Fillable Printable De 2088C Explanation Of The Notice Of Contribution Rates And Statement Of Ui Reserve Account

Fillable Printable De 2088C Explanation Of The Notice Of Contribution Rates And Statement Of Ui Reserve Account

De 2088C Explanation Of The Notice Of Contribution Rates And Statement Of Ui Reserve Account

1 of 4

DE 2088C Rev. 44 (12-16) (INTERNET)

EXPLANATION OF THE NOTICE OF CONTRIBUTION RATES AND STATEMENT OF UI RESERVE ACCOUNT

(DE 2088) FOR THE PERIOD OF JANUARY 1, 2017, TO DECEMBER 31, 2017

The Notice of Contribution Rates and Statement of

UI Reserve Account, DE 2088, informs you of your

Unemployment Insurance (UI), Employment Training Tax

(ETT), and State Disability Insurance (SDI) contribution

rates for the calendar year 2017. It also shows the items

used to determine your UI rate and the balance in your UI

reserve account as of July 31, 2016. For more information

on experience rating, refer to Information Sheet:

California System of Experience Rating, DE 231Z, from the

Employment Development Department (EDD) website at

www.edd.ca.gov/Forms, visit your local Employment Tax

Office listed in the California Employer’s Guide, DE 44, or

at www.edd.ca.gov/Office_Locator, or call the Taxpayer

Assistance Center at 888-745-3886 or TTY (non-verbal

access) at 800-547-9565.

ISSUED DATE

This is the official mail date for the Notice of Contribution

Rates and Statement of UI Reserve Account for Calendar

Year 2017. Due to bulk mailing, some notices are mailed

prior to this date.

YOUR ACCOUNT NUMBER

This is the eight-digit number assigned to you when you

registered as an employer with the EDD. This number

is assigned to you for UI, ETT, SDI, Personal Income

Tax (PIT), and Federal Unemployment Tax Act (FUTA)

purposes. Please refer to your employer account number

when making inquiries about your account.

CONTRIBUTION RATES

UI Contribution Rate - This is your UI contribution rate for

the calendar year 2017. New employers are assigned a

3.4 percent UI rate for a period of two to three years. This

will depend on when the employer meets the criteria under

Section 982(b) of the California Unemployment Insurance

Code (CUIC). After that, an employer’s contribution rate is

determined by his/her experience rating and the condition

of the UI Fund.

