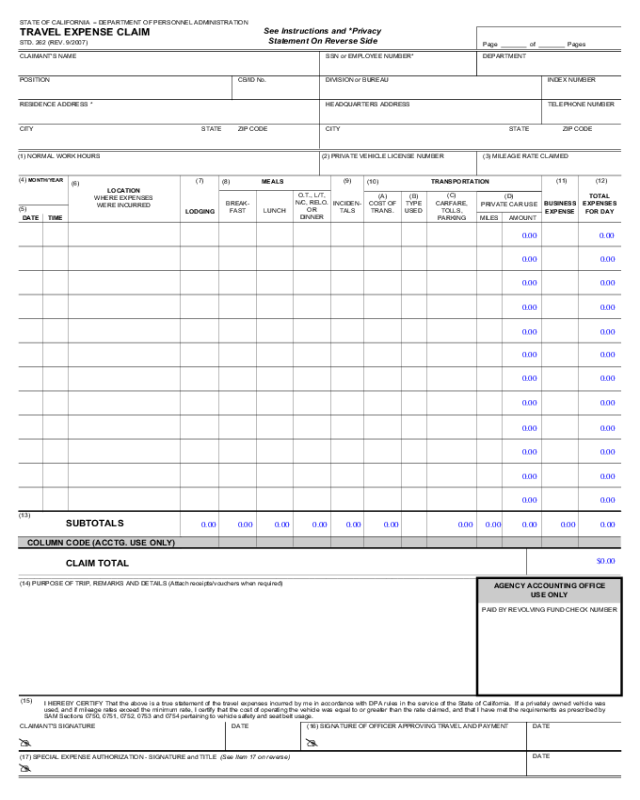

Fillable Printable Travel Expense Claim Form- California

Fillable Printable Travel Expense Claim Form- California

Travel Expense Claim Form- California

STATE OF CALIFORNIA

DEPARTMENT OF PERSONNEL ADMINISTRATION

TRAVEL EXPENSE CLAIM

See Instructions and *Privacy

STD. 262 (REV. 9/2007)

Statement On Reverse Side

Page of Pages

CLAIMANT'S NAME

SSN or EMPLOYEE NUMBER* DEPARTMENT

CB/ID No.

POSITION DIVISION or BUREAU INDEX NUMBER

RESIDENCE ADDRESS * HEADQUARTERS ADDRESS TELEPHONE NUMBER

CITY

STATE

ZIP CODE CITY

STATE

ZIP CODE

(1) NORMAL WORK HOURS (2) PRIVATE VEHICLE LICENSE NUMBER (3) MILEAGE RATE CLAIMED

(4) MONTH/YEAR

(7) (9) (11) (12)

(8) MEALS

(10) TRANSPORTATION

(6)

LOCATION

(C)

O.T., L/T,

(A) (B)

TOTAL

(D)

WHERE EXPENSES

N/C, RELO.

BREAK-

CARFARE,

COST OF

BUSINESS EXPENSES

INCIDEN-

TYPE

PRIVATE CAR USE

WERE INCURRED

(5)

OR

TOLLS,

LUNCH TRANS.

FAST

TALS

USED

LODGING

EXPENSE

FOR DAY

DINNER

PARKING

AMOUNT

DATE TIME

MILES

(13)

SUBTOTALS

COLUMN CODE (ACCTG. USE ONLY)

CLAIM TOTAL

(14) PURPOSE OF TRIP, REMARKS AND DETAILS (Attach receipts/vouchers when required)

PAID BY REVOLVING FUND CHECK NUMBER

AGENCY ACCOUNTING OFFICE

USE ONLY

(15)

I HEREBY CERTIFY That the above is a true statement of the travel expenses incurred by me in accordance with DPA rules in the service of the State of California. If a privately owned vehicle was

used, and if mileage rates exceed the minimum rate, I certify that the cost of operating the vehicle was equal to or greater than the rate claimed, and that I have met the requirements as prescribed by

SAM Sections 0750, 0751, 0752, 0753 and 0754 pertaining to vehicle safety and seat belt usage.

