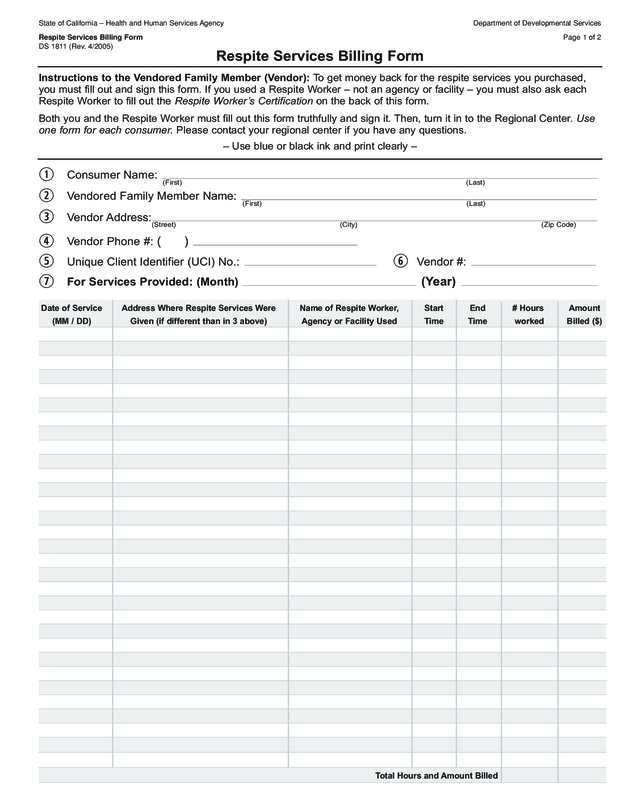

Fillable Printable Ds 1811 - Respite Services Billing Form

Fillable Printable Ds 1811 - Respite Services Billing Form

Ds 1811 - Respite Services Billing Form

q

Consumer Name:

(First) (Last)

w

Vendored Family Member Name:

(First) (Last)

e

Vendor Address:

(Street) (City) (Zip Code)

r

Vendor Phone #: ( )

t

Unique Client Identifier (UCI) No.:

y

Vendor #:

u

For Services Provided: (Month) (Year)

Date of Service Address Where Respite Services Were Name of Respite Worker, Start End # Hours Amount

(MM / DD) Given (if different than in 3 above) Agency or Facility Used Time Time worked Billed ($)

Instructions to the Vendored Family Member (Vendor): To get money back for the respite services you purchased,

you must fill out and sign this form. If you used a Respite Worker – not an agency or facility – you must also ask each

Respite Worker to fill out the Respite Worker’s Certification on the back of this form.

Both you and the Respite Worker must fill out this form truthfully and sign it. Then, turn it in to the Regional Center. Use

one form for each consumer. Please contact your regional center if you have any questions.

– Use blue or black ink and print clearly –

Respite Services Billing Form

State of California – Health and Human Services Agency Department of Developmental Services

Respite Services Billing Form Page 1 of 2

DS 1811 (Rev. 4/2005)