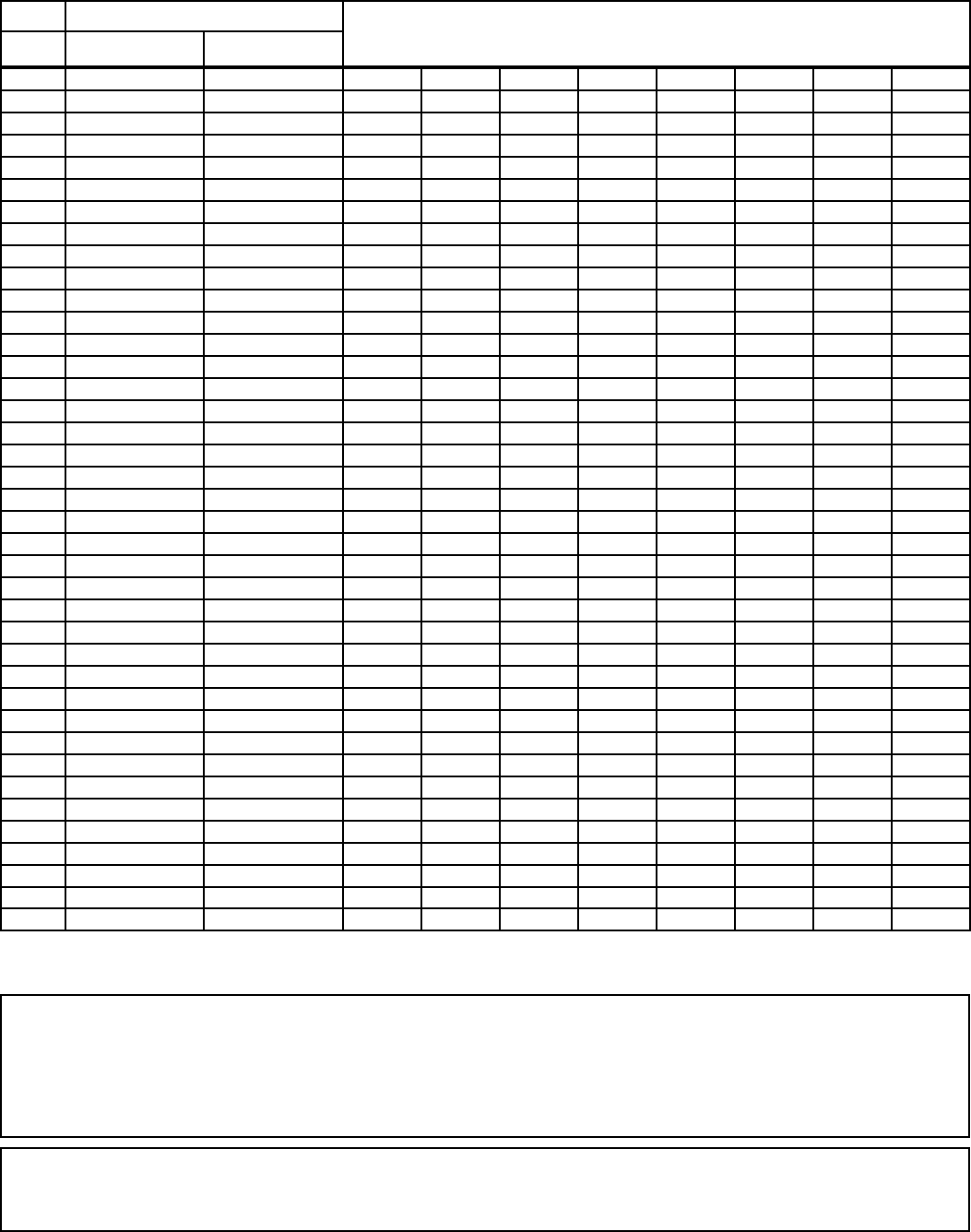

UI Rate Schedule - Section 977 of the CUIC mandates

which Contribution Rate Schedule is in effect. Each year,

the schedule is determined by the ratio between the

UI Fund balance on September 30 and the total wages paid

by all employers. When this calculation produces a ratio

of less than 0.6 percent, the rate the employer would have

paid in Schedule F is multiplied by 1.15, rounded to the

nearest tenth, as mandated by Section 977.5 of the CUIC.

All tax-rated employers are rated under the same schedule.

A copy of the Contribution Rate Schedule is on the last page

of this explanation sheet.

To determine your rate, find your reserve ratio (shown on

line 17 of the DE 2088) on the assigned UI rate schedule

(i.e., on Schedule “F,” ratio .129 would be 2.7 percent).

When the ratio between the UI Fund balance and the total

wages paid by all employers is less than 0.6 percent, rates

in Schedule F are multiplied by 1.15 (i.e., 2.7 percent

multiplied by 1.15 equals 3.1 percent).

ETT Rate - Employers whose UI reserve account balance

is positive (zero or greater) pay an ETT of 0.1 percent.

Employers whose UI reserve account balance is negative

(shows a minus sign before the amount) do not pay ETT

and it is shown as 0.0 percent on the notice.

Exception: Employers subject to Section 977(c) of the CUIC.

SDI Contribution Rate - This is the percentage amount

to be withheld from each employee’s salary. SDI is a

wage continuation plan for employees who are unable

to work because of nonoccupational illness, injury, or

due to pregnancy. It is funded through employee payroll

deductions.

The SDI withholding rate is the same for all employers and

is calculated pursuant to Section 984 of the CUIC. The rate

is based on the balance in the SDI Fund and the amount of

disbursements and wages paid.

ANNUAL TAXABLE WAGE LIMITS

UI and ETT are paid on the first $7,000 earned by each

employee per calendar year. SDI is withheld on the first

$110,902 earned by each employee per calendar year.

RIGHT TO PROTEST

Any item on the DE 2088 may be protested except SDI

and ETT, which are specifically set by law. The protest

must be filed in writing and postmarked within 60 days of

the issued date shown on the notice. Please include your

employer account number, the specific item you wish to

protest, and the reason you are protesting. You may request

up to a 60-day extension. The extension request must be

in writing and show good cause. Mail your protest and/or

request for an extension to:

Employment Development Department

Rate Management Group, MIC 4

PO Box 826880

Sacramento, CA 94280-0001

You may call the Taxpayer Assistance Center at

888-745-3886 if you need additional information.

CU

2 of 4

DE 2088C Rev. 44 (12-16) (INTERNET)

EXPLANATION OF THE UI RESERVE ACCOUNT

BREAKDOWN:

1. Previous Reserve Balance - Shows the ending balance

in your UI reserve account as of July 31, 2015.

