Fillable Printable Dtf-804 - New York State

Fillable Printable Dtf-804 - New York State

Dtf-804 - New York State

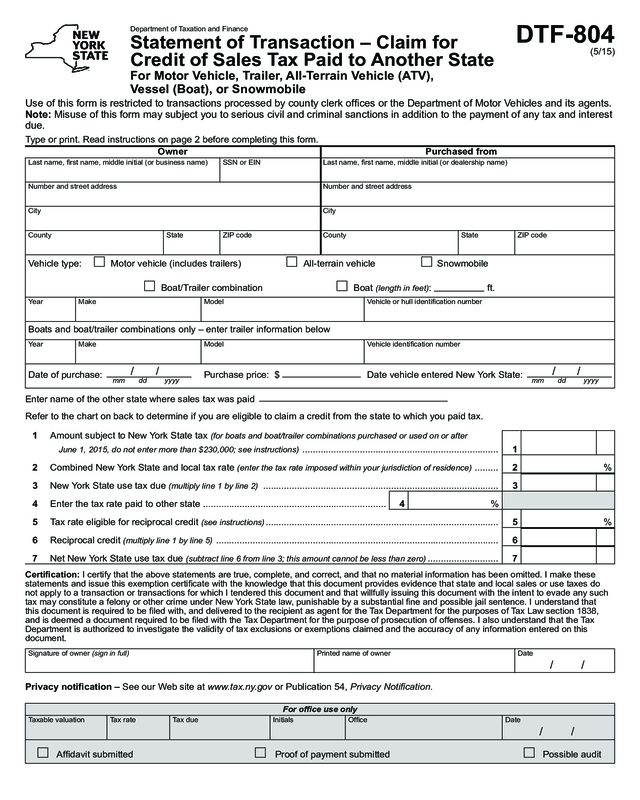

Department of Taxation and Finance

Statement of Transaction – Claim for

Credit of Sales Tax Paid to Another State

For Motor Vehicle, Trailer, All‑Terrain Vehicle (ATV),

Vessel (Boat), or Snowmobile

DTF‑804

(5/15)

Type or print. Read instructions on page 2 before completing this form.

Owner Purchased from

Lastname,rstname,middleinitial(orbusinessname)SSNorEINLastname,rstname,middleinitial(ordealershipname)

NumberandstreetaddressNumberandstreetaddress

City City

CountyStateZIPcodeCountyStateZIPcode

Vehicletype:Motorvehicle(includestrailers)All-terrainvehicleSnowmobile

Boat/Trailer combination Boat

(length in feet): ft.

YearMakeModelVehicleorhullidenticationnumber

Boatsandboat/trailercombinationsonly–entertrailerinformationbelow

YearMakeModelVehicleidenticationnumber

Date of purchase:

Purchaseprice:$DatevehicleenteredNewYorkState:

Enternameoftheotherstatewheresalestaxwaspaid

Refertothechartonbacktodetermineifyouareeligibletoclaimacreditfromthestatetowhichyoupaidtax.

1 AmountsubjecttoNewYorkStatetax

(for boats and boat/trailer combinations purchased or used on or after

June 1, 2015, do not enter more than $230,000; see instructions) ...........................................................................1

2 CombinedNewYorkStateandlocaltaxrate(enter the tax rate imposed within your jurisdiction of residence) .........2 %

3 NewYorkStateusetaxdue(multiply line 1 by line 2) ..........................................................................................3

4 Enterthetaxratepaidtootherstate...................................................................... 4 %

5 Tax rate eligible for reciprocal credit (see instructions) .........................................................................................5 %

6Reciprocal credit (multiply line 1 by line 5) ............................................................................................................6

7 NetNewYorkStateusetaxdue(subtract line 6 from line 3; this amount cannot be less than zero) ........................... 7

