Fillable Printable Endorsement Fee Sheet

Fillable Printable Endorsement Fee Sheet

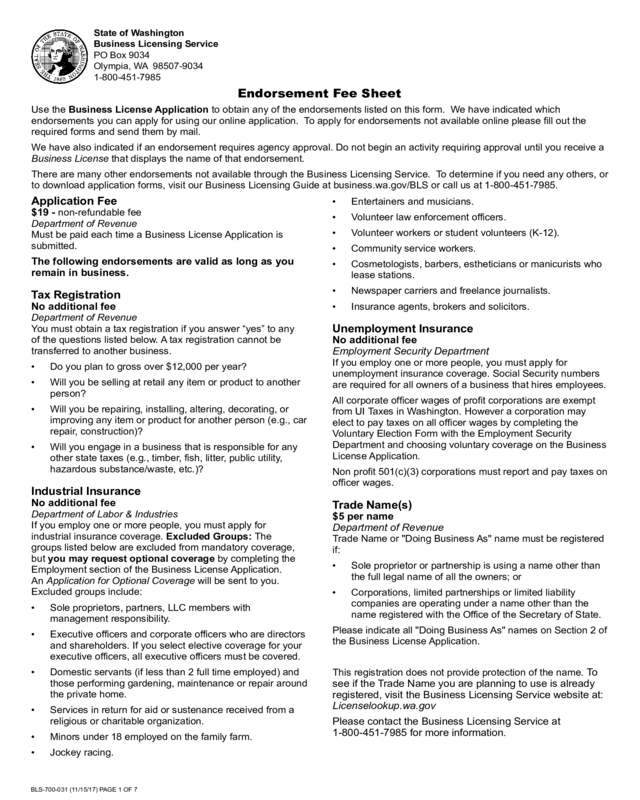

Endorsement Fee Sheet

BLS-700-031 (11/15/17) PAGE 1 OF 7

Application Fee

$19 - non-refundable fee

Department of Revenue

Must be paid each time a Business License Application is

submitted.

The following endorsements are valid as long as you

remain in business.

Tax Registration

No additional fee

Department of Revenue

You must obtain a tax registration if you answer “yes” to any

of the questions listed below. A tax registration cannot be

transferred to another business.

• Do you plan to gross over $12,000 per year?

• Will you be selling at retail any item or product to another

person?

• Will you be repairing, installing, altering, decorating, or

improving any item or product for another person (e.g., car

repair, construction)?

• Will you engage in a business that is responsible for any

other state taxes (e.g., timber, fish, litter, public utility,

hazardous substance/waste, etc.)?

Industrial Insurance

No additional fee

Department of Labor & Industries

If you employ one or more people, you must apply for

industrial insurance coverage. Excluded Groups: The

groups listed below are excluded from mandatory coverage,

but you may request optional coverage by completing the

Employment section of the Business License Application.

An Application for Optional Coverage will be sent to you.

Excluded groups include:

• Sole proprietors, partners, LLC members with

management responsibility.

• Executive officers and corporate officers who are directors

and shareholders. If you select elective coverage for your

executive officers, all executive officers must be covered.

• Domestic servants (if less than 2 full time employed) and

those performing gardening, maintenance or repair around

the private home.

• Services in return for aid or sustenance received from a

religious or charitable organization.

• Minors under 18 employed on the family farm.

• Jockey racing.

Use the Business License Application to obtain any of the endorsements listed on this form. We have indicated which

endorsements you can apply for using our online application. To apply for endorsements not available online please ll out the

required forms and send them by mail.

We have also indicated if an endorsement requires agency approval. Do not begin an activity requiring approval until you receive a

Business License that displays the name of that endorsement.

There are many other endorsements not available through the Business Licensing Service. To determine if you need any others, or

to download application forms, visit our Business Licensing Guide at business.wa.gov/BLS or call us at 1-800-451-7985.

Endorsement Fee Sheet

• Entertainers and musicians.

• Volunteer law enforcement officers.

• Volunteer workers or student volunteers (K-12).

• Community service workers.

• Cosmetologists, barbers, estheticians or manicurists who

lease stations.

• Newspaper carriers and freelance journalists.

• Insurance agents, brokers and solicitors.

