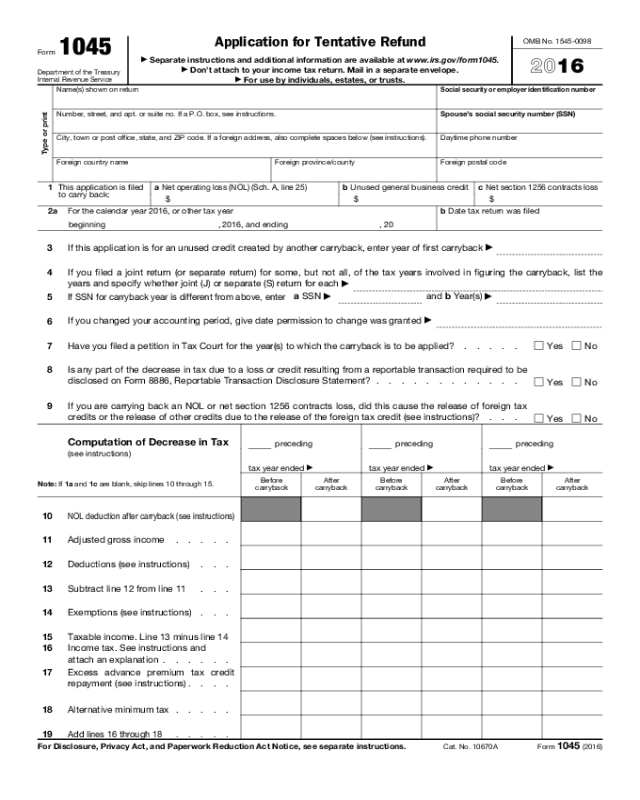

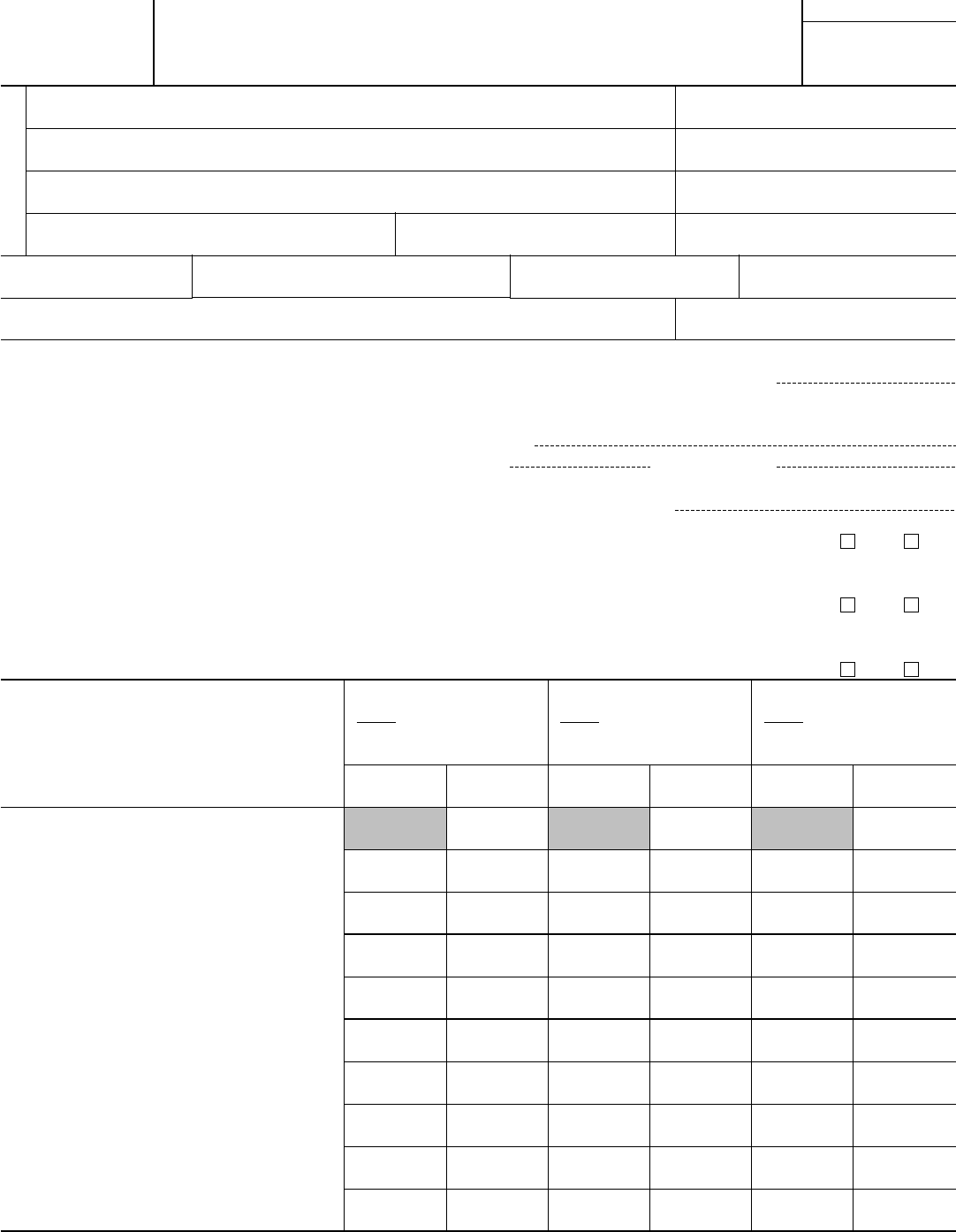

Form 1045 (2016)

