1 of the CUIC.

SIGNATURE OF APPLICANT DATE

RESIDENCE ADDRESS (NUMBER AND STREET OR PO BOX, STREET, CITY, AND ZIP CODE) RESIDENCE PHONE

( )

APPLICATION MUST BE SIGNED TO BE VALID

DE 1378A Rev. 39 (11-16) (INTERNET) Page 3 of 4

INFORMATION CONCERNING UNEMPLOYMENT INSURANCE, STATE DISABILITY INSURANCE, AND

PAID FAMILY LEAVE ELECTIVE COVERAGE UNDER SECTION 708(a) OF THE CUIC

Do not send any payment with this application.

You will receive a written notice of the approval or denial of your application.

NOTE: If you want to elect only State Disability Insurance (SDI) and Paid Family Leave (PFL) coverage under Section 708(b) or

Section 708.5 of the CUIC, you should file form

Application for Disability Insurance Elective Coverage,

DE 1378DI.

If your elective coverage agreement is approved, instructions will be sent to you for filing your returns and paying the premiums due.

Your agreement is subject to the requirements and conditions outlined below.

Please retain this page for reference.

PERSONS ELIGIBLE TO ELECT COVERAGE

Section 708(a) of the CUIC provides that any individual who is an employer under Section 675 of the CUIC, or two or more

individuals who have qualified, may elect coverage. Each individual who applies must provide evidence of an annual net profit of at

least $4,600 or an average of $1,150 per quarter if in business for less than one year.

Sole proprietors, general partners, managing members of Limited Liability Companies (LLC) treated as sole-proprietors for federal

income tax purposes, and members of LLCs treated as partnerships for federal income tax reporting purposes are eligible to apply

for coverage. It is not required that all active general partners or members be included in the election. An active general partnership

also includes a husband and wife co-ownership in which both spouses are active in the operation and management of the business.

Limited partners and corporate officers are considered to be employees subject to the compulsory provisions of the CUIC, the same

as all other employees, and are not eligible to elect self-coverage.

CONDITIONS FOR DENIAL OF COVERAGE

Section 704 of the CUIC provides that an election under Section 708(a) of the CUIC shall not be approved if it is found that any of

the following conditions exist:

(a) The self-employed individual is currently unable to perform his or her regular and customary work due to injury or illness.

(b) The employing unit or self-employed individual is

not

normally and continuously engaged in a regular trade, business, or

occupation.

(c) The employing unit or self-employed individual intends to discontinue the regular trade, business, or occupation within eight

calendar quarters.

(d) The regular trade, business, or occupation of the employing unit or self-employed individual is seasonal in its operations.

(e) The major portion of the self-employed individual’s remuneration is not derived from his or her trade, business, or occupation.

(f) The self-employed individual is unable to provide a copy of his or her Internal Revenue Service (IRS) Schedule SE for the

preceding year showing a net profit of at least $4,600 or to certify to an average net profit of at least $1,150 per quarter since

becoming self-employed or for the preceding four quarters, whichever period is less.

(g) The employing unit or self-employed individual has failed to make a return or to pay contributions within the time required,

pursuant to the CUIC, and there is an unpaid amount of contributions owing by the employing unit or self-employed individual.

(h) Section 704(h) (1) and (2) of the CUIC: (1) A prior elective coverage agreement entered into pursuant to Section 708 or 708.5

has been terminated by the department under Section 704.1 or by means of a written application for termination as required

by this division, and the individual has not completed a waiting period of 18 consecutive months from the date of termination.

(2) The waiting period for reinstatement to the elective coverage program may be waived for any individual who becomes

eligible for coverage after being terminated under paragraph (1), (2), (4), or (5) of subdivision (a) of Section 704.1, upon

receipt by the department of an application for coverage to be effective the first day of the quarter in which the application is

received.

(i) The employing unit or any officer or agent or person having charge of the affairs of the employing unit, or the self-employed

individual has been convicted within the preceding eight consecutive calendar quarters of any violation under Chapter 10

(commencing with Section 2101 of the CUIC). For the purposes of this subdivision, a plea or verdict of guilty or a conviction

following a plea of nolo contendere is deemed to be a conviction irrespective of whether an order granting probation or other

order is made suspending the imposition of the sentence or whether sentence is imposed for execution thereof is suspended.

(j) For purposes of this section, IRS Schedule SE is defined as IRS Form 1040 Schedule SE, or in the case of statutory

employees under the Internal Revenue Code, it shall be defined as IRS Form 1040 Schedule C, or the California Income Tax

Return, when accompanied by IRS Form W-2.