Unemployment Insurance

No additional fee

Employment Security Department

If you employ one or more people, you must apply for

unemployment insurance coverage. Social Security numbers

are required for all owners of a business that hires employees.

All corporate ofcer wages of prot corporations are exempt

from UI Taxes in Washington. However a corporation may

elect to pay taxes on all ofcer wages by completing the

Voluntary Election Form with the Employment Security

Department and choosing voluntary coverage on the Business

License Application.

Non prot 501(c)(3) corporations must report and pay taxes on

ofcer wages.

Trade Name(s)

$5 per name

Department of Revenue

Trade Name or "Doing Business As" name must be registered

if:

• Sole proprietor or partnership is using a name other than

the full legal name of all the owners; or

• Corporations, limited partnerships or limited liability

companies are operating under a name other than the

name registered with the Office of the Secretary of State.

Please indicate all "Doing Business As" names on Section 2 of

the Business License Application.

This registration does not provide protection of the name.

To

see if the Trade Name you are planning to use is already

registered, visit the Business Licensing Service website at:

Licenselookup.wa.gov

Please contact the Business Licensing Service at

1-800-451-7985 for more information.

State of Washington

Business Licensing Service

PO Box 9034

Olympia, WA 98507-9034

1-800-451-7985

BLS-700-031 (11/15/17) PAGE 2 OF 7

Renewable Endorsements

Must be renewed annually

Architect Firm

Certicate of Authorization

$278 main location

Additional forms required

Department of Licensing

Required for businesses practicing or offering to practice

architectural services in Washington. Each rm is required

to have at least one Designated Architect listed at the

licensed location. The Designated Architect must have an

active architect registration.

Bulk Fertilizer Distributor

$25 per location

Department of Agriculture

Required for any business that brings into or that distributes

within Washington commercial fertilizer in bulk (nonpackaged

form).

Cigarette/Tobacco Sales, Retail and Wholesale

Liquor and Cannabis Board

The cigarette and tobacco product endorsements must both

be held if cigarette and other tobacco products are sold

at the same location. Additional documents and agency

approval required.

Cigarettes

Cigarette Retailer $175

Cigarettes sold at retail. Fee required per

location. (If BOTH a Cigarette Retailer OR an Other

Tobacco Product Retailer AND a Vapor Product

Retailer are applied for at the same time, for the same

business location, a combined total of $250.00 will be

due for both endorsements)

Commercial Cigarette Making Machine $93

Required where a machine to produce ‘Roll Your

Own’ cigarettes is provided. The fee is required for

each location with one or more machines. A Cigarette

Retailer endorsement and Tobacco Products Retailer

endorsement is also required. The machine can only

be used with tobacco sold at the location at the time of

purchase.

Cigarette Vending Machine

$30 per machine at each location

A Cigarette Retailer endorsement is also required.

Fee required per machine at each location.

Cigarette Wholesaler

Main location $650

Each branch location $115

Purchase, sell, or distribute cigarettes to

retailers for resale. You must include with

your application the $5,000 surety bond

required by the Department of Revenue.

Tobacco Products

Tobacco Products Retailer $175

Retail sales of tobacco products other

than cigarettes. Fee required per location.

(Fee waived if also applying for, or already have,

Cigarette Retailer at same business location. If BOTH

a Cigarette Retailer OR an Other Tobacco Product

Retailer AND a Vapor Product Retailer are applied

for at the same time, for the same business location,

a combined total of $250.00 will be due for both

endorsements)

Tobacco Products Distributor

Main location $650

Each branch location $115

Purchase, sell, or distribute tobacco products

other than cigarettes to retailers for resale.

(Fee waived if also applying for, or

already have, Cigarette Wholesaler.)

Collection Agency

$850 for main location in Washington

$550 for each branch location (in Washington or out of

state/country)

Additional forms and agency approval required

Department of Licensing

Required for any Washington business that:

• Directly or indirectly collects debts on behalf of clients

located in Washington and/or other states;

• Solicits claims for collection;

• Markets forms or a collection system to be used in debt

collection; or

• Collects their own debts using a fictitious name to imply

that a third party is involved; or

• Purchases claims for collection purposes in Washington,

whether or not it collects the claim itself.

The business must maintain a trust account and an ofce in

Washington for the purpose of conducting its collection agency

business. The ofce must be managed by a Washington

resident and be open to the public during regular business

hours. A $5,000 surety bond is required.

