Fillable Printable Employee Trip Expense Report Template - Minnesota

Fillable Printable Employee Trip Expense Report Template - Minnesota

Employee Trip Expense Report Template - Minnesota

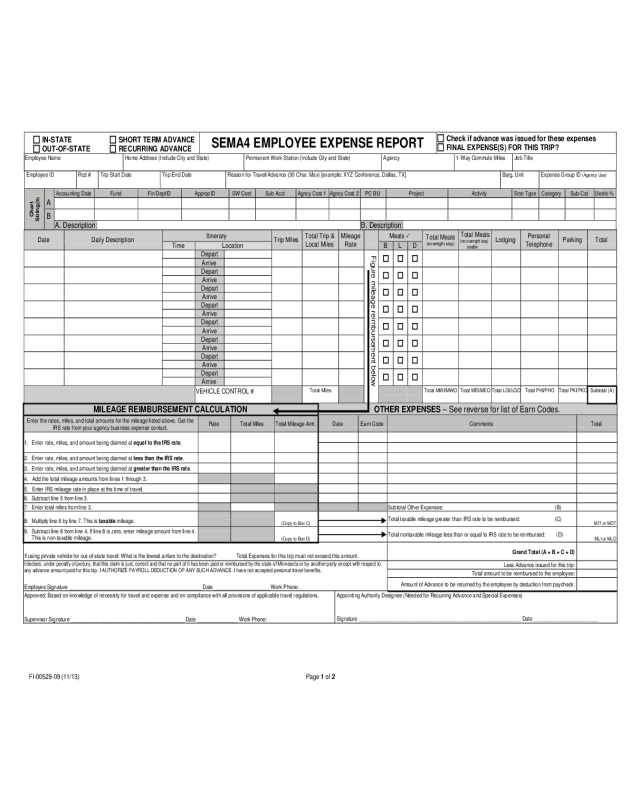

FI-00529-09 (11/13) Page 1 of 2

IN-STATE SHO RT TERM ADVANCE

OUT-OF-STATE RECURRI NG ADV ANCE

SEM A4 EM PLOYEE EXPENSE REPORT

Check if advance w as issued for these expenses

FINAL EXPENSE(S) FOR THIS TRIP?

Employee Name

Home Address (Include City and State)

Permanent Work Station (Include City and State)

Agency

1-Way Commute Mi les

Job Title

Employee ID

Rcd #

Trip Start Date

Trip End Date

Reason for Travel/Advance (30 Char. Max) [example: XYZ Conference, Dallas, TX]

Barg. Unit

Expense Group ID (Agency Use)

Chart

String(S)

A

Accounting Date

Fund

Fin DeptID

AppropID

SW C ost

Sub Acct

Agncy Cost 1

Agncy Cost 2

PC BU

Project

Activity

Srce Type

Category

Sub-Cat

Distrib

%

B

A. Descript i on:

B. Descript i on:

Date Daily Description

Itinerary

Trip Mil es

Total Trip &

Loc al Mil es

Mileage

Rate

Meals

Total Meal s

(overnight stay )

Total Meal s

(no ov erni ght stay)

taxable

Lodging

Personal

Telephone

Parking Total

Time

Location

B

L

D

Depart

Figure mi l eage reimbursement below

Arrive

Depart

Arrive

Depart

Arrive

Depart

Arrive

Depart

Arrive

Depart

Arrive

Depart

Arrive

Depart

Arrive

VEHICLE CONT R OL #

Total Miles

Total MWI/MWO

T otal MEI/MEO

Total LGI /L GO

Total PHI/PHO

Total PKI/P KO

Subtotal (A)

MIL E AGE REIM BURS E MENT CALCULATION

OTHER EXPENSES – See reverse for list of Earn Codes.

Enter the rates, miles, and total amounts for the mileage listed above. Get the

IRS rate from your agency business expense contact.

Rate Total Miles Total Mileage Amt.

Date Earn Code Comments Total

1.

Enter rate, miles, and amount being claimed at equal to the IRS rate.

2.

Enter rate, miles, and amount being claimed at less than the IRS rate.

3. Enter rate, miles, and amount being claimed at greater than the IRS rate.

4.

Add the total mileage amounts from lines 1 through 3.

5. Enter IRS m ileage rate in place at the t im e of travel .

6. Subtract line 5 from line 3.

7. Enter total mi les from line 3.

Subtotal Other Expenses: (B)

8.

Multip ly line 6 by line 7. This is taxable mileage.

(Copy t o Box C)

Total

taxable mileage greater than IRS rate to be reimbursed: (C)

MIT or MOT

9.

Subtract line 8 from line 4. If line 8 is zero, enter mi leage amount from line 4.

This is non-taxable mileage.

(Copy t o B ox D)

Total nontaxable mileage less than or equal to IRS rate to be rei

mbursed: (D)

MLI or MLO

If using private vehicle for

out-of-state travel: What is the lowest airfare to the destination?