Page 3

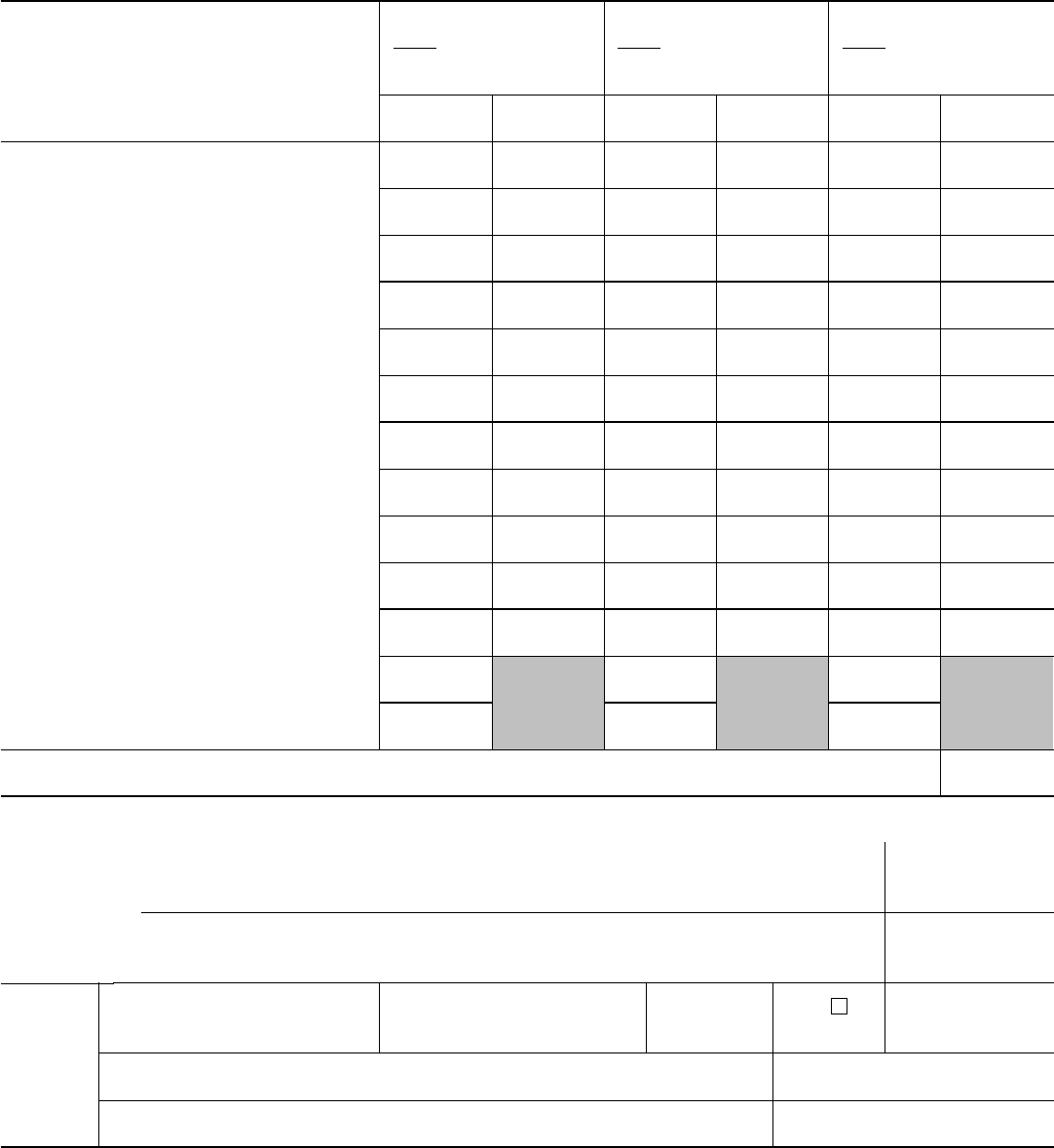

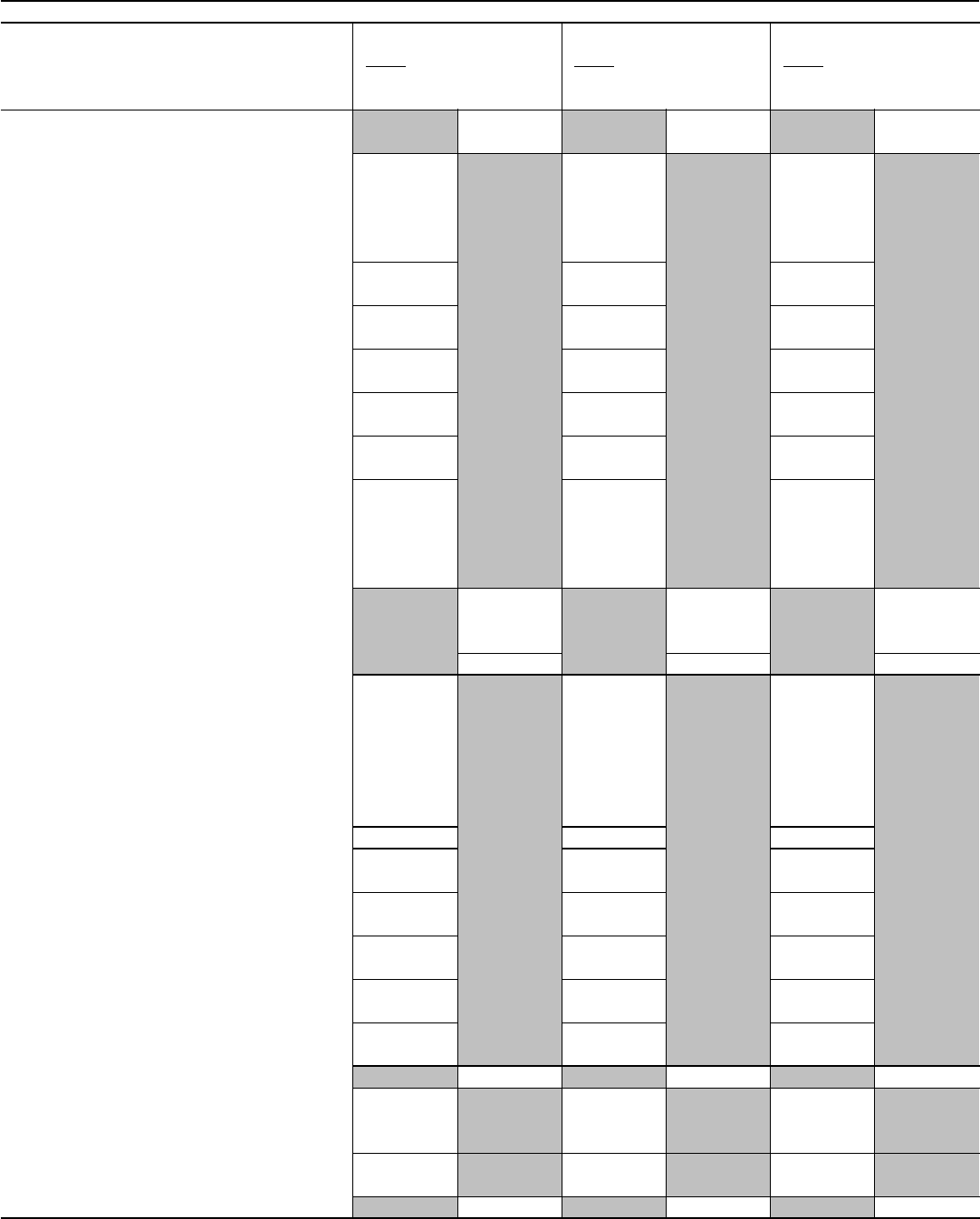

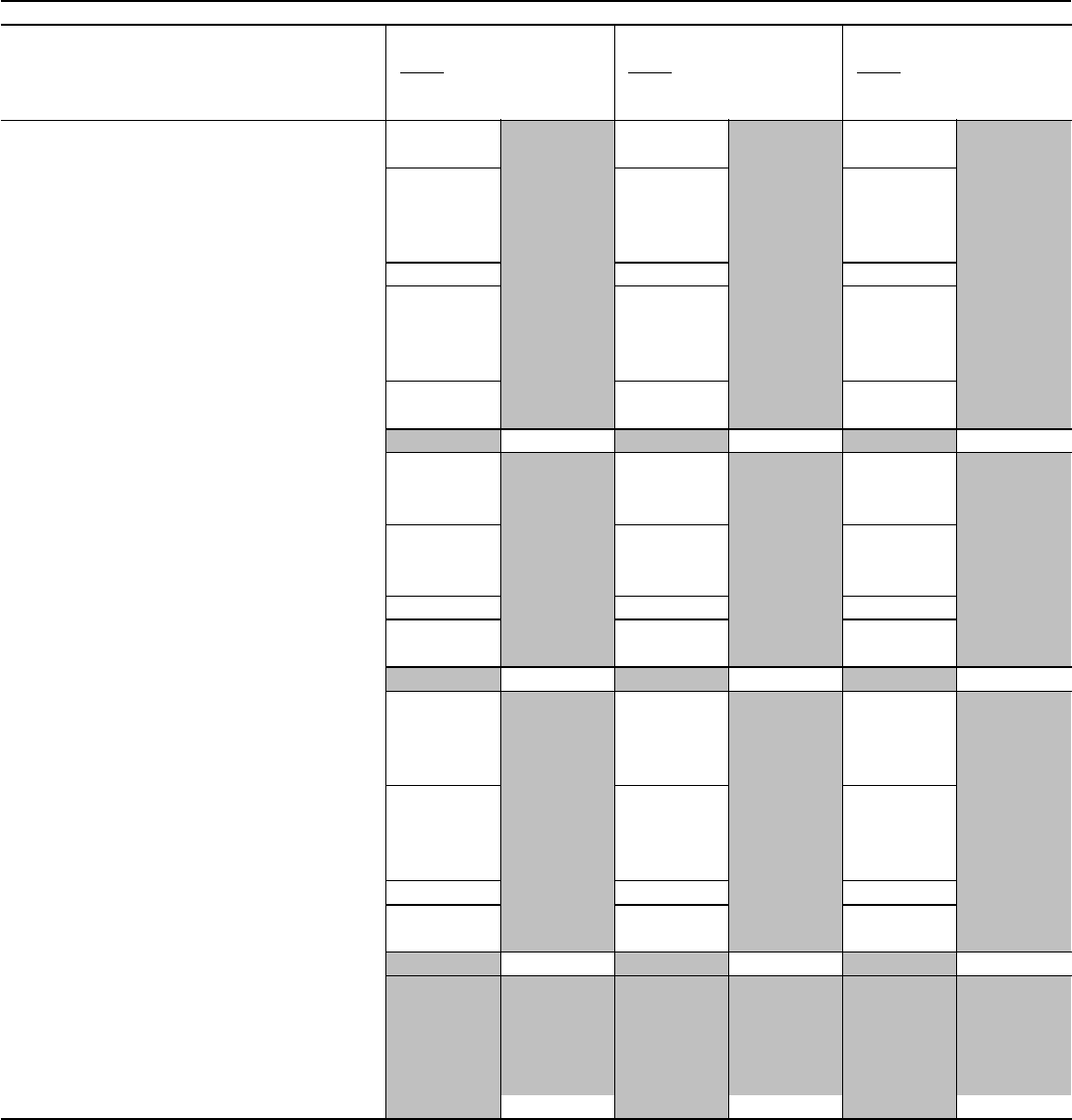

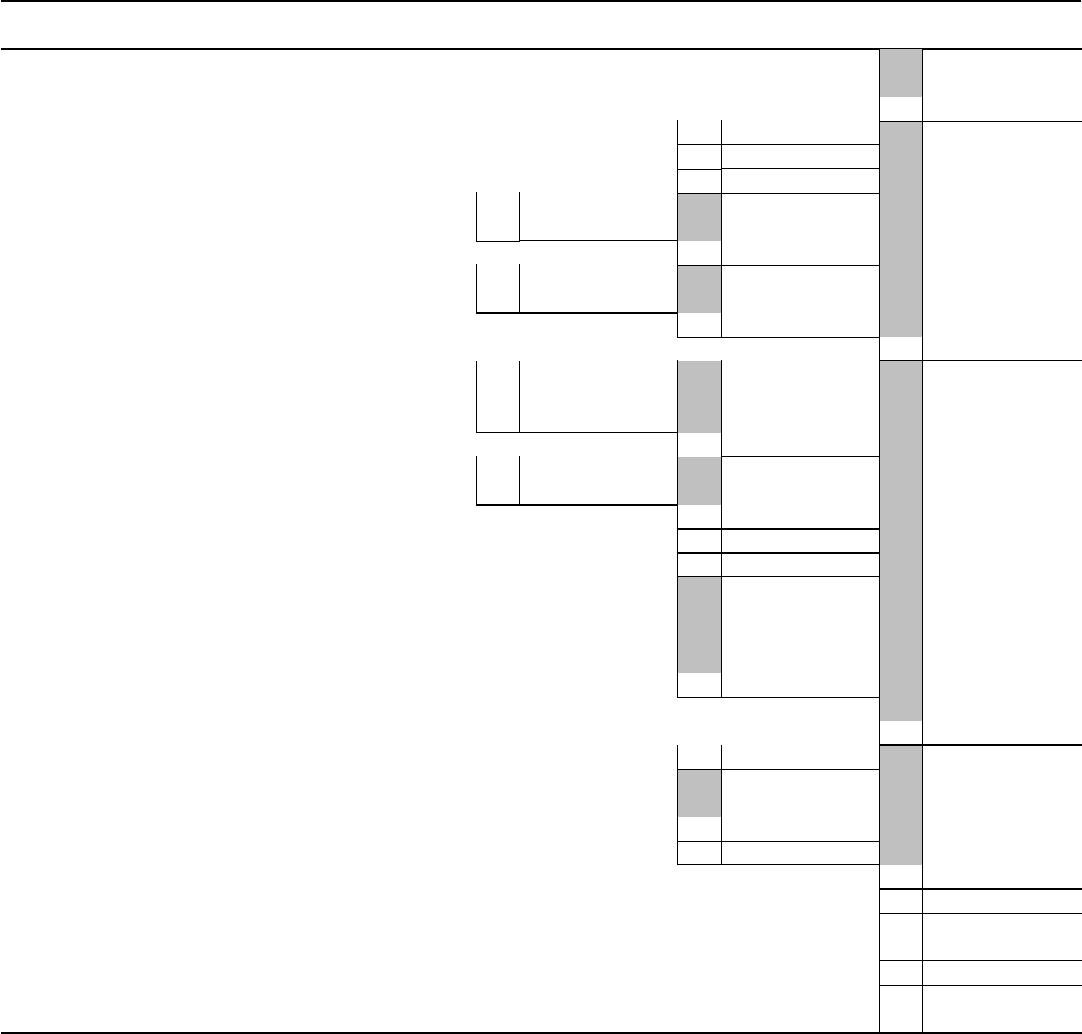

Schedule A—NOL (see instructions)

1

Enter the amount from your 2016 Form 1040, line 41, or Form 1040NR, line 39. Estates and trusts,

enter taxable income increased by the total of the charitable deduction, income distribution

deduction, and exemption amount (see instructions) . . . . . . . . . . . . . . .

1

2 Nonbusiness capital losses before limitation. Enter as a positive number 2

3 Nonbusiness capital gains (without regard to any section 1202 exclusion)

3

