Fillable Printable Disability Insurance Elective Coverage (Diec) Rate Notice (De 3Di-I)

Fillable Printable Disability Insurance Elective Coverage (Diec) Rate Notice (De 3Di-I)

Disability Insurance Elective Coverage (Diec) Rate Notice (De 3Di-I)

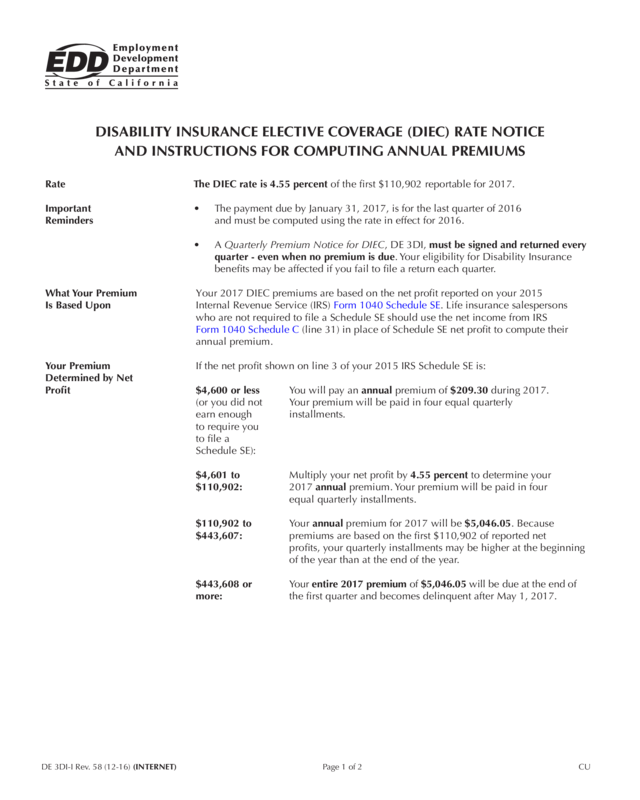

DISABILITY INSURANCE ELECTIVE COVERAGE (DIEC) RATE NOTICE

AND INSTRUCTIONS FOR COMPUTING ANNUAL PREMIUMS

Rate The DIEC rate is 4.55 percent of the first $110,902 reportable for 2017.

Important • The payment due by January 31, 2017, is for the last quarter of 2016

Reminders and must be computed using the rate in effect for 2016.

• A Quarterly Premium Notice for DIEC, DE 3DI, must be signed and returned every

quarter - even when no premium is due. Your eligibility for Disability Insurance

benefits may be affected if you fail to file a return each quarter.

What Your Premium

Is Based Upon

Your 2017 DIEC premiums are based on the net profit reported on your 2015

Internal Revenue Service (IRS) Form 1040 Schedule SE. Life insurance salespersons

who are not required to file a Schedule SE should use the net income from IRS

Form 1040 Schedule C (line 31) in place of Schedule SE net profit to compute their

annual premium.

Your Premium If the net profit shown on line 3 of your 2015 IRS Schedule SE is:

Determined by Net

Profit $4,600 or less You will pay an annual premium of $209.30 during 2017.

(or you did not Your premium will be paid in four equal quarterly

earn enough installments.

to require you

to file a

Schedule SE):

$4,601 to Multiply your net profit by 4.55 percent to determine your

$110,902: 2017 annual premium. Your premium will be paid in four

equal quarterly installments.

$110,902 to Your annual premium for 2017 will be $5,046.05. Because

$443,607: premiums are based on the first $110,902 of reported net

profits, your quarterly installments may be higher at the beginning

of the year than at the end of the year.

$443,608 or Your entire 2017 premium of $5,046.05 will be due at the end of

more: the first quarter and becomes delinquent after May 1, 2017.

DE 3DI-I Rev. 58 (12-16) (INTERNET) Page 1 of 2 CU

What Your Benefits Benefits are based on the income credits during the four quarters of the base period of

Are Based Upon your claim, not on your actual earnings during those quarters. For additional information

on eligibility or benefit amounts, please contact your local Disability Insurance office.

Disabled You do not pay premiums for periods when you are disabled. You are, however, required

to pay premiums on the first $110,902 in reported net profits. Therefore, a decreased

premium in one quarter may result in an increased premium later in the same calendar

year. For additional information, please refer to your DE 3DI.

How to Cancel Members who have been in the DIEC program for two complete calendar years and wish

to voluntarily cancel their elective coverage agreement may do so by filing a written

request. The request must be postmarked during the month of January and will be

effective on January 1. Requests postmarked after January 31 must show good cause for

failure to meet this cut-off date or they will be rejected.

Please send correspondence to:

Employment Development Department

DIEC Unit, MIC 5

PO Box 826880

Sacramento, CA 94280-0001

Remember, your premium notice and payment for the quarter ended December 31 are

still due by the following January 31, even if you request cancellation of your coverage.

Involuntary

Termination

Section 704.1 of the California Unemployment Insurance Code (CUIC) allows

the Employment Development Department (EDD) to terminate an elective coverage

agreement if it is discovered that:

(1) The individual is an employee and not self-employed.

(2) The individual is no longer self-employed.

(3) The individual’s self-employment is seasonal.

(4) The major portion of the individual’s work-related income does not come from

self-employment activities.

(5) The individual’s net profit from self-employment is less than $4,600 for three

consecutive years.

(6) The individual fails to file returns or pay premiums within the time required by the

EDD.

(7) The individual filed a false statement in order to be considered eligible for elective

coverage.

(8) The individual has been convicted of any violation for filing a false claim for

benefits pursuant to Chapter 10 (commencing with Section 2101) of the CUIC.

Additional

Information

Additional information regarding the DIEC program may be obtained by calling

888-745-3886 or by writing to the address shown above. Information may also

be obtained by visiting the EDD website at www.edd.ca.gov/Disability/faqs.htm.

The EDD is an equal opportunity employer/program. Auxiliary aids and services are available upon request to

individuals with disabilities. Requests for services, aids, and/or alternate formats need to be made by calling

888-745-3886 (voice) or TTY 800-547-9565.

DE 3DI-I Rev. 58 (12-16) (INTERNET) Page 2 of 2