Certication: Icertifythattheabovestatementsaretrue,complete,andcorrect,andthatnomaterialinformationhasbeenomitted.Imakethese

statementsandissuethisexemptioncerticatewiththeknowledgethatthisdocumentprovidesevidencethatstateandlocalsalesorusetaxesdo

notapplytoatransactionortransactionsforwhichItenderedthisdocumentandthatwillfullyissuingthisdocumentwiththeintenttoevadeanysuch

taxmayconstituteafelonyorothercrimeunderNewYorkStatelaw,punishablebyasubstantialneandpossiblejailsentence.Iunderstandthat

thisdocumentisrequiredtobeledwith,anddeliveredtotherecipientasagentfortheTaxDepartmentforthepurposesofTaxLawsection1838,

andisdeemedadocumentrequiredtobeledwiththeTaxDepartmentforthepurposeofprosecutionofoffenses.IalsounderstandthattheTax

Department is authorized to investigate the validity of tax exclusions or exemptions claimed and the accuracy of any information entered on this

document.

Signatureofowner(sign in full) PrintednameofownerDate

For ofce use only

TaxablevaluationTaxrateTaxdueInitialsOfceDate

AfdavitsubmittedProofofpaymentsubmittedPossibleaudit

UseofthisformisrestrictedtotransactionsprocessedbycountyclerkofcesortheDepartmentofMotorVehiclesanditsagents.

Note: Misuse of this form may subject you to serious civil and criminal sanctions in addition to the payment of any tax and interest

due.

Privacy notication –SeeourWebsiteatwww.tax.ny.govorPublication54,Privacy Notication.

mm dd

yyyy

mm dd

yyyy

/ // /

/ /

/ /

Page 2 of 2 DTF-804 (5/15)