4 If line 2 is more than line 3, enter the difference. Otherwise, enter -0- . .

4

5 If line 3 is more than line 2, enter the difference.

Otherwise, enter -0- . . . . . . . . .

5

6 Nonbusiness deductions (see instructions) . . . . . . . . . . .

6

7 Nonbusiness income other than capital gains (see

instructions) . . . . . . . . . . . .

7

8 Add lines 5 and 7 . . . . . . . . . . . . . . . . . . .

8

9 If line 6 is more than line 8, enter the difference. Otherwise, enter -0- . . . . . . . . . .

9

10

If line 8 is more than line 6, enter the difference.

Otherwise, enter -0-. But don’t enter more than

line 5 . . . . . . . . . . . . . .

10

11 Business capital losses before limitation. Enter as a positive number . .

11

12 Business capital gains (without regard to any

section 1202 exclusion) . . . . . . . .

12

13 Add lines 10 and 12 . . . . . . . . . . . . . . . . . . 13

14 Subtract line 13 from line 11. If zero or less, enter -0- . . . . . . . 14

15 Add lines 4 and 14 . . . . . . . . . . . . . . . . . . .

15

16

Enter the loss, if any, from line 16 of your 2016 Schedule D (Form 1040).

(Estates and trusts, enter the loss, if any, from line 19, column (3), of

Schedule D (Form 1041).) Enter as a positive number. If you don’t have a

