Fillable Printable Employer Of Household Worker Election Notice (De 89)

Fillable Printable Employer Of Household Worker Election Notice (De 89)

Employer Of Household Worker Election Notice (De 89)

DE 89 Rev.10(12-16) (INTERNET)Page 1 of 1CU

Date:

Account Number:

Cal

ifornia law allows certain employers of household workers the option to pay Californiaemployment taxes for their

household employees annually instead of quarterly. Information on wages paid to employees must still be reported on a

quarterly basis on a form provided for this purpose. To be eligible to elect this option, an employer must:

•Beregistered with the Employment Development Department (EDD) as an employer of household workers.

•Have no delinquent taxes or returns due to the EDD.

•Intend to pay $20,000 or less in wages in a calendar year to your household employees. (The sum of all subject

wages, cash or noncash, paid to all employees must be no more than $20,000 per year.)

To elect this tax payment option, complete the election notice at the bottom of this document and return it to the address

indicated below. If approved, you will be notified in writing. Once approved, the election is effective the first day of the

calendar year, January 1, in which the election is filed.

As an annual pa

yer, you will file the quarterly Employerof Household Worker(s)Quarterly Report of Wages and

Wi

thholdings,DE 3BHW, and the annualEmployer ofHouseholdWorker(s)Annual Payroll Tax Return,DE 3HW.

Until the EDD respondsto your request, please continue to file theQuarterly Contribution Return and Report ofWages,

DE 9, and theQuarterly Contribution Return and Report of Wages (Continuation),DE 9C, along with yourPayroll Tax

Deposit, DE 88, coupon.

Please note, if you pay more than $20,000 in wages in any given year, the election will be terminated, your account will

revert back to a quarterly payer, and you will be required to file and pay all payroll taxes owed for the year at the end of the

calendar quarter.

If you have any questions or need assistance, call the Taxpayer Assistance Center toll-free at 888-745-3886 or

TTY 800-547-9565, or visit the EDD website at www.edd.ca.govto view theHousehold Employer's Guide,DE8829.

Please cut and return the bottom portion of this notice to the address below. You may also fax your election notice to 916-654-9211.

— — — — — — —— — — — —— — — — — —— — — — —— — — —— — — — —— — — —— — — — — —

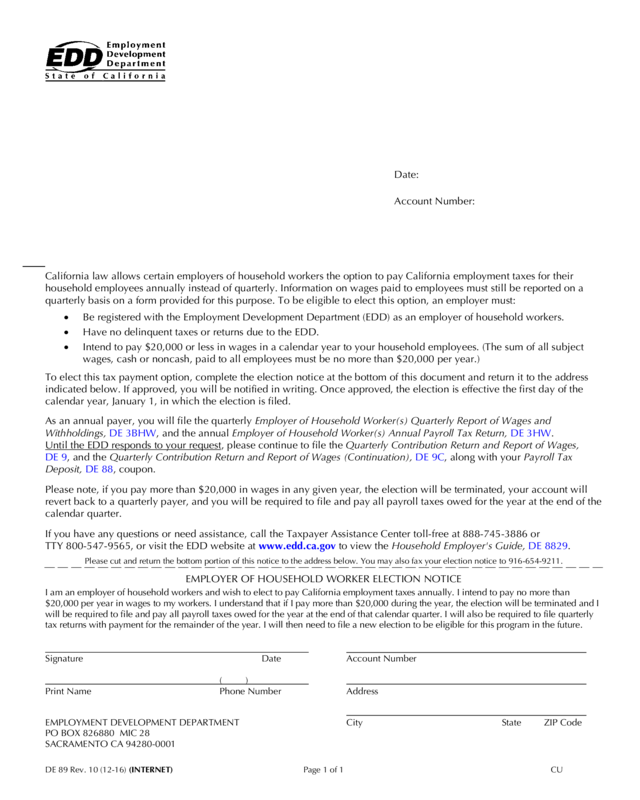

EMPLOYER OF HOUSEHOLD WORKER ELECTION NOTICE

I am an employer of household workers and wish to elect to pay Californiaemployment taxes annually.I intend to pay no more than

$20,000 per year in wages to my workers. I understand that if I pay more than $20,000 during the year, the election will be terminated and I

will be required to file and pay all payroll taxes owed for the year at the end of that calendar quarter.I will also be required to file quarterly

tax returns with payment for the remainder of the year. I will then need to file a new election to be eligible for this program in the future.

SignatureDateAccount Number

( )

Print NamePhone NumberAddress

EMPLOYMENT DEVELOPMENT DEPARTMENTCityStateZIP Code

PO BOX 826880 MIC 28

SACRAMENTO CA 94280-0001