Total Hours and Amount Billed

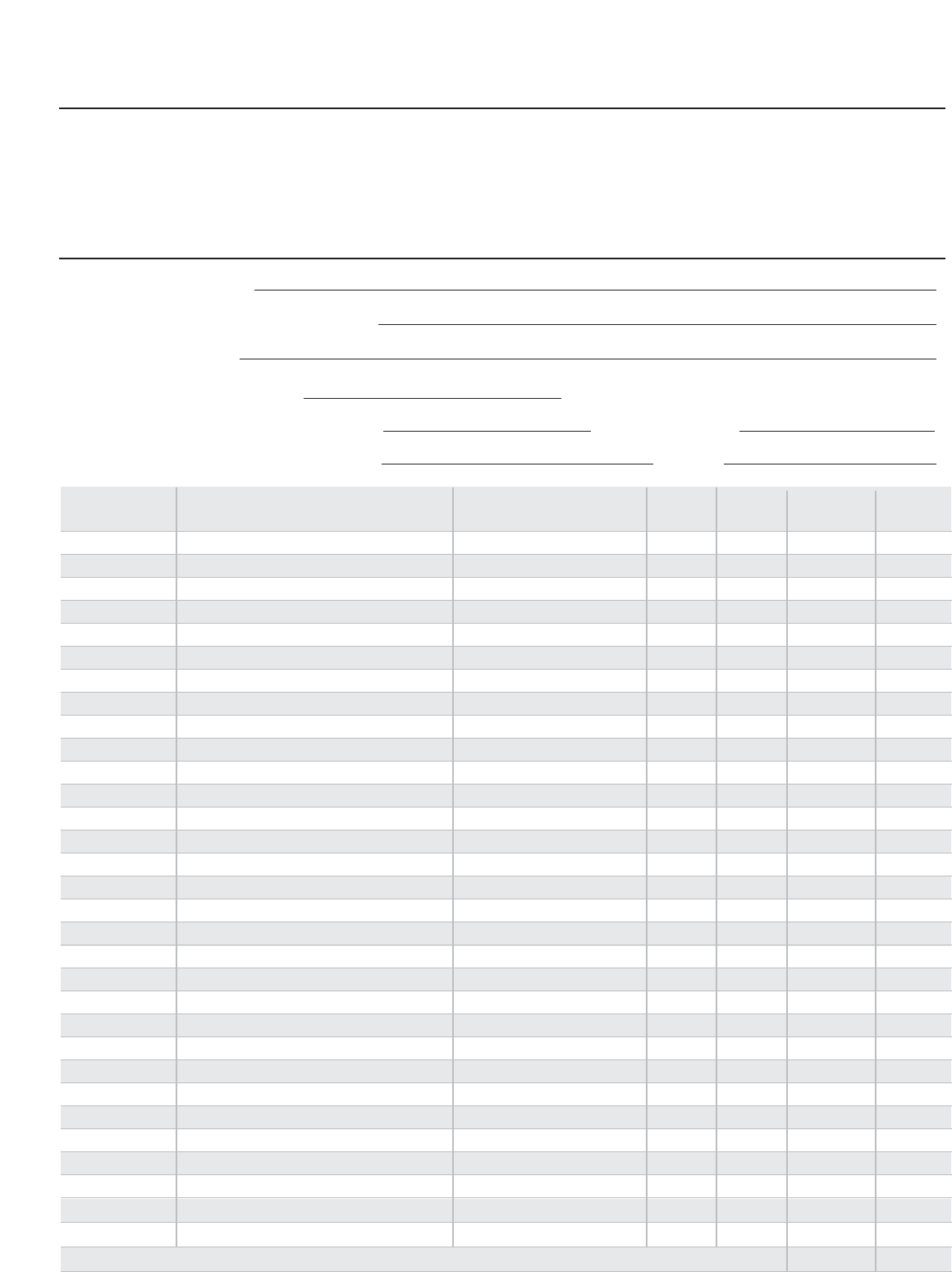

– Respite Worker’s Certification –

If you are a Respite Worker — not an agency or facility — you

must fill out and sign below.

– Use blue or black ink and print clearly –

Respite Worker Name:

(First) (Last)

Phone #: ( ) SS #*:

Address:

I certify I gave respite services to the consumer listed on this form at

the address, dates and times shown. I understand if I knowingly give

information that is untrue, I may be fined or go to jail.

X Date: / /

(Respite Worker #1 Signature)

If more than one Respite Worker was used, Respite Worker #2

must fill out and sign below:

– Use blue or black ink and print clearly –

Respite Worker Name:

(First) (Last)

Phone #: ( ) SS #*:

Address:

I certify I gave respite services to the consumer listed on this form at

the address, dates and times shown. I understand if I knowingly give

information that is untrue, I may be fined or go to jail.

X Date: / /

(Respite Worker #2 Signature)

– Vendored Family Member’s Certification –

q

My family member received all the respite service hours reported on this form. I

understand that I can only bill for the respite services actually given to my family

member by a Respite Worker, agency or facility. I cannot provide the respite service

myself. The consumer can receive the service at a relative’s home.

w

I must keep printed copies of all respite service records for 5 years. The records

must include all of the following:

• dates of service

• address where the services were provided

• name/s of the Respite Worker/s, agency or facility

• proof of payment (like cancelled checks, money orders, cashiers checks, payroll

records/documents or bank statements, etc.). If I provide receipts for cash

payment, I must also provide payroll records/documents and/or bank statements.

e

If I used a Respite Worker – not an agency or facility – I must also keep records of

each worker’s:

• date of birth, • Social Security number or a copy of the proof of

• address, eligibility for employment given to me by my worker.

• phone number, and

r

Any authorized county, state or federal agency can audit me and I agree to show

the information and records listed above to the auditor.

t

I did not choose my Respite Worker/s based on race, religion, color, national or

ethnic origin, sex, age, or physical or mental disability. The Respite Worker/s I

chose were at least 18 years old. I made sure they had the skills, training, or

education to provide the respite services. I also made sure they were trained to take

care of any special supports or needs listed in the consumer’s IPP or IFSP.

y

The government may consider me the Respite Worker/s’ employer. I may be

responsible for withholding federal, state, and local taxes from the Respite Worker/s’

wages and for paying and reporting the Respite Worker/s’ payroll taxes and wages

to the IRS and the Employment Development Department (EDD). I may also have

to provide Workers’ Compensation for the worker/s I hire. If I do not know how to do

this, it is my responsibility to contact a tax consultant, IRS or EDD or a Workers’

Compensation carrier for more information. I declare under penalty of perjury, that

the above information and the information on page 1 are true and correct. I also

declare that I am the only person who employed, supervised, and assigned duties

to the Respite Worker/s listed on this form. I have read and followed all respite

service program requirements and the terms and conditions listed above.

u

All information on this form is correct and complete. I understand if I knowingly give

information that is untrue, I may be fined or go to jail.

– Use blue or black ink –

X Date: / /

(

V

endored Family Member Signature

)

DS 1811 (Rev. 4/2005) Page 2 of 2

* We will use your Social Security number to verify your statements on this form and

to confirm compliance with all applicable laws and regulations. If you do not provide

this information truthfully, you will not be paid or reimbursed for these services. If

you do not have a Social Security number, write what type of proof of eligibility for

employment you gave your employer.