Fillable Printable De 231T

Fillable Printable De 231T

De 231T

DE 231T Rev. 6 (1-11) (INTERNET) Page 1 of 2 CU

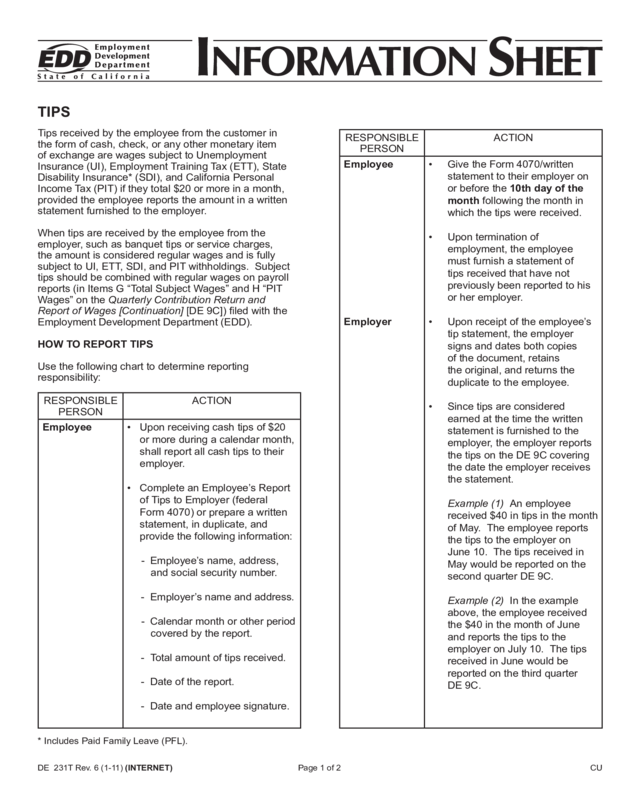

TIPS

* Includes Paid Family Leave (PFL).

Tips received by the employee from the customer in

the form of cash, check, or any other monetary item

of exchange are wages subject to Unemployment

Insurance (UI), Employment Training Tax (ETT), State

Disability Insurance* (SDI), and California Personal

Income Tax (PIT) if they total $20 or more in a month,

provided the employee reports the amount in a written

statement furnished to the employer.

When tips are received by the employee from the

employer, such as banquet tips or service charges,

the amount is considered regular wages and is fully

subject to UI, ETT, SDI, and PIT withholdings. Subject

tips should be combined with regular wages on payroll

reports (in Items G “Total Subject Wages” and H “PIT

Wages” on the Quarterly Contribution Return and

Report of Wages [Continuation] [DE 9C]) led with the

Employment Development Department (EDD).

HOW TO REPORT TIPS

Use the following chart to determine reporting

responsibility:

RESPONSIBLE

PERSON

ACTION

Employee • Upon receiving cash tips of $20

or more during a calendar month,

shall report all cash tips to their

employer.

• Complete an Employee’s Report

of Tips to Employer (federal

Form 4070) or prepare a written

statement, in duplicate, and

provide the following information:

- Employee’s name, address,

and social security number.

- Employer’s name and address.

- Calendar month or other period

covered by the report.

- Total amount of tips received.

- Date of the report.

- Date and employee signature.

RESPONSIBLE

PERSON

ACTION

Employee

Employer

• Give the Form 4070/written

statement to their employer on

or before the 10th day of the

month following the month in

which the tips were received.

• Upon termination of

employment, the employee

must furnish a statement of

tips received that have not

previously been reported to his

or her employer.

• Upon receipt of the employee’s

tip statement, the employer

signs and dates both copies

of the document, retains

the original, and returns the

duplicate to the employee.

• Since tips are considered

earned at the time the written

statement is furnished to the

employer, the employer reports

the tips on the DE 9C covering

the date the employer receives

the statement.

Example (1) An employee

received $40 in tips in the month

of May. The employee reports

the tips to the employer on

June 10. The tips received in

May would be reported on the

second quarter DE 9C.

Example (2) In the example

above, the employee received

the $40 in the month of June

and reports the tips to the

employer on July 10. The tips

received in June would be

reported on the third quarter

DE 9C.

DE 231T Rev. 6 (1-11) (INTERNET) Page 2 of 2 CU

ADDITIONAL INFORMATION

For further assistance, please contact the Taxpayer

Assistance Center at (888) 745-3886, or visit the

nearest Employment Tax Ofce listed in the California

Employer’s Guide (DE 44), or access EDD’s Web site

at www.edd.ca.gov/Ofce_Locator/.

The EDD is an equal opportunity employer/program.

Auxiliary aids and services are available upon request

to individuals with disabilities. Requests for services,

aids, and/or alternate formats need to be made by

calling (888) 745-3886 (voice), or TTY (800) 547-9565.

This information sheet is provided as a public service and is intended to provide nontechnical assistance. Every attempt has been made

to provide information that is consistent with the appropriate statutes, rules, and administrative and court decisions. Any information that

is inconsistent with the law, regulations, and administrative and court decisions is not binding on either the Employment Development

Department or the taxpayer. Any information provided is not intended to be legal, accounting, tax, investment, or other professional advice.

RESPONSIBLE

PERSON

ACTION

Employer

(cont.)

be issued in quadruplicate and

distributed as follows:

- Original and one copy issued

to the employee.

- Second copy attached to the

Quarterly Contribution Return

and Report of Wages (DE 9)

when it is submitted to EDD.

- Third copy retained in the

employer’s record.

• If the employer estimates or

allocates the amount of tips

received by the employee, the

employer will reconcile the

estimation/allocation with the

amount of tips actually reported

by employee, adjusting for any

differences between the amount

of SDI and PIT withheld and the

amount actually due. On the

DE 9C for the quarter, the

employer includes the actual

amount of tips reported by the

employee.

RESPONSIBLE

PERSON

ACTION

Employer

(cont.)

Example (3) As in example (2),

the employee received $40 in

June; however, the employee

reported the $40 in tips for that

month on June 30. The tips

received would be reported on

the second quarter DE 9C.

• The employer combines the

reported tips with the employee’s

regular wages and reports the

total in Items G and H on the DE

9C.

• The employer withholds

SDI contributions and PIT

withholdings on the employee’s

reported tips from one of the

following:

- Wages payable at the time the

tip statement is led by the

employee.

- Wages that become payable

later in the same calendar year

that the tip statement is led.

- The employee directly, at the

time the tip statement is led or

later in the same calendar year.

• If unable to collect the SDI and

PIT withholding due on reported

tips (for example, the wages

to be paid are insufcient),

the employer can provide the

employee with a Statement

of Amount Due From Worker

(DE 370) available from EDD.

Completion of the DE 370 or a

similar statement relieves the

employer of the uncollected

employee liability. The DE 370

or similar statement must