Fillable Printable De 231Q Infor Sheet: Ss/Medicare/Sdi Employr

Fillable Printable De 231Q Infor Sheet: Ss/Medicare/Sdi Employr

De 231Q Infor Sheet: Ss/Medicare/Sdi Employr

An employer may pay an employee’s share of Social

Security/Medicare (taxes imposed under the Federal

Insurance Contributions Act [FICA]), State Disability

Insurance* (SDI), and/or federal income taxes without

deduction from the employee’s salary. The payments made

by the employer on behalf of the employee may constitute

additional wages, depending on the type of employer.

HOUSEHOLD OR AGRICULTURAL EMPLOYER

When a household or agricultural employer pays Social

Security and Medicare (FICA) without deduction from

an employee’s wages, the additional amount is not

considered an increase to the employee’s wages

when calculating the Unemployment Insurance (UI),

Employment Training Tax (ETT), or SDI taxes.

When a household or agricultural employer pays SDI

without deduction from the employee’s wages, the

additional amount is considered an increase to the

employee’s wages for payroll tax purposes and is subject to

UI, ETT, and SDI.

Household and agricultural employers are not required to

withhold Personal Income Tax (PIT) from wages. However,

the amount the employer paid in FICA and/or SDI without

deduction from the employee’s pay is to be included as

part of the employee’s wages when reporting PIT wages.

These amounts should be included on the Wage and Tax

Statement, Form W-2, and reported by the employee as

taxable income on his or her personal income tax returns.

ALL OTHER EMPLOYERS

When employers other than household or agricultural

pay the employee’s share of FICA and/or SDI without

deducting it from the employee’s wages, the employee’s

wages increase by the amount of FICA and/or SDI paid. The

amount the employer paid is subject to UI, ETT, and SDI.

This amount is also reportable as PIT wages, is subject to

PIT withholding, should be included on the Form W-2, and

should be reported by the employee as taxable income on

his or her personal income tax returns.

DETERMINING TOTAL SUBJECT WAGES (Wages subject

to UI, ETT, and SDI)

The following formula is used to calculate the total subject

wages:

Formula: S = W

(1 – R)

S = Actual amount of salary paid, without deductions

R = Rate of tax or taxes paid

W = The employee’s reportable wage

(total subject wages)

SOCIAL SECURITY/MEDICARE/STATE DISABILITY INSURANCE/FEDERAL INCOME

TAXES PAID BY AN EMPLOYER

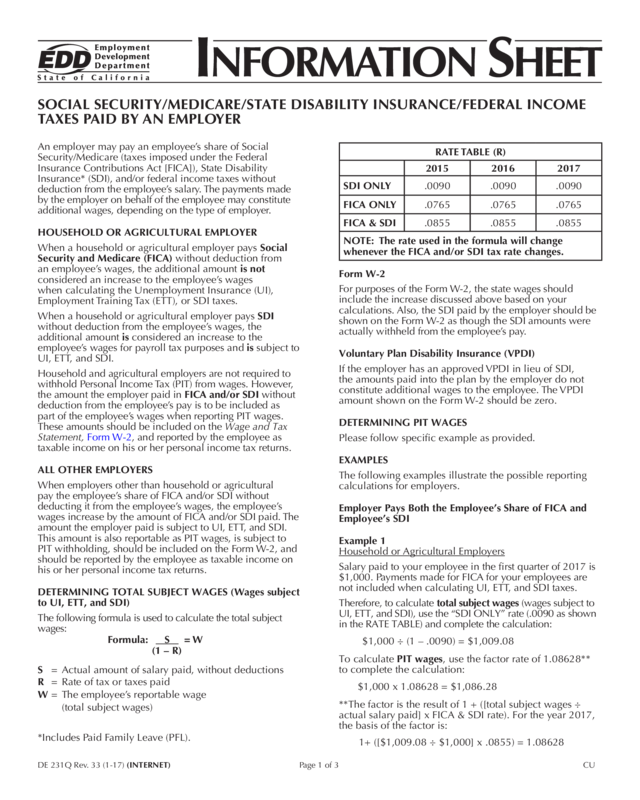

RATE TABLE (R)

2015 2016 2017

SDI ONLY .0090 .0090 .0090

FICA ONLY .0765 .0765 .0765

FICA & SDI .0855 .0855 .0855

NOTE: The rate used in the formula will change

whenever the FICA and/or SDI tax rate changes.