Collection Agency – Out-of-State/Country

$425 for main out-of-state location

$275 for each branch location (out-of-state/country)

Additional forms and agency approval required

Department of Licensing

Required for any business outside Washington that;

• Undertakes the collection of a debt on behalf of clients

who are also outside Washington, and that uses only

telephone, mail or fax to collect, or attempt to collect,

on debts from persons or businesses located inside

Washington. A $5,000 surety bond is required; or

• Purchases claims for collection purposes in Washington,

whether or not it collects the claim itself.

Note: Based on other states’ laws, some businesses may be

exempt from these endorsement fees and bonding. Please

contact the Business & Professions Division at (360) 664-1388

for more information.

Commercial Telephone Solicitor

$72 per location

Additional forms and agency approval required

Department of Licensing

Required for each location making unsolicited commercial

telephone calls and selling goods or products during the call.

Also required for those who offer free prizes by mail and invite

a telephone response. Exclusions from coverage include, but

are not limited to, those soliciting for educational, political, or

charitable purposes; those for whom less than 60 percent of

the prior year's sales were made by telephone solicitations;

and those who sell to businesses who either resell the product

or use it for manufacturing.

For tax assistance or to request this document in an alternate format, please call 1-800-451-7985. Teletype (TTY) users may use the Washington Relay Service by calling 711.

BLS-700-031 (11/15/17) PAGE 3 OF 7

Contractor Registration

Additional forms required

Registration not available through BLS

Contact: Dept. of Labor & Industries (360) 902-6359 or

1-800-647-0982 (in state only) or www.lni.wa.gov

Any individual or business involved in construction,

remodeling, repair, excavation, or demolition of any structure,

road or property must obtain a Contractor Registration. This

includes those who install oor coverings, lawn sprinkler

systems, or scaffolding. Those who perform plumbing or

electrical work must have additional certications or licenses.

Registration is also required for an individual who plans to hire

subcontractors from more than one trade to work on a single

project related to the individual's own property, with the intent

to sell that improved property.

Corporate Registration

Additional forms required

Registration not available through BLS

Contact: Ofce of the Secretary of State (360) 725-0377

Washington based corporations doing business in Washington

must le Articles of Incorporation.

Firms incorporated in any other state or country should contact

the Corporations Division of the Ofce of the Secretary of

State for ling requirements. In addition to ling the corporate

registration forms a Business License Application is required

to BLS.

For expedited service to incorporate your business, complete

the Application to Form a Prot Corporation at www.secstate.

wa.gov/corps

Or you can complete the application on paper and mail it in a

separate envelope to:

Corporations Division

Ofce of the Secretary of State

PO Box 40234

Olympia, WA 98504-0234

Egg Handler/Dealer

$30 for rst location

$15 for each additional location

Additional forms required

Department of Agriculture

Required for businesses or persons that:

• Produce, handle, contract for, or obtain possession or

control of eggs for sale to wholesalers, dealers or retailers

within or into Washington; or

• Process eggs and sell them to wholesalers, dealers,

retailers or consumers within or into Washington.

A license must be posted at each location where the

licensee

operates. Note: Poultry producers who sell eggs from their

own ocks at the place of production directly to household

consumers do not need to be licensed.

For Hire

Permit: $110 (one-time, nonrefundable)

Certicates: $55 per vehicle

Additional forms and agency approval required

Department of Licensing

Required for all vehicles used for the transportation of

passengers for compensation in taxicabs, cabulances or

other for hire vehicles (except limousines see Limousine

Carrier for those for hire vehicles). The state permit fee

is not required if a permit fee is paid to a local city or

county, however all vehicles must have a for hire certicate

from the state, regardless. See also the section headed

"Weighing & Measuring Devices" about registering the

meter used in for hire vehicles.

Limousine Carrier

$350 per location

Vehicle Certicate: $75 per limousine

Vehicle Inspection Report: $25 per limousine

Additional forms and agency approval required

Department of Licensing, Washington State Patrol, and

Port Districts of King County

Required for any business that operates unmetered,

unmarked, chauffeur-driven, luxury, for hire vehicles

(denition of a limousine is found in RCW 46.04).