CLAIMANT'S SIGNATURE

DATE

(16) SIGNATURE OF OFFICER APPROVING TRAVEL AND PAYMENT DATE

(17) SPECIAL EXPENSE AUTHORIZATION - SIGNATURE and TITLE (See Item 17 on reverse)

DATE

STATE OF CALIFORNIA DEPARTMENT OF PERSONNEL ADMINISTRATION

TRAVEL EXPENSE CLAIM

STD. 262 (REV. 9/2007)

INSTRUCTIONS

Expense accounts are to be submitted at least once a month and not more often than twice a month, except where the amount claimed is less than $10, the claim need not be submitted until it exceeds $10 or

until June 30, whichever occurs first. Requests for reimbursement of out-of-state travel expenses must be claimed separately. Requests for reimbursement of travel expenses which are incurred in different

fiscal years must be claimed separately. A brief statement, one line if possible, of the purpose or objective, of the trip must be entered on the line immediately below the last entry for each trip. If the claim is

for several trips for the same purpose or objective, one statement will suffice for those trips. Vouchers which are required in support of various expenses must be arranged in chronological order and attached

to the claim. Each voucher must show the date, cost, and nature of the expense.

MULTIPLE PAGES

If your claim is more than one page, indicate page number and total number of pages. DO NOT total each page. Use subtotals and enter the total amount of the claim on the last page of

the claim in the space for "TOTALS" and "CLAIM TOTAL."

COLUMN ENTRIES

(1)

NORMAL WORK HOURS Enter your beginning and ending normal work hours using

(B)

TYPE OF TRANSPORTATION USED Enter method of transportation used. Use "R"

twenty-four-hour clock (example: 0800 = 8:00 a.m.).

for railway, "B" for bus, airporter, light rail, or BART, "A" for scheduled commercial

(2)

PRIVATE VEHICLE LICENSE NUMBER

Enter license number of the privately owned

vehicle used on official State business. To claim reimbursement, you must have met the

requirements as prescribed by SAM Sections 0751, 0752 and 0753 pertaining to operator

requirements, vehicle safety, seat belt usage and authorization.

airline, "RA" for rental aircraft, "DA" for department-owned aircraft, "PA" for privately

owned aircraft, "PC" for privately owned car, truck or other privately owned vehicles,

"SV" for specially equipped vehicle for the handicapped, "SC" for State vehicles, "RC"

for rental vehicles, "T" for taxi, and "BI" for bicycle. Supervisors shall not authorize the

use of motorcycles on official State business, and no reimbursement will be allowed for

(3)

MILEAGE RATE CLAIMED

Enter the rate of reimbursement being claimed for private

motorcycles.

vehicle use. Rate will not exceed rate established in contracts and DPA rule 599.631 .

(C)

CAR FARE, TOLLS, AND PARKING Enter streetcar, ferry, local rapid transit, taxi,

(4)

(5)

MONTH/YEAR

Enter numerical designation of month and last two digits of the year in

which the first expenses shown on the form were incurred.

DATE/TIME Enter date and time of departure on the appropriate line using twenty-four-hour

clock (example: 1700 = 5:00 p.m.). Show time of departure on date of departure, show time of

return on the date of return. If departure and return are on the same date, enter departure time

above and return time below on the same line. Where the first date shown is a continuation of

(D)

shuttle or hotel-bus fares, bridge and road tolls, and parking charges; attach a voucher for

any parking charge in excess of $10.00 for any one continuous period of parking and

each item of expense in this item.

PRIVATE CAR USE Enter number of miles traveled and amount due for mileage for

the use of privately owned automobiles as authorized by current agreements and DPA

regulations 599.631.

(6)

trip, enter "Continuing" above that date, and where a trip is continuing beyond the last date

shown, write "Continuing" after the last date.

LOCATIONS WHERE EXPENSES WERE INCURRED Enter the name of the city, town, or

(11)

BUSINESS EXPENSE

Claims for phone calls must include the place and party called. If

charge exceeds $5.00, support by vouchers or other evidence. Emergency purchases of

equipment, clothing or supplies, travel expenses of inmates, wards, or patients of institutions,

location where expenses were incurred. Abbreviations may be used.

and all other charges in excess of $1.00 require receipts and an explanation.