Form W-2

For purposes of the Form W-2, the state wages should

include the increase discussed above based on your

calculations. Also, the SDI paid by the employer should be

shown on the Form W-2 as though the SDI amounts were

actually withheld from the employee’s pay.

Voluntary Plan Disability Insurance (VPDI)

If the employer has an approved VPDI in lieu of SDI,

the amounts paid into the plan by the employer do not

constitute additional wages to the employee. The VPDI

amount shown on the Form W-2 should be zero.

DETERMINING PIT WAGES

Please follow specific example as provided.

EXAMPLES

The following examples illustrate the possible reporting

calculations for employers.

Employer Pays Both the Employee’s Share of FICA and

Employee’s SDI

Example 1

Household or Agricultural Employers

Salary paid to your employee in the first quarter of 2017 is

$1,000. Payments made for FICA for your employees are

not included when calculating UI, ETT, and SDI taxes.

Therefore, to calculate total subject wages (wages subject to

UI, ETT, and SDI), use the “SDI ONLY” rate (.0090 as shown

in the RATE TABLE) and complete the calculation:

$1,000 ÷ (1 – .0090) = $1,009.08

To calculate PIT wages, use the factor rate of 1.08628**

to complete the calculation:

$1,000 x 1.08628 = $1,086.28

**The factor is the result of 1 + ([total subject wages ÷

actual salary paid] x FICA & SDI rate). For the year 2017,

the basis of the factor is:

1+ ([$1,009.08 ÷ $1,000] x .0855) = 1.08628

DE 231Q Rev. 33 (1-17) (INTERNET) Page 1 of 3 CU

*Includes Paid Family Leave (PFL).

Total subject wages of $1,009.08 must be reported on

the Quarterly Contribution Return and Report of Wages

(Continuation), DE 9C, or the Employer of Household

Worker(s) Quarterly Report of Wages and Withholdings,

DE 3BHW. The PIT wages of $1,086.28 must be reported

on the DE 9C or DE 3BHW and included as wages on the

employee’s Form W-2.

Example 2

All Other Employers

Salary paid to your employee in the first quarter of 2017

is $1,000. To calculate total subject wages (wages subject

to UI, ETT, and SDI) and PIT wages, use the “FICA & SDI”

rate (.0855 as shown in the RATE TABLE) and complete

the calculation:

$1,000 ÷ (1 – .0855) = $1,093.49

Total subject wages of $1,093.49 must be reported on

the DE 9C. The PIT wages of $1,093.49 are subject to PIT

withholding, must be reported on the DE 9C, and should be

included as wages on the employee’s Form W-2.

Employer Pays Employee’s Share of FICA Only

Example 3

Household or Agricultural Employers

Salary paid to your employee in the first quarter of 2017 is

$1,000. Payments made for FICA for your employees are

not included when calculating the UI, ETT, and SDI taxes.

Therefore, the total subject wages are $1,000.

To calculate PIT wages, use the factor rate of 1.0765** to

complete the calculation:

$1,000 x 1.0765 = $1,076.50

**The factor is the result of 1 + ([total subject wages ÷

actual wages paid] x FICA Only rate). For the year 2017,

the basis of the factor is:

1 + ([$1,000 ÷ $1,000] x .0765) = 1.0765

Total subject wages of $1,000 must be reported on the

DE 9C or the DE 3BHW. The PIT wages of $1,076.50

must be reported on the DE 9C or DE 3BHW and

included as wages on the employee’s Form W-2.

Example 4

All Other Employers

Salary paid to your employee in the first quarter of 2017 is

$1,000. To calculate total subject wages and PIT wages,

use the “FICA ONLY” rate (.0765 as shown in the RATE

TABLE) and complete the calculation:

$1,000 ÷ (1 – .0765) = $1,082.84

Total subject wages of $1,082.84 must be reported on

the DE 9C. The PIT wages of $1,082.84 are subject to PIT

withholding, must be reported on the DE 9C, and should

be included as wages on the employee’s Form W-2.

