Fillable Printable Form 0008

Fillable Printable Form 0008

Form 0008

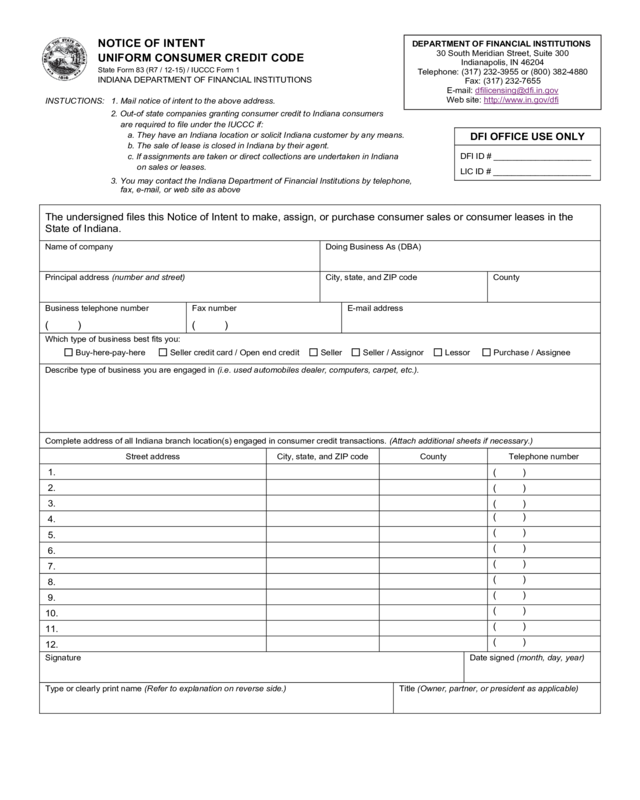

NOTICE OF INTENT

UNIFORM CONSUMER CREDIT CODE

State Form 83 (R7 / 12-15) / IUCCC Form 1

INDIANA DEPARTMENT OF FINANCIAL INSTITUTIONS

INSTUCTIONS: 1. Mail notice of intent to the above address.

2. Out-of state companies granting consumer credit to Indiana consumers

are required to file under the IUCCC if:

a. They have an Indiana location or solicit Indiana customer by any means.

b. The sale of lease is closed in Indiana by their agent.

c. If assignments are taken or direct collections are undertaken in Indiana

on sales or leases.

3. You may contact the Indiana Department of Financial Institutions by telephone,

fax, e-mail, or web site as above

DFI OFFICE USE ONLY

DFI ID # _____________________

LIC ID # _____________________

The undersigned files this Notice of Intent to make, assign, or purchase consumer sales or consumer leases in the

State of Indiana.

Name of company Doing Business As (DBA)

Principal address (number and street) City, state, and ZIP code County

Business telephone number

( )

Fax number

( )

E-mail address

Which type of business best fits you:

Buy-here-pay-here Seller credit card / Open end credit Seller Seller / Assignor Lessor Purchase / Assignee

Describe type of business you are engaged in (i.e. used automobiles dealer, computers, carpet, etc.).

Complete address of all Indiana branch location(s) engaged in consumer credit transactions. (Attach additional sheets if necessary.)

Street address City, state, and ZIP code County Telephone number

1. ( )

2. ( )

3. ( )

4.

( )

5.

( )

6.

( )

7.

( )

8.

( )

9.

( )

10.

( )

11.

( )

12.

( )

Signature Date signed (month, day, year)

Type or clearly print name (Refer to explanation on reverse side.) Title (Owner, partner, or president as applicable)

DEPARTMENT OF FINANCIAL INSTITUTIONS

30 South Meridian Street, Suite 300

Indianapolis, IN 46204

Telephone: (317) 232-3955 or (800) 382-4880

Fax: (317) 232-7655

E-mail: [email protected]

Web site: http://www.in.gov/dfi

Reset Form

IC 24-4.5-6-201; 6-202; 6-203

Persons subject to filing shall file notification with the Department within thirty (30) days after commencing business in

Indiana and thereafter, on or before January 31 of each year.

