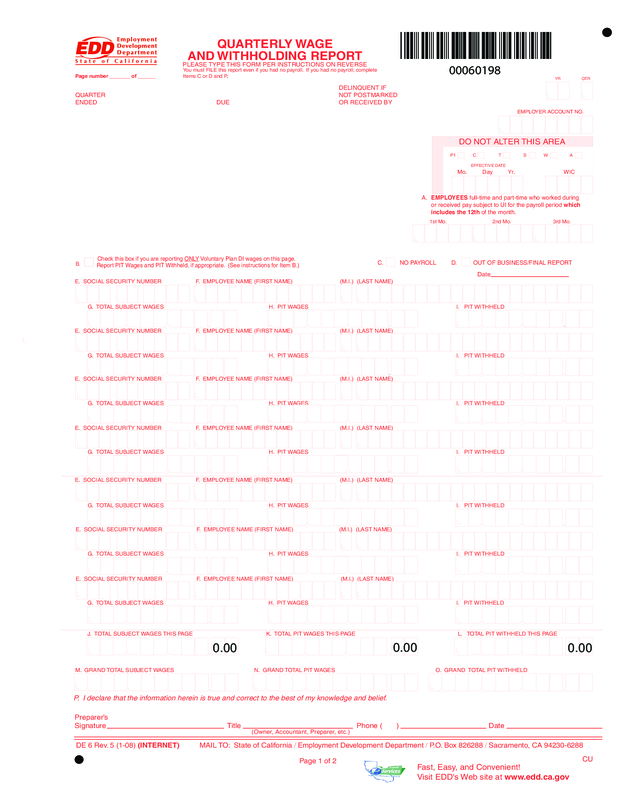

Fillable Printable De 6 Form

Fillable Printable De 6 Form

De 6 Form

00060198

You must FILE this report even if you had no payroll. If you had no payroll, complete

Items C or D and P.

QUARTERLY WAGE

AND WITHHOLDING REPORT

PLEASE TYPE THIS FORM PER INSTRUCTIONS ON REVERSE

DE 6 Rev. 5 (1-08) (INTERNET) MAIL TO: State of California / Employment Development Department / P.O. Box 826288 / Sacramento, CA 94230-6288

QUARTER

ENDED

DUE

Page number _______ of ______

Check this box if you are reporting ONLY Voluntary Plan DI wages on this page.

Report PIT Wages and PIT Withheld, if appropriate. (See instructions for Item B.)

C. NO PAYROLL D. OUT OF BUSINESS/FINAL REPORT

Preparer’s

Signature Title Phone ( ) Date

DELINQUENT IF

NOT POSTMARKED

OR RECEIVED BY

(Owner, Accountant, Preparer, etc.)

YR QTR

EMPLOYER ACCOUNT NO.

Mo. Day Yr. WIC

DO NOT ALTER THIS AREA

P1 C T S W A

EFFECTIVE DATE

A. EMPLOYEES full-time and part-time who worked during

or received pay subject to UI for the payroll period which

includes the 12th of the month.

.

E. SOCIAL SECURITY NUMBER F. EMPLOYEE NAME (FIRST NAME) (M.I.) (LAST NAME)

G. TOTAL SUBJECT WAGES H. PIT WAGES I. PIT WITHHELD

E. SOCIAL SECURITY NUMBER F. EMPLOYEE NAME (FIRST NAME) (M.I.) (LAST NAME)

G. TOTAL SUBJECT WAGES H. PIT WAGES I. PIT WITHHELD

.