Total Expenses for this trip must not exceed this amount.

Grand Total (A + B + C + D)

I declare, under penalty of perjury, that this claim is just, correct and that no part of it has been paid or reimbursed by the state of Minnesota or by another party except with respect to

any advance amount paid for this trip. I AUTHORIZE PAYROLL DEDUCTION OF ANY SUCH ADVANCE. I have not accepted personal travel

benefits.

Employee Signature _________________________________________________ Date _____________________Work Phone:

Less Advance issued for this trip:

Total amount to be reimbursed to the employee:

Amount of Advance to be returned by the employee by deduction from paycheck:

Approved: Based on knowledge of necessity for travel and expense and on compliance with all provisions of appli cable travel regulations.

Supervisor Signature __________________________________________ Date _______________ Work Phone:

Appointing Authority Designee (Needed for Recurring Advance and Special Expenses)

Signature ____________________________________________________________ Date ________________________

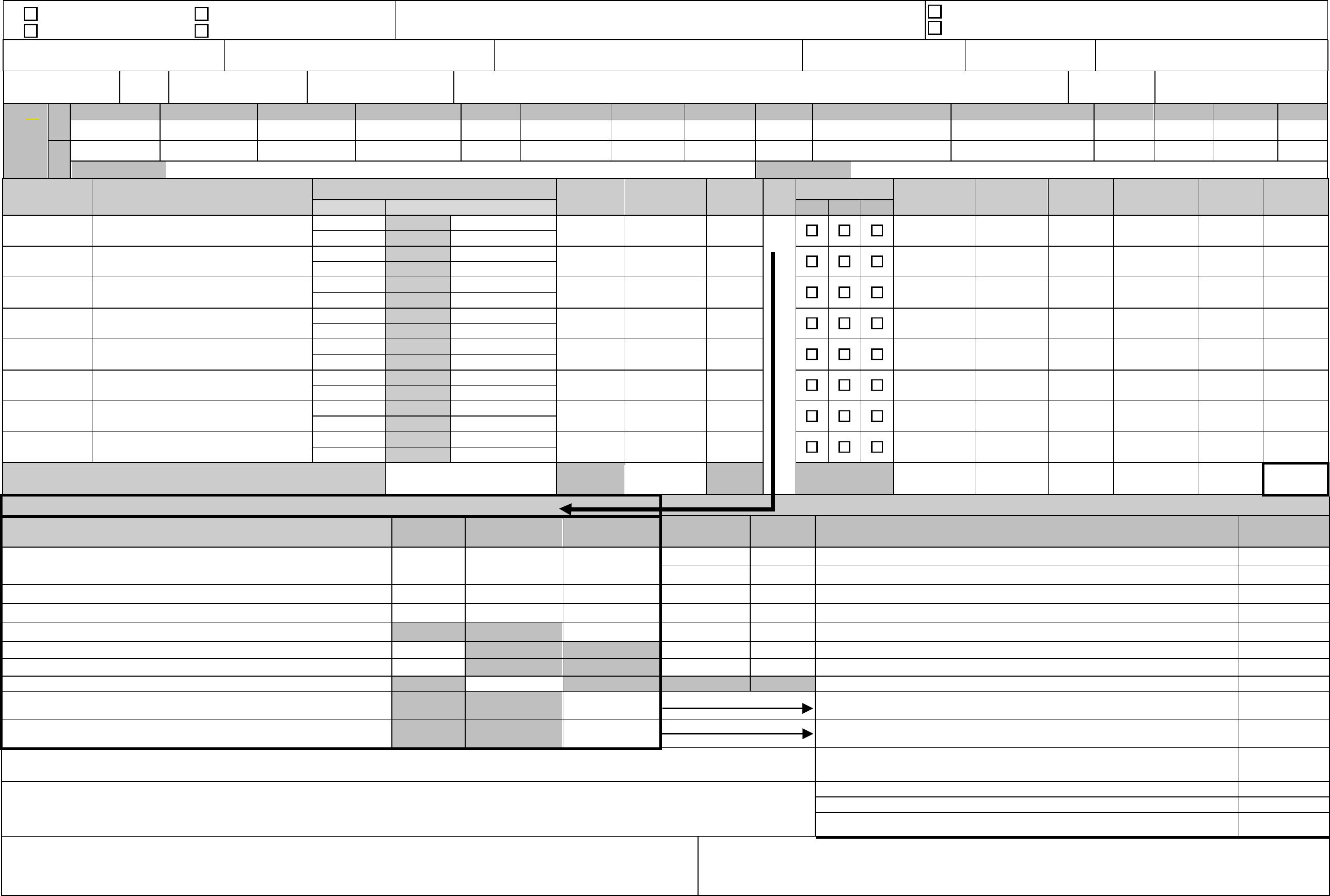

FI-00529-09 (11/13) Page 2 of 2

EMPLOYEE EXPENSE REPORT (Instructions)

DO NOT PAY RELOCATION EXPENSES ON THIS FORM.

