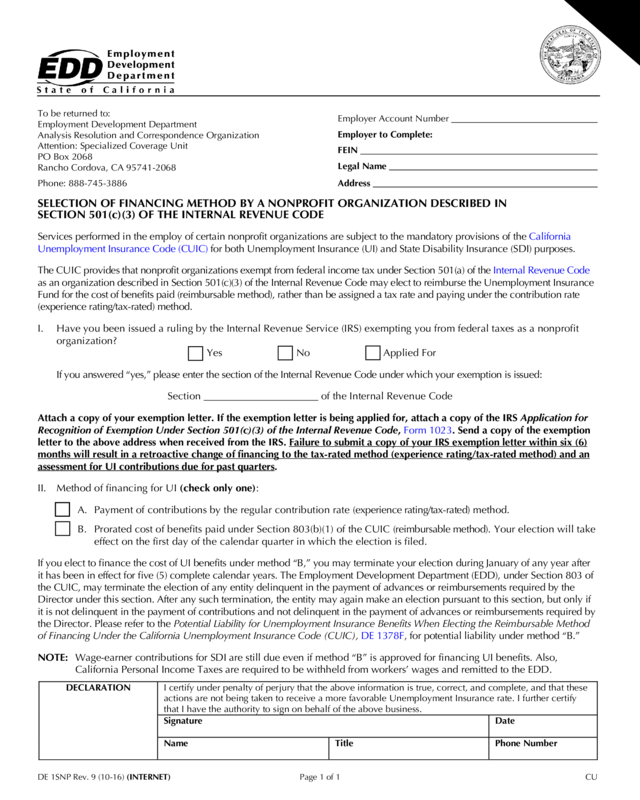

Fillable Printable De 1Snp Selection Of Financing Method By A Nonprofit Organization Described In Section 501(C)(3) Of The Irc

Fillable Printable De 1Snp Selection Of Financing Method By A Nonprofit Organization Described In Section 501(C)(3) Of The Irc

De 1Snp Selection Of Financing Method By A Nonprofit Organization Described In Section 501(C)(3) Of The Irc

DE 1SNP Rev. 9 (10-16) (INTERNET) Page 1 of 1 CU

To be returned to:

Employment Development Department

Analysis Resolution and Correspondence Organization

Attention: Specialized Coverage Unit

PO Box 2068

Rancho Cordova, CA 95741-2068

Phone: 888-745-3886

Employer Account Number

Employer to Complete:

FEIN

Legal Name

Address

SELECTION OF FINANCING METHOD BY A NONPROFIT ORGANIZATION DESCRIBED IN

SECTION 501(c)(3) OF THE INTERNAL REVENUE CODE

Services performed in the employ of certain nonprofit organizations are subject to the mandatory provisions of the California

Unemployment Insurance Code (CUIC) for both Unemployment Insurance (UI) and State Disability Insurance (SDI) purposes.

The CUIC provides that nonprofit organizations exempt from federal income tax under Section 501(a) of the Internal Revenue Code

as an organization described in Section 501(c)(3) of the Internal Revenue Code may elect to reimburse the Unemployment Insurance

Fund for the cost of benefits paid (reimbursable method), rather than be assigned a tax rate and paying under the contribution rate

(experience rating/tax-rated) method.

I. Have you been issued a ruling by the Internal Revenue Service (IRS) exempting you from federal taxes as a nonprofit

organization?

Yes

No

Applied For

If you answered “yes,” please enter the section of the Internal Revenue Code under which your exemption is issued:

Section of the Internal Revenue Code

Attach a copy of your exemption letter. If the exemption letter is being applied for, attach a copy of the IRS Application for

Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code, Form 1023

. Send a copy of the exemption

letter to the above address when received from the IRS. Failure to submit a copy of your IRS exemption letter within six (6)

months will result in a retroactive change of financing to the tax-rated method (experience rating/tax-rated method) and an

assessment for UI contributions due for past quarters.

II. Method of financing for UI (check only one):

A. Payment of contributions by the regular contribution rate (experience rating/tax-rated) method.

B. Prorated cost of benefits paid under Section 803(b)(1) of the CUIC (reimbursable method). Your election will take

effect on the first day of the calendar quarter in which the election is filed.

If you elect to finance the cost of UI benefits under method “B,” you may terminate your election during January of any year after

it has been in effect for five (5) complete calendar years. The Employment Development Department (EDD), under Section 803 of

the CUIC, may terminate the election of any entity delinquent in the payment of advances or reimbursements required by the

Director under this section. After any such termination, the entity may again make an election pursuant to this section, but only if

it is not delinquent in the payment of contributions and not delinquent in the payment of advances or reimbursements required by

the Director. Please refer to the Potential Liability for Unemployment Insurance Benefits When Electing the Reimbursable Method

of Financing Under the California Unemployment Insurance Code (CUIC), DE 1378F, for potential liability under method “B.”

NOTE: Wage-earner contributions for SDI are still due even if method “B” is approved for financing UI benefits. Also,

California Personal Income Taxes are required to be withheld from workers’ wages and remitted to the EDD.

DECLARATION

I certify under penalty of perjury that the above information is true, correct, and complete, and that these

actions are not being taken to receive a more favorable Unemployment Insurance rate. I further certify

that I have the authority to sign on behalf of the above business.

Signature

Date

Name

Title

Phone Number