Fillable Printable Financial Statement (De 926B)

Fillable Printable Financial Statement (De 926B)

Financial Statement (De 926B)

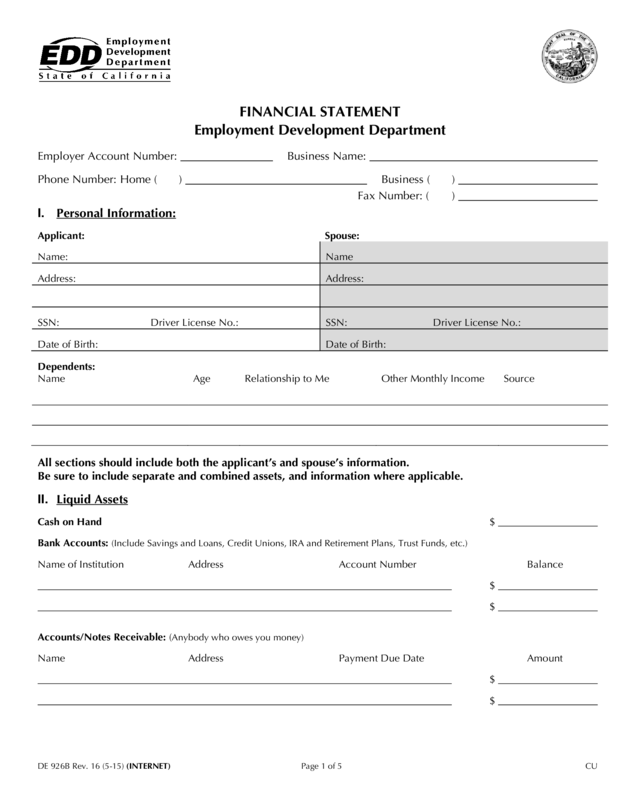

FINANCIAL STATEMENT

Employment Development Department

Employer Account Number: Business Name:

Phone Number: Home ( ) Business ( )

Fax Number: ( )

I. Personal Information:

Applicant: Spouse:

Name:

Name

Address:

Address:

SSN: Driver License No.:

SSN: Driver License No.:

Date of Birth:

Date of Birth:

Dependents:

Name Age Relationship to Me Other Monthly Income Source

All sections should include both the applicant’s and spouse’s information.

Be sure to include separate and combined assets, and information where applicable.

II. Liquid Assets

Cash on Hand $

Bank Accounts: (Include Savings and Loans, Credit Unions, IRA and Retirement Plans, Trust Funds, etc.)

Name of Institution Address Account Number Balance

$

$

Accounts/Notes Receivable: (Anybody who owes you money)