Limousines must transport persons under a single

contract, on a prearranged basis, to a specic destination

or particular itinerary. Each limousine vehicle must pass

a vehicle inspection and be certied by the Department

of Licensing. Businesses operating in the Port District of

King County may be licensed through the port district.

Other for hire businesses (such as taxi cabs) must register

separately with the Department of Licensing (see For Hire

license).

Liquor

Variable fees (see Liquor License Description and Fee

Information Sheet)

Additional forms and agency approval required

Liquor and Cannabis Board

Required for businesses or nonprot organizations retailing

or serving beer, wine or spirits; or manufacturing, distilling,

wholesaling, transporting, importing, or exporting alcoholic

beverages. Also needed for changing the location of a

licensed premises.

Lottery Retailer

$25 per location (one-time, nonrefundable)

Additional forms and agency approval required.

Washington’s Lottery

Required for businesses selling Lottery products. Applicants

must certify that they comply with federal, state and agency

accessibility requirements, and provide a personal/criminal

history. The Lottery also requires an electronic funds

transfer account to transfer Lottery sales debits and credits.

The Lottery will separately charge retailers a one-time

$200 set-up fee, and a weekly equipment and support fee.

Contact the Lottery at 1-800-732-5101, option 4, for more

information.

Manufactured/Mobile Home Community

(Mobile Home Parks)

$10 per qualifying manufactured home in park*

Additional forms required

Department of Revenue

Required of all manufactured and mobile home parks that

offer two or more spaces (lots) in the park for rent or lease

for year-round occupancy. A separate application must be

submitted for each park. New parks must be registered

within three months of offering spaces for rent to avoid

penalties.

*A $10 fee must be paid for each manufactured or mobile

home within the park when the owner of the home does not

also own the space on which the home is located.

BLS-700-031 (11/15/17) PAGE 4 OF 7

Marijuana Research

$250 application fee

Additional forms and agency approval required

Liquor and Cannabis Board

A marijuana research license is required for the licensee

to produce, process, or possess marijuana to conduct

scientic research on marijuana and marijuana-derived

products.

Note: The Liquor and Cannabis Board will contact

applicants for any addiitional required information or

documentation, and bill for the intitial annual license fee

prior to approval of any license.

Marijuana Transportation

$250 application fee

Additional forms and agency approval required

Liquor and Cannabis Board

Required for common carrier businesses to transport or

deliver marijuana, marijuana concentrates, or marijuana

infused products between licensed marijuana businesses in

Washington State.

Note: The Liquor and Cannabis Board will contact

applicants for any additional required information or

documentation, and bill for the initial annual license fee

prior to approval of any license.

Marijuana - Other Licenses

Note: Applications for the following marijuana liceses:

Medical, Retailer, Producer, or Processor are NOT being

accepted at this time.

Minor Work Permit

No fee

Agency approval required

Department of Labor and Industries

If you employ one or more people under 18 years old, you

must apply for a permit to employ minors, in addition to

industrial insurance as described on page 1.

Nursery Retailer/Wholesaler

Fees listed below include a 20% surcharge

Additional forms required

Department of Agriculture

Required for businesses that:

• Sell or hold live plants or turf for planting, breeding, or

decoration; or

• Perform landscaping and lawn maintenance which

provides planting or installing new plants or turf.

Is not required if you sell less than $100 per year or only

sell cut owers.

Choose either a wholesale or retail endorsement based

on what you believe will be your primary source of income,

then estimate your total nursery sales for the calendar year.

Determine the fee due based on your license type and your

sales estimate.

Pesticide Dealer

$67 per location

Additional forms and agency approval required

Department of Agriculture

Required to sell all pesticides. Exception: Not required if

the pesticide is labeled home and garden use only. Each

location must have a licensed Pesticide Dealer Manager to

supervise pesticide distribution.

Private Investigative Agency

$600 with unarmed principal

$700 with armed principal

No fee for each additional location

Additional forms and agency approval required

Department of Licensing

Required for any business that exists to detect, discover

or reveal criminal activity; obtain information related to

persons or things; recover lost property; identify cause

for accidents/losses; obtain evidence for investigations or

detect eavesdropping devices. See RCW Chapter 18.165

for full description.