E. SOCIAL SECURITY NUMBER F. EMPLOYEE NAME (FIRST NAME) (M.I.) (LAST NAME)

G. TOTAL SUBJECT WAGES H. PIT WAGES I. PIT WITHHELD

E. SOCIAL SECURITY NUMBER F. EMPLOYEE NAME (FIRST NAME) (M.I.) (LAST NAME)

G. TOTAL SUBJECT WAGES H. PIT WAGES I. PIT WITHHELD

E. SOCIAL SECURITY NUMBER F. EMPLOYEE NAME (FIRST NAME) (M.I.) (LAST NAME)

G. TOTAL SUBJECT WAGES H. PIT WAGES I. PIT WITHHELD

E. SOCIAL SECURITY NUMBER F. EMPLOYEE NAME (FIRST NAME) (M.I.) (LAST NAME)

G. TOTAL SUBJECT WAGES H. PIT WAGES I. PIT WITHHELD

E. SOCIAL SECURITY NUMBER F. EMPLOYEE NAME (FIRST NAME) (M.I.) (LAST NAME)

G. TOTAL SUBJECT WAGES H. PIT WAGES I. PIT WITHHELD

.

J. TOTAL SUBJECT WAGES THIS PAGE K. TOTAL PIT WAGES THIS PAGE L. TOTAL PIT WITHHELD THIS PAGE

M. GRAND TOTAL SUBJECT WAGES N. GRAND TOTAL PIT WAGES O. GRAND TOTAL PIT WITHHELD

.

3rd Mo.2nd Mo.

1st Mo.

.

P. I declare that the information herein is true and correct to the best of my knowledge and belief.

.

.

.

.

.

.

CU

.

.

.

.

B.

Date

.

.

.

.

.

. . . . . . .

. . . . .

. . . . . . .

. . . . . . .

. . . . . . .

. . . . . . .

.

Fast, Easy, and Convenient!