Employer Pays the Employee’s SDI Only

Example 5

For All Employers (Including Household and Agricultural

Employers)

Salary paid to your employee in the first quarter of 2017 is

$1,000. To calculate total subject wages and PIT wages,

use the “SDI ONLY” rate (.0090 as shown in the RATE

TABLE) and complete the calculation:

$1,000 ÷ (1 – .0090) = $1,009.08***

Total subject wages of $1,009.08 must be reported on the

DE 9C or DE 3BHW. The PIT wages of $1,009.08 must

be reported on the DE 9C or DE 3BHW and included as

wages on the employee’s Form W-2.

***For all employers except household and agricultural

employers, PIT wages of $1,009.08 are subject to PIT

withholding.

FEDERAL INCOME TAX PAID BY AN EMPLOYER

A

s a result of the changes made to Section 17141.3 of the

Revenue and Taxation Code, effective October 1, 2013,

Section 13009(q) of the California Unemployment Insurance

Code (CUIC) also excludes from gross income, for PIT

purposes only, any amounts received by an employee from

an employer to compensate for additional federal income

taxes the employee incurs on employer-provided benefits

because, for federal income tax purposes, the registered

domestic partner of the employee is not considered a

spouse under Section 105(a) or Section 106(a) of the

Internal Revenue Code. This exclusion is effective until

January 1, 2019.

However, no changes were made to Division 1, Part 1,

of the CUIC. Therefore, the additional federal income

taxes paid by the employer on behalf of the employee are

considered subject wages for UI, ETT, and SDI purposes.

Example:

Chris and Kelly are registered domestic partners. Chris’

employer pays for the cost of health insurance for Kelly.

The cost of Kelly’s insurance is $5,000 for the year 2017.

Kelly is not Chris’ dependent; therefore, the $5,000 cost of

insurance for Kelly is included in Chris’ wages and subject

to federal income tax, UI, ETT, and SDI. Chris’ employer

pays all federal income tax incurred by Chris for the cost

of health insurance for Kelly.

To calculate the total subject wages with regards to the

employer provided health insurance, assume that the

taxpayer is in the 35 percent federal tax bracket and

complete the calculation:

$5,000 ÷ (1 – .3500) = $7,692.31

Total subject wages must include the $7,692.31 when

reported on the DE 9C and included as wages on the

employee’s Form W-2. The total PIT wages should not

include the $7,692.31 as the entire amount is excluded

from gross wages for PIT purposes.

Note: For California income tax purposes, a registered

domestic partner is considered a spouse and the employer-

provided benefits are excluded from gross wages for PIT

purposes.

DE 231Q Rev. 33 (1-17) (INTERNET) Page 2 of 3

REFERENCES

The CUIC governs and defines reportable wages in

California. Section 935 of the CUIC excludes from

wages, for UI, ETT, and SDI purposes, payments made by

household and agricultural employers for the employee’s

share of FICA. Section 926 of the CUIC governs all other

employers when determining wages subject to UI, ETT,

and SDI.

Household and agricultural employers are not required to

withhold PIT from wages. However, these wages should

be reported by the employees as taxable income on their

personal income tax returns. Therefore, the employer

is required to report the wages as PIT subject wages.

Sections 13009, 13009.5, and 13020 of the CUIC govern

PIT withholding and reportable PIT wages.

This information sheet is provided as a public service and is intended to provide nontechnical assistance. Every attempt has been made

to provide information that is consistent with the appropriate statutes, rules, and administrative and court decisions. Any information that

is inconsistent with the law, regulations, and administrative and court decisions is not binding on either the Employment Development

Department or the taxpayer. Any information provided is not intended to be legal, accounting, tax, investment, or other professional advice.

ADDITIONAL INFORMATION

For further assistance, please contact the Taxpayer

Assistance Center at 888-745-3886 or visit the nearest

Employment Tax Office listed in the California Employer’s

Guide, DE 44, and on the Employment Development

Department (EDD) website at

www.edd.ca.gov/Office_Locator/.

The EDD is an equal opportunity employer/program.

Auxiliary aids and services are available upon request to

individuals with disabilities. Requests for services, aids,

and/or alternate formats need to be made by calling

888-745-3886 (voice) or TTY 800-547-9565.

DE 231Q Rev. 33 (1-17) (INTERNET) Page 3 of 3