Name Address Payment Due Date Amount

$

$

DE 926B Rev. 16 (5-15) (INTERNET) Page 1 of 5 CU

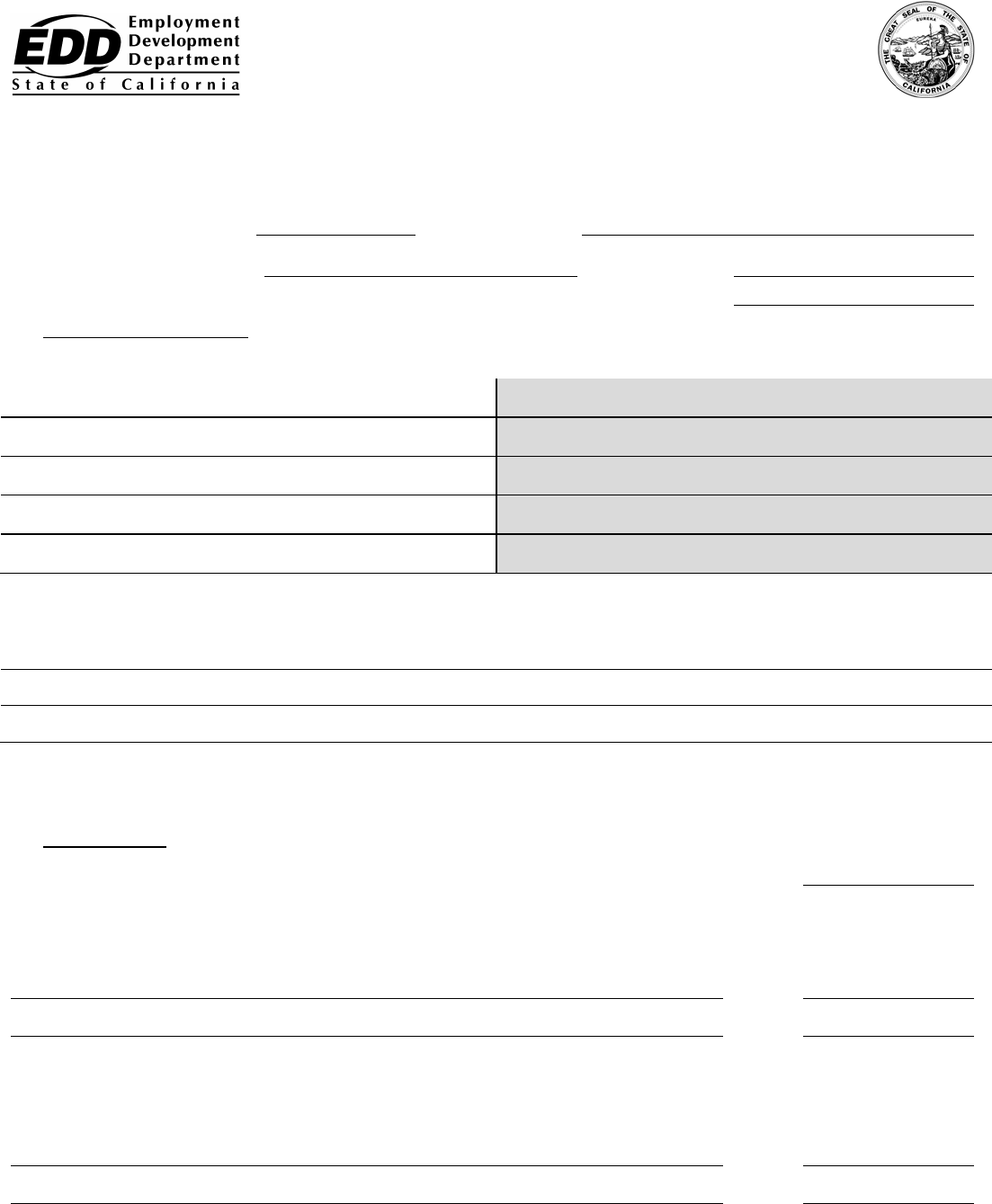

Available Credit Sources: (Credit Unions, Lines of Credit, Charge Cards with cash advance features, etc.)

Type of Account or Card Name and Address Credit Available

$

$

Securities: (Stocks, Bonds, Mutual Funds, Money Market Funds, Government Securities, etc.)

Kind Quantity/Denomination Location Value

$

$

Life Insurance:

Name of Company Policy Number Type Face Amount Loan Value

$

$

III. Personal Assets (Vehicles, Boats, RVs, Motorcycles, etc.)

Year Make Model License Number Market Value Balance Due Legal Owner Equity

$

$

$

IV. Real Property Assets (Include Partnerships and Investments)

Ownership Physical Address County Market Value Mo. Payment Bal. Due Equity

$

$

$

V. Monthly Income Information

Applicant:

(Attach last three months pay stubs.)

Employer Name and Address

Spouse:

(Attach last three months pay stubs.)