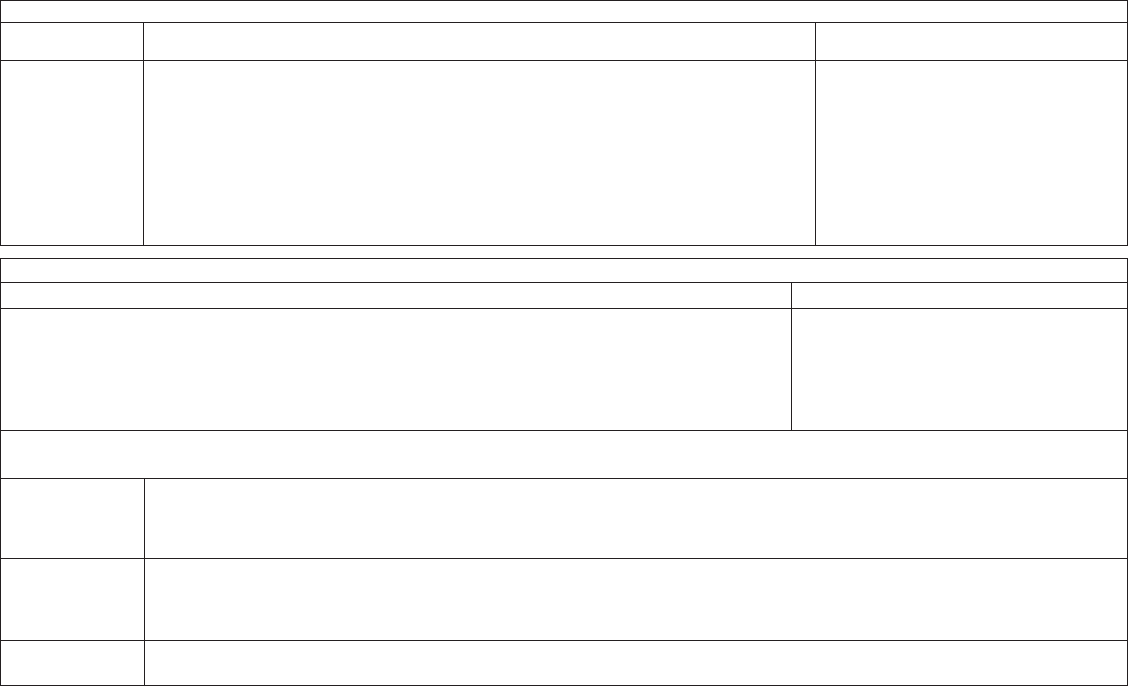

Instructions

Motor vehicles

Full rate eligible No New York State credit currently allowed* Special rules

for credit

Arizona

California

Florida

Hawaii

Massachusetts

Michigan

SouthCarolina

Wyoming

Alabama

Alaska

Arkansas

Colorado

Connecticut

Delaware

District of Columbia

Georgia

Idaho

Illinois

Iowa

Kansas

Kentucky

Louisiana

Maine

Missouri

Minnesota

Mississippi

Montana

Nebraska

NewHampshire

Nevada

NewJersey

NewMexico

NorthCarolina

NorthDakota

Ohio

Oklahoma

Oregon

Pennsylvania

RhodeIsland

SouthDakota

Tennessee

Texas

Utah

Vermont

Virginia

Washington

WestVirginia

Wisconsin

Maryland–Creditisallowedonlyagainstthe

4%stateportionoftheNewYorkStatetax

for the Maryland excise tax on motor vehicles.

Enteronline5thelesserofthe4%NewYork

StaterateortheMarylandrate.

Indiana–Creditisallowedonlyagainstthe

4%stateportionoftheNewYorkStatetax

fortaxpaidtoIndiana.Enteronline5the

lesserofthe4%NewYorkStaterateorthe

Indianarate.

All‑terrain vehicles (ATVs), snowmobiles, vessels, and trailers

Full rate eligible for credit No New York State credit currently allowed*

Alabama

Arkansas

Arizona

California

Colorado

Connecticut

District of Columbia

Florida

Hawaii

Idaho

Illinois

Kansas

Louisiana

Maryland

Massachusetts

Michigan

Missouri

Nebraska

Nevada

NewJersey

NewMexico

NorthDakota

Ohio

Pennsylvania

RhodeIsland

SouthCarolina

SouthDakota

Tennessee

Creditagainstthe4%stateportionoftheNewYorkStatetaxisallowedforthestate portion of the tax paid to these states. Also, credit

isallowedagainstthelocalportionoftheNewYorkStatetaxforthelocalportionofthetaxpaidtothesestates.However,nocredit

isallowedagainstthestateportionoftheNewYorkStatetaxforthelocalportionofthetaxpaid.Nocreditisallowedagainstthelocal

portionoftheNewYorkStatetaxforthestateportionofthetaxpaid.

Creditisallowedonlyagainstthe4%stateportionoftheNewYorktaxforthestateportionofthetaxpaidtothesestates.Enter

online5thelesseroftheNewYorkStaterateortheapplicablestaterate.

Credit against the state and localNewYorktaxisallowedonlyforthestateportionofthetaxpaidtoMississippi.Nocreditis

allowedagainstNewYork’slocal taxes for any localtaxpaidtoMississippi.Enteronline5theMississippistatetaxrateonly.

Texas

Utah

Vermont

Virginia

Washington

WestVirginia

Wyoming

Alaska

Delaware

Maine

Montana

NewHampshire

Oregon

Special rules

Formoreinformation,seeTaxBulletinST-765(TB-ST-765),Reciprocal Credit for Sales or Use Taxes Paid to Other Taxing Jurisdictions.

Georgia

NorthCarolina

Oklahoma

Wisconsin

Indiana

Iowa

Kentucky

Minnesota

Mississippi

General information

This form is to be used by a purchaser of a motor vehicle, all-terrain vehicle,

trailer,vessel,orsnowmobile(qualifying vehicle or vessel) to report the

salesandusetaxdueonapurchaseforwhichthepurchaserwantstoclaim

a credit for sales tax paid to another state.

ANewYorkStateresidentwhopurchasesaqualifyingvehicleorvessel

outsidethestatebecomesliableforNewYorkStateandlocalsalesanduse

taxifthequalifyingvehicleorvesselisbroughtintothestate.However,a

creditagainsttheNewYorktaxduemaybeavailableifallofthefollowing

apply:

•Thebuyerwasrequiredtopaytaxtoanotherstateonthepurchase;

•thatstateprovidesareciprocaltaxcreditthatissimilartothetaxcreditfor

NewYorkState;and

•thebuyerisnotentitledtoarefundofthattaxfromtheotherstate.