See form FI-00568 Relocation Expense Report. Relocation expenses must be

sent to Minnesota Management & Budget, Statewide Payroll Services, for pay-

ment.

USE OF FORM: Use the form for the following purposes:

1. To reimburse emp loy ee s for author iz ed travel expenses.

2. To request and pay all travel advances.

3. To request reimbursement for small cash purchases paid for by employees.

Description In State Out of State Description In State Out of State

Advance ADI ADO Membership

Airfare ARI ARO Mileage > IRS Rat e MIT* MOT*

Baggage Handling BGI BGO Mileage < or = IRS Rate MLI MLO

Car Rental CRI CRO Network S ervices

Clothi ng A l l owance Other E xpenses OEI OEO

Clothi ng-Non Cont rac t Parking PKI PKO

Com munications - Other Photocopies CPI CPO

Conference/Registration F ee CFI CFO

Pos t al , Mail & S hi ppi ng

Svcs.(outbound)

Department Head Expense St orage of S tate P ropert y

Fax FXI FXO Supplies/Materials/Parts

Freight & Del i very (inbound) Telephone, B usiness Use BPI BPO

Hosting Telephone, P ersonal Use PHI PHO

Laundry LDI LDO Training/Tuit i on F ee

Lodging LGI LGO Taxi/A i rport Shutt l e TXI TXO

Meals Wit h Lodgi ng MWI MWO Ves t Rei mburs ement

Meals Wit hout Lodgi ng MEI* MEO* Note: * = t axable, taxed at supplemental rat es

SMP

MEM

CLN

VST

NWK

PMS

HST

COM

FDS

TRG

Earn Code

CLA

Earn Code

STO

DHE

COMPLETION OF THE FORM: Employee: Complete, in ink, all parts of this

form. If cl aiming reimbursement, enter actual amounts you paid, not to exceed

the l imits set in your barg aini n g agreement or compensation plan. If you do not

know these limits, contact your agency's business expense contact. Employees

must submit an expense report within 60 days of incurring any expense(s) or the

reimbursement comes taxable.

All of the data you provide on this form is public information, except for your home

address. You are not legally required to provide your home address, but the state of

Minnesot a cannot process certain mileage payments with out it .

Supervisor: Approve the c orrectness and necessity of this request in compliance with existing bargaining agreements or compensation plans and all other applicable rules and poli-

cies. Forward to the agency business expense contact person, who will then process the payments. Note: The expense report f orm mu st include or ig in al signa tures.

Final Expense For This Trip?: Check this box if there will be no further expenses submitted for this trip. By doing this, any outstanding advance balance associated with this trip will

be deduc ted fr om the next payche ck that is issued .

1-Wa y Commute Miles: Enter the number of miles from your home to your permanent workstation.

Expense Group ID: Entered by accounting or payroll office at the time of entering expenses. The Expense Group ID is a unique number that is system-assigned. It will be used to

reference any advance payment or expense reimbursement associated with this trip.

Earn Code: Select an Earn Code from the list that describes the expenses for which you are requesting reimbursement. Be sure to s elect the code that correctly reflects whether the

trip is in state or out-of-state. Note: Some expense reimbursements may be taxable.

Travel Ad vances, Short-Term and Recurring: An employee can only have one outstanding advance at a time. An advance must be settled before another advance can be issued.

Travel Ad vance Settlement: W hen the total expenses submitted are l ess than the advance amount or if the trip is cancelled, the employee will owe money to the state. Except for

rare situations, personal checks will not be accepted for settlement of advanc es; a deduction will be taken from the employee's paycheck.

FMS ChartStrings: Funding source(s) for advance or ex pense(s)

Mileage: Use the Mileage Reimbursement Calculation table to figure your mileage reimbursement. Mileage may be authorized for reimbursement to the employee at one of three

rates (referred to as the equal to, less than, or greater than rate) . The rates ar e specif ied in the appl icable bar g ain ing agr eeme nt /c om pen sati on plan. Note: If the mileage rate you

are using is above the IRS rate at the time of travel (this is not common), part of the mileage reimbursement w ill be taxed.

Vehicle Control #: If your agency assigns vehicle control numbers follow your agency’s internal policy and procedure. Contact your agency’s business expense contact for more

information on the vehicle control number procedure.

Personal Trav el Benefit s: State employ ees and other offi ci als cannot accept personal benefits resulting from travel on state business as their own. These benefits include frequent

flyer miles/poi nts and other benefits (i.e. discounts issued by lodging facilities.) Employees must certify that they have not accepted personal travel benefits when they apply for

travel reimbursement.

Receipts: Attach itemized receipts for all expenses except meals, taxi services, baggage handling, and parking meters, to this reimbursement claim. The Agency Designee may, at

its option, require attachment of meal receipts as well . Credit card receipts, bank drafts, or cancelled checks are not allowable receipts.

Copies and Distribution: Su bmit the orig ina l docu ment for pay ment and reta in a copy for your employee records.