Employer Name and Address

Gross Wages/Salaries

$

Gross Wages/Salaries

$

DE 926B Rev. 16

(5-15) (INTERNET) Page 2 of 5

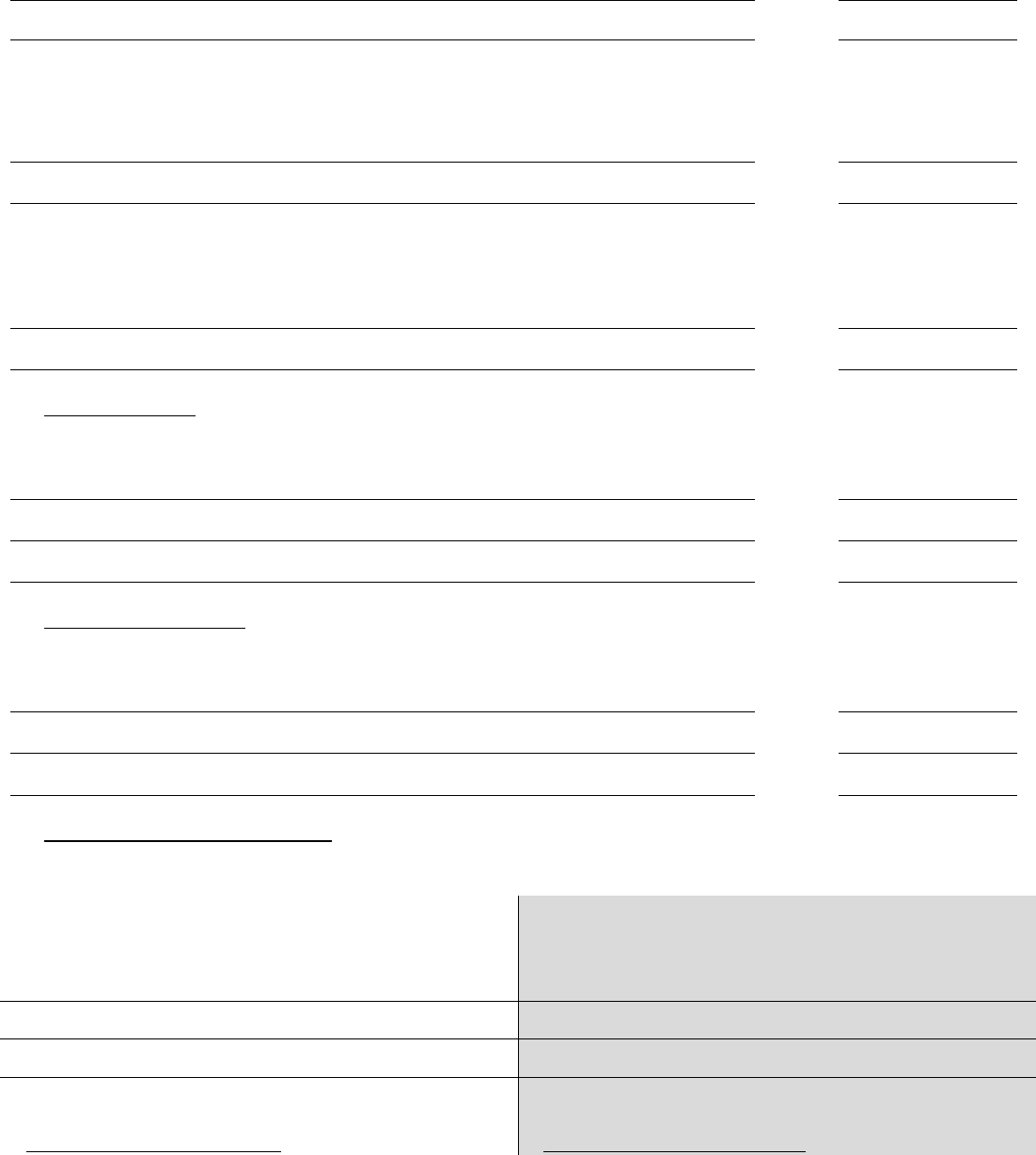

Mandatory Payroll Deductions:

Taxes (Federal, State, FICA, SDI) $

Medical Insurance $

Retirement $

Court Ordered Payments $

Other Payroll Deductions (List) $

Net Wages/Salaries $

Net Business Income $

Commissions, Bonuses, Overtime $

Net Rental Income $

Interest and Dividends $

Alimony (Name and Address) $

Other Income: (Identify)

$

$

VI. Monthly Expense Information (Necessary Living Expenses)

(Mark the appropriate box)

Support Payment: Child Spousal $

Rent Mortgage $

Utilities (gas, electric, water, etc.) $

Phone $

Life Insurance $

Vehicle Expenses: Payment Vehicle No. 1 $

Payment Vehicle No. 2 $

Insurance $

Fuel $

Food $

Clothing $

Medical Expenses $

Current Liabilities: Internal Revenue Service $

Other Tax Agencies (List):

