Fillable Printable Fill-In Form

Fillable Printable Fill-In Form

Fill-In Form

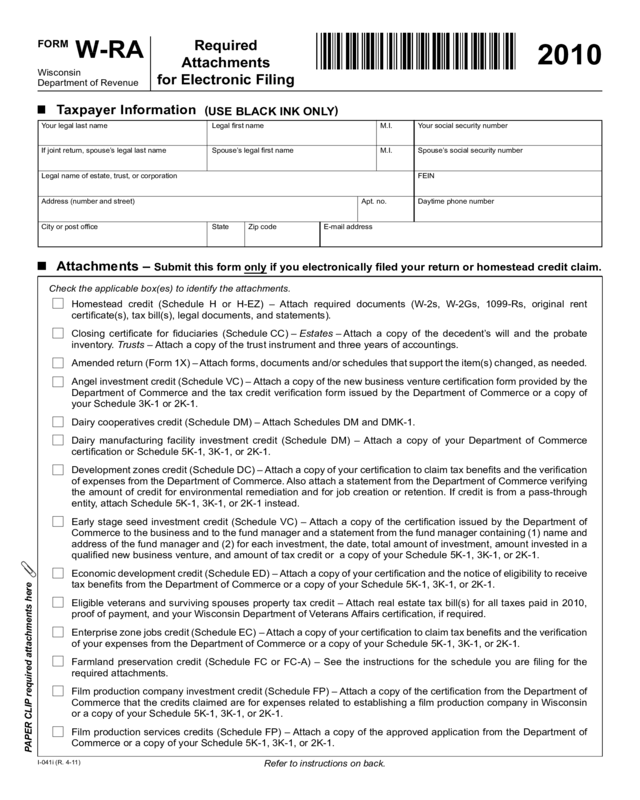

Homestead credit (Schedule H or H-EZ) – Attach required documents (W-2s, W-2Gs, 1099-Rs, original rent

certicate(s), tax bill(s), legal documents, and statements).

Closing certicate for duciaries (Schedule CC) – Estates – Attach a copy of the decedent’s will and the probate

inventory. Trusts – Attach a copy of the trust instrument and three years of accountings.

Amended return (Form 1X) – Attach forms, documents and/or schedules that support the item(s) changed, as needed.

Angel investment credit (Schedule VC) – Attach a copy of the new business venture certication form provided by the

Department of Commerce and the tax credit verication form issued by the Department of Commerce or a copy of

your Schedule 3K-1 or 2K-1.

Dairy cooperatives credit (Schedule DM) – Attach Schedules DM and DMK-1.

Dairy manufacturing facility investment credit (Schedule DM) – Attach a copy of your Department of Commerce

certication or Schedule 5K-1, 3K-1, or 2K-1.

Development zones credit (Schedule DC) – Attach a copy of your certication to claim tax benets and the verication

of expenses from the Department of Commerce. Also attach a statement from the Department of Commerce verifying

the amount of credit for environmental remediation and for job creation or retention. If credit is from a pass-through

entity, attach Schedule 5K-1, 3K-1, or 2K-1 instead.

Early stage seed investment credit (Schedule VC) – Attach a copy of the certication issued by the Department of

Commerce to the business and to the fund manager and a statement from the fund manager containing (1) name and

address of the fund manager and (2) for each investment, the date, total amount of investment, amount invested in a

qualied new business venture, and amount of tax credit or a copy of your Schedule 5K-1, 3K-1, or 2K-1.

Economic development credit (Schedule ED) – Attach a copy of your certication and the notice of eligibility to receive

tax benets from the Department of Commerce or a copy of your Schedule 5K-1, 3K-1, or 2K-1.

Eligible veterans and surviving spouses property tax credit – Attach real estate tax bill(s) for all taxes paid in 2010,

proof of payment, and your Wisconsin Department of Veterans Affairs certication, if required.

Enterprise zone jobs credit (Schedule EC) – Attach a copy of your certication to claim tax benets and the verication

of your expenses from the Department of Commerce or a copy of your Schedule 5K-1, 3K-1, or 2K-1.

Farmland preservation credit (Schedule FC or FC-A) – See the instructions for the schedule you are ling for the

required attachments.

Film production company investment credit (Schedule FP) – Attach a copy of the certication from the Department of

Commerce that the credits claimed are for expenses related to establishing a lm production company in Wisconsin

or a copy of your Schedule 5K-1, 3K-1, or 2K-1.