Visit EDD's Web site at www.edd.ca.gov

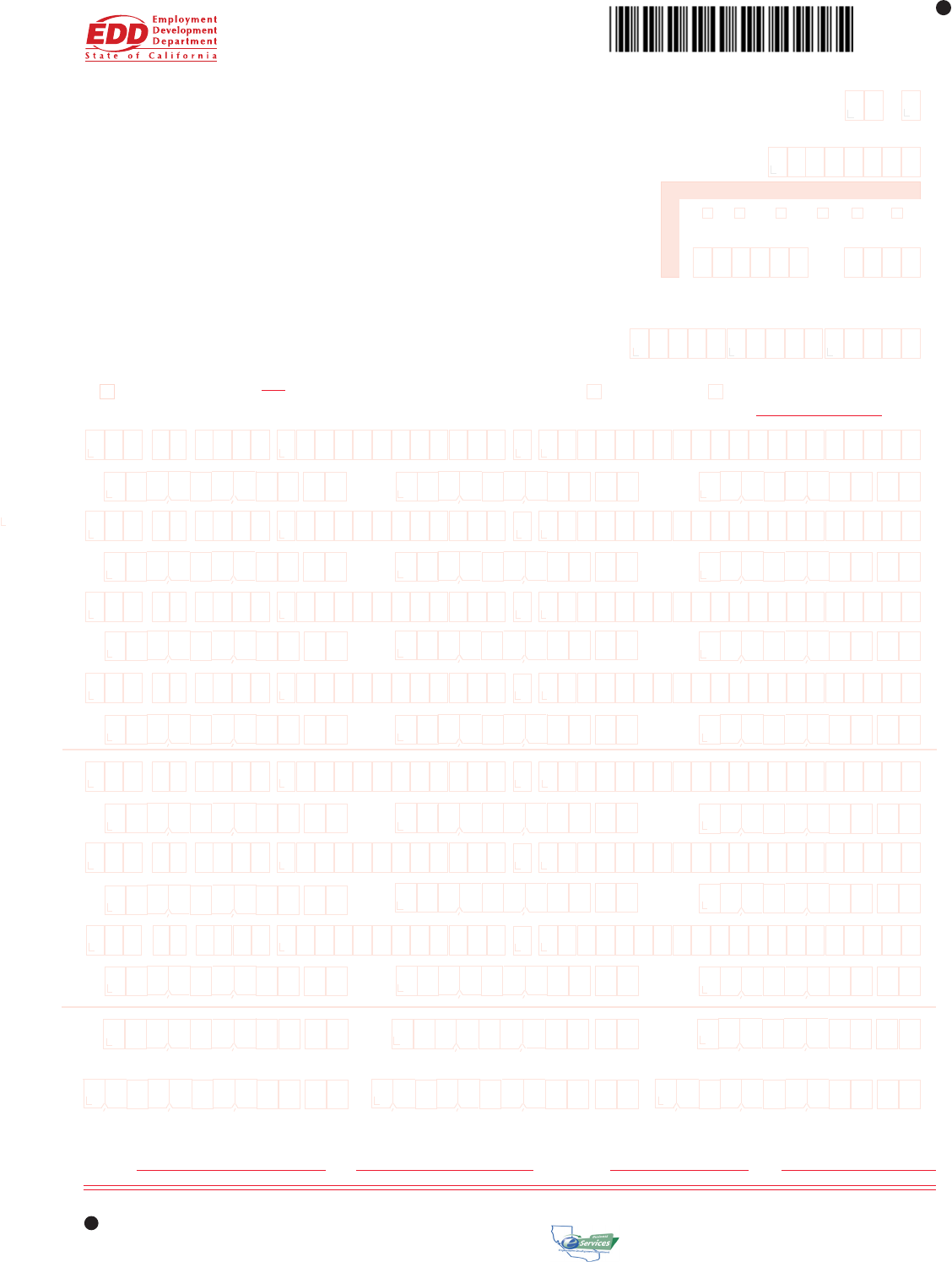

Page 1 of 2

0.00

0.00

0.00

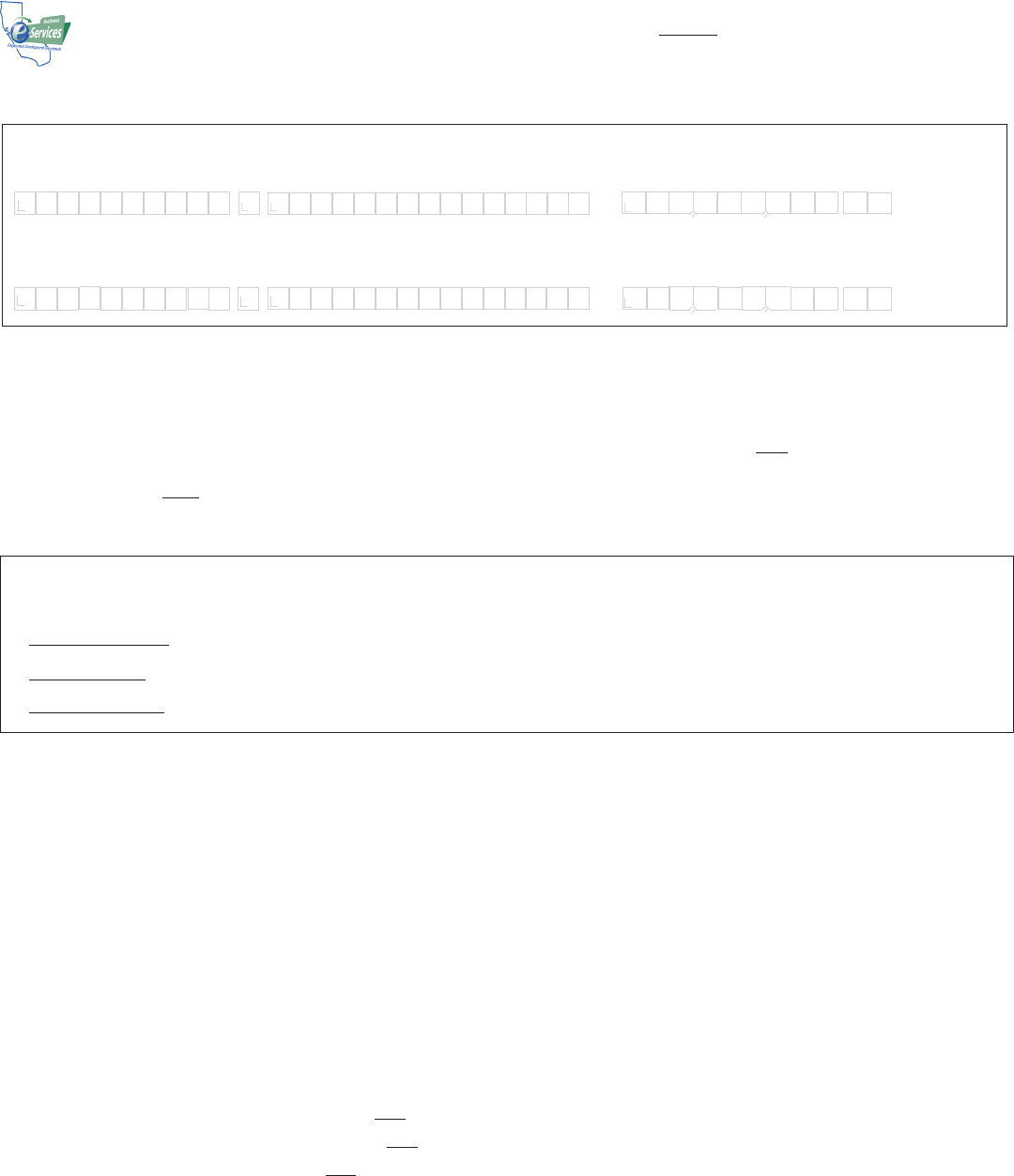

INSTRUCTIONS FOR COMPLETING QUARTERLY WAGE AND WITHHOLDING REPORT

PLEASE TYPE ALL INFORMATION - TYPE DOUBLE SPACE ONLY – DO NOT SINGLE SPACE

ITEM C. NO PAYROLL: Check this box if you had no payroll this quarter. Enter zeroes in each box in Item A and in Items M, N, and O.

ITEM D. OUT OF BUSINESS/FINAL REPORT: Check this box if this is your final report and you will not be reporting wages in any subsequent quarter. You

must also complete an Annual Reconciliation Statement (DE 7) and pay any amounts due with a Payroll Tax Deposit (DE 88), within 10 days of quit-

ting business to avoid penalty and interest charges. In the date line, please indicate the date your business closed.

ITEM E. SOCIAL SECURITY NUMBER (SSN): Enter the SSN of each employee or individual to whom you paid wages in subject employment, paid PIT

wages, and/or from whom you withheld state income taxes during the quarter. If someone does not have an SSN, report their name, wages and/or

withholdings without the SSN and TAKE IMMEDIATE STEPS TO SECURE ONE. Report the correct SSN to EDD as soon as possible on a Tax and

Wage Adjustment Form (DE 678).

ITEM F. EMPLOYEE NAME: Enter the name of each employee or individual to whom you paid wages in subject employment, paid PIT wages, and/or from

whom you withheld state income taxes during the quarter.

ITEM G. TOTAL SUBJECT WAGES: Enter the total subject wages paid (including cents) to each employee during the quarter. Generally, most wages are

considered “subject” wages. For special classes of employment and payments considered subject wages, refer to the California Employer’s Guide

Appendix under “Types of Employment” and “Types of Payments.”

ITEM H. PIT WAGES: Enter the amount of wages paid (including cents) that are subject to California state income taxes, even if you do not withhold PIT from

the wages. You must enter PIT wages even if they are the same as total subject wages. For additional information regarding PIT wages, refer to the

Information Sheet: Personal Income Tax Wages Reported on the Quarterly Wage and Withholding Report (DE 231PIT).

ITEM I. PIT WITHHELD: Enter the amount of PIT withheld from each individual during the quarter.

ITEM J. Enter the total subject wages paid (Item G) for each separate page. Do not carry this total forward from page to page.

ITEM K. Enter the total amount of PIT wages (Item H) for each separate page. Do not carry this total forward from page to page.

