Fillable Printable Form 1040Ss

Fillable Printable Form 1040Ss

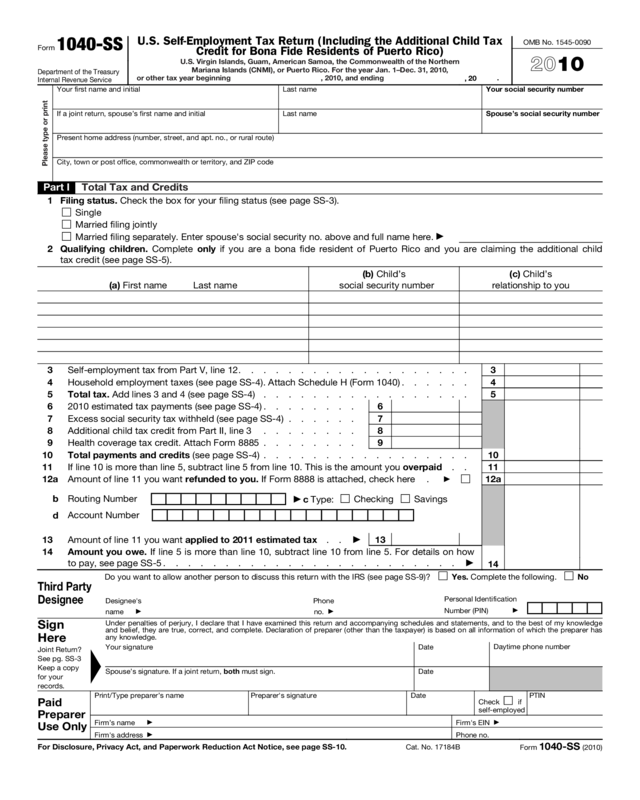

Form 1040Ss

Form 1040-SS

Department of the Treasury

Internal Revenue Service

U.S. Self-Employment Tax Return (Including the Additional Child Tax

Credit for Bona Fide Residents of Puerto Rico)

U.S. Virgin Islands, Guam, American Samoa, the Commonwealth of the Northern

Mariana Islands (CNMI), or Puerto Rico. For the year Jan. 1–Dec. 31, 2010,

or other tax year beginning , 2010, and ending

, 20

.

OMB No. 1545-0090

2010

Please type or print

Your first name and initial Last name Your social security number

If a joint return, spouse’s first name and initial Last name Spouse’s social security number

Present home address (number, street, and apt. no., or rural route)

City, town or post office, commonwealth or territory, and ZIP code

Part I Total Tax and Credits

1 Filing status. Check the box for your filing status (see page SS-3).

Single

Married filing jointly

Married filing separately. Enter spouse's social security no. above and full name here.

▶

2 Qualifying children. Complete only if you are a bona fide resident of Puerto Rico and you are claiming the additional child

tax credit (see page SS-5).

(a) First name Last name

(b) Child’s

social security number

(c) Child’s

relationship to you

3 Self-employment tax from Part V, line 12. . . . . . . . . . . . . . . . . . . 3

4 Household employment taxes (see page SS-4). Attach Schedule H (Form 1040) . . . . . . 4

5 Total tax. Add lines 3 and 4 (see page SS-4) . . . . . . . . . . . . . . . . . 5

6 2010 estimated tax payments (see page SS-4) . . . . . . . . 6

7 Excess social security tax withheld (see page SS-4) . . . . . . 7

8 Additional child tax credit from Part II, line 3 . . . . . . . . 8

9 Health coverage tax credit. Attach Form 8885 . . . . . . . . 9

10 Total payments and credits (see page SS-4) . . . . . . . . . . . . . . . . . 10

11 If line 10 is more than line 5, subtract line 5 from line 10. This is the amount you overpaid . . 11

12 a Amount of line 11 you want refunded to you. If Form 8888 is attached, check here .

▶

12a

b Routing Number

▶

c Type:

Checking Savings

d

Account Number

13 Amount of line 11 you want applied to 2011 estimated tax . .

▶

13

14 Amount you owe. If line 5 is more than line 10, subtract line 10 from line 5. For details on how

to pay, see page SS-5 . . . . . . . . . . . . . . . . . . . . . . . .

▶

14

Third Party

Designee

Do you want to allow another person to discuss this return with the IRS (see page SS-9)?