Radiology Benet Manager

$200 per location

Additional forms required

Department of Licensing

Required for any person or company conducting business

in Washington or with Washington customers when the

business is owned by a third party payor or a carrier, as

dened in RCW 48.43.005, or contracts with a third party

payor or carrier in order to:

• Process claims for services and procedures performed

by a licensed radiologist or advanced diagnostic

imaging service provider.

• Pay or authorize payment to radiology clinics,

radiologists, or advanced diagnostic imaging services

providers for services or procedures.

Rental Car Registration

No fee

Department of Licensing

A rental car is a passenger vehicle (PAS or M/H use class)

that is used solely by a rental car business for rental to

others, without a driver provided by the rental car business,

for periods of not more than 30 consecutive days. Only

passenger vehicles (cars, SUVs and motor home qualify).

Trucks and other types of vehicles such as motorcycles are

exempt from the rental car registration.

Scrap Metal

Various Fees (see the Vehicle-Related and Scrap Metal

Recycling Fee Description Sheet)

Additional forms and agency approval required.

Department of Licensing

Required for businesses that are suppliers, processors,

and/or recyclers of scrap metal.

Note: These endorsements do NOT include handling

scrap metal from motor vehicles. For vehicle-related Motor

Vehicle Salvage processing see the entry under "Vehicle

Sales or Disposal".

Nursery Retailer:

$100 - $2,499

$2,500 - $14,999

$15,000 and over

Nursery Wholesaler:

$100 - $14,999

$15,000 and over

Fee:

$63.00 per location

$138.00 per location

$273.60 per location

Fee:

$138.00 per location

$273.60 per location

BLS-700-031 (11/15/17) PAGE 5 OF 7

Seed Dealer

$125 per location

Department of Agriculture

Required for selling seeds except those packaged in

containers of 8 ounces or less by a registered seed labeler.

Seller of Travel

$202 per location

Additional documents and agency approval required

Department of Licensing

Required for businesses that arrange, or advertise to

arrange travel accommodations for Washington consumers.

Shopkeeper

$40 per location

Department of Health – Board of Pharmacy

Required of businesses (except licensed pharmacies)

selling any nonprescription medication. These medications

must be in the original manufacturer's packaging.

Tobbaco Sales, Retail and Wholesale -

Please see Cigarette/Tobacco Sales

Underground Storage Tanks

$160 per tank

Effective July 1, 2017: $166.99 per tank

Additional forms required

Department of Ecology

Required for owners of storage tanks with a capacity

greater than 110 gallons, that have at least 10 percent of

volume (including piping) below the surface of the ground,

and that contain petroleum or other hazardous substances.

Some tanks may be exempt. The application must be

led by the owner within 30 days after a new installation

is complete, or upon modication or purchase of existing

tanks. Note: A notice of intent to install (Form ECY 020-95)

must also be led directly with the Department of Ecology

at least 30 days before new installation work begins.

Vapor Product Retailer $175

Required for each location of a business where vapor

products are sold at retail to consumers. (If BOTH a

Cigarette Retailer OR an Other Tobacco Product Retailer

AND a Vapor Product Retailer are applied for at the same

time, for the same business location, a combined total of

$250.00 will be due for both endorsements) Note: To sell

at retail cigarettes and other tobacco products, a Cigarette

Retailer or a Tobacco Products Retailer endorsement is

also required.

Vapor Product Distributor $150

Vapor Product Distributor Branch $100

Required for each location of a business that purchases

vapor products and conducts wholesale sales or distribution

to vapor product retailers for resale to consumers. Note: To

sell or distribute at wholesale cigarettes or other tobacco

products you'll also need a Cigarette Wholesaler or a

Tobacco Products Distributor endorsement.

Vapor Product Delivery Sales $250

Required for each location of a business, regardless

whether located inside or outside Washington, from which

retail sales orders for vapor products are taken from

Washington consumers by means of telephone or other

voice transmissions, by mail or other delivery services, or

the Internet or other online services; or from which vapor

products are delivered to Washington consumers by use of

the mails or other delivery services.

