Fillable Printable Dyed Diesel User Application

Fillable Printable Dyed Diesel User Application

Dyed Diesel User Application

Office use only

Account number Initials Date

X

Dyed Diesel User Application

Use this form to apply for a Dyed Diesel User license from the International Fuel Tax Agreement (IFTA) unit. As a first time

user, read all the instructions on the following page. Once you have completed the application, mail to the address below.

We will contact you after we have processed the application. Send this completed form to:

Prorate and Fuel Tax IFTA Unit

Department of Licensing

PO Box 9228

Olympia WA 98507-9228

Fax: (360) 570-7829 or (360) 570-7839

Please read instructions before continuing

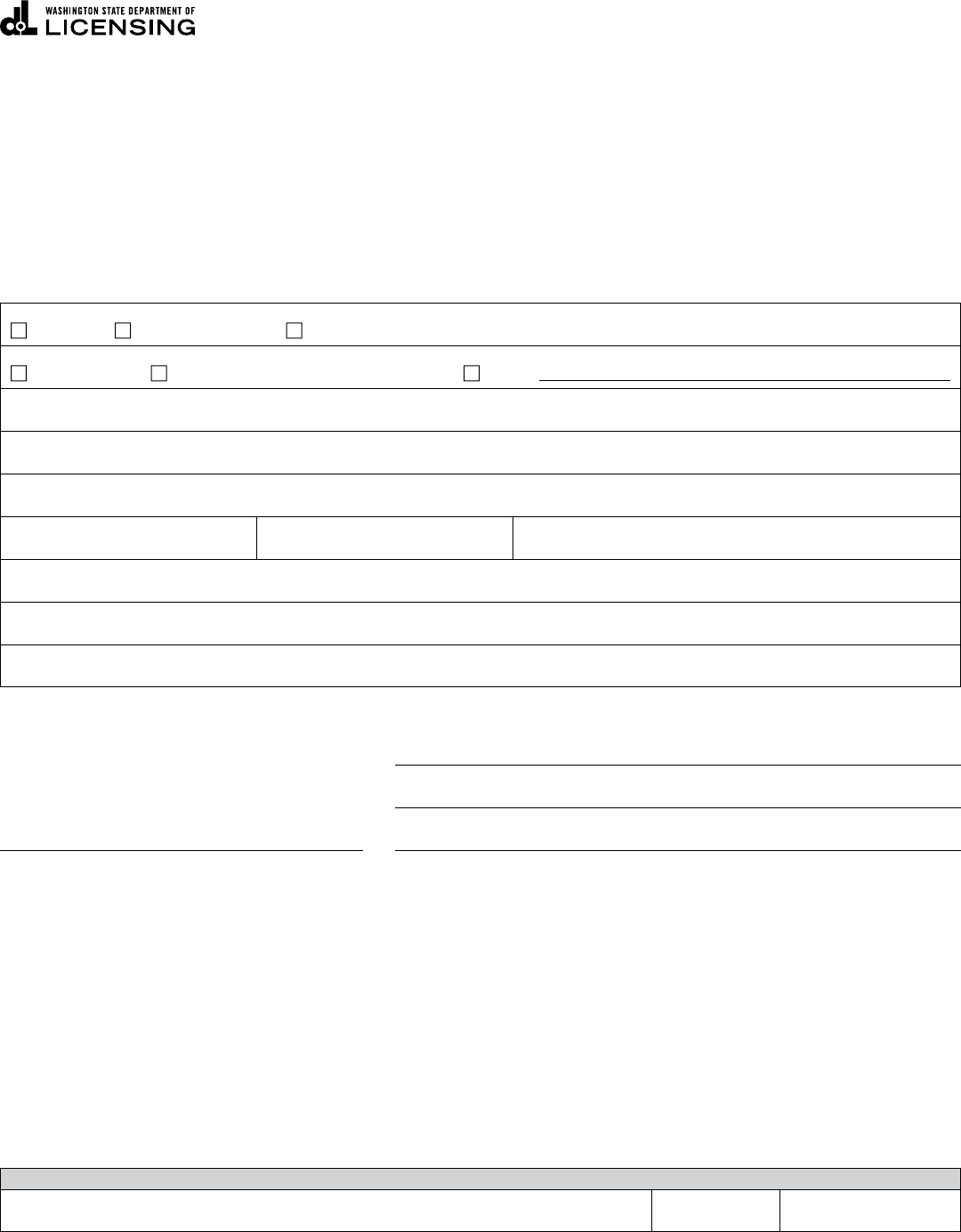

Application type

Original Address change Reinstatement

Business type

Government Nonprofit educational organization Other

TIN

PRINT or TYPE Legal name

Contact name

Contact (Area code) Telephone number (Area code) Fax number Email

Physical address, City, State, ZIP code

Mailing address, City, State, ZIP code

Address of location of records, City, State, ZIP code

I certify under penalty of perjury under the laws of the state of Washington that the foregoing is true and correct.