Film production services credits (Schedule FP) – Attach a copy of the approved application from the Department of

Commerce or a copy of your Schedule 5K-1, 3K-1, or 2K-1.

Required

Attachments

for Electronic Filing

PAPER CLIP required attachments here

I-041i (R. 4-11)

Refer to instructions on back.

Check the applicable box(es) to identify the attachments.

FORM

W-RA

2010

Wisconsin

Department of Revenue

Your legal last name Legal rst name M.I. Your social security number

If joint return, spouse’s legal last name Spouse’s legal rst name M.I. Spouse’s social security number

Address (number and street) Apt. no. Daytime phone number

City or post ofce State Zip code E-mail address

Taxpayer Information (

USE BLACK INK ONLY

)

Attachments – Submit this form only if you electronically led your return or homestead credit claim.

Legal name of estate, trust, or corporation FEIN

Tab to navigate within form. Use mouse to check

applicable boxes, press spacebar or press Enter.

Save

Print

Clear

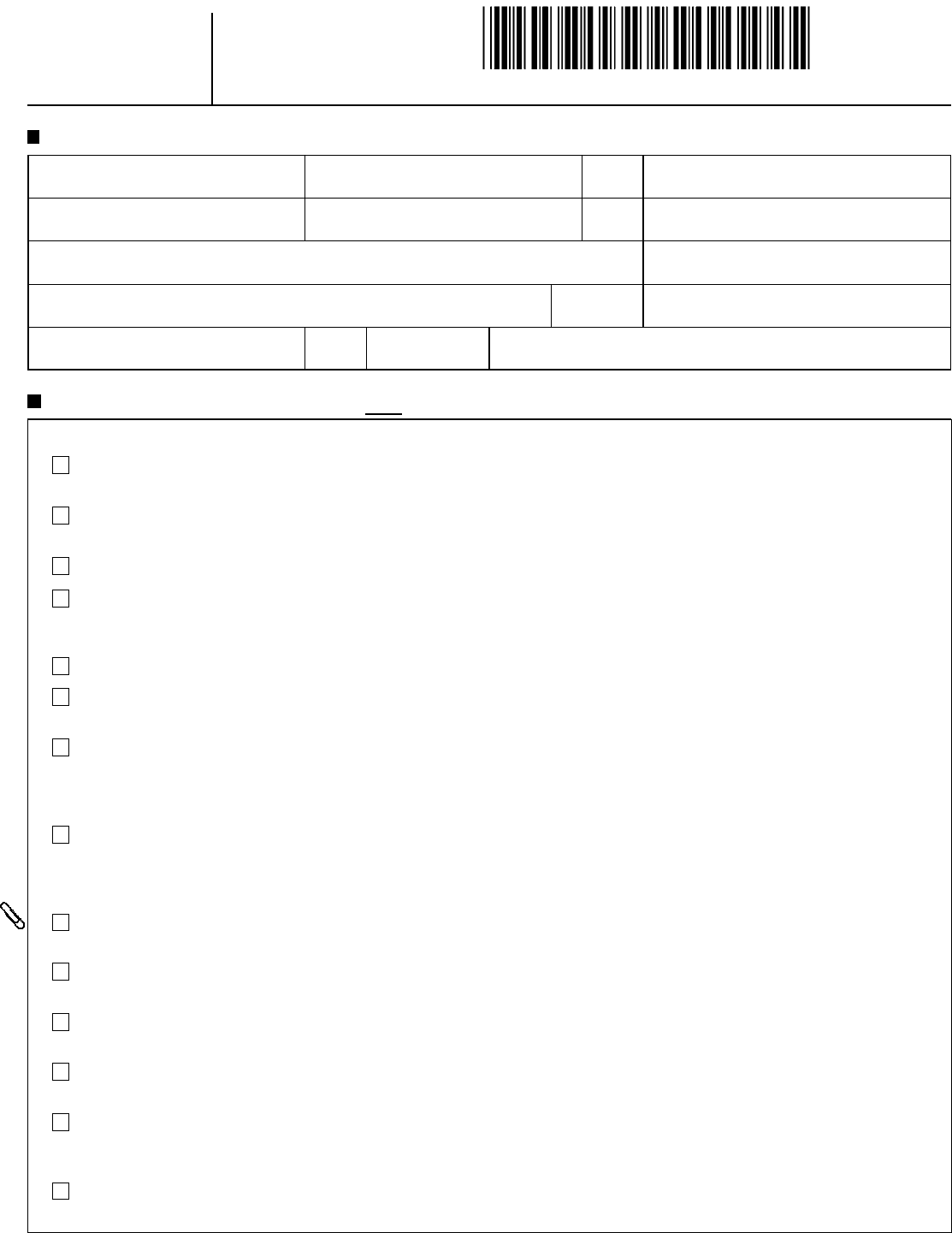

Food processing plant and food warehouse investment credit – Attach a copy of your certication to claim tax benets

issued by the Department of Commerce and the notice of the amount of credit allocated to you by the Department of

Commerce or a copy of your Schedule 5K-1, 3K-1, or 2K-1.