2. UI Contributions Paid - Shows the total of all UI

contributions paid by you from August 1, 2015,

through July 31, 2016.

NOTE: The ETT paid is not considered UI contributions

and is not included in this figure. When allowed,

voluntary UI payments are included but cannot be

taken as a credit on any tax return.

3. Interest Earned by UI Fund - Shows the amount

credited to positive UI reserve accounts for interest

earned on the UI Fund. Employers with a negative UI

reserve account balance as of July 31, 2016, do not

receive a portion of these interest earnings.

4. Negative Balance Reduction - Shows the amount of

your negative UI reserve balance canceled per

Section 1027.5 of the CUIC.

5. Benefit Overpayments Collected - Shows the amount

credited to your UI reserve account for overpayments

recovered from claimants who were overpaid UI

benefits as a result of error or fraud.

6. Positive Reserve Account Balances Canceled -

Shows the amount credited to your UI reserve account

as the result of the cancelation of positive UI reserve

accounts. Whenever an employer ceases to pay

wages, the UI reserve account (unless transferred to a

successor’s account) is canceled after a period of three

consecutive years. Each year, the total of the canceled

UI reserve accounts with positive balances is prorated

to all employers’ accounts.

7. Other Income - Shows your share of money deposited

in the UI Fund from other sources.

8. TOTAL CREDITS - Shows the total of all the items

added to your UI reserve account beginning

August 1, 2015, through July 31, 2016. This amount is

the total of items 2 through 7 above.

9. UI Benefits Charged - Shows the amount of UI benefits

paid to your former employees from July 1, 2015,

through June 30, 2016. This amount should agree with

the amount shown on your Statement of Charges to

Reserve Account, DE 428T. These charges may also be

as a result of a UI reserve account transfer. For partial

transfers, the successor will not receive the DE 428T.

10. Increase in Negative Reserve Balances - Shows the

amount of prorated charges to your UI reserve account

as a result of the increase in the total of all negative UI

reserve account balances.

11. Benefit Overpayments Established - Shows the

amount of prorated charges to your UI reserve

account as a result of UI benefit overpayments

established.

12. UI Benefits not Charged to Reserve Accounts - Shows

the amount that has been charged to your UI reserve

account as a result of CUIC provisions relieving

individual UI reserve accounts of charges under

certain conditions. Each year, the total of all benefit

charges not charged to individual UI reserve accounts

is accumulated and prorated to all employers.

13. Other Expenses - Shows the amount of prorated

charges to your UI reserve account for miscellaneous

expenses of the UI Fund.

14. TOTAL CHARGES - Shows the total of all the items

subtracted from your UI reserve account beginning

July 1, 2015, through June 30, 2016. This amount is

the total of items 9 through 13 above.

15. Your UI Reserve Balance as of July 31, 2016:

Previous Reserve Balance (line 1)

Plus Total Credits (line 8)

Minus Total Charges (line 14)

New Reserve Balance (line 15)

16.

UI Taxable Payroll - Shows the total of all UI taxable

wages reported on your Quarterly Contribution

Return, DE 3D, Employer of Household Worker(s)

Annual Payroll Tax Return, DE 3HW, or Quarterly

Contribution Return and Report of Wages, DE 9, for

the years 2013, 2014, and 2015, and any adjustments

made to the taxable wages for those years. An

increase in UI taxable payroll may result in an

increase to your UI contribution rate.

17. Reserve Ratio - Shows the ratio between your UI

reserve balance and your average base payroll.

Reserve Account Balance = Reserve Ratio

Average Base Payroll

To determine your average base payroll, divide the

UI Taxable Payroll figure shown:

by three if you began business in 2013

by two if you began business in 2014

by one if you began business in 2015

UI Taxable Payroll = Average

3, 2, or 1 (depending on Base Payroll

taxable payroll history)

NOTE: If taxable wages are reported in at least

one quarter of a year, that is considered a full year

with wages.

The UI taxable wages from July 1, 2015, through

June 30, 2016, shown at the bottom of the DE 2088 are

calculated by dividing the UI contributions paid (for the

third quarter of 2015 through the second quarter of 2016)

by the UI contribution rate assigned for the quarters. The

total UI taxable wages are used to calculate the prorated

credits and charges.

3 of 4

DE 2088C Rev. 44 (12-16) (INTERNET)

MINIMIZING YOUR UI RATE

• Work with your employees to avoid separations.