Consumer credit sales are sales of goods, services, or an interest in land in which the credit is granted by a person who regularly

engages as

a seller in credit transactions. The goods, services, or interest in land are purchased primarily for a personal, family, or

household purpose,

either the debt is by written agreement payable in more than four (4) installments or a credit service charge is made.

With respect to a sale of

goods or services, either the amount financed does not exceed the applicable exempt threshold amount

specified in Regulation Z [12 CFR

1026.3(b)] or the debt is secured by personal property used or expected to be used as the principal

dwelling of the buyer.

Consumer leases to be reported are those in which the amount payable under the lease does not exceed the applicable exempt

threshold amount specified in Regulation M [12 CFR 1013.2(e)] and which is for a contractual term exceeding four (4) months. Consumer

leases do not include "Rent-to-own" transactions. Persons engaging in rent-to-own transactions must file with the Department of

Financial Institutions under the Rental Purchase Agreement Act. (IC 24-7)

Seller credit cards or open end credit means an arrangement which gives to a buyer or lessee the privilege of using a credit card, letter

of

credit, or other credit confirmation or identification for the purpose of purchasing or leasing goods or services from that person, a

person related

to that person, or from that person and any other person. These are reportable if you are the "Creditor" in the transaction

as defined in IC 24-4.5-1-301(11).

NOTE: If you are regularly engaged as the "creditor" in making consumer LOANS in Indiana, other than first lien

mortgages, you need to apply for a consumer loan license with this department.

A bank who has their principal place of business in Indiana or a branch as defined in IC 28-2-17-6 must comply

with the provisions of IC 28-2-17-23(f) and IC 24-4.5-6-201 through 6-203. These sections require the reporting of

consumer credit volume excluding first lien mortgages. Contact the DFI for further details.

ASSIGNMENTS

Pursuant to IC 24-4.5, an entity originating consumer credit, as defined, is required to pay, or ensure the payment of, a fee to the DFI

based

on the volume of credit initiated during the prior calendar year.

Your company may originate credit agreements and assign that credit to another company. If the assignee company pays the fee

associated

with that credit, you do not need to pay the fee.

It is the responsibility of your company to determine conclusively that the assignee company pays the appropriate volume fee associated

with

credit your company assigns.

If your company accepts the assignment of credit agreements

from an initiating entity and your company agrees to pay the volume fee

associated with the assigned credit, this volume should be reflected in your company's volume total. Even though your company may

agree to

pay the volume fee associated with assigned credit it accepts, your company should ensure that the originator of the credit

is registered

with the DFI.

FEES

There are no initial fees to file notification with the Department. The annual notification requires disclosure of the original unpaid balances

arising from consumer credit sales or consumer leases originating from the person's business during the calendar year preceding the

notification, unless the fees for the obligation have been paid by another person, individual, or organization. There are no fees due if the

total

original unpaid balances reported are $100,000 or less. The volume reported over $100,000 is subject to a fee set by the

Department for

each $100,000 or part there-of.

EXCLUSIONS

NOTE: See IC 24-4.5-1-202 for additional information regarding exclusions.

1.

Credit primarily for a business, commercial, or an agricultural purpose.

2.

FIRST lien mortgages and contracts which involve land.

3.

Consumer credit transactions in excess of the applicable exempt threshold amount not secured by an interest in land or personal

property used as

principal dwelling of the debtor.

4. Extensions of credit to government or governmental agencies or instrumentality.

5. If you are not deemed "regularly engaged." Regularly engaged means you transact more than five (5) mortgages or dwelling

secured

transactions, or more than twenty-five (25) other consumer credit transactions in a year. See IC 24-4.5-1-301.

SIGNATURE

The individual that will receive and complete the annual report of consumer credit volume shall sign the Notice of Intent. If mailing

address of

individual is different from principal address, please indicate correct mailing address. If necessary, attach an additional sheet.