DE 1378A Rev. 39 (11-16) (INTERNET) Page 4 of 4

COST OF COVERAGE

You will receive notification of the following year’s premium rate, reportable “income credits,” and premiums payable with your fourth

quarter premium notice. You may estimate the cost of coverage using form

Disability Insurance Elective Coverage (DIEC) Rate Notice and

Instructions for Computing Annual Premiums

, DE 3DI-I, or call the phone number shown on the front of your application for assistance.

Use the same Unemployment Insurance (UI) rate as the one you use for your employees and, regardless of your actual earnings,

report both total and taxable quarterly “wages” in the amount determined by the EDD pursuant to the formula provided in the CUIC.

Total wage information is necessary to provide maximum benefits and to serve as a basis for collecting contributions for the coverage.

For reporting the proper amount of wages, see

Instructions for Reporting Wages and Contributions for Employers Who Have

Elected Unemployment and State Disability Insurance Coverage Under Section 708(a) of California’s Unemployment Insurance

Code (CUIC)

, DE 3F, which will be mailed to you each quarter with your quarterly reporting forms.

QUARTERLY REPORTS REQUIRED

The

Quarterly Premium Notice for Disability Insurance Elective Coverage,

DE 3DI, and the

Quarterly Contribution Return and

Report of Wages (Continuation),

DE 9C, must be filed each quarter whether or not payments are due. The DE 3DI and DE 9C are

mailed to you each quarter. These reports are due on the first day of the first month of the following calendar quarter and are

delinquent if not paid on or before the last day of that month. These reports must be filed whether or not payments are due. Failure

to receive a reporting form does not relieve you of the responsibility to make your payments on time. Submitting the DE 3DI

with SDI or PFL information is not a claim for benefits.

REPORTABLE COMPENSATION FOR DISABILITY INSURANCE

Any adjustment of the reportable income credits and premiums due to SDI or PFL must be noted on the DE 3DI. If you

have any questions regarding computing or adjusting the premium base and premiums, contact your local Employment

Tax Office or call the Analysis Resolution and Correspondence Organization at 888-745-3886.

For an explanation of reportable compensation for UI, refer to form DE 3F.

BENEFIT ELIGIBILITY

The EDD determines eligibility for UI, SDI, and PFL benefits pursuant to the CUIC and authorized regulations. Generally, a

minimum of seven months must elapse from the commencement date of coverage before a valid claim may be filed based

solely on income credits reportable under your election. Eligibility is dependent on a number of factors including: proof of a

claimant’s eligibility, filing of a timely claim for benefits, and filing and payment of all required reports and amounts due. Weekly SDI

or PFL benefits are payable under elective coverage regardless of whether the claimant continues to receive any compensation

from his/her business.

The SDI benefits cover both work related and nonoccupational injur

ies and illnesses. For SDI benefit information, see the pamphlet

Disability Insurance Provisions,

DE 2515, or contact your DI field office at 800-480-3287. For information on PFL, refer to brochure

Paid Family Leave,

DE 2511, or call PFL at 877-238-4373.

CANCELLATION/TERMINATION OF ELECTIVE COVERAGE

A participant may cancel his or her elective coverage agreement as of January 1 of any calendar year, only if the agreement has

been in effect for two complete calendar years, by filing a letter with the EDD requesting termination on or before January 31 of

that year.

The EDD may terminate the UI coverage if the employer no longer qualifies as an employer for one complete calendar year.

The EDD may terminate your entire elective coverage agreement if it is found that any of the “Conditions for Denial of

Coverage” exist or you meet one of the following conditions for termination of coverage by the EDD found in Section 704.1

of the CUIC:

• Section 704.1(a)(5): The self-employed individual reports a net profit of less than $4,600 on his or her IRS Schedule SE

for a third consecutive year.

• Section 704.1(a)(7): The employing unit or self-employed individual, or a representative thereof, is found to have filed

a false statement in order to be considered eligible for elective coverage.

You will be given written notification of the EDD’s termination of your elective coverage agreement and will have 30 days

to file a Petition for Review of the termination of elective coverage. The termination shall not affect the liability of the self-

employed individual for any premiums due, owing, or unpaid to the EDD. Termination by the EDD may affect your ability to draw

benefits.

The EDD is an equal opportunity employer/program. Auxiliary aids and services are available upon request to individuals with disabilities.

Requests for services, aids, and/or alternate formats need to be made by calling 888-745-3886 (voice) or TTY 800-547-9565.