Every discharge has the potential to increase your

contribution rate.

• When a layoff is unavoidable, contact your local EDD

office for assistance in finding work for your displaced

workers.

• Respond in time to all claim notices. Failure to respond

may cause you to lose future protest rights.

• If possible, offer former employees a job when you are

notified they are drawing UI benefits.

• Submit your UI payment within the required time

limits, along with an accurately completed Payroll Tax

Deposit, DE 88, coupon. Make sure that each of the

funds the deposit represents is individually listed and

that the funds are totaled correctly. Entering the total

figure only on the DE 88 coupon may cause your

fund amounts to be incorrectly allocated and your UI

rate could increase.

•

S

ubmit your Quarterly Contribution Return and Report

of Wages (Continuation), DE 9C, or Employer of

Household Worker(s) Quarterly Report of Wages and

Withholdings, DE 3BHW, at the close of each quarter.

RESERVE ACCOUNT TRANSFERS

You may request a transfer of the predecessor’s (former

owner’s) reserve account after acquiring another business.

You must submit an Application for Transfer of Reserve

Account, DE 445

3. If your application is approved, your

UI rate will be recalculated and may result in a reduction

or increase in your UI rate.

• If you acquire part of another business and wish to

transfer a portion of it’s reserve account, you must

file an application within 90 days after the date of

acquisition.

• If you acquire all of another business, you have up

to three years to file an application after the date of

acquisition. However, an application filed after

90 days may be restricted.

Not all reserve account balances are desirable. If the transfer

of your predecessor’s reserve account is approved, you will

be subject to all or a percentage of the predecessor’s benefit

charges, which could increase your rate in future years.

VOLUNTARY UI CONTRIBUTIONS

Voluntary Unemployment Insurance (VUI) payments are

allowed in years when rate schedules AA to D are in

effect. VUI is not available when rate schedules E or F are

in effect, or in calendar years in which the emergency

solvency surcharge is in effect.

COMMON QUESTIONS

Q. Why did my rate increase?

A. The rate will increase for any one or all of the

following reasons:

1. A change in the UI rate schedule used for all UI

tax-rated employers. (Refer to page 1, “UI Rate

Schedule,” for more information.)

2. A change in your taxable payroll for the three years

used – 2013, 2014, and 2015. If there is either an

increase or decrease, this will alter the ratio. (Refer

to page 2, item 16, for more information.)

3. The total charges were more than the total credits.

(Refer to page 2, “Explanation of the UI Reserve

Account Breakdown,” for more information.)

Q. Why is my reserve account charged when none of my

former employees drew benefits?

A. To ensure the UI Fund remains solvent, all costs must

be reimbursed. This is done by sharing costs and

income to the UI Fund that are not directly credited

or charged to an employer’s reserve account. (Refer to

page 2, items 5-7 and 10-13, for more information.)

Q. Is my reserve account balance refundable?

A. No. The UI contributions are deposited in the UI Fund

and used only to pay UI benefits. The reserve account

is a statistical method of measuring employment

experience and it is only used to determine your UI

contribution rate. Your reserve balance may not be

used as a credit on your Quarterly Contribution Return

and Report of Wages, DE 9.

Q. Why does my rate increase when I hire more

employees?

A. The more employees you have, the greater your risk

of UI claims. Any increase in your taxable payroll

without a corresponding increase in the reserve

account balance can result in a higher UI tax rate.

If your average taxable payroll increases but your

reserve balance does not increase proportionately,

your reserve ratio will decrease, causing your UI rate

to increase. (See page 2, items 16 and 17, for more

information.)

Q. Can my reserve account be canceled?

A. Yes. Whenever you cease to pay wages, the reserve

account, unless it has been transferred under Sections

1051-1061 of the CUIC, shall be canceled on the

records of the EDD after a period of three consecutive

years has elapsed following the latest calendar quarter

in which you paid wages.

4 of 4

DE 2088C Rev. 44 (12-16) (INTERNET)

UI TAX RATE SCHEDULE

e-Services for Business

e-Services for Business provides employers and t

heir agents with the ability to request rate information

online and also the ability to obtain an electronic DE 428T. To begin the enrollment process,

go to www.edd.ca.gov/e-Services_for_Business. For assistance with e-Services for Business, please call 855-866-2657.

For state payroll tax assistance or information, please call the Taxpayer Assistance Center at 888-745-3886.

*The emergency solvency surcharge rate (1.15 times the rate the employer would have paid in Schedule F, rounded to the

nearest tenth).