Yes. Complete the following.

No

Designee's

name

▶

Phone

no.

▶

Personal Identification

Number (PIN)

▶

Sign

Here

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge

and belief, they are true, correct, and complete. Declaration of preparer (other than the taxpayer) is based on all information of which the preparer has

any knowledge.

Joint Return?

See pg. SS-3

Keep a copy

for your

records.

▲

Your signature Date

Daytime phone number

Spouse’s signature. If a joint return, both must sign.

Date

Paid

Preparer

Use Only

Print/Type preparer’s name Preparer's signature Date

Check if

self-employed

PTIN

Firm’s name

▶

Firm's address

▶

Firm's EIN

▶

Phone no.

For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see page SS-10.

Cat. No. 17184B

Form 1040-SS (2010)

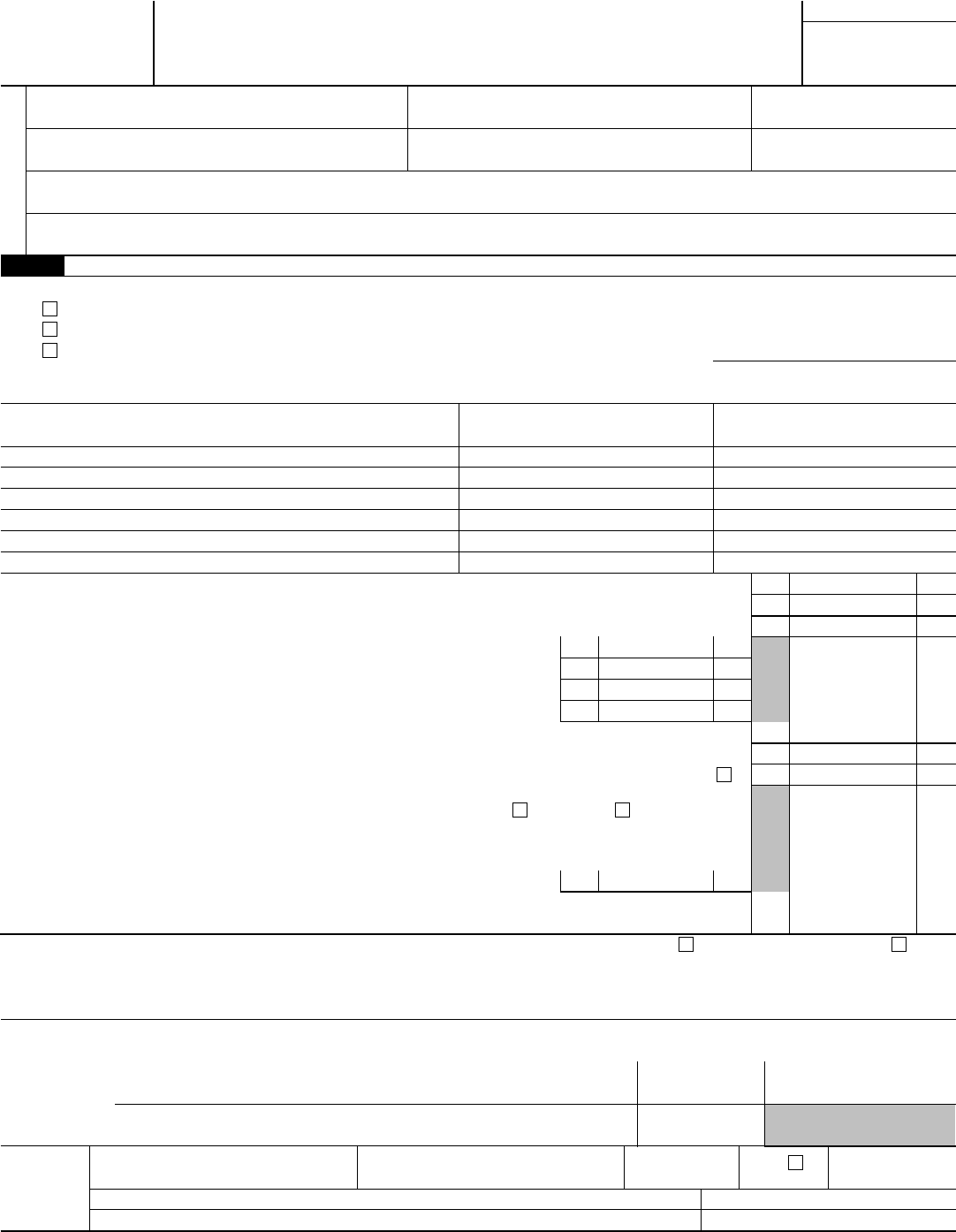

Form 1040-SS (2010)

Page 2

Part II Bona Fide Residents of Puerto Rico Claiming Additional Child Tax Credit—See page SS-5.