Health insurance risk-sharing plan assessments credit – Attach a copy of your Schedule 5K-1 or 3K-1.

Historic rehabilitation credit (Schedule HR) – See Schedule HR for the required attachments.

Internet equipment credit (Schedule IE) – Attach a copy of your certication to claim tax benets and the verication

of your expenses from the Department of Commerce or a copy of your Schedule 5K-1, 3K-1, or 2K-1.

Jobs tax credit – Attach a copy of your certication to claim tax benets issued by the Department of Commerce and

the notice of eligibility to receive tax benets that reports the amount of tax benet from the Department of Commerce

or a copy of your Schedule 5K-1, 3K-1, or 2K-1.

Manufacturing investment credit (Schedule MI) – Attach a copy of the certication from the Department of Commerce.

Meat processing facility investment credit (Schedule MP) – Attach a copy of your Department of Commerce certication

and allocation of credits or Schedule 5K-1, 3K-1, or 2K-1.

Model Form for legislators who make the sec. 162(h) election – If using electronic ling software that does not submit

the SPL-01 Model Form as part of the electronic return, attach a copy of the 2010 Model Form.

Tax paid to another state (Schedule OS) – Attach a copy of your income tax return from the other state and withholding

statements or a copy of your Schedule 3K-1 or 5K-1 if credit based on tax paid by a pass-through entity.

Technology zone credit (Schedule TC) – Attach a copy of your certication for tax benets issued by the Department of

Commerce and a statement from the Department of Commerce verifying the amount of your credits for property taxes

paid, capital investments made, and wages paid for jobs created in a technology zone or a copy of your Schedule

5K-1, 3K-1, or 2K-1.

Woody biomass harvesting and processing credit – Attach a copy of your certication to claim tax benets issued by

the Department of Commerce and the notice of the amount of credit allocated to you by the Department of Commerce

or a copy of your Schedule 5K-1, 3K-1, or 2K-1.

Other – Attach any other documents you were instructed to attach when e-ling.

General Instructions

Purpose of Form

Use Form W-RA to submit supporting documentation when

you electronically le an income or franchise tax return and

claim any of the credits or items listed. You may also be

instructed to submit Form W-RA when using Wisconsin

e

-le.

Legislators making the special section 162(h) election must

mail the Model Form to the department when using electronic

ling software that does not submit the Model Form as part of

the electronic return.

Paper clip your attachments to Form W-RA.

Refunds can be processed faster if you use paper clips

instead of staples.

When to File

The W-RA and required attachments must be mailed to the

department within 48 hours of receipt of your Wisconsin

acknowledgment. Refunds may not complete processing until

the W-RA and attachments have been received.

Note Individuals and tax practitioners ling on behalf of

individuals required to send the Form W-RA attachments to the

department may transmit this data in an electronic le over the

Internet. Further information can be found on the department’s

web site at: http://www.revenue.wi.gov/eserv/w-ra.html.

Where to File

Send Form W-RA and all attachments to one of the addresses

listed below. Failure to mail timely to the correct address with

all attachments will result in a delay in issuing the refund or

closing certicate for duciaries.

Homestead credit claims and requests for a closing

certicate

If sending attachments required for homestead credit or a

request for a closing certicate, send the Form W-RA and

attachments to:

Wisconsin Department of Revenue

PO Box 8977

Madison WI 53708-8977

The Form W-RA for any return including homestead credit

should be mailed to the above address regardless of any other

credits that may also be claimed.

Others

If you are not claiming homestead credit or requesting a

closing certicate for duciaries, send the Form W-RA and

attachments to:

Wisconsin Department of Revenue

PO Box 8967

Madison WI 53708-8967

Note If you use a mail service provider that is not the U.S.

Postal Service, deliver to: Wisconsin Department of Revenue,

Mail Stop 1-151, 2135 Rimrock Road, Madison WI 53713.

- 2 -

Your legal name Social security number or FEIN

Return to Page 1