loss on that line (and don’t have a section 1202 exclusion), skip lines 16

through 21 and enter on line 22 the amount from line 15 . . . . . .

16

17 Section 1202 exclusion. Enter as a positive number . . . . . . . . . . . . . . . .

17

18 Subtract line 17 from line 16. If zero or less, enter -0- . . . . . . .

18

19

Enter the loss, if any, from line 21 of your 2016 Schedule D (Form 1040).

(Estates and trusts, enter the loss, if any, from line 20 of Schedule D (Form

1041).) Enter as a positive number . . . . . . . . . . . . .

19

20 If line 18 is more than line 19, enter the difference. Otherwise, enter -0- . 20

21 If line 19 is more than line 18, enter the difference. Otherwise, enter -0- . . . . . . . . . 21

22 Subtract line 20 from line 15. If zero or less, enter -0- . . . . . . . . . . . . . . . 22

23 Domestic production activities deduction from your 2016 Form 1040, line 35, or Form 1040NR, line

34 (or included on Form 1041, line 15a) . . . . . . . . . . . . . . . . . . . .

23

24 NOL deduction for losses from other years. Enter as a positive number . . . . . . . . . 24

25 NOL. Combine lines 1, 9, 17, and 21 through 24. If the result is less than zero, enter it here and on

page 1, line 1a. If the result is zero or more, you don’t have an NOL . . . . . . . . . .

25

Form 1045 (2016)