ITEM L. Enter the total PIT withheld (Item I) for each separate page. Do not carry this total forward from page to page.

ITEM M. ON PAGE 1 or the last page, enter the grand total of total subject wages paid (Item J) for all pages for the quarter.*

ITEM N. ON PAGE 1 or the last page, enter the grand total of PIT wages (Item K) for all pages for the quarter.*

ITEM O. ON PAGE 1 or the last page, enter the grand total of PIT withheld from all the employees (Item L) for all pages for the quarter.*

*NOTE: Provide separate grand totals for Voluntary Plan DI reporting and special exemption reporting (Religious Exemption, Sole Shareholder,

Third Party Sick Pay). Combine all other wage and withholding reports to arrive at the grand totals for Items M, N, and O.

ITEM P. ON PAGE 1 ONLY, please sign, state your title, enter your telephone number, and date the form.

WAGES AND WITHHOLDINGS TO REPORT ON A SEPARATE DE 6

Prepare a DE 6 to report the types of exemptions listed below. All three exemptions can be reported on one DE 6. Write the exemption title(s) at the top of the

form (e.g., SOLE SHAREHOLDER), and report only those individuals under these categories. Report all other employees or individuals without exemp-

tions on a separate DE 6.

• Religious Exemption: Employees who file and are approved by the Department for an exemption from SDI taxes under Section 2902 of the California

Unemployment Insurance Code (CUIC).

• Sole Shareholder: An individual who elects and is approved by the Department to be excluded from SDI coverage for benefits and taxes under Section

637.1 of the CUIC.

• Third Party Sick Pay: Recipients exempt from SDI taxes under Section 931.5 of the CUIC. Refer to the Employer’s Guide for detailed instructions on how

to report.

For a faster, easier, and more convenient method of reporting your DE 6 information, visit our Web site at www.edd.ca.gov.

Contact our Taxpayer Assistance Center at 1-888-745-3886 voice or TTY 1-800-547-9565 for additional forms or inquiries regarding reporting wages or

the subject status of employees. You may also refer to the California Employer’s Guide (DE 44) for additional information.

IF YOU STILL OWE TAXES when preparing this report, submit a Payroll Tax Deposit (DE 88) with your payment to the address on the DE 88.

Retain a copy of the DE 6(s) for your records. If you have more than seven employees, use additional pages or a format approved by the Department. If using

more than one page, number the pages consecutively at the top of the form. If the form is not preprinted, enter your account number, business name and address,

the year, and quarter the report is for. For information, specifications and approvals of alternate forms, contact the Alternate Forms Coordinator at (916) 255-0649.

ITEM A. NUMBER OF EMPLOYEES: Page 1 only: Enter the number of full-time and part-time workers who worked during or received pay subject to Unem-

ployment Insurance for the payroll period which includes the 12th of the month. Please provide a count for each of the three months. Blank fields

will be identified as missing data.

ITEM B. Check this box ONLY if the employees reported are covered by an employer sponsored Voluntary Plan for the payment of disability benefits. If you also

have employees covered under the State Plan for disability benefits, report their wages and withholdings separately on another page of the DE 6.

I M O G E N E A S A M P L E 1 2 3 4 5 0 0

Please record information in the spaces provided. If you use a typewriter or printer, ignore the boxes and type in UPPER CASE as shown.

When reporting dollar amounts, use DOLLARS AND CENTS. Do not use dashes or slashes.

.

EMPLOYEE FIRST NAME M.I. EMPLOYEE LAST NAME TOTAL SUBJECT WAGES

If you must hand write this form, print each letter or number in a separate box as shown. Do not write commas or decimal points.

TOTAL SUBJECT WAGES

EMPLOYEE FIRST NAME M.I. EMPLOYEE LAST NAME

.

IMOGENE A SAMPLE 12345.67

DE 6 Rev. 5 (1-08) (INTERNET) Page 2 of 2 CU