Caution. You must have three or more qualifying children to claim the additional child tax credit.

1 Income derived from sources within Puerto Rico . . . . . . . . . . . . . . . . .

1

2

Withheld social security and Medicare taxes from Forms 499R-2/W-2PR (attach copy of form(s)) . .

2

3

Additional child tax credit. Use the worksheet on page SS-6 to figure the amount to enter here

and in Part I, line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

Part III Profit or Loss From Farming—See the instructions for Schedule F (Form 1040).

Name of proprietor Social security number

Note. If you are filing a joint return and both you and your spouse had a profit or loss from a farming business, see Joint returns and

Husband-Wife Business beginning on page SS-2 for more information.

Section A—Farm Income—Cash Method

Complete Sections A and B. (Accrual method taxpayers, complete Sections B and C, and Section A, line 11.)

Do not include sales of livestock held for draft, breeding, sport, or dairy purposes (see page SS-5).

1 Sales of livestock and other items you bought for resale . . . . .

1

2 Cost or other basis of livestock and other items reported on line 1 . . 2

3 Subtract line 2 from line 1. . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Sales of livestock, produce, grains, and other products you raised . . . . . . . . . . . 4

5 a Total cooperative distributions (Form(s)

1099-PATR) . . . . . . . . . . .

5a 5b Taxable amount 5b

6 Agricultural program payments received . . . . . . . . . . . . . . . . . . . . 6

7 Commodity Credit Corporation (CCC) loans reported under election (or forfeited) . . . . . . 7

8 Crop insurance proceeds . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Custom hire (machine work) income . . . . . . . . . . . . . . . . . . . . . 9

10 Other income. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11

Gross farm income. Add amounts in the right column for lines 3 through 10. If accrual method

taxpayer, enter the amount from Section C, line 50 . . . . . . . . . . . . . . .

▶

11

Section B—Farm Expenses—Cash and Accrual Method

Do not include personal or living expenses (such as taxes, insurance, or repairs on your home) that did not produce farm income.

Reduce the amount of your farm expenses by any reimbursements before entering the expenses below.

12 Car and truck expenses

(see page SS-6) . . . . .

12

13 Chemicals. . . . . . . 13

14 Conservation expenses . . 14

15 Custom hire (machine work) 15

16

Depreciation and section 179

expense deduction not

claimed elsewhere (attach

Form 4562 if required). . .

16

17 Employee benefit programs

other than on line 25 . . .

17

18 Feed purchased . . . . . 18

19 Fertilizers and lime . . . . 19

20 Freight and trucking . . . 20

21 Gasoline, fuel, and oil . . . 21

22 Insurance (other than health) 22

23 Interest:

a Mortgage (paid to banks, etc.)

23a

b Other . . . . . . . . 23b

24 Labor hired . . . . . . 24

25 Pension and profit-sharing

plans . . . . . . . .

25

26 Rent or lease:

a

Vehicles, machinery, and

equipment . . . . . . .

26a

b Other (land, animals, etc.) . . 26b

27 Repairs and maintenance . . 27

28 Seeds and plants purchased 28

29 Storage and warehousing . 29

30 Supplies purchased . . . . 30

31 Taxes . . . . . . . . 31

32 Utilities . . . . . . . . 32

33

Veterinary, breeding, and

medicine . . . . . . .