Vehicle Sales or Disposal

Various fees (see the Vehicle-Related and Scrap Metal

Recycling Fee Description Sheet)

Additional forms and agency approval required

Department of Licensing

Required for businesses that:

• Annually offer, display or sell more than four cars,

trucks and/or motor homes, or otherwise act as a

dealer of such vehicles;

• Deal in boats or vessels, manufactured homes, park

homes, travel trailers, fifth wheel trailers, horse trailers,

utility trailers, off-road vehicles, motorcycles and/or

snowmobiles;

• Manufacture or remanufacture vehicles for distribution

to Washington dealerships;

• Transport vehicles over Washington highways;

• Operate a registered tow truck; and/or

• Act as a hulk hauler, vehicle wrecker or motor vehicle

salvage processor. Note: This is NOT for non-vehicle

scrap metal. To handle non-vehicle scrap metal see the

entry under "Scrap Metal".

Waste Tire Carrier

$200 ($50 nonrefundable) plus $50 per vehicle

Additional forms and agency approval required

Department of Ecology

Required for businesses transporting tires no longer usable

due to wear, damage or defect. Businesses licensed by

the Utilities and Transportation Commission or a local

government authority need not apply. A $10,000 bond is

required.

Waste Tire Storage Site Owner

$250 per location ($50 nonrefundable)

Additional forms and agency approval required

Department of Ecology

Required of any business with outside storage of more

than 800 tires which are no longer suitable for their original

purpose. The business is required to have:

• A permit from the County Health Department where the

site is located.

• Financial assurance sufficient for hiring a third party

to remove the maximum number of tires permitted to

be stored at the facility and deliver the tires to a facility

permitted to accept the tires.

Contact Dept. of Health for regulatory questions at 1-800-

299-9729.

BLS-700-031 (11/15/17) PAGE 6 OF 7

Weighing and Measuring Devices

Various fees (see the Weighing and Measuring Devices

Addendum)

Department of Agriculture (statewide); and Cities of Seattle

& Spokane

Required for businesses where devices are used to

determine the charges for a product or service on the basis

of weight or measure (i.e. scales or meters). The Weighing

and Measuring Devices addendum must be submitted with

the Business License Application.

Whitewater River Outtter

$25 per location

Additional form and agency approval required

Department of Licensing

Required for businesses carrying, or advertising to carry,

for-hire passengers on whitewater sections of Washington

rivers. Applicants must provide proof of correct liability

insurance and certify that they meet all requirements,

including use of qualied guides.

X-Ray Facilities and Devices

Various fees (see the X-ray Facility and Devices

Registration Addendum)

Department of Health (statewide)

Required for businesses that have a facility with any of

the X-ray tube types listed on the x-ray addendum form,

including dental or medical ofces, hospitals, veterinary,

educational, security, research or industrial facilities.

Contact Dept. of Health for regulatory questions at 1-800-

299-9729.

BLS-700-031 (11/15/17) PAGE 7 OF 7

Additional cities continue to partner with the Business Licensing Service program. Visit our website at

http://business.wa.gov/BLS or contact us at 1-800-451-7985 for a current listing.

Longview

Maple Valley

Marysville

Millwood

Milton

Monroe

Mount Vernon

Newcastle

North Bend

Olympia

Port Orchard

Port Townsend

Poulsbo

Prosser

Pullman

Richland

Rockford

Ruston

Sammamish

Sedro Woolley

Sequim

Shoreline

Skykomish

Spokane

Spokane Valley

Stanwood

Sultan

Sumner

Sunnyside

Tumwater

University Place

Vancouver

Washougal

West Richland

Woodinville

Anacortes

Battle Ground

Bellingham

Blaine

Bonney Lake

Bridgeport

Buckley

Carbonado

Carnation

Clyde Hill

Connell

College Place

Covington

Deer Park

DuPont

Duvall

East Wenatchee

Eatonville

Edgewood

Ellensburg

Enumclaw

Ephrata

Fife

Fircrest

Gig Harbor

Gold Bar

Granite Falls

Ilwaco

Issaquah

Kelso

Kenmore

Kennewick

Lacey

Lake Stevens

Leavenworth

Liberty Lake

Long Beach

Business Licensing Service City Partners - Available online

Most cities require businesses operating within the city limits to register and renew annually. This includes businesses that

are located outside the city limits but perform services inside city limits.

Apply for the cities listed below by using the Business License Application. See the City Fee Sheet for fees and descriptions.

Some cities may have other requirements to conduct particular business activities such as a home occupation permit or

temporary license. Contact the city directly for more information. City approval and additional forms may be required.