(7)

LODGING

Enter the actual cost of the lodging in accordance with and not to exceed the

maximum amount authorized by current Department of Personnel Administration (DPA)

regulations and bargaining agreements. A receipt is required for any lodging expense.

(12)

(13)

ENTER TOTAL EXPENSES FOR DAY

ENTER SUBTOTALS OR TOTALS

(8)

MEALS

Enter the actual cost of each meal not to exceed the maximum amount for each meal

(14)

PURPOSE OF TRIP, REMARKS OR DETAILS

Explain need for travel and any unusual

as authorized by current DPA regulations and in accordance with bargaining agreements.

expenses. Enter detail or explanation of items in other columns, if necessary. Vouchers must

Dinner column is to be used to claim dinner on regular travel, overtime meals, and long term

be provided for any miscellaneous item of expense.

(9)

(10)

and relocation daily meal expenses. Receipts for meals must be maintained by the employee as

substantiation that the amount claimed was not in excess of the amount of actual expense.

OVERTIME MEAL AND BUSINESS RELATED MEAL

Enter the actual cost of the meal

not to exceed the maximum amount authorized by current DPA regulations, and bargaining

agreements. Refer to DPA Management Memos for receipt requirements.

INCIDENTALS The term incidentals includes, but is not limited to, expenses for laundry,

cleaning and pressing of clothing, and fees and tips for services, such as for porters and

baggage carriers. It does not include taxicab fares, lodging taxes or the costs of telegrams or

telephone calls. Enter the total actual cost of incidentals not to exceed the maximum amount

authorized by current DPA regulations and agreements.

TRANSPORTATION

Purchase the least expensive round-trip or special rate ticket available.

Otherwise the difference will be deducted from the claim. If you travel between the same

(15)

(16)

(17)

CLAIMANT'S CERTIFICATION AND SIGNATURE

Your signature certifies that expenses

claimed were actually incurred as a result of conducting state business and that the cost of

operating the vehicle is at or above the rate claimed.

SIGNATURE OF OFFICER APPROVING PAYMENT

Certifies and authorizes travel;

approves expenses as incurred on State business.

SIGNATURE OF AUTHORITY FOR SPECIAL EXPENSES

When a claim for conference

or convention expense under Sections 599.635 and 599.635.1 of the DPA regulations and

detailed in SAM Section 0724 is included, or when reimbursement of a business expense

exceeds $25.00 or when reimbursement for Bar dues or license fees is included, the signature

of the approving officer is required, either on a separate document attached to this claim or by

signature in this block.

points without using round-trip tickets, an explanation should be given.

(A)

COST OF TRANSPORTATION

Enter the cost of purchased transportation. Show how

transportation was obtained if fare was not purchased for cash. Use "CC" for credit card

and "C" for cash. If transportation was paid by the State, enter method of payment only.

Use "SCC" for State credit card, "TO" for ticket order or "BSA" for billed to State

agency. Attach all passenger coupons and ticket order stubs including the unused portion

of tickets, other credit documents or premiums, where credits or refunds are due to the

State.

* PRIVACY STATEMENT

The Information Practices Act of 1977 (Civil Code Section 1798.17) and the Federal Privacy Act (Public Law 93-579) require that the following notice be provided when collecting personal information

from individuals.

AGENCY NAME: Appointing powers and the State Controller's Office (SCO).

UNITS RESPONSIBLE FOR MAINTENANCE: The accounting office within each appointing power and the Audits Division, SCO, 3301 C Street, Room 404, Sacramento, CA 95816.

AUTHORITY: The reimbursement of travel expenses is governed by Government Code Sections 19815.4(d), 19816, and 19820. These sections allow the Department of Personnel Administration (DPA) to

establish rules and regulations which define the amount, time, and place that expenses and allowances may be paid to representatives of the State while on State business.

PURPOSE: The information you furnish will allow the above-named agencies to reimburse you for expenses you incur while on official State business.

OTHER INFORMATION: While your social security account number (SSAN) and home address are voluntary information under Civil Code Section 1798.17, the absence of this information may cause

payment of your claim to be delayed or rejected. You should contact your department's Accounting Office to determine the necessity for this information.