33

34 Other expenses (specify):

a

34a

b 34b

c 34c

d 34d

e 34e

35 Total expenses. Add lines 12 through 34e . . . . . . . . . . . . . . . . . .

▶

35

36 Net farm profit or (loss). Subtract line 35 from line 11. Enter the result here and in Part V, line 1a 36

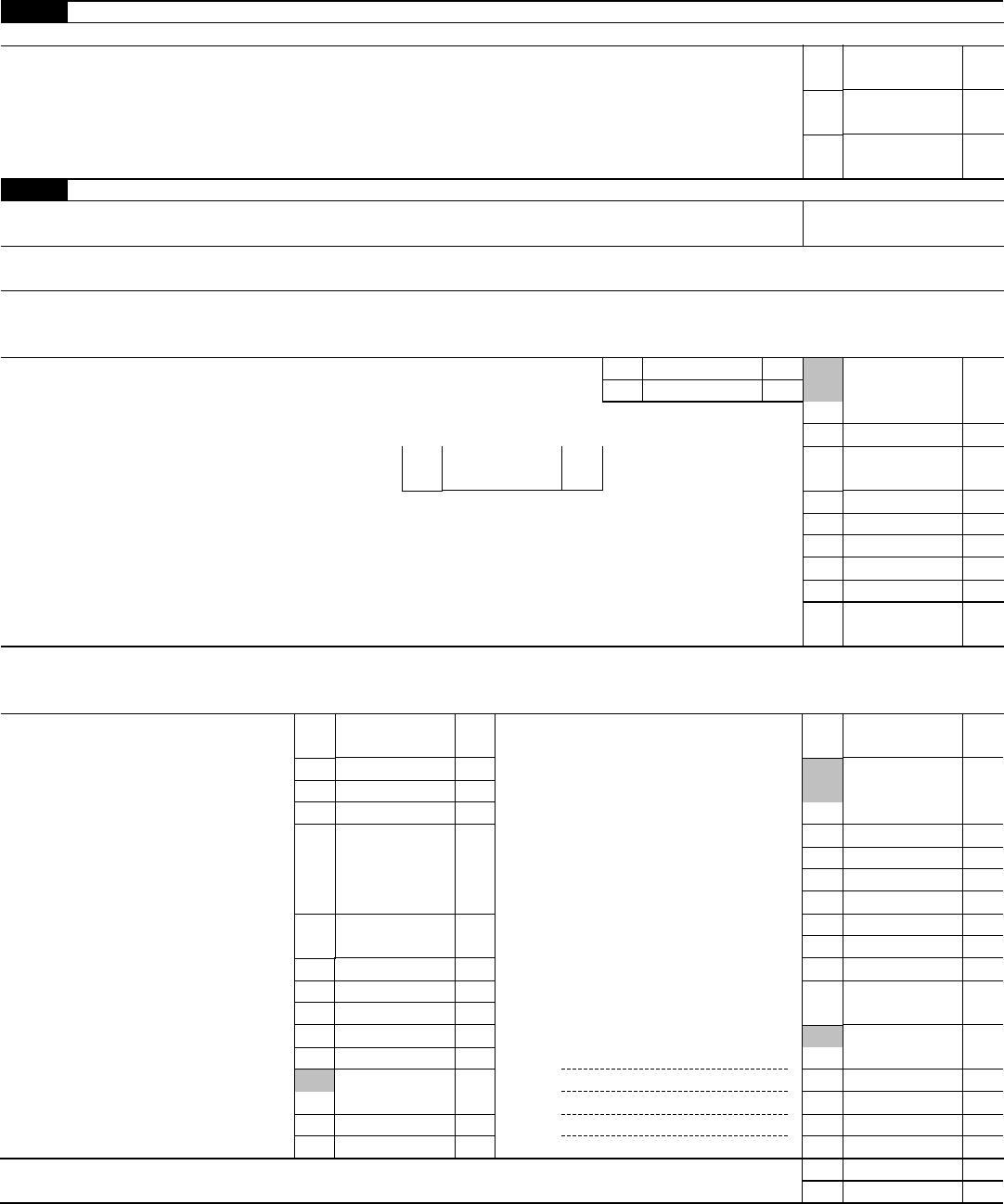

Form 1040-SS (2010)

Form 1040-SS (2010)

Page 3

Section C—Farm Income—Accrual Method

Do not include sales of livestock held for draft, breeding, sport, or dairy purposes on any of the lines below (see page SS-5).