$

$

Subtotals This Page $ $

(A) Expenses/Deductions (B) Wages/Income

DE 926B Rev. 16 (5-15) (INTERNET) Page 3 of 5

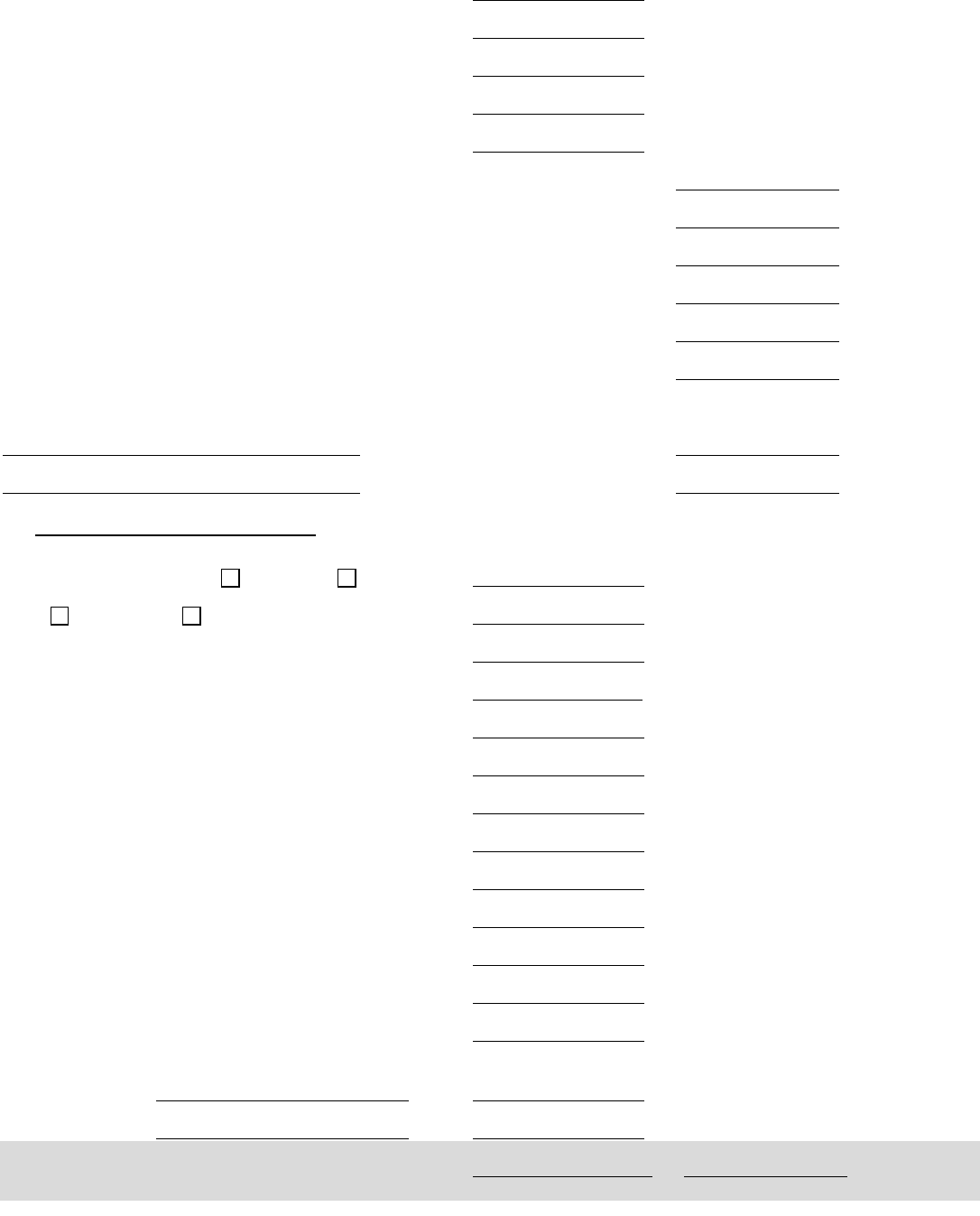

0

0

0

General Creditors: (Credit cards, loans, etc.) Minimum Payment

$

$

$

$

$

Miscellaneous Expenses

$

$

Subtotal This Page $

(C) Expenses

Grand Total From Pages 3 and 4 $ $

(A+C) Expenses/Deductions (B) Wages/Income

VII. Other Information (If yes, provide dates and explain below.) Yes No

Professional/Contractor Licenses

Court Proceedings

Bankruptcies

Repossessions

Participation or beneficiary to trust, estate, etc.