The EDD is an equal opportunity employer/program. Auxiliary services and services are available upon request to

individuals with disabilities. Requests for services, aids, and/or alternate formats need to be made by calling

888-745-3886 (voice) or TTY 800-547-9565.

Reserve Ratio

Contribution Rate Schedules

Stated as a Percent

Line Exceeds or = Less than

AA A B C D E F *F+

1 Less than -0.20 5.4 5.4 5.4 5.4 5.4 5.4 5.4 6.2

2 -0.20 -0.18 5.2 5.3 5.4 5.4 5.4 5.4 5.4 6.2

3 -0.18 -0.16 5.1 5.2 5.4 5.4 5.4 5.4 5.4 6.2

4 -0.16 -0.14 5.0 5.1 5.3 5.4 5.4 5.4 5.4 6.2

5 -0.14 -0.12 4.9 5.0 5.3 5.4 5.4 5.4 5.4 6.2

6 -0.12 -0.11 4.8 4.9 5.2 5.4 5.4 5.4 5.4 6.2

7 -0.11 -0.10 4.7 4.8 5.1 5.3 5.4 5.4 5.4 6.2

8 -0.10 -0.09 4.6 4.7 5.1 5.3 5.4 5.4 5.4 6.2

9 -0.09 -0.08 4.5 4.6 4.9 5.2 5.4 5.4 5.4 6.2

10 -0.08 -0.07 4.4 4.5 4.8 5.1 5.3 5.4 5.4 6.2

11 -0.07 -0.06 4.3 4.4 4.7 5.0 5.3 5.4 5.4 6.2

12 -0.06 -0.05 4.2 4.3 4.6 4.9 5.2 5.4 5.4 6.2

13 -0.05 -0.04 4.1 4.2 4.5 4.8 5.1 5.3 5.4 6.2

14 -0.04 -0.03 4.0 4.1 4.4 4.7 5.0 5.3 5.4 6.2

15 -0.03 -0.02 3.9 4.0 4.3 4.6 4.9 5.2 5.4 6.2

16 -0.02 -0.01 3.8 3.9 4.2 4.5 4.8 5.1 5.4 6.2

17 -0.01 0.00 3.7 3.8 4.1 4.4 4.7 5.0 5.4 6.2

18 0.00 0.01 3.4 3.6 3.9 4.2 4.5 4.8 5.1 5.9

19 0.01 0.02 3.2 3.4 3.7 4.0 4.3 4.6 4.9 5.6

20 0.02 0.03 3.0 3.2 3.5 3.8 4.1 4.4 4.7 5.4

21 0.03 0.04 2.8 3.0 3.3 3.6 3.9 4.2 4.5 5.2

22 0.04 0.05 2.6 2.8 3.1 3.4 3.7 4.0 4.3 4.9

23 0.05 0.06 2.4 2.6 2.9 3.2 3.5 3.8 4.1 4.7

24 0.06 0.07 2.2 2.4 2.7 3.0 3.3 3.6 3.9 4.5

25 0.07 0.08 2.0 2.2 2.5 2.8 3.1 3.4 3.7 4.3

26 0.08 0.09 1.8 2.0 2.3 2.6 2.9 3.2 3.5 4.0

27 0.09 0.10 1.6 1.8 2.1 2.4 2.7 3.0 3.3 3.8

28 0.10 0.11 1.4 1.6 1.9 2.2 2.5 2.8 3.1 3.6

29 0.11 0.12 1.2 1.4 1.7 2.0 2.3 2.6 2.9 3.3

30 0.12 0.13 1.0 1.2 1.5 1.8 2.1 2.4 2.7 3.1

31 0.13 0.14 0.8 1.0 1.3 1.6 1.9 2.2 2.5 2.9

32 0.14 0.15 0.7 0.9 1.1 1.4 1.7 2.0 2.3 2.6

33 0.15 0.16 0.6 0.8 1.0 1.2 1.5 1.8 2.1 2.4

34 0.16 0.17 0.5 0.7 0.9 1.1 1.3 1.6 1.9 2.2

35 0.17 0.18 0.4 0.6 0.8 1.0 1.2 1.4 1.7 2.0

36 0.18 0.19 0.3 0.5 0.7 0.9

1.1 1.3 1.5 1.7

37 0.19 0.20 0.2 0.4 0.6 0.8 1.0 1.2 1.4 1.6

38 0.20 or more 0.1 0.3 0.5 0.7 0.9 1.1 1.3 1.5