37 Sales of livestock, produce, grains, and other products during the year. . . . . . . . . .

37

38 a

Total cooperative distributions (Form(s) 1099-PATR)

38a 38b Taxable amount 38b

39 Agricultural program payments received . . . . . . . . . . . . . . . . . . . . 39

40 Commodity Credit Corporation (CCC) loans reported under election (or forfeited) . . . . . . 40

41 Crop insurance proceeds . . . . . . . . . . . . . . . . . . . . . . . . . 41

42 Custom hire (machine work) income . . . . . . . . . . . . . . . . . . . . . 42

43

Other farm income (specify)

43

44 Add the amounts in the right column for lines 37 through 43 . . . . . . . . . . . . . 44

45

Inventory of livestock, produce, grains, and other products at the

beginning of the year . . . . . . . . . . . . . . . . .

45

46

Cost of livestock, produce, grains, and other products purchased during the year

46

47 Add lines 45 and 46 . . . . . . . . . . . . . . . . . 47

48

Inventory of livestock, produce, grains, and other products at the end of the year

48

49 Cost of livestock, produce, grains, and other products sold. Subtract line 48 from line 47* . . . 49

50 Gross farm income. Subtract line 49 from line 44. Enter the result here and in Part III, line 11 .

▶

50

*If you use the unit-livestock-price method or the farm-price method of valuing inventory and the amount on line 48 is larger than the amount on

line 47, subtract line 47 from line 48. Enter the result on line 49. Add lines 44 and 49. Enter the total on line 50 and in Part III, line 11.

Part IV

Profit or Loss From Business (Sole Proprietorship)—See the instructions for Schedule C (Form 1040).

Name of proprietor Social security number

Note. If you are filing a joint return and both you and your spouse had a profit or loss from a business, see Joint returns and

Husband-Wife Business beginning on page SS-2 for more information.

Section A—Income

1

Gross receipts $ Less returns and allowances $

Balance

▶

1

2 a Inventory at beginning of year . . . . . . . . . . . . . . 2a

b Purchases less cost of items withdrawn for personal use . . . . . 2b

c Cost of labor. Do not include any amounts paid to yourself. . . . . 2c

d Materials and supplies. . . . . . . . . . . . . . . . . 2d

e Other costs (attach statement) . . . . . . . . . . . . . . 2e

f Add lines 2a through 2e . . . . . . . . . . . . . . . . 2f

g Inventory at end of year . . . . . . . . . . . . . . . . 2g

h Cost of goods sold. Subtract line 2g from line 2f . . . . . . . . . . . . . . . . . 2h

3 Gross profit. Subtract line 2h from line 1 . . . . . . . . . . . . . . . . . . . 3

4

Other income. . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5

Gross income. Add lines 3 and 4 . . . . . . . . . . . . . . . . . . . . .

▶

5

Section B—Expenses

6 Advertising . . . . . .

6

7

Car and truck expenses

(see page SS-6) . . . . .

7

8

Commissions and fees . .

8

9 Contract labor . . . . . 9

10 Depletion . . . . . . . 10

11

Depreciation and section 179

expense deduction (not

included in Section A). (Attach

Form 4562 if required.) . .

11

12

Employee benefit programs

(other than on line 17) . . .

12

13 Insurance (other than health) 13

14

Interest on business

indebtedness. . . . . .

14

15

Legal and professional services

15

16 Office expense . . . . . 16

17

Pension and profit-sharing plans

17

18 Rent or lease:

a

Vehicles, machinery, and

equipment . . . . . . .

18a

b Other business property . . 18b

19

Repairs and maintenance . .

19

20

Supplies (not included in Section A)

20

21

Taxes and licenses . . . . 21

22

Travel, meals, and entertainment:

a Travel . . . . . . . . 22a

b

Deductible meals and entertainment

22b

23 Utilities . . . . . . . . 23

24 Wages not included on line 2c 24

25a

Other expenses (list type and amount):

25 b Total other expenses . . . 25b

26 Total expenses. Add lines 6 through 25b . . . . . . . . . . . . . . . . . .

▶

26

27 Net profit or (loss). Subtract line 26 from line 5. Enter the result here and in Part V, line 2 . . . 27

Form 1040-SS (2010)