Ifalltheseconditionsaremet,thenthebuyermaybegrantedacredit

againsttheusetaxduetoNewYorkStateforthetaxpaid(oraportionof

the tax paid) to the other state.

Note:Beforecompletingthisform,refertothechartsbelowtodetermineif

NewYorkStateprovidesareciprocalcreditforsalestaxpaidtothestate

whereyoumadeyourpurchase.For motor vehicles, New York State

provides a reciprocal credit for tax paid to a very limited number of

states.Ifnoreciprocalcreditisavailable,useFormDTF-802,Statement of

Transaction - Sale or Gift of Motor Vehicle, Trailer, All-Terrain Vehicle (ATV),

Vessel (Boat), or Snowmobile,insteadofthisform.Ifyoupaidtaxtoastate

forwhichnoNewYorkStatereciprocalcreditisallowedyoushouldapply

tothatstateforarefund.Ifthestatedeniestherefundyoumaybeeligible

foracreditforsomeoralloftheNewYorktaxyoumustpaynow.Toapply,

leFormAU-11,Application for Credit or Refund of Sales or Use Tax, and

attach proof of tax payment to and proof of the refund denial by the other

state.

Specic instructions

•Entertheownerinformation.Completeallentries,includingtheowner’s

socialsecuritynumber(SSN)oremployeridenticationnumber(EIN).

•Enterthenameandaddressofthepersonordealershipfromwhomthe

qualifyingvehicleorvesselwaspurchased.

•Enterthequalifyingvehicleorvesselidenticationinformation.

•Enterthedateofpurchaseandthepurchaseprice.Purchase price

includes any monetary consideration, the value of any property

exchangedortraded(otherthanatrade-inallowancegrantedbya

dealer), and any assumption of a debt or liability of the seller. Also enter

thedatethevehicleenteredNewYorkState.

•Enterthenameofthestatetowhichthesalestaxwaspaid.

Line 1 –EntertheamountsubjecttoNewYorkStatesalestax.Thisamount

iseitherthepurchasepriceenteredaboveor,ifthevehiclewasused

outsideNewYorkStateformorethansixmonthsbeforeitwasbroughtinto

thestate,thefairmarketvalue,whicheverislower.Fairmarketvalueis

generally determined from values established by private companies.

For boats and boat/trailer combinations purchased or used on or after

June1,2015,theamounteligibleforcreditcannotexceed$230,000,

regardlessofthepurchasepriceoftheboatortrailer.SeeTSB-M-15(2)S,

Change to the Application of Sales and Use Tax on Vessels.

Line 2 – The applicable local rate of tax on the purchase or use of a

qualifyingvehicleorvesselistherateoftaxforthelocalityinwhichthe

purchaserisaresident.Ifthepurchaserisaresidentofmorethanone

localitywithinthestate,theapplicablelocaltaxrateistherateoftaxfor

thatlocalitywherethepurchaserisaresidentandthequalifyingvehicleor

vesselisprincipallyusedorgaraged.RefertoPublication718,New York

State Sales and Use Tax Rates by Jurisdiction, for a listing of current

combined state and local tax rates.

Line 5

–

Enterthetaxrateeligibleforcredit.Usethechartsbelowto

determinethecorrectrateoftaxeligibleforcreditforthestatewhereyou

made the purchase, based on the type of vehicle you purchased. The

maximum rate eligible for credit cannot be higher than the rate of tax

imposedwithinyourjurisdictionofresidence(seeline2onthefront).Ifyou

made your purchase in a state listed under Special rulesinthechartsbelow,

besuretocalculatetheallowablecreditexactlyasexplained.

Any excess reciprocal credit cannot be refunded or used to offset any other

sales or use tax liabilities. For more information regarding reciprocal credits,

seeTaxBulletinST-765(TB-ST-765),Reciprocal Credit for Sales or Use

Taxes Paid to Other Taxing Jurisdictions.

*You may be eligible for a refund of the taxes paid to the other state (see Note: above).