PRINT or TYPE name

Title

Date and place Signature

FT-441-772 (R/

11/15)WA Page 1 of 3

Click here to START or CLEAR, then hit the TAB button

When you have completed this form, please print it out and sign here.

Dyed Diesel User Application

Instructions

The Dyed Diesel section is to be completed by the applicant.

Application type: check only one box

Business type: check only one box

Legal name: your legal name

TIN: your Taxpayer Identification number

Contact name, telephone,

fax, and email address: these sections must be completed

Physical address: address where your business is located and may be different from your mailing address

Mailing address: United States Postal Service (USPS) address

Location of records: address where you keep your records

Sign and date the application: this section must be completed so the application may be processed.

Additional information

Definitions

Dyed diesel fuel has red dye added to identify it as not having federal or state fuel taxes included in the cost. Other names

commonly used for dyed diesel are: marked fuel, farm fuel, “red dyed” diesel.

Using dyed diesel

This license allows approved government agencies and organizations to use dyed diesel or biodiesel when operating

licensed motor vehicles on public roadways. Some examples of approved users are:

• Public school districts

• Nonprofit educational organizations

• Government agencies

Unlawful use

It is unlawful to use dyed diesel in vehicles that drive on Washington State public roadways or highways unless you have a

Dyed Diesel User license. Examples of unlawful use include:

• Using a licensed vehicle with dyed diesel and you don’t have the Dyed Diesel User license.

• Fueling a licensed vehicle with dyed diesel from your bulk storage tank (both the vehicle and the tank are subject to

penalties) and you aren’t licensed properly.

• Operating farm vehicles, registered with “Q” decal, with dyed diesel beyond the allowed radius.

• Using a farm licensed vehicle registered in Canada and filled with “marked fuel” on United States highways.

Penalties for unlawful use of dyed diesel

Each violation will result in a fine of $10 a gallon or $1,000, whichever is greater. For example,

• If you have three licensed vehicles, each with a 20-gallon capacity, you may be fined $3,000.

• If you use a 150-gallon dyed diesel slip tank or bulk storage tank that you use to fuel a highway licensed vehicle, you

may be fined $1,500 for the bulk storage tank and $1,000 for the fuel in the vehicle tank.

Cancellation and revocation

• Current Dyed Diesel User licensees may cancel their license at any time by marking a current tax return in the “cancel

license” section, pay any taxes owed, and adding the effective date.

• A revocation of a Dyed Diesel User license will occur for failing to file a quarterly tax return or for not paying your fuel

taxes. We will send you a “Notice of Intent to Revoke” letter and you will have 20 days from the date of the letter to

submit your return and any applicable payment. When you are in a “revoked” status, you cannot operate your vehicle

with dyed diesel.

• To reissue your revoked or cancelled license, you will need to complete the following:

• submit a new Dyed Diesel User License Application

• submit all tax returns due

• pay any unpaid taxes for each license

• include $100 reinstatement fee for all revoked licenses

FT-441-772 (R

/11/15)WA Page 2 of 3

Record keeping

You must keep your dyed diesel records for five years from the date the tax return was due or filed, whichever is later.

Investigation and enforcement is conducted by the Fuel Tax Evasion Unit

This is a partnership between the Department of Licensing and the Washington State Patrol (WSP). This unit investigates

fuel tax evasion, and takes phone calls from a tip line 1-800-497-FUEL (3835).

WSP enforcement

WSP will conduct “dips” to check fuel tanks for dyed fuel and determine if the operator is using the fuel illegally. If a

violation occurs, the operator will receive a fine, which may appear on their record as a felony or misdemeanor.

More information about dyed diesel

Visit our website at www.dol.wa.gov, fuel tax, Dyed Diesel, or under Fuel Licenses, Dyed Diesel User.

IFTA contact information

IFTA unit’s telephone number is (360) 664-1858

Olympia office location

Prorate and Fuel Tax Services

405 Black Lake Blvd, Bldg 2

Olympia WA 98507

FT-441-772 (R/11/15)WA Page 3 of 3