Health considerations that will affect earning potential

Explanation:

Do you anticipate an increase in income? Or have you had a recent transfer of assets of any kind? Yes No

If yes, please explain:

Certification Under penalties of perjury, I declare that to the best of my knowledge and belief this statement of assets,

liabilities and other information is true, correct and complete. I also understand any costs incurred to verify questionable

information may be my responsibility.

Your Signature Date

Additional Comments:

DE 926B Rev. 16 (5-15) (INTERNET) Page 4 of 5

0

0

0

HOW TO PREPARE THE FINANCIAL STATEMENT

Complete all requested information. Write “N/A” (not applicable) in those areas that do not apply to you. If the

form is incomplete and/or unsigned, we will not be able to consider your request for a payment proposal. If you

are self-employed or a partner or officer in an active business, include all business and personal assets and

expenses in all the sections. The financial statement must include information on both you and your spouse. The

areas explained below are those for which we have found to be most difficult to complete or more specific

information is to be provided for full disclosure. You may attach additional pages if needed.

Section I. Personal Information

List all persons dependent upon you, in whole or in part, for support. Include their name, age, relationship to

you, and any income the dependents receive along with the source of income.

Section II. Liquid Assets

Bank Account – Enter all accounts even if there is currently no balance. DO NOT enter bank loans. You may be

requested to furnish bank statements for the last six (6) months.

Accounts/Notes Receivable – Enter requested information. Also attach a separate list describing when the

receivable is due and how frequent (i.e., regular customer or one-time customer.) Include anyone who owes you money.

Available Credit Sources – List only credit lines or cards by a bank, credit union, or savings and loan that have

cash advance features.

Section III. Personal Assets

Enter all vehicles, boats, RVs, motorcycles, campers, etc. You may be requested to furnish a list detailing where

the assets are located, the registered owners and lien holders, and expected payoff dates.

Section IV. Real Property Assets

List all real estate that you own or are purchasing, both as an individual or with others. Attach a list of all owners

names and type of ownership (joint tenants, tenants in common), describe type of mortgage payments and rental

income amounts, and what the property is used for (residence, vacation, office, or shop rental).

Section V. Monthly Income Information

Enter gross amount of wages, salary, commission, or draw amount and frequency (attach pay stubs for the last

three [3] months). If you are self-employed, enter the NET business income (that is what you earn after you have

paid your ordinary, necessary monthly business expenses) and attach a current profit/loss statement and balance

sheet. Enter mandatory payroll deductions (regular withholdings for state and federal taxes, and Social Security;

do not include insurance payments, loan payments, wage garnishments, etc.) List net rental income. Identify

sources of other income.

Section VI. Monthly Expense Information

Necessary Living Expenses – Attach an itemized list for medical, insurance, vehicle, and other expenses. You

may be requested to submit documentation that court ordered payments and child/spousal support payments

have been paid for the last six (6) months and are currently being paid. You may also be requested to submit

documentation of all wage garnishments, payment plans, estimated tax payments, and settlement offers with

Internal Revenue Service, other tax agencies, and general creditors.

Note: Total household income and expenses are to be listed for both you and your spouse, even if only one

spouse has a tax liability.

Section VII. Other Information

Other Information – Mark the appropriate box. For all “yes” answers, enter full explanation. If you have any

professional licenses, please explain the type and provide the license number.

Health/Medical Considerations – Describe disability or medical considerations that do or will affect current or

future financial status or earning potential for either you or your spouse.

DE 926B Rev. 16 (5-15) (INTERNET) Page 5 of 5