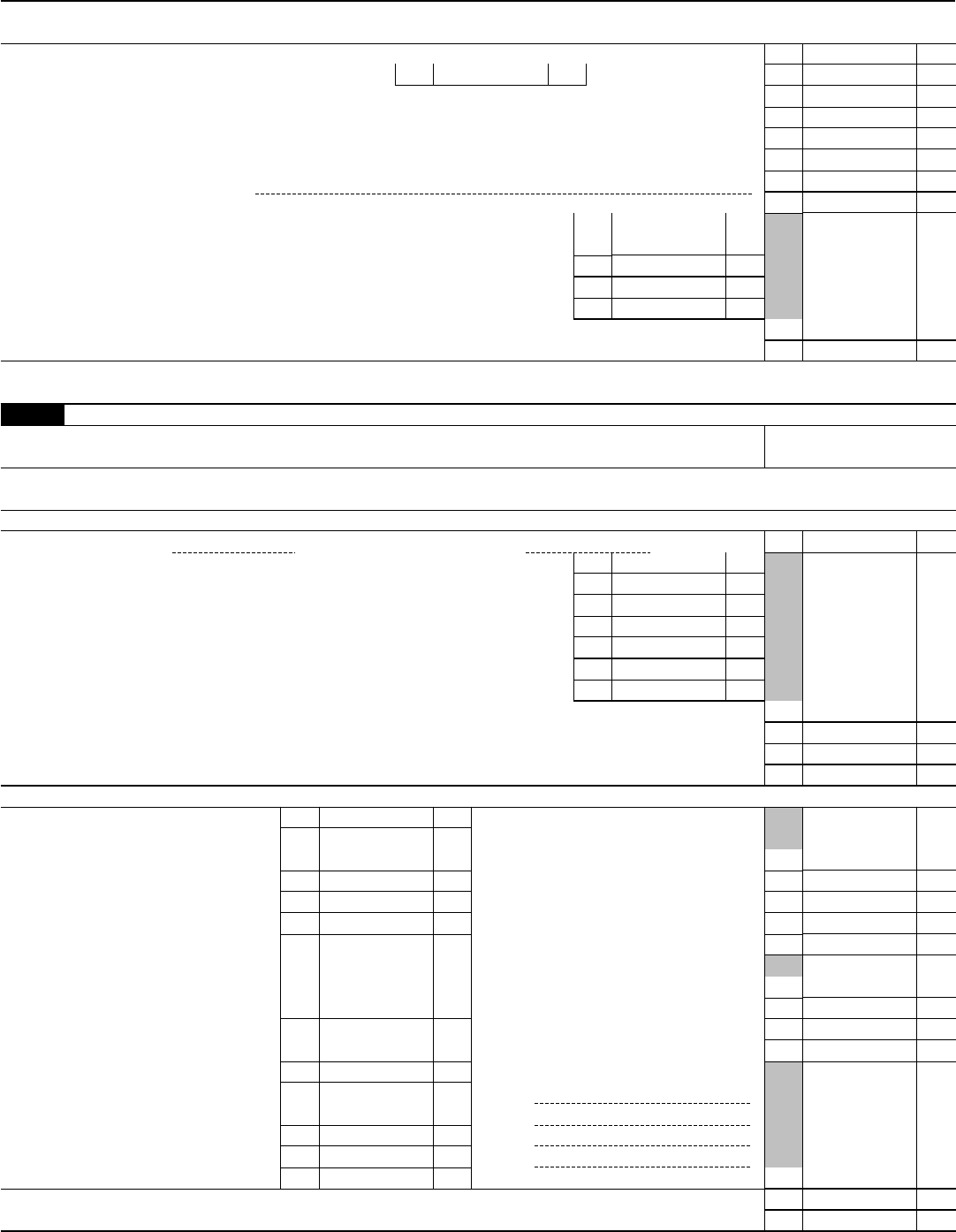

Form 1040-SS (2010)

Page 4

Part V Self-Employment Tax—If you had church employee income, see page SS-1 before you begin.

Name of person with self-employment income

Social security number of person

with self-employment income

▶

Note. If you are filing a joint return and both you and your spouse had self-employment income, you must each complete a

separate Part V.

A

If you are a minister, member of a religious order, or Christian Science practitioner and you filed Form 4361, but you had

$400 or more of other net earnings from self-employment, check here and continue with Part V

. . . . . . .

▶

1 a

Net farm profit or (loss) from Part III, line 36, and your distributive share from farm partnerships.

Note. Skip lines 1a and 1b if you use the farm optional method (see page SS-8). . . . . . .

1a

b

Include on this line any allowable self-employed health insurance deduction (see page SS-8). On

the dotted line next to line 1b, enter “SEHI” and the amount of the self-employed health insurance

deduction. Also, if you received social security retirement or disability benefits, also include on this

line the amount of Conservation Reserve Program payments included in Part III, line 6, plus your

distributive share of these payments from farm partnerships . . . . . . . . . . . . .

1b

( )

2

Net nonfarm profit or (loss) from Part IV, line 27, and your distributive share from nonfarm

partnerships. Ministers and members of religious orders, see pages SS-1 and SS-2 for amounts to

report on this line. See page SS-7 for other income to report. Note. Skip this line if you use the

nonfarm optional method (see page SS-8) . . . . . . . . . . . . . . . . . . .

2

3 Combine lines 1a, 1b, and 2 . . . . . . . . . . . . . . . . . . . . . . . . 3

4 a

If line 3 is more than zero, multiply line 3 by 92.35% (.9235). Otherwise, enter the amount from

line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4a

Note. If line 4a is less than $400 due to Conservation Reserve Program payments on line 1b, see

page SS-8.

b If you elect one or both of the optional methods, enter the total of lines 2 and 4 of Part VI here . .

4b

c

Combine lines 4a and 4b. If less than $400, stop; you do not owe self-employment tax.

Exception. If less than $400 and you had church employee income, enter -0- and continue .

▶

4c

5 a

Enter your church employee income from Form(s) W-2, W-2AS,

W-2CM, W-2GU, W-2VI, or 499R-2/W-2PR. See page SS-1 for

definition of church employee income. . . . . . . . . . . .

5a

b Multiply line 5a by 92.35% (.9235). If less than $100, enter -0- . . . . . . . . . . . . 5b

6 Add lines 4c and 5b . . . . . . . . . . . . . . . . . . . . . . . . .

▶

6

7

Maximum amount of combined wages and self-employment earnings subject to social security

tax for 2010 . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

106,800 00

8 a

Total social security wages and tips from Form(s) W-2, W-2AS,

W-2CM, W-2GU, W-2VI, or 499R-2/W-2PR. If $106,800 or more, skip

lines 8b through 10, and go to line 11 . . . . . . . . . . . .

8a

b

Unreported tips subject to social security tax from Form 4137, line 10

(see page SS-8) . . . . . . . . . . . . . . . . . . .

8b

c

Wages subject to social security tax from Form 8919, line 10 (see page

SS-8) . . . . . . . . . . . . . . . . . . . . . .

8c

d Add lines 8a, 8b, and 8c . . . . . . . . . . . . . . . . . . . . . . . . . 8d

9 Subtract line 8d from line 7. If zero or less, enter -0- here and on line 10 and go to line 11 . .

▶

9

10 Multiply the smaller of line 6 or line 9 by 12.4% (.124) . . . . . . . . . . . . . . .

10

11 Multiply line 6 by 2.9% (.029) . . . . . . . . . . . . . . . . . . . . . . .

11

12

Self-employment tax. Add lines 10 and 11. Enter here and in Part I, line 3 . . . . . . . .

12

Part VI Optional Methods To Figure Net Earnings—See page SS-8 for limitations.

Note. If you are filing a joint return and both you and your spouse choose to use an optional method to figure net earnings, you

must each complete and attach a separate Part VI.

Farm Optional Method

1

Maximum income for optional methods . . . . . . . . . . . . . . . . . . . .

1

4,480 00

2

Enter the smaller of: two-thirds (

2

/3) of gross farm income (Part III, line 11, plus your distributive

share from farm partnerships), but not less than zero; or $4,480. Also include this amount in Part

V, line 4b, above. . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

Nonfarm Optional Method

3 Subtract line 2 from line 1. . . . . . . . . . . . . . . . . . . . . . . . .

3

4

Enter the smaller of: two-thirds (

2

/3) of gross nonfarm income (Part IV, line 5, plus your distributive

share from nonfarm partnerships), but not less than zero; or the amount in Part VI, line 3, above.

Also include this amount in Part V, line 4b, above . . . . . . . . . . . . . . . . .

4

Form 1040-SS (2010)